INSUBCONTINENT EXCLUSIVE:

From Howeycoin to a Chinese study that found 421 fake token sales, governments and researchers are finally shedding light on bad actors in

the token sale space.

Take, for example, Operation Cryptosweep

According to an North American Securities Administrator Association, regulators in the US and Canada are looking into 70 token sales and may

be taking action against as many as 35

They write:

NASAA members from more than 40 jurisdictions throughout North America participated in &Operation Cryptosweep,& which to date

has resulted in nearly 70 inquiries and investigations and 35 pending or completed enforcement actions related to ICOs or cryptocurrencies

since the beginning of May

NASAA members are conducting additional investigations into potentially fraudulent conduct that may result in additional enforcement actions

These actions are in addition to more than a dozen enforcement actions previously undertaken by NASAA members regarding these types of

Many NASAA members also are conducting public outreach initiatives to warn investors in their jurisdictions of the risks associated with

ICOs and cryptocurrencies.

&The persistently expanding exploitation of the crypto ecosystem by fraudsters is a significant threat to Main

Street investors in the United States and Canada, and NASAA members are committed to combating this threat,& said NASAA President, Joseph P

&Despite a series of public warnings from securities regulators at all levels of government, cryptocriminals need to know that state and

provincial securities regulators are taking swift and effective action to protect investors from their schemes and scams.&

Further,

regulators in China have compiled a page detailing scams including products that are clearly pyramid schemes featuring &dynamic (rewards in

proportion to money invested)& and &static (fixed)& incentives

After all, anything that claims to offer regular returns is probably suspect.

Other scams include over-the-counter tokens & OTC & that are

only available from a certain site and are difficult to trade

Any token without a sufficient & and difficult-to-build & market is ripe for abuse.

