INSUBCONTINENT EXCLUSIVE:

Bespoke Financial wants to provide cannabis businesses with the same kind of financial services that other businesses get, but that

dispensaries and growers can&t yet access.

The regulations around cannabis operations are so stringent at the local level — and so

nebulous at the federal level — that national banks won&t give businesses in the cannabis industry the same basic services (like

short-term loans).

That why one former Goldman Sachs banker has partnered with two entrepreneurs from the traditional agriculture industry

to create Bespoke Financial

And it why the company has raised $7 million in financing led by Casa Verde Capital — the investment firm launched by legendary cannabis

aficionado, Calvin Broadus (AKA Snoop Dogg).

In some ways, George Mancheril is the new face of the cannabis business

The former banker hails from Goldman Sachs and Guggenheim Partners and worked on the desks that dealt with alternative lending.

A transplant

to Los Angeles roughly six years ago, Mancheril says he saw the migration of legally sanctioned cannabis begin for recreational use and knew

there would be opportunities for new lending businesses.

&Cannabis will become a broad, mature industry just like any other, and if that is

going to happen, there needs to be a debt structure that can support that,& Mancheril says.

The biggest impediment to the industry growth is

the one that Bespoke Financial wants to tackle first — and that access to debt.

To build the company first product, Mancheril looked to

his co-founder Pablo Borquez-Schwarzbeck and Benjamin Dusastre

Borquez-Schwarzbeck and Dusastre previously launchedProducePay, a fintech platform focused on produce farmers that has financed roughly $2

billion in perishable commodities throughout 13 countries

It backed by around $200 million in venture capital and debt financing

What Mancheril and his co-founders have done is take ProducePay underwriting model and apply it to the cannabis industry

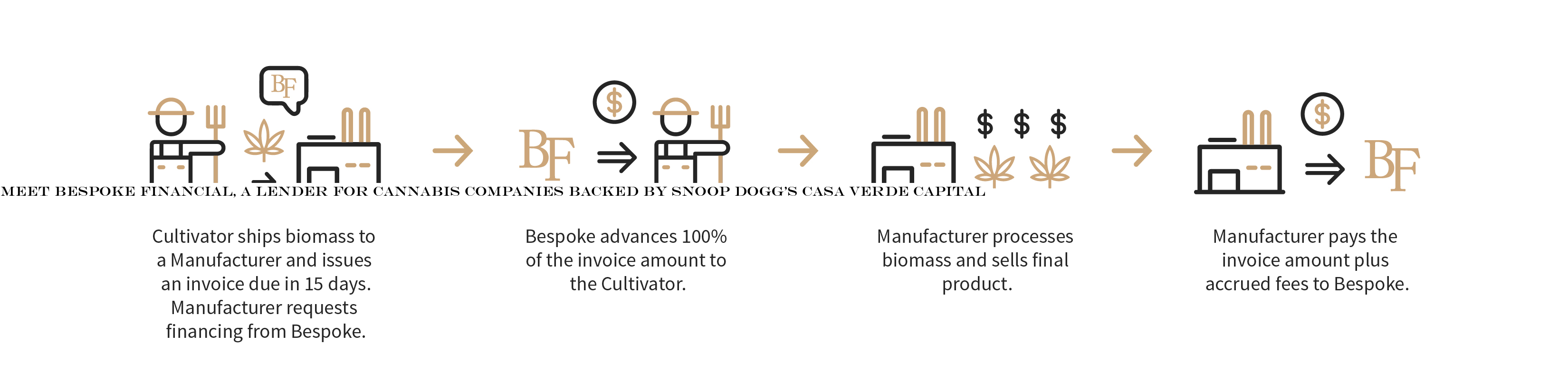

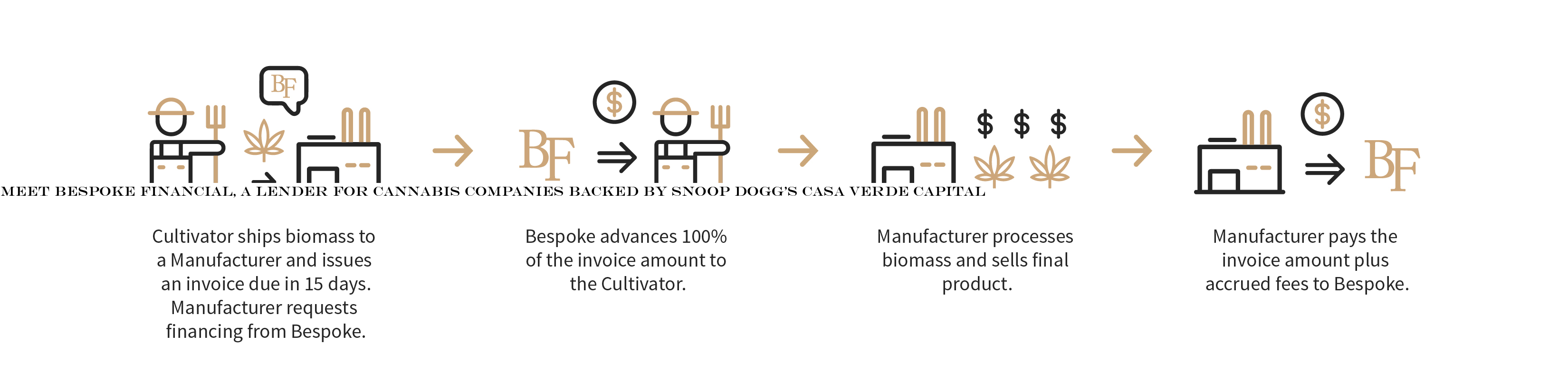

The financial instrument that they&re starting with is known &in the business& as factoring.

It basically advancing money to businesses for

a contract that signed in exchange for a cut of the money once a company gets paid for the goods or services they&ve rendered.

&While the

US legal cannabis market is forecasted to grow over 20% annually, reaching $23B by 2022, the industry true growth potential is limited by

long cash flow cycles throughout the supply chain and a lack of scalable and efficient capital sources,& says Bespoke Financial co-founder

and chief executive, George Mancheril, in a statement

&Our approach will dramatically improve cash flow cycles across the supply chain and provide scalable working capital to fuel our clients&

growth.&

The $7 million infusion from investors, including Casa Verde, Greenhouse Capital Partners and Outbound Ventures, will be used to

build out the company business and establish its first credit lines with customers

Mancheril says it already has around $3 million worth of loans revolving through its business

Right now, the company is focused on California, but says it could expand to other regions that are embracing legalization.

&In general, in

the cannabis industry overall, it difficult to access any part of the financial system,& says Karan Wadhera, a managing director at Casa

&Now that we&re moving into a place where equity financing is getting expensive, a company like Bespoke plays an important and valuable role

in the ecosystem to help young brands and mature brands get access to working capital when they need it the most.&