Technology

Pan-African e-commerce startup Jumia released its third-quarter financial results today.

The numbers and presentation reflected some of the same past trends, with a dash of new, and nary a mention of a declining share price.

The results

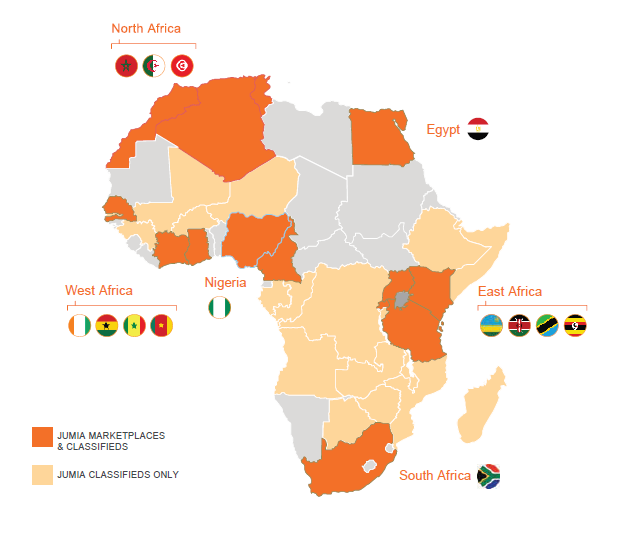

Jumia — with online goods and service verticals in 14 countries — posted third-quarter revenue growth of 19% (€40 million) and increased its active customer base 56% to 5.5 million from 3.5 million over the same period a year ago.

JumiaGross Merchandise Value (GMV) — the total amount of goods sold over the period — grew by 39% to €275 million. The online retailer nearly doubled its orders from 3.6 million in Q3 2018 to 7 million in Q3 2019.

Jumia also saw growth in its JumiaPay digital finance product, with total payment volume growing 95% to €32 million in Q3 2019 from €16.4 million in Q3 2018.

This is significant, as the company has committed to generate more revenues from digital payment products and offer JumiaPay as a standalone service across Africa.

The overall pattern of growing revenues and customers YoY has been consistent for Jumia.

But so too have the companylosses, which widened 34% in 3Q 2019 to €54.6 million, compared to €40.6 million. Negative EBITDAincreased 26% to €45.4 million from €35.8 over the same period in 2018.

Jumia pegged a large part of the spike in losses to an increase in fulfillment expenses due to more cross-border goods transactions (with higher shipping costs) on its platform in 3Q 2019.

Whatnew

Jumia introduced some new methodologies and measures for its results. &We believe the most relevant monetization metrics for us are market-based revenue and gross profit,& Jumia Group CFO Antoine Maillet-Mezeray explained on the call.

&We don&t see revenue as a meaningful metric to assess the monetization of our business as it is impacted by shifts in the revenue mix between first party and marketplace,& he said.

If and when Jumia does get into the black, I suspect revenue will shift back as key.

On its path to profitability, Jumia CEO Sacha Poignonnec reaffirmed the companycommitment to generate more revenue from higher margin (straight through) products, such as JumiaPay and Jumiaclassified business, over cost-intensive (and logistically complicated) online goods sales.

&We are focused on driving the adoption and penetration of Jumia pay within our own ecosystem,& he said — meaning across Jumiaexisting buyer-seller universe.

Since its founding in 2012, the company has been forced to adapt to slower digital payments integration in its core Nigeria and allow cash-on-delivery payments, which are costly and more problematic than digital processing.

Poignonnec highlighted Jumiacommitment to build a financial services marketplace (and revenues) from consumers and partners using JumiaPay and JumiaLending for products such as loans, third-party credit-scoring and insurance, he explained. This has led to Jumia moving into working-capital services for vendors on its platform.

On the movement of online goods, Jumia highlighted the expansion of its JumiaMall service, which offers brands — such as L&Oreal, Samsung and Unliver — more tailored selling options on its website around shipping, product positioning and consumer data analytics.

