INSUBCONTINENT EXCLUSIVE:

Hello and welcome back to our regular morning look at private companies, public markets and the grey space in between.

Today, we&re digging

into a host of data concerning the East Coast venture capital scene, specifically looking into the performance of its two key startup

markets.

It 12 degrees Fahrenheit as I write this in my office situated between Boston and New York City — a perfect vantage point for

studying these vibrant tech ecosystems

Let see what the data tells us.

The information we&re examining today comes from White Star Capital (often via CBInsights), a venture

capital firm that describes itself as &transatlantic& and takes part in seed, Series A and Series B rounds around the globe

The group last raised a $180 million fund that TechCrunch covered here, noting at the time that capital pool was &oversubscribed from an

initial target of $140 million& and would be invested into &around 20 new companies from the new fund, writing opening cheques of between $1

million and $6 million.&

With boots on the ground in New York, White Star cares about the East Coast, so the fund put dossier on the region

What it includes, however, is.

We&ll start with NYC and its surprising 2019 before turning to Boston, digging into its super-giant venture

totals and hearing from Founder Collective Eric Paley on the state of things in urban Massachusetts.

New York City

White Star report details

record-breaking figures for NYC current year

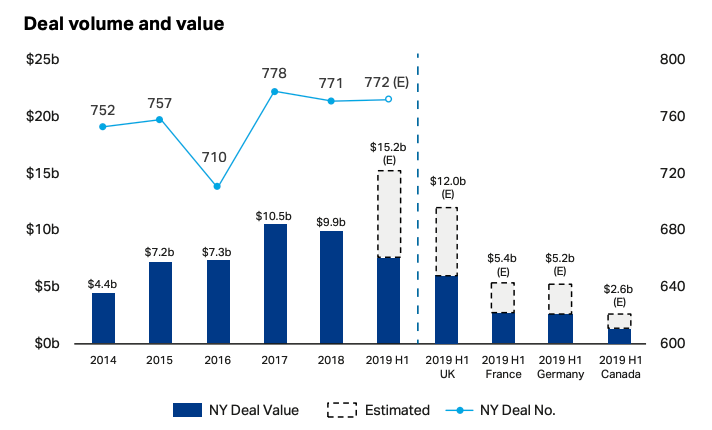

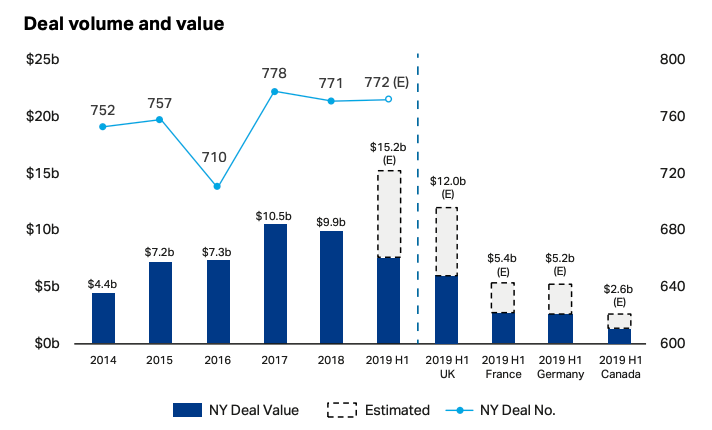

Off of effectively flat deal volume (New York City sees around 775 venture deals per year at the moment, or a little more than two per day),

the overgrown town should set record venture dollar volume in 2019.

Observe the following, astounding chart detailing the abnormality of

2019 from a comparative venture dollar perspective:

By smashing 2017 local maximum, 2019 appears set to crush the city record — and rich

— venture investment totals

The graphic also manages to point out (somewhat embarrassingly) that Gotham will manage to best a number of European countries& aggregate

venture dollar investments by itself this year.

That is a useful bit of context as in the United States, New York City is always Number Two

But, this chart argues, being number two in the number-one market is still a hell of a lot of capital.

Putting New York City venture into

even sharper comparative perspective, observe the following table: