INSUBCONTINENT EXCLUSIVE:

Singapore-headquartered FinAccel has secured $90 million in one of the largest funding rounds for a fintech startup in Southeast Asia as it

looks to further grow its credit lending app Kredivo and build more financial services.The financing round, dubbed Series C, for the

three-and-a-half-year-old startup was jointly led by Asia Growth Fund — a joint venture between Mirae Asset and Naver — and Square

Peg.Singtel Innov8, TMI (Telkomsel Indonesia), Cathay Innovation, Kejora-InterVest, Mirae Asset Securities, Reinventure and DST Partners

participated in the “oversubscribed” financing round, the startup said.FinAccel said it has raised more than $200 million in debt and

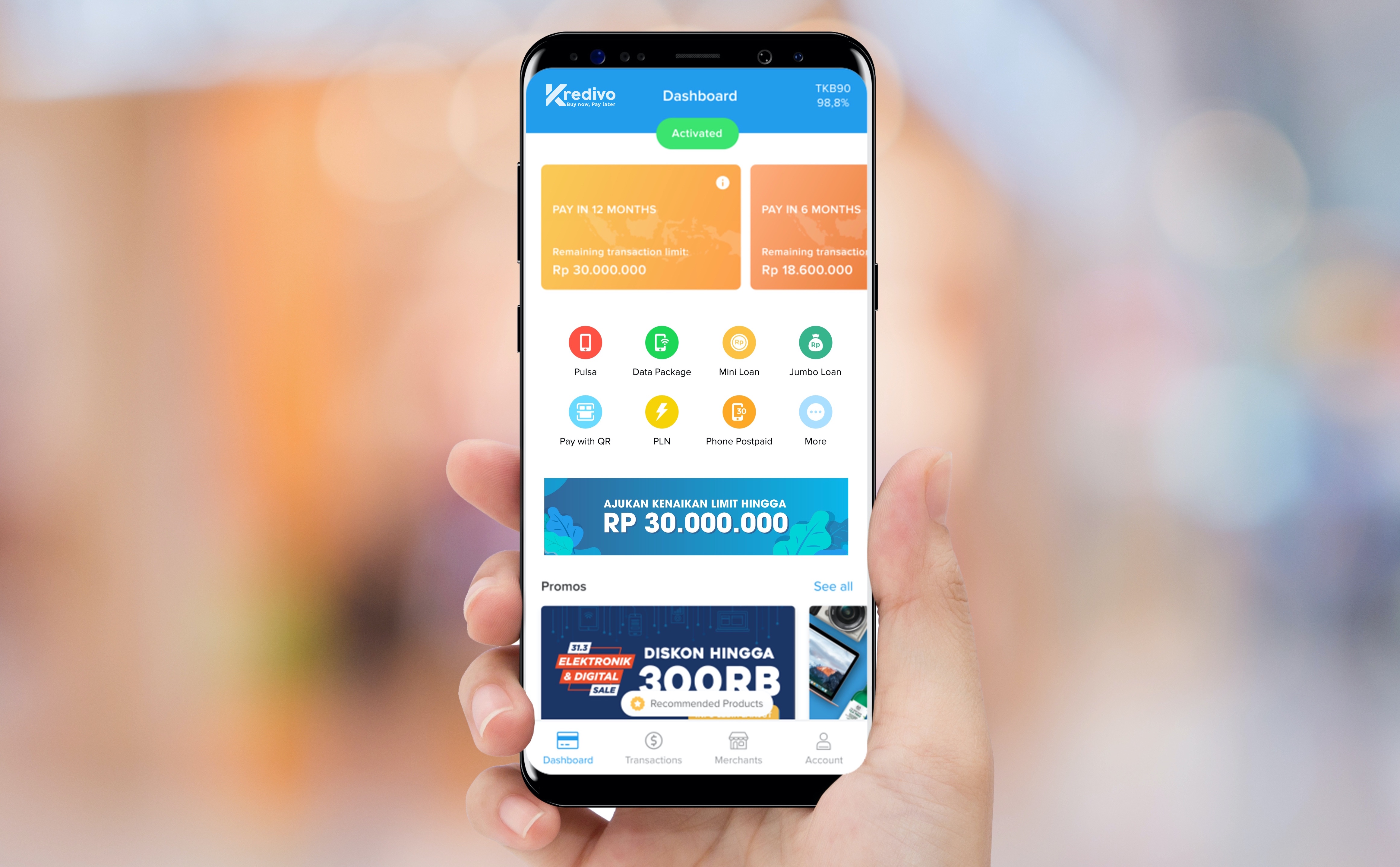

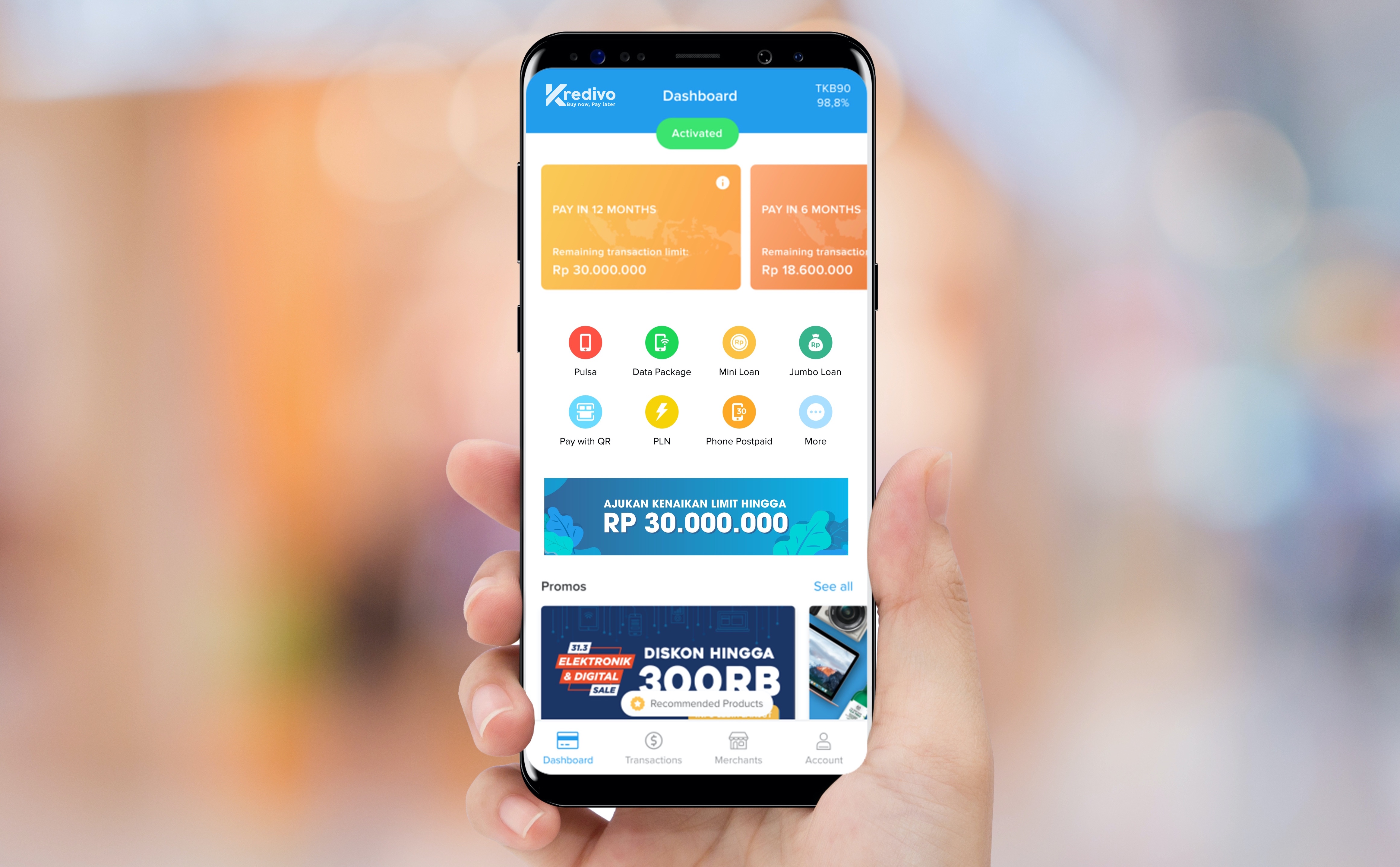

It has raised $140 million in equity to date.FinAccel operates credit lending app Kredivo in Indonesia, where it has amassed more than a

million customers and is growing by a whopping 300% each year, Akshay Garg, chief executive of FinAccel, told TechCrunch in an interview.The

app enables customers to secure credit between $100 and $2,200

If a customer pays it back in full in a month, FinAccel does not charge them any fee

Otherwise, the service levies an interest rate of 2.95%, he explained.Kredivo’s payments option is also integrated with a number of

e-commerce firms, including Lazada and Shoppe, and food delivery startups in Indonesia, so users can quickly access the credit to purchase

things and pay the app later.Credit lending apps are increasingly gaining popularity across the globe, but especially in Southeast Asian

markets, where the penetration of credit cards remains low — hence, there are very few people with a traditional credit score

