INSUBCONTINENT EXCLUSIVE:

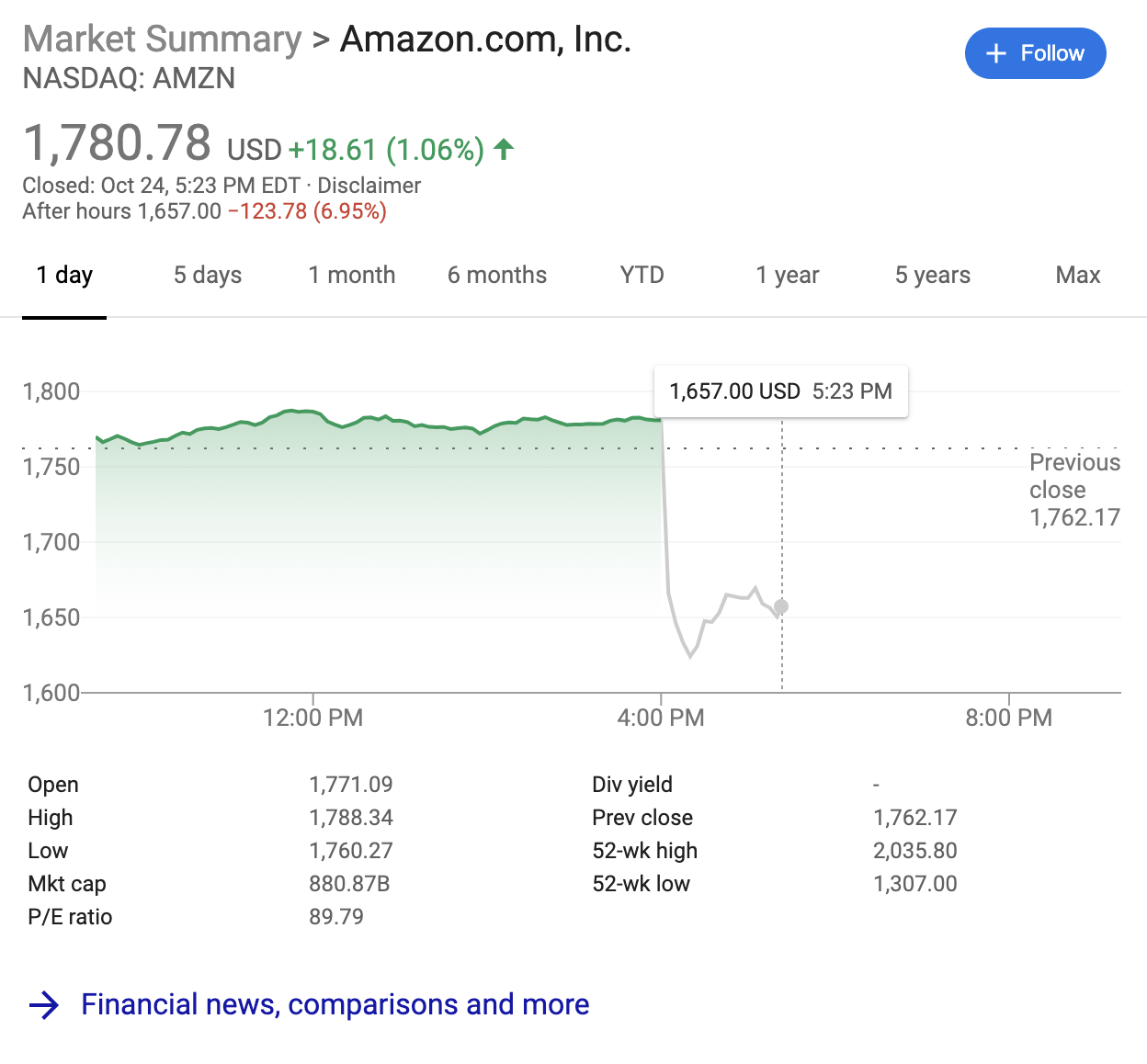

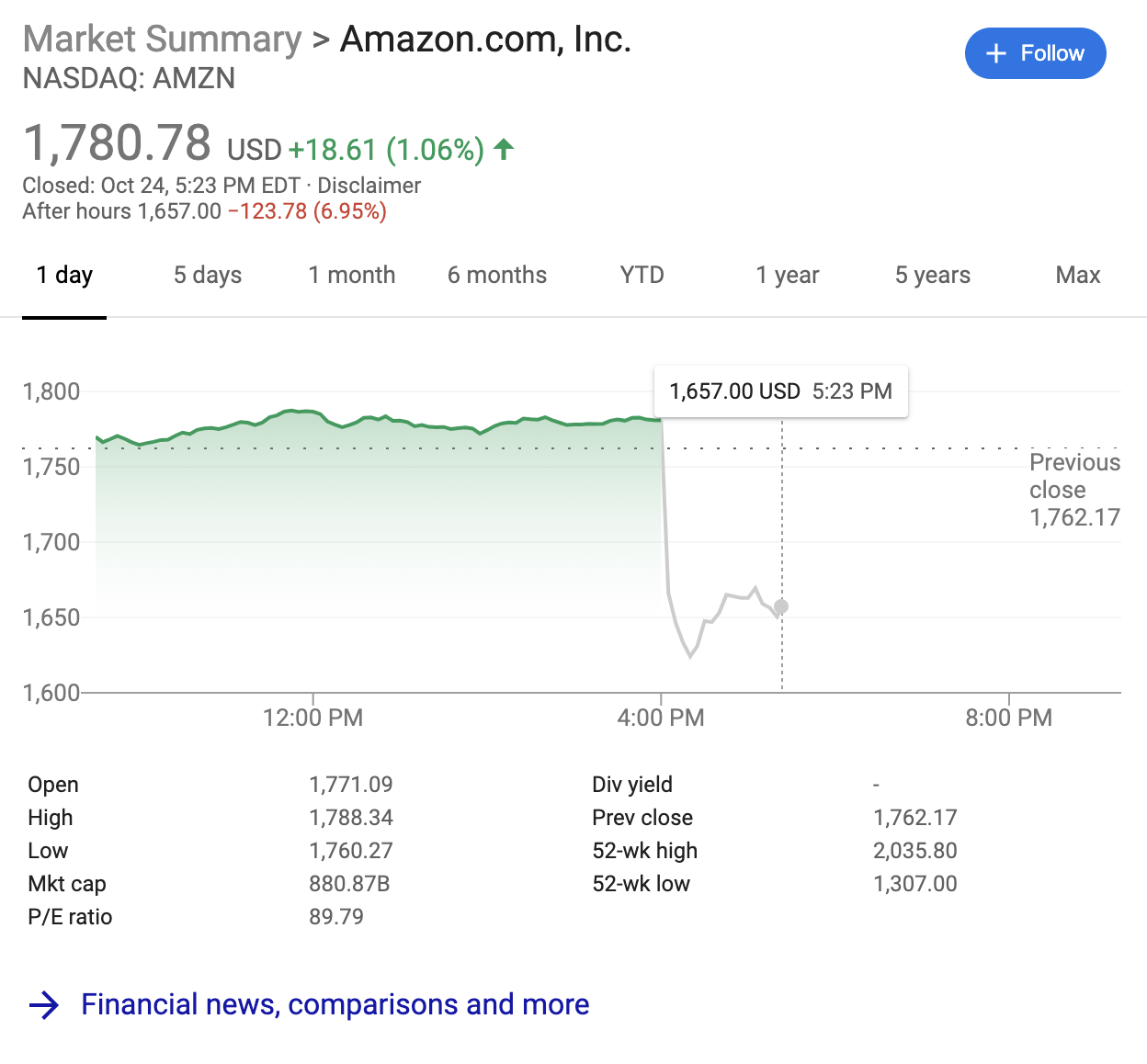

Amazon shares fell by nearly 7%, or $118.38, in after-hours trading on Thursday after the company reported its first earnings miss in two

years.

Financial analysts had predicted that the launch of one-day shipping would eat into Amazon earnings, but even with the forewarning

investors pummeled the stock after the market closed

It didn&t help that the company predicted revenues for the fourth quarter — including the all-important holiday season — also look

soft.

The good news for Amazon amidst all the bad news was that revenue was actually up at the company

For the quarter Amazon raked in $70 billion, beating analysts& expectations of $68.8 billion.

However, the company reported a profit of $2.1

billion, or $4.23 a share versus the $4.62 that analysts had projected

And even though sales were up this year, earnings per share were down from $5.75 in the year-ago period

As MarketWatch noted, it the first time earnings at the company have shrunk since 2017.

Another potential warning sign for investors was

the revenue from the company web services business, which came in at $9 billion

Analysts had predicted roughly $9.2 billion from the business line

If competition starts eating into the services business (which still grew at a healthy 35% over the year-ago period), that could spell

problems for the company stock — which has used AWS revenues to buoy spending elsewhere.

The company has been spending heavily all year to

The expansion of its free one-day delivery program has cost Amazon more than $800 million in the second quarter.

Amazon founder and chief

executive Jeff Bezos defended the move to one-day shipping in a statement.

&Customers love the transition of Prime from two days to one day

— they&ve already ordered billions of items with free one-day delivery this year

It a big investment, and it the right long-term decision for customers,& Bezos said

&And although it counterintuitive, the fastest delivery speeds generate the least carbon emissions because these products ship from

fulfillment centers very close to the customer — it simply becomes impractical to use air or long ground routes.&

Looking ahead to the

holiday season Amazon predicted net sales of between $80 billion and $86.5 billion, with operating income between $1.2 billion and $2.9

billion, versus $3.8 billion from a year-ago period

Analysts were expecting to see revenue numbers more in the $87 billion range.