Technology

Northzone, the European VC firm thatprobably best-known for being an early backer of Spotify, has raised a new $500 million fund, which it claims was oversubscribed and will reach its final close imminently.

Dubbed &Northzone IX,& the new fund pretty much represents business as usual for Northzone and will be used to invest primarily at Series A and B, with &selective& Seed investments (as many Series A firms increasingly do).

Geographically, Northzone is targeting Europe and the East Coast of the U.S., and is eyeing up early-stage consumer and enterprise companies that are addressing &large and established industries saddled with legacy technology&. This includes financial services, healthcare, education, mobility and construction.

The VC firm is also announcing two promotions. Hello Fresh co-founder Jessica Schultz and Dots co-founder Paul Murphy have been promoted to General Partners, in addition to existing GPs Pär-Jörgen Pärson, Jeppe Zink, and Michiel Kotting.

&Tech businesses are becoming giants in new industries like construction, food, and finance,& says Murphy, during a telephone interview alongside Schultz and Kotting. &And these industries are 4 trillion to 10 trillion in size, so quite a bit bigger than media, which is where most of the focus has been in the past few decades. I think itexciting, we look at huge addressable markets, both in terms of existing incumbents, and consumers and users and businesses. But italso challenging because it means we do sort of become, you know, pretty deep on multiple industries, instead of just one&.

To manage this, Murphy explains that Northzone takes a &thematic approach& to investing, whereby themes cut across sectors. &So it could be a certain theme that leads us to a finTech investment or to a mobility investment,& he says. &We try to let the themes take us where they take us, instead of having to focus in on one particular sector&.

&I think our strategy is still looking for founders with huge ambition and conviction to build transformative businesses,& adds Schultz.

With an avalanche of new European VC funds being announced — I chalk this up as the fourth I&ve covered in the last week, I posit that we could be in a bubble or at least somewhat frothy times.

&I think that therealways cycles,& says Murphy. &And I think where we are in this cycle, therea lot of people that are speculating. I think the broad macro climate indicates that we&re maybe at the high end of that cycle, and tech is core to many, many countries& economy now. So I don&t want to claim that we&re immune to any sort of downturn that may come.

&That said, as I mentioned before, tech is now going after industries that are exponentially larger than what they&ve gone after in the past. There is a whole lot of opportunity out there. Yes, theremore funds than ever, but if we want to fully capture all of the opportunities that exist around the world in tech, I think we need many more funds than exists today&.

&I think thatwhere we have the benefit of history a little bit, as we&ve been in the business for 23 years now,& says Schultz. &We&ve seen a lot of the downturns from dot com boom to the financial crisis in 2008. And I think that also gives us a little bit of a perspective on the opportunities you get in the downturns and also the important areas to focus on during challenging market conditions. As Paul said, we think there will still be a lot of opportunities regardless of the economic cycles&.

The key to VC investing, regardless of cycle, is to stay disciplined &and look for the fundamentals of the businesses& that fit a long term view of how the world is changing.

Somewhat related to this, although Northzone isn&t able to disclose a list of its LPs — who are said to be a mixture of existing investors and new ones — General Partner Michiel Kotting says the majority are in Europe.

&We have always maintained that as a European product, we want predominantly European investors behind us. So itan awful lot of European but we&re not one of these EIF [European Investment Fund] dominated funds at all. And we also have systematically stepped up Asian and U.S. LPs in recent years. But the key thing for us is, we learned that lesson a decade ago, you can&t be a European product and be dominated by U.S. or Asian LPs. Because when a financial crisis comes around, they tend to drop those sort of products first. So we&ve always made sure that we have a natural alignment with our LP base&.

- Details

- Category: Technology

Read more: Northzone raises new $500M fund to back startups in Europe (and the East Coast, US)

Write comment (98 Comments)Thereliterally a lot more stuff in space than there was last week & or at least, the number of active human-made satellites in Earthorbit has gone up quite a bit, thanks to the launch of SpaceX first 60 production Starlink satellites. This week also saw movement in other key areas of commercial space, and some continued activity in early-stage space startup ecosystem encouragement.

