Technology

The co-creator of Facebook's Librasays that once the blockchain-based digital currency is launched users' social media information & and financial data tied to the stablecoin & will not be connected in any way.

Christian Catalini, the head economist at Calibra, the Facebook subsidiary in charge of the launch of Libra and its associatedonline digital wallet, said that from the beginning the plan for the cash-backed cryptocurrency was to profit from advertising and not the sale of private data.

To read this article in full, please click here

- Details

- Category: Technology

Read more: Facebook’s Libra co-creator: Social, financial data will remain separate

Write comment (95 Comments)Balderton Capital, one of the so-called &big four& early-stage VC firms in London (the others being Accel, Atomico and Index), has raised a new $400 million fund to continue backing European tech startups at Series A.

Dealroom recently released a report that pegged Balderton as the most active Series A investor in Europe (between 2014-2018), and in many ways this new fund is a continuation, and business as usual for the firm. It is also roughly the same size as the VClast Series A fund, which it closed in 2017 at $375 million.

Thatnot to be confused with Baldertonother recently launched &secondary& fund, which is dedicated to buying equity stakes from early shareholders in European-founded &high-growth, scale-up& technology companies. The move essentially formalised the secondary share dealing that already happens — typically as part of a Series C or other later rounds — which often sees founders take some money off the table so they can improve their own financial situation and won&t be tempted to sell their company too soon, but also gives early investors a way out so they can begin the cycle all over again.

Meanwhile, Balderton says the new Series A fund is being launched against a backdrop of &unprecedented momentum& within the European tech ecosystem. The VC notes that the number of Series A rounds in Europe per year has quadrupled since 2012, with the total amount of VC funding going into European startups hitting record highs last year — from €11.5 billion in 2014 to a chunky €24.6 billion in 2018.

That, together with the sheer number of new funds that have launched over the last 12 months — and three I&m covering this week — leads me to wonder out loud if tech, and Europe in particular, has entered a bubble.

&I don&t think we are,& Balderton Partner Suranga Chandratillake tells me during a call, before acknowledging that it is often hard to know if you are in a bubble if you are actually in one. &If you look at the public markets, the valuations around tech companies, while they are high, I would argue that in many cases they are justifiable when you look at the profitability and the growth rate of those businesses, especially things like enterprise software. But I think itharder when you get into businesses where they are more one-off… [where] we don&t necessarily know exactly how to value those long term.&

On Europe specifically, Chandratillake points out that some European tech hubs are more heated than others and that sentiment can vary considerably per geography. &As you get to more and more the local level, of course, you can experience what feel like sort of comparative bubbles. So, you know, maybe London was expensive two years ago, and France is expensive right now at Series A or whatever, but I don&t think those things really matter in the long run, because ultimately they iron out as long as the employee valuations are sensible. And as an investor, you&re paying attention to that stuff when you&re going to make an investment.&

One rumour within London VC is there are firms that have felt pressured to do follow-on investments in portfolio companies they otherwise might not have during cooler times, for fear of signalling to the market not just that a company isn&t doing well but that the VC firm itself isn&t as founder-friendly as competing VCs. How does Balderton think about signaling?

&Signaling is a massive deal [in venture capital],& says Chandratillake. &And actually, this is an area where, you know, we think we have a fairly strong position, because for over 10 years now we have focused almost entirely on Series A… and we are very open about that.&

He says that unlike other Series A VCs that invest at Series B or Series C, too, and also quite often dabble in seed, companies backed by Balderton shouldn&t expect the firm to &lead or be a major part of your Series B.&

&Of course, we&ll help, we&re going to do some of our pro-rata or maybe all of our pro-rata to try and protect some of our ownership, all those sorts of rational things we do. But we&re not raising a fund which allows us to be a big investor in your Series B and your C and your D and so on. I think as long as you&re really open with entrepreneurs about that early, they totally get that and they understand why it works economically for us and why ita good thing.

