Technology

As pilot fish is installing a new workstation, he notices something sitting on the stack of paper in a nearby printer.

&It was a piece of coral,& says fish, &so I took it out.&

Give it to me, says a user who sees what fish has done, and she puts the piece of coral back, explaining that itneeded to hold the top of the tray up so the printed sheets don&t fall to the floor.

Fish removes the coral again and flips over the tray extension. User is amazed.

Sharky knows printers need healing crystals, not corals. Send me your true tales of IT life at This email address is being protected from spambots. You need JavaScript enabled to view it.. You can also subscribe to the Daily Shark Newsletter.

To read this article in full, please click here

- Details

- Category: Technology

Read more: Wayback Wednesday: If it works, don’t knock it

Write comment (100 Comments)

Atomico is among the most widely respected venture firms in Europe, ranking right up there with friendly rivals like Accel London and Index Ventures.

Italso just 13 years old at this point, compared with its more established peers. Iteasy to overlook this, considering the impact the firm has made on the European startup scene since Swedish billionaire Niklas Zennström — who&d previously cofounded Skype and Kazaa — first swung open its doors.

Consider that four funds and $1.5 billion dollars in asset under management later, Atomico is now among Europelargest early-stage funds. It also has one of the most enviable portfolios, with companies that include Klarna (valued at $5.5 billion), Graphcore (valued at $1 billion), Stripe (valued at $35 billion) and Compass (valued at $6.4 billion), as well as a growing long list of past winners, including Climate Corp., which sold to Monsanto for $1.1 billion back in 2013.

In fact, it was through this last investment that Atomico first met Siraj Khaliq, who is today among the most senior members of the Atomico team and who will be joining us on stage at TechCrunch Berlin next week for a wide-ranging discussion about where Atomico is shopping — and how the different geographies it covers are evolving.

Khaliq previously cofounded and served as CTO of The Climate Corp. and today leads Atomico&frontier& investment team. He&ll be talking with us along the firmother most senior members, including Niall Wass, who co-leads the firmconsumer investment team; Sophia Bendz, who lead AtomicoNordic investment sourcing, as well as its angel program; and Hiro Tamura, who co-leads the firmconsumer investment team with Wass and also leads its later-stage investing team. (Tamura is also the longest serving partner at Atomico after Zennström.)

What excites them, what concerns them, and how are they trying to prepare for 2020? We&re thrilled to be sitting down with them to talk about these questions and much more.

If you care about whathappening on the ground in Europe, this is one conversation you won&t want to miss. Tickets to the show are still available. You can find the entire Disrupt Berlin agendahere.

- Details

- Category: Technology

Read more: See Atomico’s most senior VCs on stage at Disrupt Berlin

Write comment (99 Comments)After a three-day trial, Elon Musk was found not liable for defamation in a federal court today in Los Angeles, where Musk reportedly owns a cluster of six homes as well as oversees the operations of both SpaceX and Tesla.

British diver Vernon Unsworth had brought the suit against Musk in the fall of 2018 after Musk tweeted that Unsworth was a &pedo guy,& meaning a pedophile. Why: after Musk and his employees developed what they called a mini-submarine or escape pod to save a childrensoccer team from a flooded cave in Thailand in July of 2018, Unsworth — a stranger to Musk and an experienced diver with specific knowledge of the cave — called the production a &PR stunt& when asked about the effort in an interview with CNN.

Musk could &stick his submarine where it hurts,& Unsworth told the reporter.

Soon after, Musk hit the &tweet& button, publishing the now-infamous insult.

Unsworth brought the suit after Musk doubled down on his accusation, describing Unsworth as a &child rapist& in August 2018 emails to BuzzFeed. He claimed in court this week that since &being branded a pedophile& by Musk, he has felt &vulnerable and sometimes, when I&m in the U.K., I feel isolated.&

Unsworth — who in addition to being a diver is a financial consultant who divides his time between England and Thailand — was seeking damages from Musk to the tune of $190 million, including actual, assumed and punitive damages. Indeed, this week, his team tried to make the point that what he was seeking is a pittance for Musk, who was told to estimate his own net worth during the trial and guessed it to be roughly $20 billion, based on his Tesla and SpaceX holdings.