Some of the ‘New Space& companies are flexing the advantages that are helping them shake up an industry typically reserved for just a few deep-pocketed defence contractors, and NASA is getting ready for planetary space exploration in more ways than one.

1. SpaceX launches 60 Starlink satellites

The 60 Starlink satellites that SpaceX launched this week are the first that aren&t specifically designated as tester vehicles, even though it launched a batch of 60 earlier this year, too. These ones will form the cornerstone of between 300-400 or so that will provide the first commercial service to customers in the U.S. and Canada next year, if everything goes to SpaceXplan for its new global broadband service.

Aside from being the building blocks for the companyfirst direct-to-consumer product, this launch was also an opportunity for SpaceX to show just how far its come with reusability. It flew the companyfirst recovered rocket fairing, for instance, and also used a Falcon 9 booster for the fourth time &and landed it, so that it can potentially use it on yet another mission in the future.

2. Rocket Labnew room-sized robot can don in 12-hours what used to take ‘hundreds&

Rocket Lab is aiming to providing increasingly high-frequency launch capabilities, and the company has a new robot to help it achieve very quick turnaround on rocket production: Rosie. Rosie the Robot can produce a launch vehicle about once every 12 hours & handling the key task of processing the companyElectron carbon composite stages in a way that cuts what used to take hundreds of manual work hours into something that can be done twice a day.

Rocket Lab is aiming to providing increasingly high-frequency launch capabilities, and the company has a new robot to help it achieve very quick turnaround on rocket production: Rosie. Rosie the Robot can produce a launch vehicle about once every 12 hours & handling the key task of processing the companyElectron carbon composite stages in a way that cuts what used to take hundreds of manual work hours into something that can be done twice a day.

3. SpaceX completes Crew Dragon static fire test

This is big because the last time SpaceX fired up the Crew Dragoncrucial SuperDraco thrust system, it exploded and took the capsule with it. Now, the crew spacecraft can move on to the next step of demonstrating an in-flight abort (the emergency ‘cancel& procedure that will let astronauts on board get out with their lives in the case of a post-launch, mid-flight emergency) and then iton to crewed tests.

4. Virgin Galacticfirst paying customers are doing their astronaut training

Itnot like they&ll have to get out and fix something in zero gravity or anything, but the rich few who have paid Virgin Galactic $250,000 per seat for a trip to space will still need to train before they go up. They&ve now begun doing just that, as Virgin looks to the first half of next year for its first commercial space tourism flights.

5. TechStars launches another space tech accelerator

They have a couple now, and this new one is done in partnership with the U.S. Air Force, along with allied government agencies in The Netherlands and Norway. This one doesn&t require that participants relocated to a central hub for the duration of the program, which should mean more global appeal.

6. NASA funds new Stingray-inspired biomimetic spacecraft

Bespincloud cars were cool, but a more realistic way to navigate the upper atmosphere of a gaseous planet might actually be with robotic stingrays that really flap their ‘fins.& Yes, actually.

Bespincloud cars were cool, but a more realistic way to navigate the upper atmosphere of a gaseous planet might actually be with robotic stingrays that really flap their ‘fins.& Yes, actually.

7. Blue Originlunar lander partner Draper talks blending old and new space companies

Blue Origin Jeff Bezos announced a multi-partner team that will work on the companylunar lander, and its orbital delivery mechanism. A key ingredient there is longtime space industry experts Draper, which was born out of MIT and which is perhaps most famous for having developed the Apollo 11 guidance system. Draper will be developing the avionics and guidance systems for Blue Originlunar lander, too, and Mike Butcher caught up with Draper CEO Ken Gabriel to discuss. (Extra Crunch subscription required)

- Details

- Category: Technology

Read more: Max Q: SpaceX starts building out its production Starlink constellation

Write comment (100 Comments)It was the one of the best phishing emails we&ve seen… that wasn&t.

Phishing remains one of the most popular attack choices for scammers. Phishing emails are designed to impersonate companies or executives to trick users into turning over sensitive information, typically usernames and passwords, so that scammers can log into online services and steal money or data. But detecting and preventing phishing isn&t just a user problem — ita corporate problem too, especially when companies don&t take basic cybersecurity precautions and best practices to hinder scammers from ever getting into a userinbox.