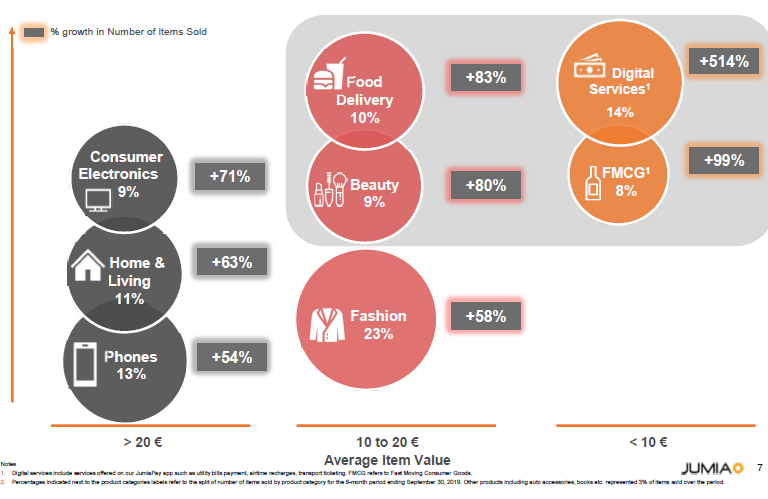

Jumia also shared info on product mix and diversification, which showed strong upward trends in digital services, the sale of consumer electronics and beauty products.

Share price

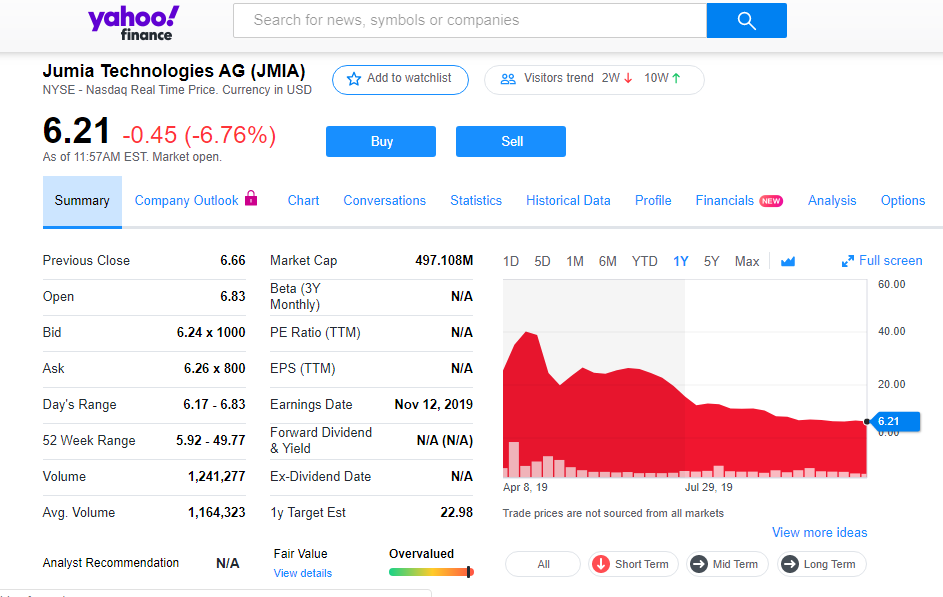

Surprisingly absent from Jumiaearnings call and the subsequent Q-A was any discussion of the companyshare price.

Todayreporting was slightly more anticipated, given Jumia has faced a short-seller assault, sales scandal and significant market-cap drop since its April IPO on the NYSE.

The online retailer gained investor confidence out of the gate, more than doubling its $14.50 opening share price after the IPO.

That lasted until May, when Jumiastock came under attack from short-seller Andrew Left,whose firm Citron Research issued a reportaccusing the company of fraud. That prompted several securities-related lawsuits against Jumia.

The companyshare price plummeted 43% — from $49 to $26 — the week Left released his short-sell claims.

The companyshare price plummeted 43% — from $49 to $26 — the week Left released his short-sell claims.

Then on its second-quarter earnings call in August, Jumia offered greater detail on the fraud perpetrated by some employees and agents of its JForce sales program.

The company declared the matter closed, but Jumiastock price plummeted more after the August earnings call (and sales-fraud disclosure), and has lingered in the $6 range for weeks.

That50% below the companyIPO opening in April and 80% below its high.

Jumia can offer new metrics to evaluate its performance, but the simplest measure — the ability to generate revenues in excess of costs to turn a profit — will still apply.