During the trial, Musk apologized repeatedly for the&pedo guy& tweet, saying that what he&d really meant was &creepy old man.& Muskattorney also defended Musktemper, telling Unworth at one point: &Do you believe Mr. Musk is so cold-hearted that he was sending over this sub with no regard for the childrenlives? . . . Are you willing to apologize to Mr. Musk for saying that it was just a PR stunt?&

Unsworth declined, saying his insult was &to the tube and not Mr. Musk personally.&

In the end, the court decided Muskoutburst wasn&t meant as a statement of fact.

CNBC notes in a separate report that the verdict could &set a precedent where free speech online, libel and slander are concerned& as among the first court cases brought by a private individual over a tweet.

Whether it emboldens Musk is another question. Musk is an avid user of Twitter and this isn&t the first time tweets have landed him in hot water.

A tweet-related battle with the Securities and Exchange Commission last year ultimately cost Musk $20 million and his role as chairman of Tesla for at least three years.

As part of the settlement, Musk also agreed to a condition stipulating that he get pre-approval before sending social media posts containing information that is &material& to Tesla investors. In April of this year, the two sides struck an updated deal that narrowed the scope of what Musk can&t tweet about without first receiving outside approval.

Unsworth had reportedly fought not to cry during the trial, saying he was &effectively given a life sentence with no parole.& He said, &It feels very raw. I feel humiliated, ashamed, dirtied.&

Unsworth created a map that helped several British divers ultimately lead the young soccer team to safety. He received an honorable mention from the Thai government along with 186 other people. Among them: Elon Musk.

Correction: We originally reported that Unsworth was among the rescuers who led the team to safety, based on other erroneous reports. Instead, according to the Washington Post, his maps led divers to the chambers where the boys were trapped, 2.5 miles from the entrance of the cave.

- Details

- Category: Technology

Read more: Elon Musk found not liable in case brought against him by British diver

Write comment (92 Comments)Once you&ve found product/market fit, scaling a SaaS business is all about honing go-to-market efficiency.

Many extremely helpful metrics and analytics have been developed to provide instrumentation for this journey: LTV (lifetime value of a customer), CAC (customer acquisition cost), Magic Numberand SaaS Quick Ratio are all very valuable tools. But the challenge in using derived metrics such as these is that there are often many assumptions, simplifications and sampling choices that need to go into these calculations, thus leaving the door open to skewed results.

For example, when your company has only been selling for a year or two, it is extremely hard to know your true lifetime customer value. For starters, how do you know the right length of a &lifetime?&

Taking one divided by your annual dollar churn rate is quite imperfect, especially if all or most of your customers have not yet reached their first renewal decision. How much account expansion is reasonable to assume if you only have limited evidence?

LTV is most helpful if based on gross margin, not revenue, but gross margins are often skewed initially. When there are only a few customers to service, cost of goods sold (COGS) can appear artificially low because the true costs to serve have not yet been tracked as distinct cost centers as most of your team members wear multiple hats and pitch in ad hoc.

Likewise, metrics derived from sales and marketing costs, such as CAC and Magic Number, can also require many subjective assumptions. When itjust founders selling, how much of their time and overhead do you put into sales costs? Did you include all sales-related travel, event marketing and PR costs? I can&t tell you the number of times entrepreneurs have touted having a near-zero CAC when they are just starting out and have only handfuls of customers — which were mostly sold by the founder or are &friendly& relationships.

Even if you think you have nearly zero CAC today, you should expect dramatically rising sales costs once professional sellers, marketers, managers, and programs are put in place as you scale.

