INSUBCONTINENT EXCLUSIVE:

Pan-African e-commerce startup Jumia released its third-quarter financial results today.

The numbers and presentation reflected some of the

same past trends, with a dash of new, and nary a mention of a declining share price.

The results

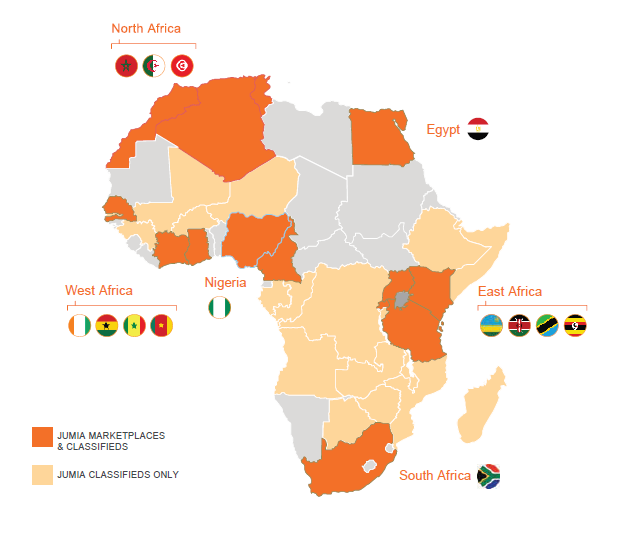

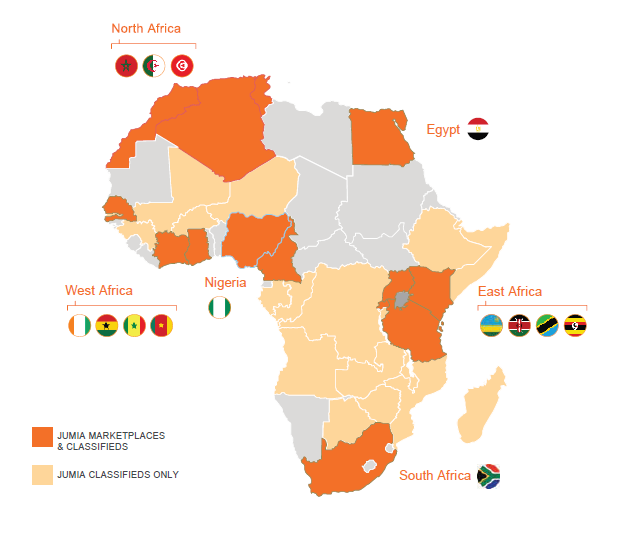

Jumia — with online goods and service

verticals in 14 countries — posted third-quarter revenue growth of 19% (€40 million) and increased its active customer base 56% to 5.5

million from 3.5 million over the same period a year ago.

Jumia Gross Merchandise Value (GMV) — the total amount of goods sold over the

period — grew by 39% to €275 million

The online retailer nearly doubled its orders from 3.6 million in Q3 2018 to 7 million in Q3 2019.

Jumia also saw growth in its JumiaPay

digital finance product, with total payment volume growing 95% to €32 million in Q3 2019 from €16.4 million in Q3 2018.

This is

significant, as the company has committed to generate more revenues from digital payment products and offer JumiaPay as a standalone service

across Africa.

The overall pattern of growing revenues and customers YoY has been consistent for Jumia.

But so too have the company losses,

which widened 34% in 3Q 2019 to €54.6 million, compared to €40.6 million

Negative EBITDAincreased 26% to €45.4 million from €35.8 over the same period in 2018.

Jumia pegged a large part of the spike in losses

to an increase in fulfillment expenses due to more cross-border goods transactions (with higher shipping costs) on its platform in 3Q

2019.

What new

Jumia introduced some new methodologies and measures for its results

&We believe the most relevant monetization metrics for us are market-based revenue and gross profit,& Jumia Group CFO Antoine

Maillet-Mezeray explained on the call.

&We don&t see revenue as a meaningful metric to assess the monetization of our business as it is

impacted by shifts in the revenue mix between first party and marketplace,& he said.

If and when Jumia does get into the black, I suspect

revenue will shift back as key.

On its path to profitability, Jumia CEO Sacha Poignonnec reaffirmed the company commitment to generate more

revenue from higher margin (straight through) products, such as JumiaPay and Jumia classified business, over cost-intensive (and

logistically complicated) online goods sales.

&We are focused on driving the adoption and penetration of Jumia pay within our own

ecosystem,& he said — meaning across Jumia existing buyer-seller universe.

Since its founding in 2012, the company has been forced to

adapt to slower digital payments integration in its core Nigeria and allow cash-on-delivery payments, which are costly and more problematic

than digital processing.

Poignonnec highlighted Jumia commitment to build a financial services marketplace (and revenues) from consumers and

partners using JumiaPay and JumiaLending for products such as loans, third-party credit-scoring and insurance, he explained

This has led to Jumia moving into working-capital services for vendors on its platform.

On the movement of online goods, Jumia highlighted

the expansion of its JumiaMall service, which offers brands — such as L&Oreal, Samsung and Unliver — more tailored selling options on

its website around shipping, product positioning and consumer data analytics.

Jumia also shared info on product mix and diversification,

which showed strong upward trends in digital services, the sale of consumer electronics and beauty products.

Share price

Surprisingly absent

from Jumia earnings call and the subsequent Q-A was any discussion of the company share price.

Today reporting was slightly more

anticipated, given Jumia has faced a short-seller assault, sales scandal and significant market-cap drop since its April IPO on the

NYSE.

The online retailer gained investor confidence out of the gate, more than doubling its $14.50 opening share price after the IPO.

That

lasted until May, when Jumia stock came under attack from short-seller Andrew Left,whose firm Citron Research issued a reportaccusing the

That prompted several securities-related lawsuits against Jumia.

The company share price plummeted 43% — from $49 to $26 — the week

Left released his short-sell claims.

Then on its second-quarter earnings call in August, Jumia offered greater detail on the fraud

perpetrated by some employees and agents of its JForce sales program.

The company declared the matter closed, but Jumia stock price

plummeted more after the August earnings call (and sales-fraud disclosure), and has lingered in the $6 range for weeks.

That 50% below the

company IPO opening in April and 80% below its high.

Jumia can offer new metrics to evaluate its performance, but the simplest measure —

the ability to generate revenues in excess of costs to turn a profit — will still apply.

The sooner Jumia can go in that direction the

faster it can revive its share price and investor confidence.

Revisiting Jumia JForce scandal and Citron short-sell claims