Ultimately, crooks follow money

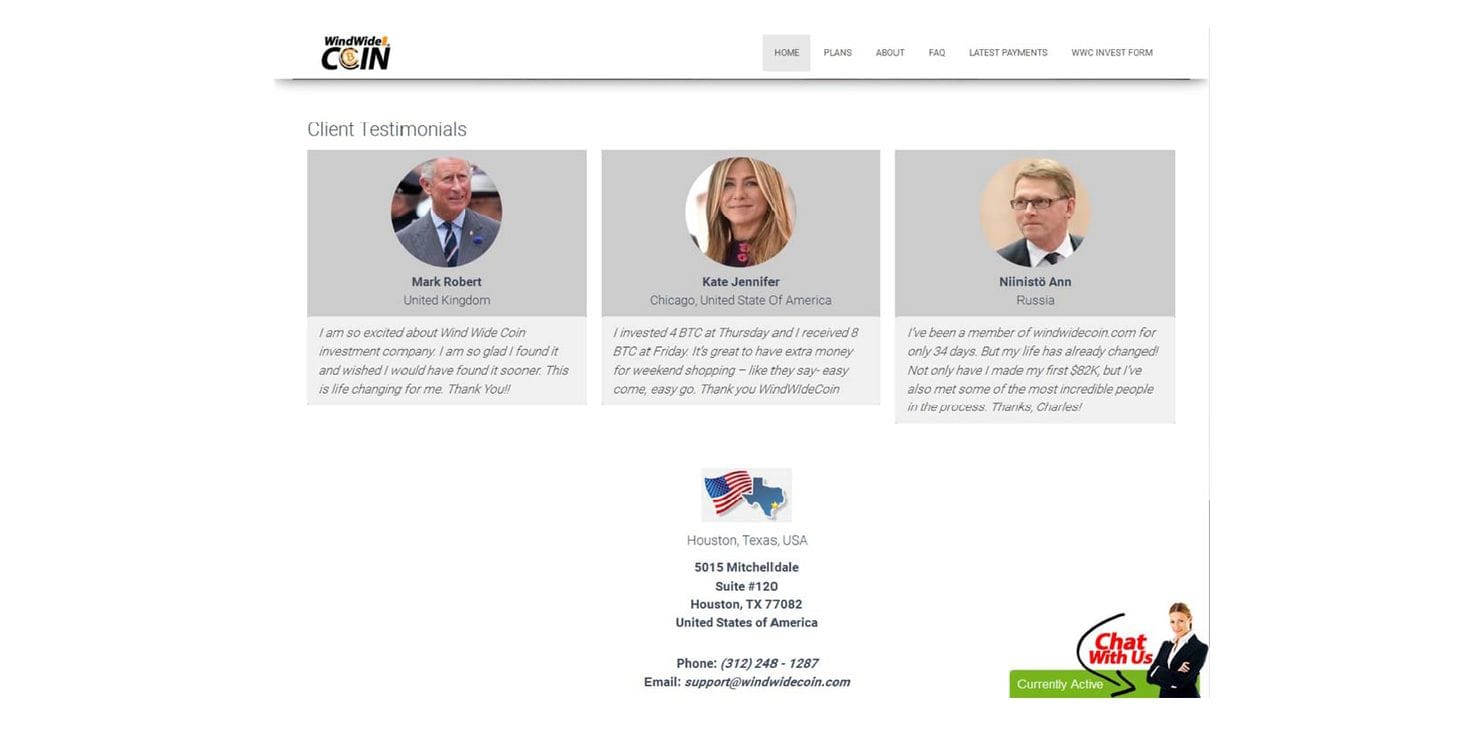

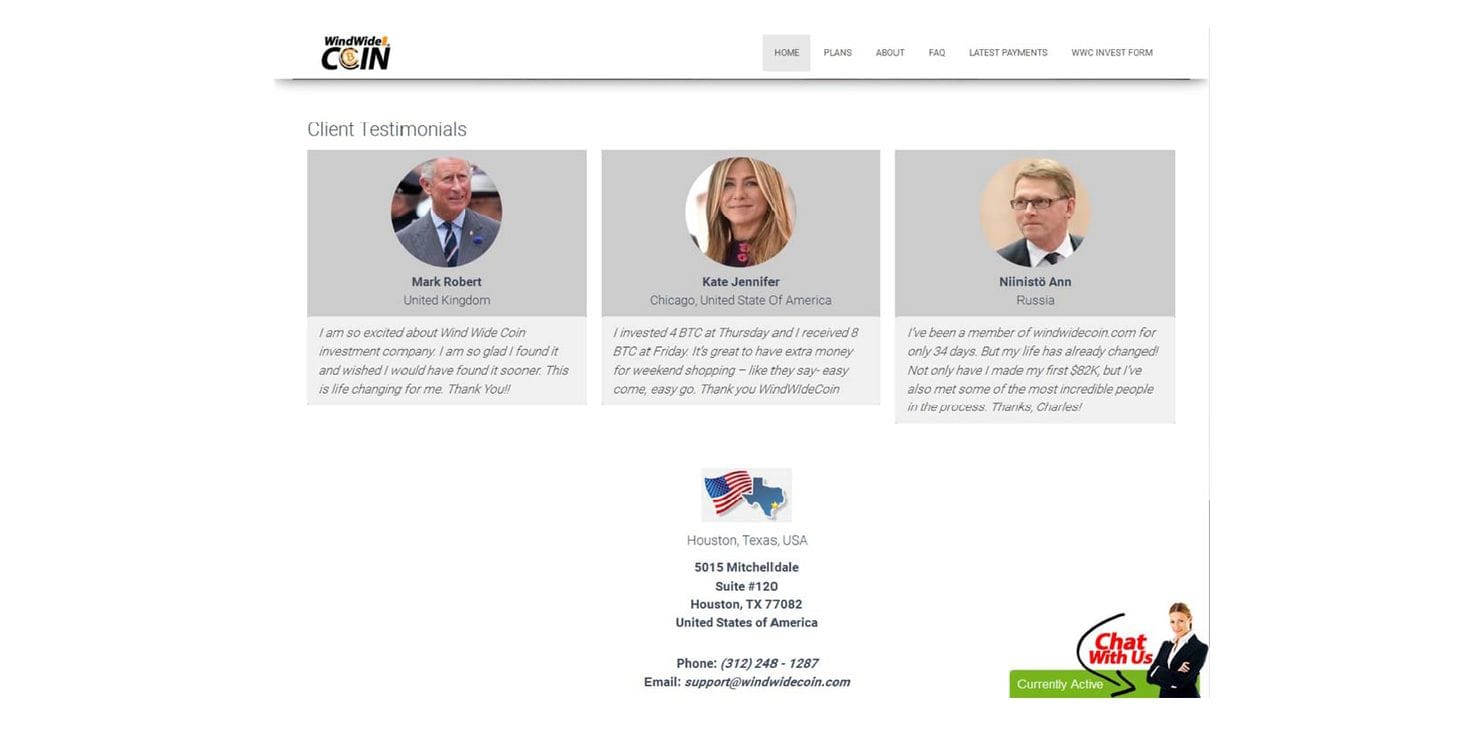

The Washington Post found hundreds of ICOs that featured spurious teams and claims including one site that featured Prince Charles and

Jennifer Aniston & under fake names & as members of the advisory board.

What the bottom line There is not nearly enough oversight and far

too much fun being had at the expense of the uneducated investor

The financial equivalent of script kiddies are breaking the markets that others are taking time and money to create and there is little

Ultimately, this does little more than damage the perception of ICOs and hurts folks who are trying to legitimately use the techniques to

raise cash and build projects

It is, in short, as messy as the early Internet with no fix in sight.