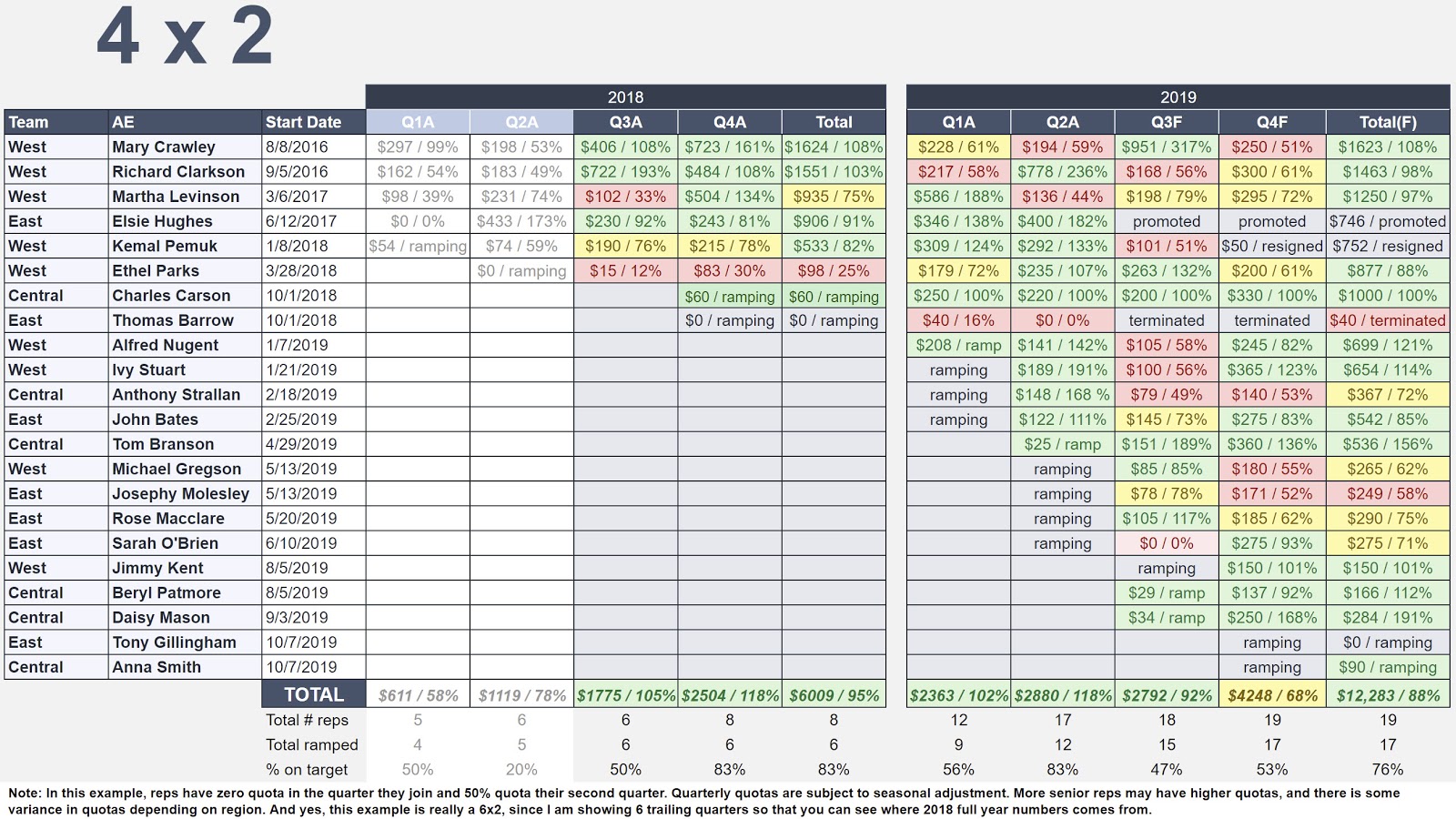

One alternative to using derived metrics is to examine raw data, which is less prone to assumptions and subjectivity. The problem is how to do this efficiently and without losing the forest for the trees. The best tool I have encountered for measuring sales efficiency is called the 4×2 (that&four by two&) which I credit to Steve Walske, one of the master strategists of software sales, and the former CEO of PTC, a company renowned for its sales effectiveness and sales culture. [Herea podcast I did with Steve on How to Build a Sales Team.]

The 4×2 is a color-coded chart where each row is an individual seller on your team and the columns are their quarterly performance shown as dollars sold. [See a 4×2 chart example below].

Sales are usually measured as net new ARR, which includes new accounts and existing account expansions net of contraction, but you can also use new TCV (total contract value), depending on which number your team most focuses. In addition to sales dollars, the percentage of quarterly quota attainment is shown. The name 4×2 comes from the time frame shown: trailing four quarters, the current quarter, and the next quarter.