Enter TriNet, a human resources giant, which this week became the poster child for how how to make a genuine email to its customers look inadvertently as suspicious as it gets.

Remote employees at companies across the U.S. who rely on TriNet for access to outsourced human resources, like their healthcare benefits and workplace policies, were sent an email this week as part of an effort to keep employees &informed and up-to-date on the labor and employment laws that affect you.&

Workers at one Los Angeles-based health startup that manages its employee benefits through TriNet all got the email at the same time. But one employee wasn&t convinced it was a real email, and forwarded it — and its source code — to TechCrunch.

TriNet is one of the largest outsourced human resources providers in the United States, primarily for small-to-medium-sized businesses that may not have the funding to hire dedicated human resources staff. And this time of year is critical for companies that rely on TriNet, since health insurance plans are entering open enrollment and tax season is only a few weeks away. With benefit changes to consider, itnot unusual for employees to receive a rash of TriNet-related emails towards the end of the year.

But this email didn&t look right. In fact when we looked under the hood of the email, everything about it looked suspicious.

This is the email that remote workers received. TriNet said the use of an Imgur-hosted image in the email was &mistakenly& used. (Image: TechCrunch/supplied)

We looked at the source code of the email, including its headers. These email headers are like an envelope — they say where an email came from, who itaddressed to, how it was routed, and if there were any complications along the way, such as being marked as spam.

There were more red flags than we could count.

Chief among the issues were that the TriNet logo in the email was hosted on Imgur, a free image-hosting and meme-sharing site, and not the companyown website. Thata common technique among phishing attackers — they use Imgur to host images they use in their spam emails to avoid detection. Since the image was uploaded in July, that logo was viewed more than 70,000 times until we reached out to TriNet, which removed the image, suggesting thousands of TriNet customers had received one of these emails. And, although the email contained a link to a TriNet website, the page that loaded had an entirely different domain with nothing on it to suggest it was a real TriNet-authorized site besides a logo, which if it were a phishing site could&ve been easily spoofed.

Fearing that somehow scammers had sent out a phishing email to potentially thousands of TriNet customers, we reached out to security researcher John Wethington, founder of security firm Condition:Black, to examine the email.

It turns out he was just as convinced as us that the email may have been fake.

&As hackers and self-proclaimed social engineers, we often think that spotting a phishing email is ‘easy&,& said Wethington. &The truth is ithard.&

&When we first examined the email every alarm bell was going off. The deeper we dug into it the more confusing things became. We looked at the domain name records, the sitesource code, and even the webpage hashes,& he said.

There was nothing, he said, that gave us &100% confidence& that the site was genuine until we contacted TriNet.

TriNet spokesperson Renee Brotherton confirmed to TechCrunch that the email campaign was legitimate, and that it uses the third-party site &for our compliance ePoster service offering. She added: &The Imgur image you reference is an image of the TriNet logo that Poster Elite mistakenly pointed to and it has since been removed.&

&The email you referenced was sent to all employees who do not go into an employerphysical workspace to ensure their access to required notices,& said TriNetspokesperson.

When reached, Poster Elite also confirmed the email was legitimate.