The sooner Jumia can go in that direction the faster it can revive its share price and investor confidence.

- Details

- Category: Technology

Read more: Pan-African e-tailer Jumia grows 3Q revenue, e-payments and losses

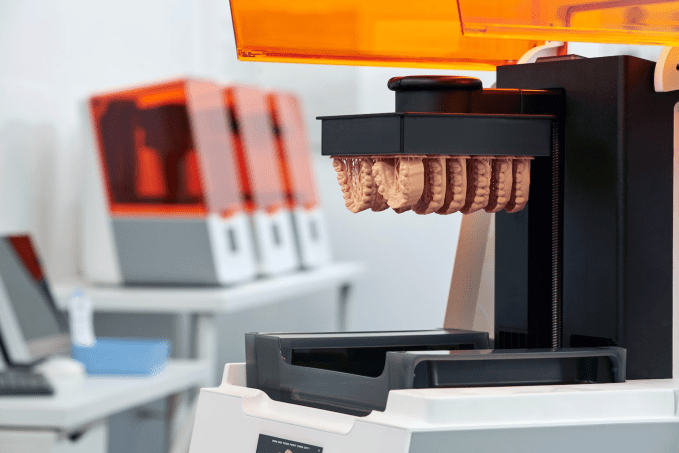

Write comment (98 Comments)Back at CES this year, we talked with 3D-printer maker Formlabs about its early experimentation in using its printers to make dentures faster and more affordably than existing alternatives.

A few months later, the company is going deep on the concept. They&re releasing a 3D printer meant specifically for dental use, opening up a whole new wing called &Formlabs Dental& and acquiring their main resin supplier in order to better make materials for the dental industry.

Unfamiliar with Formlabs? The main thing to know is that their printers use Stereolithography (SLA) rather than the Fused Deposition Modeling (or FDM) that most people probably think of when it comes to 3D printing; in other words, they use carefully aimed UV lasers to precisely harden an otherwise goopy resin into whatever you want to print, whereas FDM printers heat up a solid material until itmalleable and then push it through a hot glue gun-style nozzle to build a model layer by layer. SLA tends to offer higher accuracy and resolution, whereas FDM tends to be cheaper and offer a wider variety of colors and material properties.

Formlabs calls its new dentistry-centric printer the &Form 3b& — which, as the name suggests, is a slight variation on the Form 3 printer the company introduced earlier this year. The base package costs about a thousand bucks more per unit over the non-dental Form 3, but comes with software meant to tie into a dental teamexisting workflow, along with a year of Formlab&Dental Service Plan,& which includes training, support and the ability to request a new printer if something needs repairing (rather than waiting for yours to get shipped back and forth). The company also says the 3b has been optimized to work with its dental resins, but doesn&t say much about how.

Speaking of resins: Formlabs is acquiring Spectra, which has been its primary supplier of resins since Formlabs started back in 2012. While the company isn&t disclosing any of the terms of the deal, it does say it has put over a million dollars into building an FDA-registered clean room to make medical-grade resins. Formlabs says that anyone who already buys materials and resin from Spectra can continue to do so.

The companynew &Formlabs Dental& division, meanwhile, will focus on figuring out new dental materials and ways to better tie in to existing dentist office workflows. Right now, the company says, the Form 3b can be used to print crowns and bridges, clear retainers, surgical guides to help during dental implant procedures, custom mouth guards (or &occlusal splints&) and dentures.

- Details

- Category: Technology

Read more: Formlabs is making a 3D printer just for dentists

Write comment (95 Comments)Startups building work software for other startups have been a huge focus of investment in Silicon Valley as eager VCs hope to grab a piece of the next Slack. Notion Labs, a profitable work tools startup that recently hit a reported $800 million valuation, isn&t making it easy for VC firms to give them money, but they are partnering with some of them alongside top accelerators like Y Combinator in an effort to become another household name in work software.

Notion has north of 1 million users and has attracted thousands of young startups to its platform, which combines notes, wikis and databases into a versatile tool that can help small teams cut down on the number of enterprise software subscriptions they&re paying for. Notion charges startups $8 per employee (when billed annually) to use the service.