Color-coding the cells turns this tool from a dense table of numbers into a powerful data visualization. Thresholds for the heatmap can be determined according to your own needs and culture. For example, green can be 80% of quota attainment or above, yellow can be 60% to 79% of quota, and red can be anything below 60%.

Examining individual seller performance in every board meeting or deck is a terrific way to quickly answer many important questions, especially early on as you try to figure out your true position on the Sales Learning Curve. Publishing such leaderboards for your Board to see also tends to motivate your sales people, who are usually highly competitive and appreciate public recognition for a job well done, and likewise loathe to fall short of their targets in a public setting.

A sample 4×2 chart.

Some questions the 4×2 can answer:

Overall performance and quota targets

How are you doing against your sales plan? Lots of red is obviously bad, while lots of green is good. But all green may mean that quotas are being set too low. Raising quotas even by a small increment for each seller quickly compounds to yield big difference as you scale, so having evidence to help you adjust your targets can be powerful. A reasonable assumption would be annual quota for a given rep set at 4 to 5 times their on-target earnings potential.

- Details

- Category: Technology

Read more: To measure sales efficiency, SaaS startups should use the 4×2

Write comment (99 Comments)

Boeing and launch partner United Launch Alliance (ULA) completed a key step today in pursuit of launching U.S. astronauts aboard their commercial spacecraft. The Boeing CST-100 Starliner crew capsule was atop the ULA Atlas V rocket at Cape Canaveral Air Force StationLaunch Complext 41 in Florida, with the rocket fully fuelled while the combined crew all took part in a dress rehearsal called the &integrated Day of Launch Test & aka IDOLT because space people all love acronyms so much.

The rehearsal paves the way for the uncrewed Orbital Flight Test (OFT) that NASA, ULA and Boeing are targeting for December 20 (which just changed today from December 19), which will be exactly what the first crewed mission aboard the Starliner will be, but without the crew on board. Todaytest involved everything leading up to the actual launch, including real feeling, a launch countdown, preparing and checking the access hatch to the crew capsule and more.

This kind of practice was standard during the days of Shuttle launches, and helps ensure that everyone knows what to do and when, and that more than just knowing, they can demonstrate that it works exactly as itsupposed in a real-world setting. The full integrated dress rehearsal is especially important, since while you can always drill teams independently, you never know exactly how things are going to work until you run them all together.

As mentioned,d next up is the crucial OFT that will set the stage for a crewed launch early next year. The current target is December 20, so Boeing and its partners should get this in just before yearend, if all goes to plan.

- Details

- Category: Technology

Bird has laid off less than two dozen employees, The San Francisco Chronicle first reported. The layoffs affect employees Bird brought on board as part of its~$25 million acquisition of Scoot earlier this year.

Those affected were salaried employees and/or people with technical backgrounds, according to Bird.

&The integration of Bird and Scoot does not impact or change our previous or future commitments to San Francisco or to providing its residents and visitors access to the highest quality and most reliable shared micromobility vehicles and services,& a Bird spokesperson told TechCrunch. &We are planning to relocate a number of Scoot team members to our Santa Monica headquarters while also maintaining an office in San Francisco for our operations and maintenance teams as well as a number of regionally specific roles.&

Scoot currently operates electric kick scooters and mopeds in San Francisco, where itone of four companies permitted to do so, as well as other types of vehicles in Santiago and Barcelona.

This round marks Birdsecond set of layoffs this year. In March, Bird laid off between 4-5% of its workforce. Those layoffs were part of Birdannual performance review process and only affected U.S.-based employees.

In October, Bird closed a $275 million Series D round led by CDPQ and Sequoia Capital at a $2.5 billion pre-money valuation. That same month, at TechCrunch Disrupt San Francisco, Bird CEO Travis VanderZanden told me he wants the Scoot brand to live on.

&We think it is a strong brand particularly with cities and so we want it to live on,& he said. &It&ll certainly live on in San Francisco. And then we&re still trying to figure out in other cities what makes the most sense for the brand.&

- Details

- Category: Technology

Read more: Bird lays off several Scoot employees

Write comment (95 Comments)Page 176 of 5614

16

16