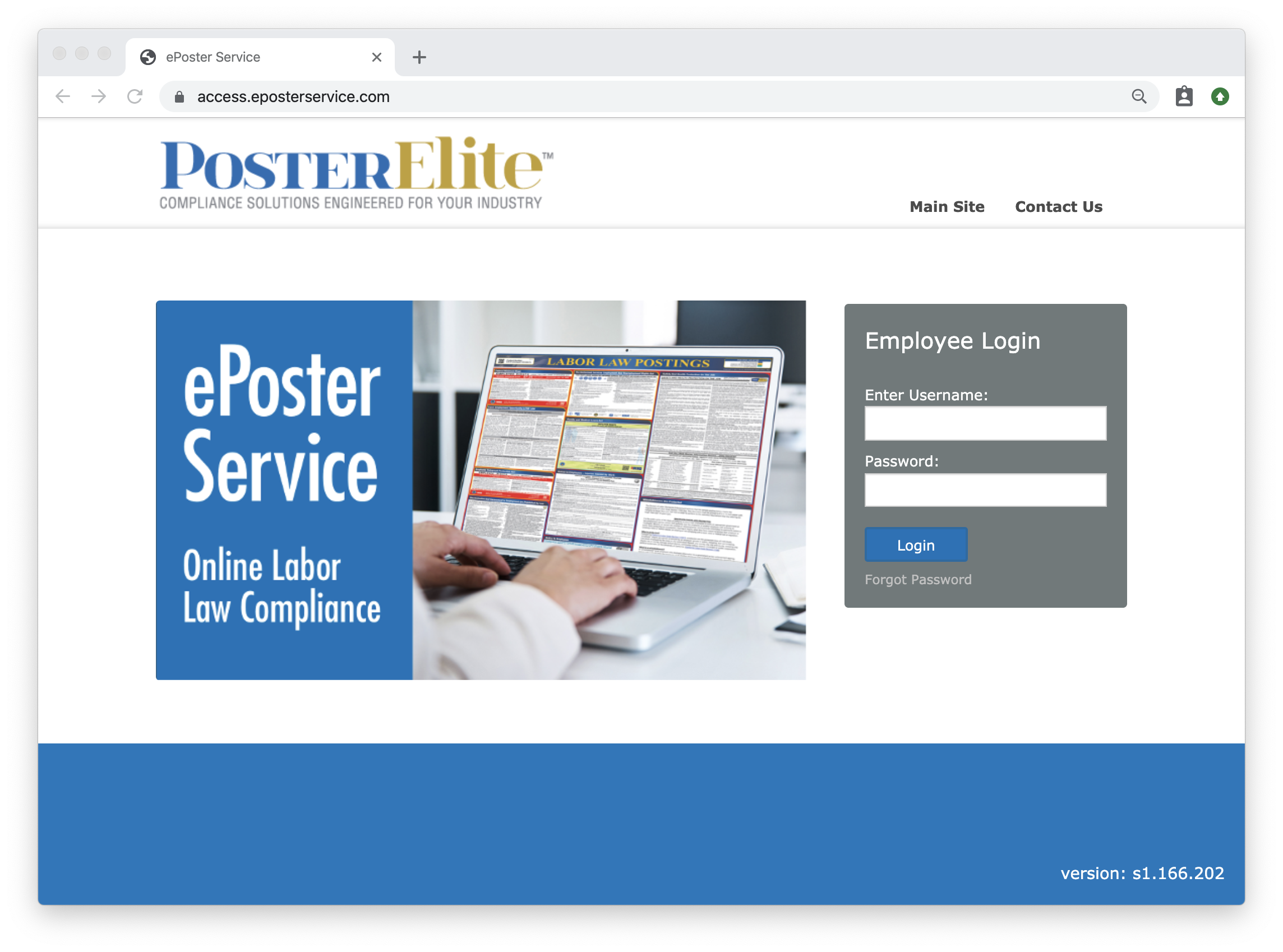

This is not a phishing site, but it sure looks like one. (Image: TechCrunch)

How did TriNet get this so wrong? This culmination of errors had some who received the email worried that their information might have been breached.

&When companies communicate with customers in ways that are similar to the way scammers communicate, it can weaken their customerability over time to spot and shut down security threats in future communications,& said Rachel Tobac, a hacker, social engineer, and founder of SocialProof Security.

Tobac pointed to two examples of where TriNet got it wrong. First,iteasy for hackers to send spoofed emails to TriNetworkers because TriNet&sDMARC policy on its domain name is not enforced.

Second, the inconsistent use of domain names is confusing for the user. TriNet confirmed that it pointed the link in the email — posters.trinet.com — to eposterservice.com, which hosts the companycompliance posters for remote workers. TriNet thought that forwarding the domain would suffice, but instead we thought someone had hijacked TriNetdomain name settings — a type of attack thaton the increase, though primarily carried out by state actors. TriNet is a huge target — it stores workers& benefits, pay details, tax information and more. We had assumed the worst.

&This is similar to an issue we see with banking fraud phone communications,& said Tobac. &Spammers call bank customers, spoof the banknumber, and pose as the bank to get customers to give account details to ‘verify their account& before ‘hearing about the fraud the bank noticed on their account — which, of course, is an attack,& she said.