More than half of the startups from Y Combinatormost recent batch are Notion customers, the company tells TechCrunch, and the startup seems intent to accelerate their adoption among small teams. They have approached and partnered with dozens of accelerators around the globe, including Y Combinator, 500 Startups and Techstars, to bring their portfolio startups onto Notionplatform, offering admitted startups $1,000 in free services each.

The new program is part of the companyefforts to embed their platform as an &operating system& for startups early-on and then scale as their customers do.

&I think we find ourselves in a really interesting spot where I think YC startups know about us and start with it,& COO Akshay Kothari says. &Our goal with the new program is getting to the point where if you&re a new company, you don&t even think about it, you just start with Notion.&

Notion COO Akshay Kothari

Kothari says their platform seems to work best for startups in the sub-50 and sub-100 employee range, but they do have larger customers like U.K. banking startup Monzo, which has organized their 1,300+ employees around the platform. Notion itself is unsurprisingly a power user of its product, running everything but internal and external communications on its own software.

The company offers a couple of pricing tiers depending on size, but individuals can also use the software for $5 per month, something that Kothari believes offers it advantages over other tools in driving adoption inside companies. &There are a lot of similarities between us and the early stages of Slack in terms of engineering and product design people loving it, tech and media loving it, but one unique thing about us is that you can use Notion alone. Slack alone would be a bit lonely.&

The company is pitching customers a vision of consolidated workplace services that are built so end-users can customize them to their needs. Notionpitch contrasts pretty heavily with the overarching enterprise SaaS trends, which has seen a wealth of specialized software tools hitting the market.

Notion is working on tools to help it court larger enterprise customers as well, including offline access, better permission systems and an API that can help developers connect their services to the platform. Notion has been iterating its product rather quickly for a company that has nine engineers and no PMs, but Kothari says they don&t believe piling more money or doubling employees is going to be the key to scaling more quickly.

&We definitely want to create a large company, a company that could eventually go public or whatever is the right — you know ittoo early for a lot of that stuff. Our preference is to stay small,& he says. &[Notion] doesn&t have a board, it doesn&t have a whole lot of external voices, pretty much everyone in this office decides what we&re doing next.&

Notion has raised millions in funding from investors like First Round Capital, Ron and Ronny Conway, Elad Gil and, most recently, Daniel Gross. The Information‘s Amir Efrati reported earlier this year that Notion had raised a $10 million &angel round& at an $800 million valuation. The round was less about raising more cash than it was about closing convertible notes, Korthari tells TechCrunch, noting that Notion has been profitable for the last 12-18 months.

&I guess we were profitable before profitability became cool. I think profitability helps you to control destiny a lot better because you&re not out fundraising every year or 18 months,& Kothari says. &Interestingly now, I think itcool to be profitable again. When I joined Notion I would tell VCs or investors ‘Oh, we&re profitable,& and they would be like ‘Oh, so you&re building a lifestyle company.& &

Kothari himself was an investor who dumped money into Notion founders Ivan Zhao and Simon Lastidea to create a platform that would help non-engineers build software. That was six years ago, after Kothari sold his previous startup to LinkedIn; he joined about a year ago as COO.

Some VCs may have been skeptical early-on, but the story of Notion over the past year has been VCs fighting to score a spot on their cap table. In January, The New York Times‘s Erin Griffith reported that VCs had &dug up Notionoffice address and sent its founders cookie dough, dog treats and physical letters& to court their interest. The unrequited VC yearning has earned Notion the reputation for being venture averse, something Kothari pushed back on a few times.

&So, again, for the record, we don&t hate venture capitalists.&

- Details

- Category: Technology

Read more: Work collaboration startup Notion Labs cozies up to Silicon Valley’s top accelerators

Write comment (94 Comments)

Eight years after raising a $1.5 million proof-of-concept fund, Boldstart Ventures, a New York-based venture firm whose portfolio companies have been enjoying some serious momentum lately, just closed two new funds with $157 million in capital commitments.

One fund is a $112 million seed and early-stage vehicle — the fourth of its kind. Boldstart also raised an opportunity fund for the first time to continue funding its best-performing startups. It was closed with $45 million in commitments from investors.