&Then if you do that for a long enough period of time, as we have, and stick to that — so you don&t do weird things like, you know, say that, but then on the other hand with the most interesting company, you try to bully your way into more of a Series B or whatever, then the ecosystem overall starts to realise… then the signal problem goes away.&

With regards to future investments, Chandratillake says Balderton will continue to invest all over Europe across any sector where &information technology& is being leveraged and creating value.

In the fund prior to last, for example, fintech was a major focus, backing companies like Revolut and Nutmeg, but more recently the VC has been investing more in health tech, where computer science is helping life science solve problems faster or cheaper.

&I think that there will be more of that,& says Chandratillake. &Therea lot more to be done in this health tech space, both at the patient level, but also actually a lot of really interesting things behind the scenes that will help health systems operate more efficiently and use technology in interesting ways. Ita really interesting area for Europe, because we have, you know, within the continent, a plethora of different health systems — from almost fully private systems through to obviously entirely state single payer systems like the NHS. Ita great place to experiment with different models. Italso of course, as a continent, home to some of the most important pharmaceutical companies [in the world].&

- Details

- Category: Technology

Read more: Balderton Capital raises new $400M fund to back European tech startups at Series A

Write comment (93 Comments)

While across much of Asia, November 11th is either &singles day& (a $38 billion Alibaba extravaganza this year) or Pepero Day (named because 11/11 looks like a bunch of chocolate dessert sticks), here in the United States and parts of Europe, November 11th also marks the end of World War I and the commemoration of Veterans Day.

Every year in the U.S., tens of thousands of soldiers leave active duty and transition into the civilian workforce, a route that can be startlingly difficult to navigate. How do you describe what an ordnance specialist does to civilians who have no idea what an MOS is? While the military teaches skills useful to a wide number of professions, holding the right conversations in a job search is key to making the leap.

Thatwhy a spate of new programs aims to help make it easier for veterans to head into the civilian workforce, and particularly into tech, which obviously has huge growth and great jobs waiting for those who can lock them up. I&ve previously covered one TechStars-connected non-profit, Patriot Boot Camp, which helps veterans looking to launch startups navigate the founder route.

One company that we haven&t covered on TechCrunch before though is Shift.org, an a16z-backed for-profit startup that aims to help veterans learn the key career skills needed to &shift& from the military into the civilian workforce.

Today for Veterans Day, the company announced a new employer partnership with mortgage fintech startup Better.com that will see Better.com hire 80 veterans in the next few months using Shift.org as a sourcing pool, with a projected hiring target of 5,000 veterans and their spouses by 2025 (assuming, as with all high-growth startups, that the high-growth continues firing on all cylinders).

In a press statement, Better.com CEO Vishal Garg said that &Veterans are an untapped source of talent that learned, operated and adapted to some of the worldmost innovative technologies from VR to robotics, nuclear technology and cyber.&

I chatted a bit with Shift.org CEO Mike Slagh about how he sees these partnerships and his own path into building a company. &I got started three years ago after serving in the Navy for just over five years as a bomb disposal officer,& he explained. In many ways, Shift.org was trying to fix his own challenge in moving back into the civilian workforce:

… My story was, I was going on base to the career fairs — there are these big aircraft hangers — and you&re sitting across the table from these employers, and they&re telling you what itlike to work at their company, they&re telling you what [their] culture is like, and itjust really hard to picture and itsuch an anxiety-ridden decision, and a big high-stakes moment in your life where you want to get it right for your family, you want to get it right for your future career trajectory.

Part of that anxiety is that saying the right things is often more crucial in recruitment settings than having the right skills. Slagh said that &I actually think that the gap is much narrower than many people naturally assume,& but, &you have to oftentimes have industry-specific context for somebody to take a bet on you when you have a non-traditional background.&

Since launching, Shift.org has partnered with employers like Better.com, Major League Baseball, and Symantec to help bridge the divide and open the pipeline to a wider and more diverse set of candidates.

The company was first funded by Garrett Camp of Expa Labs, and netted a reported $4 million round from Jeff Jordan at Andreessen Horowitz early last year. Slagh said his hope is to eventually work with hundreds of thousands of veterans not just secure great jobs, but also to train them in the skillsets they need to succeed in the future. The company is exclusively partnered today with Lambda School to help provide some of that technical background, for instance.