&This is surprisingly exactly what the legitimate phone call sounds like when the bank is truly calling to verify fraudulent transactions,& Tobac said.

Wethington noted that other suspicious indicators were all techniques used by scammers in phishing attacks. The posters.trinet.com subdomain used in the email was only set up a few weeks ago, and the eposterservice.com domain it pointed to used an HTTPS certificate that wasn&t associated with either TriNet or Poster Elite.

These all point to one overarching problem. TriNet may have sent out a legitimate email but everything about it looked problematic.

On one hand, being vigilant about incoming emails is a good thing. And while ita cat-and-mouse game to evade phishing attacks, there are things that companies can do to proactively protect themselves and their customers from scams and phishing attacks. And yet TriNet failed in almost every way by opening itself up to attacks by not employing these basic security measures.

&Ithard to distinguish the good from the bad even with proper training, and when in doubt I recommend you throw it out,& said Wethington.

- Details

- Category: Technology

Read more: TriNet sent remote workers an email that some thought was a phishing attack

Write comment (94 Comments)Something strange is afoot in the world of cryptocurrencies. For the first time since Satoshi dropped Bitcoin on us like a benevolent bomb, this painfully new, highly bizarre field has become … well … boring. The true believers will tell you that great strides are being made, and the mainstream breakthrough is just around the corner, but they&ve been saying that for long enough that itbeginning to seem reasonable to start wondering if these wolves were ever real.

I know, I know, it seems especially weird to be saying this at the same time that the President of China and CEO of Facebook have both become blockchain advocates. But Chinacryptocurrency, if it happens, will be a panopticoin, a tool to centralize monetary control even more firmly in the hands of the Communist Party, nothing like the decentralized censorship-resistant programmable money that the crypto community is theoretically all about; and Facebook&s, while making technical progress, keeps losing partners and gaining enemies.

The crypto community is currently all agog about &DeFi,& for decentralized finance, a movement which basically expands cryptocurrencies from &censorship-resistant money& to &censorship-resistant financial instruments,& such as collateralized loans and interest-bearing investments, along with &staking& (not really DeFi, but often treated as it.) Inside the crypto world, this seems like a revolution which will one day replace Wall Street. Outside the crypto world, it seems … a little like monks debating how many angels can dance on the end of a pin, one that no one is actually using and nobody outside the monastery cares about.

Iteasy to get the impression the cryptocurrency world has sacrificed technical engineering in favor of financial engineering. Iteasy to see them as having abandoned &banking the unbanked,& the alleged initial noble goal of many, to &offering sophisticated financial instruments to the unbanked,& long before any of those famous unbanked have actually been, you know, banked. And I&m sorry to report that you wouldn&t be entirely wrong.

But there are real technical advances being made. Itjust that they&re mostly slow and behind the scenes, and in the interim, the community&MOPs and sociopaths& have seized on DeFi.

There is some visible progress. ZCash is making apparent breakthroughs in important, foundational cryptographic research. Tezos continues to upgrade its governance algorithms — modify its code constitution, basically — successfully.

On the application layer, I&m interested in Vault12, which uses &friends and family to safeguard crypto assets& — basically, instead of entrusting the secret keys which control your cryptocurrencies to a third party like an exchange, something not particularly different from traditional banking, you protect them among people you trust, so that some number of them can collaborate with you to recover your keys if they&re lost, using a cryptographic protocol known as ShamirSecret Sharing. Luminaries such as Vitalik Buterin and Christopher Allen have argued for &social key recovery& for some time, and itinteresting to see it offered by a slick new Valley startup.

But a lot of whathappening is more fundamental, in search of the ability to support many more transactions than todayblockchains. The entire foundation of todaysecond-leading cryptocurrency, Ethereum, is being torn apart and replaced wholesale, in search of &Ethereum 2.0.& Bitcoin remains much more stable and conservative, but a whole new story is being added to its foundations, the Lightning Network. Both make me uneasy. A fundamental rewrite is always worrying. Lightning may scale, but it is if anything even more user-hostile than Bitcoin, basically the cryptocurrency equivalent of a hard-to-use prepaid credit card. Still, the permissionless equivalent of prepaid credit cards would be good for the unbanked that everyoneclearly so worried about, right?