We talked late last week with co-founder Ed Sim about the small firm, which also includes co-founder Eliot Durbin; Jeffrey Leventhal, a partner who was previously a venture partner; Shomik Ghosh, who is joining the firm as a principal from a role as a senior associate with Top Tier Capital Partners; Max Heald, an investor who joined the outfit as a analyst in 2017; and its office head, Charlotte Chapanoff.

What we gathered from that conversation was three things. Boldstartfocus on enterprise software is paying off, as is an extended network on which it relies heavily. The firm has also demonstrated a talent for picking smart founders, some of whom have come to Boldstart more than once for their very first institutional capital.

Consider Rahul Vohra. Backed by Boldstart, his email company Rapportive was eventually acquired by LinkedIn. A couple of years later, in late 2014, he spun up Superhuman, again with financial support from Boldstart. Itan invitation-only email management service that costs $30 and received a glowing review in The New York Times this year. It also has raised significant funding, including a $33 million Series B round led by Andreessen Horowitz that closed in early summer.

Another example? Guy Podjarny, founder of four-year-old, London-based Snyk, a company that helps organizations find and fix vulnerabilities in open-source dependencies and container images and which has now raised $102 million altogether. Podjarnylast company, Blaze.io — backed in part by Boldstart — sold to Akamai Technologies. When Podjarny started Snyk, Boldstartoffice was one of his first stops.

Even lone founders — who VCs are often hesitant to fund — are welcome by Boldstart if it believes in their vision. Among these is Pankaj Chowdhry, the founder of San Francisco-based FortressIQ, a two-year-old startup that wants to bring a new kind of artificial intelligence to process automation, called imitation learning, and whose $16 million Series A round was led last year by Lightspeed Venture Partners. According to Sim, Chowdhry was introduced to the firm through an advisor when he had not a lot to show. Chowdhry now oversees 50 people. Says Sim: &We told him, ‘It&d be great if you [find] a co-founder,& but we just never got there.&

A large part of Boldstartsecret sauce ties to the type of advisor who connected Chowdry to the firm. Itall part of what Sim calls a &leveraged model,& meaning that Boldstart relies heavily on decision-makers like Fortune 500 CTOs who are invited to invest in Boldstart and not charged management fees in exchange for their council. &Their deep understanding of what large companies are doing [and our] understanding of what founders are doing& is a powerful combination, he suggests. (Worth noting: many other firms are using the same smart model, including YL Ventures and Illuminate Ventures.)

Of course, the question begged is whether more capital will make it necessary for Boldstart to write slightly larger checks and thus move away from funding founders with little more than an idea. On this front, Sim insists the answer is no. &We&re not going upstream. [More money] just gives us more flexibility. The idea is still to write early checks of between $250,000 to $2 million in a founder with a vision, mostly at the pre-product stage, where we can even help founders start their companies.&

It certainly helps if the founder already knows well the pain point they are chasing, as has been the case at numerous Boldstart portfolio companies to nail down recent follow-on funding. Some of these other bets include Kustomer, a SaaS platform focused on customer service that closed a Series D round in May led by Tiger Global; BigID, a company whose software helps companies meet privacy regulations around customer data and closed a Series C round in September led by Bessemer Venture Partners; and SecurityScorecard, a cybersecurity risk-monitoring platform that closed a Series D round in June.

&If you&re a college student, you don&t understand how enterprises work,& says Sim. &You have to have launched or acquired and implemented new products. We back a lot of people who come out of industry for that reason. You kind of need to have lived that experience.&

- Details

- Category: Technology

5G is faster and more secure than 4G. But new research shows it also has vulnerabilities that could put phone users at risk.

Security researchers at Purdue University and the University of Iowa have found close to a dozen vulnerabilities, which they say can be used to track a victimreal-time location, spoof emergency alerts that can trigger panic or silently disconnect a 5G-connected phone from the network altogether.

5G is said to be more secure than its 4G predecessor, able to withstand exploits used to target users of older cellular network protocols like 2G and 3G like the use of cell site simulators — known as &stingrays.& But the researchers& findings confirm that weaknesses undermine the newer security and privacy protections in 5G.

Worse, the researchers said some of the new attacks also could be exploited on existing 4G networks.

The researchers expanded on their previous findings to build a new tool, dubbed 5GReasoner, which was used to find 11 new 5G vulnerabilities. By creating a malicious radio base station, an attacker can carry out several attacks against a targetconnected phone used for both surveillance and disruption.