This has created an opportunity for startups to look at other metrics to determine who should get a loan.FinAccel’s team poses for a

pictureGarg said Kredivo looks at a range of data points, including the kind of smartphone model a customer is using, and the apps they have

“Basically what we’re doing is almost like creating a user profile about the user using a combination of different data signals that

come from the existing credit bureaus, the telcos, the e-commerce accounts, the bank accounts and the users themselves,” he said.“All of

that creates a 360-degree overview of the customer that helps us determine the risk factors and decide whether to issue the credit,” he

As of today, Kredivo is only approving about one-third of the applications it receives.Jikwang Chung, managing director of Mirae Asset

Capital, the strategic investment arm of Mirae Asset, said in a statement that FinAccel is one of the leading companies in Southeast Asia

that is able to “combine a strong technology DNA with top-tier risk management and a bold vision of financial inclusion.”FinAccel, which

works with banks to finance the credit to customers, has evaluated more than 3 million applications to date and disbursed nearly 30 million

Garg said the startup is now working to develop more financial services, such as low-interest education and healthcare loans.In the next

three to four years, it aims to grow to 10 million users and expand to other Southeast Asian markets such as the Philippines, Thailand, and

Vietnam.A handful of other startups also operate in this space in Indonesia

C88, which also offers credit to customers, last year raised $28 million in a financing round led by Experian.