I&m also uneasy because almost all blockchain scaling solutions — Lightning, sharding, Plasma, optimistic rollup, etc. — turn fundamental blockchain security from something relatively passive (check the hashes and use the chain with the most computational power) to something active (&watchtowers,& &fraud proofs.&) This seems to me to increase the security attack surface a lot.

All these issues may yet be solved. Sure. But at the same time, it feels like dissonance between the attitude inside the crypto bubble and that of mundanes may never have been greater. Meanwhile, the dark spectre of Tether hangs over the entire industry. OK, circumstantial evidence is inadmissible for good reason … but there sure is a lot of it.

I&ve argued before that &ongoing associations with a cloud of crazy scandal and hangers-on snake-oil salespeople — all of which would be catastrophic signs for, say, a traditional new startup — can actually be indicators of the strength, not weakness& of the cryptocurrency movement …

…but at some point, your religion — or &brain virus,& as Naval Ravikant once called cryptocurrencies — has to begin to appeal to people who do not actually live on your compound, or else you are going to be remain a cult and wither out. When is that going to happen? Is that going to happen? The answer remains no clearer than it was five years ago.

- Details

- Category: Technology

Hello and welcome back to TechCrunchChina Roundup, a digest of recent events shaping the Chinese tech landscape and what they mean to people in the rest of the world. The earnings season is here. This week, long-time archrivals in the Chinese internet battlefield — Alibaba and Tencent — made some big revelations about their future. First off, letlook at Alibabalong-awaited secondary listing and annual shopping bonanza.

Forget about the number

Itthat time of year. On November 11, Alibaba announced it generated $38.4 billion worth of gross merchandise value during the annual SingleDay shopping festival, otherwise known as Double 11. It smashed the record and grabbed local headlines again, but the event means little other than a big publicity win for the company and showcasing the art of drumming up sales.

GMV is often used interchangeably with sales in e-commerce. Thatproblematic because the number takes into account all transactions, including refunded items, and itby no means reflective of a companyactual revenue. There are numerous ways to juice the figure, too, as I wrote last year. Presales began days in advance, incentives were doled out to spur last-minute orders and no refunds could be processed until November 12.

Even Jiang Fan, the boss of Alibabae-commerce business and the youngest among Alibaba38 most important decision-makers, downplayed the number: &I never worry about transaction volumes. Numbers don&t matter. Whatmost important is making SingleDay fun and turning it into a real festival.&

Indeed, Alibaba put together another year of whatequivalent to the Super Bowl halftime show. Taylor Swift and other international big names graced the stage as the evening gala was live-streamed and watched by millions across the globe.

Returning home

Alibaba is going ahead with its secondary listing in Hong Kong on the heels of reports that it could delay the sale due to ongoing political unrest in the city-state. The company is cash-rich, but listing closer to its customers can potentially ease some of the pressure arising from a new era of volatile U.S.-China relationships.

Alibaba is issuing 500 million new shares with an additional over-allotment option of 75 million shares for international underwriters, it said in a company blog. Reports have put the size of its offering between $10 billion and $15 billion, down from the earlier rumored $20 billion.

The giant has long expressed it intends to come home. In 2014, the e-commerce behemoth missed out on Hong Kong because the local exchange didn&t allow dual-class structures, a type of organization common in technology companies that grants different voting rights for different stocks. The giant instead went public in New York and raised the largest initial public offering in history at $25 billion.

&When Alibaba Group went public in 2014, we missed out on Hong Kong with regret. Hong Kong is one of the worldmost important financial centers. Over the last few years, there have been many encouraging reforms in Hong Kongcapital market. During this time of ongoing change, we continue to believe that the future of Hong Kong remains bright. We hope we can contribute, in our small way, and participate in the future of Hong Kong,& said chairman and chief executive Daniel Zhang in a statement.

Missing out on Alibaba had also been a source of remorse for the Stock Exchange of Hong Kong. Charles Li, chief executive of the HKEX, admitted that losing Alibaba to New York had compelled the bourse to reform. The HKEX has since added dual-class shares and attracted Chinese tech upstarts such as smartphone maker Xiaomi and local services platform Meituan Dianping.