In one attack, the researchers said they were able to obtain both old and new temporary network identifiers of a victimphone, allowing them to discover the paging occasion, which can be used to track the phonelocation — or even hijack the paging channel to broadcast fake emergency alerts. This could lead to &artificial chaos,& the researcher said, similar to when a mistakenly sent emergency alert claimed Hawaii was about to be hit by a ballistic missile amid heightened nuclear tensions between the U.S. and North Korea. (A similar vulnerability was found in the 4G protocol by University of Colorado Boulder researchers in June.)

Another attack could be used to create a &prolonged& denial-of-service condition against a targetphone from the cellular network.

In some cases, the flaws could be used to downgrade a cellular connection to a less-secure standard, which makes it possible for law enforcement — and capable hackers — to launch surveillance attacks against their targets using specialist &stingray& equipment.

All of the new attacks can be exploited by anyone with practical knowledge of 4G and 5G networks and a low-cost software-defined radio, said Syed Rafiul Hussain, one of the co-authors of the new paper.

Given the nature of the vulnerabilities, the researchers said they have no plans to release their proof-of-concept exploitation code publicly. However, the researchers did notify the GSM Association (GSMA), a trade body that represents cell networks worldwide, of their findings.

Although the researchers were recognized by GSMAmobile security &hall of fame,& spokesperson Claire Cranton said the vulnerabilities were &judged as nil or low-impact in practice.& The GSMA did not say if the vulnerabilities would be fixed — or give a timeline for any fixes. But the spokesperson said the researchers& findings &may lead to clarifications& to the standard where itwritten ambiguously.

Hussain told TechCrunch that while some of the fixes can be easily fixed in the existing design, the remaining vulnerabilities call for &a reasonable amount of change in the protocol.&

Itthe second round of research from the academics released in as many weeks. Last week, the researchers found several security flaws in the baseband protocol of popular Android models — including HuaweiNexus 6P and SamsungGalaxy S8+ — making them vulnerable to snooping attacks on their owners.

- Details

- Category: Technology

Read more: New 5G flaws can track phone locations and spoof emergency alerts

Write comment (96 Comments)

The Tech Workers Coalition and Gig Workers Rising are outside the companyheadquarters in San Francisco this morning in support of shoppers, who demand Instacart reinstate the $3 quality bonus, implement a 10% default tip and eliminate its service fees.

Last week, Instacart got rid of the $3 quality bonus shortly after thousands of shoppers participated in a 72-hour strike where workers demanded a better tip and fee structure. By protesting outside of InstacartSF HQ, shoppers are hoping to reach employees and get them on their side.

&We&re asking that Instacart employees urge management to reverse this decision,& organizers wrote in a handout. &As a worker who builds the product, you have a say over how itused.&

Instacart, in a statement to TechCrunch, said itcommitted to providing its shoppers with an earnings structure that offers upfront pay and guaranteed minimums.

&We respect the voices of all shoppers and take the feedback of our community very seriously,& an Instacart spokesperson said in a statement. &We will continue to listen and engage with shoppers to improve their experience.&

Back in 2016, Instacart removed the option to tip in favor of guaranteeing its workers higher delivery commissions.About a month later, following pressure from its workers, the company reintroduced tipping. Then, in April 2018,Instacart began suggesting a 5% default tipand reduced its service fee from a 10% waivable fee to a 5% fixed fee.

&We take the feedback of the shopper community very seriously and remain committed to listening to and using that feedback to improve their experience,& an Instacart spokesperson told TechCrunch last month.

The protest was on the heels of a class-action lawsuitover wages and tips,as well as a tipping debacle where Instacart included tips in its base pay for shoppers. Instacart, however, has since stopped that practice and provided shoppers with back pay. Though, Fast Company recently reportedthat Instacart delivery drivers& tips are mysteriously decreasing.

Following Instacartpost-protest move to eliminate the $3 quality bonus, #DeleteInstacart and #BoycottInstacart started making waves on Twitter. California Assemblyperson Lorena Gonzalez, the one who authored gig worker bill AB-5, joined in.

- Details

- Category: Technology

Read more: Instacart is under fire for how it compensates shoppers

Write comment (93 Comments)Page 374 of 5614

14

14