Tencentnew fuel

Content and social networks have been the major revenue drivers for Tencent since its early years, but new initiatives are starting to gain ground. In the third quarter ended September 30, Tencent&fintech and business services& unit, which includes its payments and cloud services, became the firmsecond-largest sales avenue trailing the long-time cash cow of value-added services, essentially virtual items sold in games and social networks.

Payments, in particular, accounted for much of the quarterly growth thanks to increased daily active consumers and number of transactions per user. Thatgood news for the company, which said back in 2016 that financial services would be its new focus (in Chinese) alongside content and social. The need to diversify became more salient in recent times as Tencent faces stricter government controls over the gaming sector and intense rivalry from ByteDance, the new darling of advertisers and owner of TikTok and Douyin.

Tencent also broke out revenue for cloud services for the first time. The unit grew 80% year-on-year to rake in 4.7 billion yuan ($670 million) and received a great push as the company pivoted to serve more industrial players and enterprises. Alibabacloud business still leads the Chinese market by a huge margin, with revenue topping $1.3 billion during the September quarter.

Also worth your attention…

Luckin Coffee, the Chinese startup that began as a Starbucks challenger, is starting to look more like a convenient store chain with delivery capacities as it continues to increase store density (a combination of seated cafes, pickup stands and delivery kitchens) and widen product offerings to include a growing snack selection. Though bottom-line loss continued in the quarter, store-level operating profit swung to $26.1 million from a loss in the prior-year quarter. 30 million customers have purchased from Luckin, marking an increase of 413.4% from 6 million a year ago.

Minecraft is on the brink of 300 million registered users in China, its local publisher Netease announced at an event this week. Thata lot of players, but not totally unreasonable given the game is free-to-play in the country with in-game purchases, so users can easily own multiple accounts. Outside China, the game has sold over 180 million paid copies, according to gaming analyst Daniel Ahmed from Niko Partners.

Xiaomi founder Lei Jun is returning a huge favor by backing a long-time friend. Xpeng Motors, the Chinese electric vehicle startup financed by Alibaba and Foxconn, has received $400 million in capital from a group of backers who weren&t identified except Xiaomi, which became its strategic investor. The marriage would allow Xpeng cars to tap Xiaomigrowing ecosystem of smart devices, but the relationship dates further back. Lei was an early investor in UCWeb, a browser company founded by He and acquired by Alibaba in 2014. A day after Xiaomibegan trading in Hong Kong in mid-2018, He wrote on his WeChat feed that he had bought $100 million worth of Xiaomi shares (in Chinese) in support of his old friend.

- Details

- Category: Technology

Read more: China Roundup: Alibaba’s Hong Kong listing and Tencent’s new fuel

Write comment (94 Comments)

Draper, the MIT spin-off engineering lab, is famed for developing the Apollo 11 Guidance Computer (not Draper Esprit, I hasten to add). Ken Gabriel, President and CEO, also recently made a major announcement. Blue Origin has now partnered with Lockheed Martin and Northrop Grumman to build elements of the companyhuman-rated lunar lander, and Draper will lead the development of the landeravionics and guidance systems, with an aim to be ready to land a crew on the moon by 2024.

&While Blue Origin is the prime contractor, Lockheed Martin is building the ascent stage, Northrop Grumman is building the transfer element and Draper is doing the GNC (guidance, navigation and control),& Blue Origin CEO and founder Jeff Bezos said, announcing the move at the International Astronautical Congress in Washington. Blue Origin is competing for a NASA contract to develop a crewed lunar lander, or Human Landing System, for the Artemis program, which aims to return astronauts to the surface of the moon by the end of 2024.

TechCrunch sat down to chat with Gabriel, who previously he co-founded GoogleAdvanced Technology and Projects (ATAP) group, to tlak about what he sees coming up in the future for the most advanced technologies. Prior to this, he was Deputy and Acting Director of the famed DARPA in the U.S. Department of Defense. During his tenure, DARPA advanced capabilities in hypersonics, offensive and defensive cyber, and big data analytics for intelligence and national security.

- Details

- Category: Technology

Read more: The man behind Bezos’ next lunar guidance system talks future tech

Write comment (94 Comments)Page 331 of 5614

20

20