- Details

- Category: Technology

Read more: A16Z-backed Shift.org announces veterans hiring pipeline partnership with Better.com

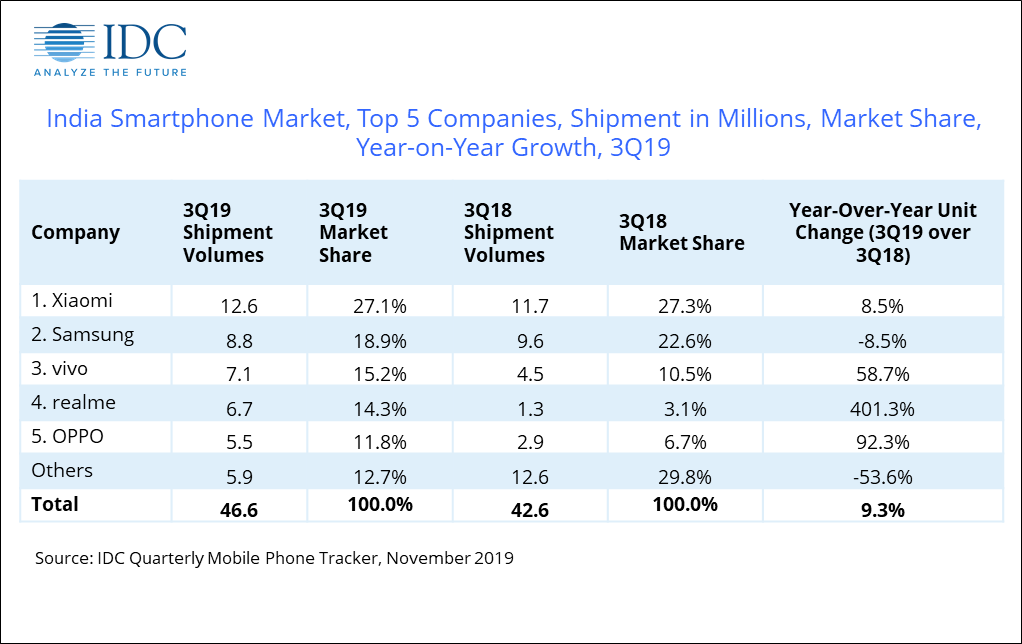

Write comment (95 Comments)As Xiaomi widens its smartphone lead over Samsung in India, a new competitor is increasingly posing a challenge.

Realme, a one-and-half-year-old smartphone vendor that spun out of Oppo, commanded 14.3% of the worldsecond largest smartphone market in the quarter that ended in September, research firm IDC said on Monday.

While Xiaomi, with 27.1% of the local smartphone market share, still dominates the market, the volume of handsets that Realme has shipped in India rose at a staggering 401.3% since the same period last year, according to IDC.

Market share of smartphone vendors in India

Whatfascinating about Realmeexpansion in India is just how closely it is replicating Xiaomiplaybook in the country. Like Xiaomi, Realme for a year sold phones only through an online channel to cut overhead costs. Last quarter, the company began selling phones in India through offline stores, which still account for more than two-thirds of all smartphone sales.

In terms of online-only shipment, the companymarket share has ballooned to 26.5% in Q3 2019 from 16.5% in Q2 this year, the research firm said.

Realme has launched more than a dozen aggressively priced smartphone models so far, all priced between $80 to $240 — the sweet spot in the local market. In fact, IDC says RealmeC2, 3i and 3 models — priced between $80 and $110 — were the top-selling phones for the company in Q3 this year.

Like Xiaomihandsets, Realme smartphones pack above the punch — sporting some of the highest-end hardware modules for their price range. The $80 Realme C2 features a six-inch HD+ display, 3+2 rear megapixel cameras, 4,000 mAh battery, 2GB of RAM and 16GB of expandable storage — and it supports 4G networks and has a facial unlock feature.

Other markets

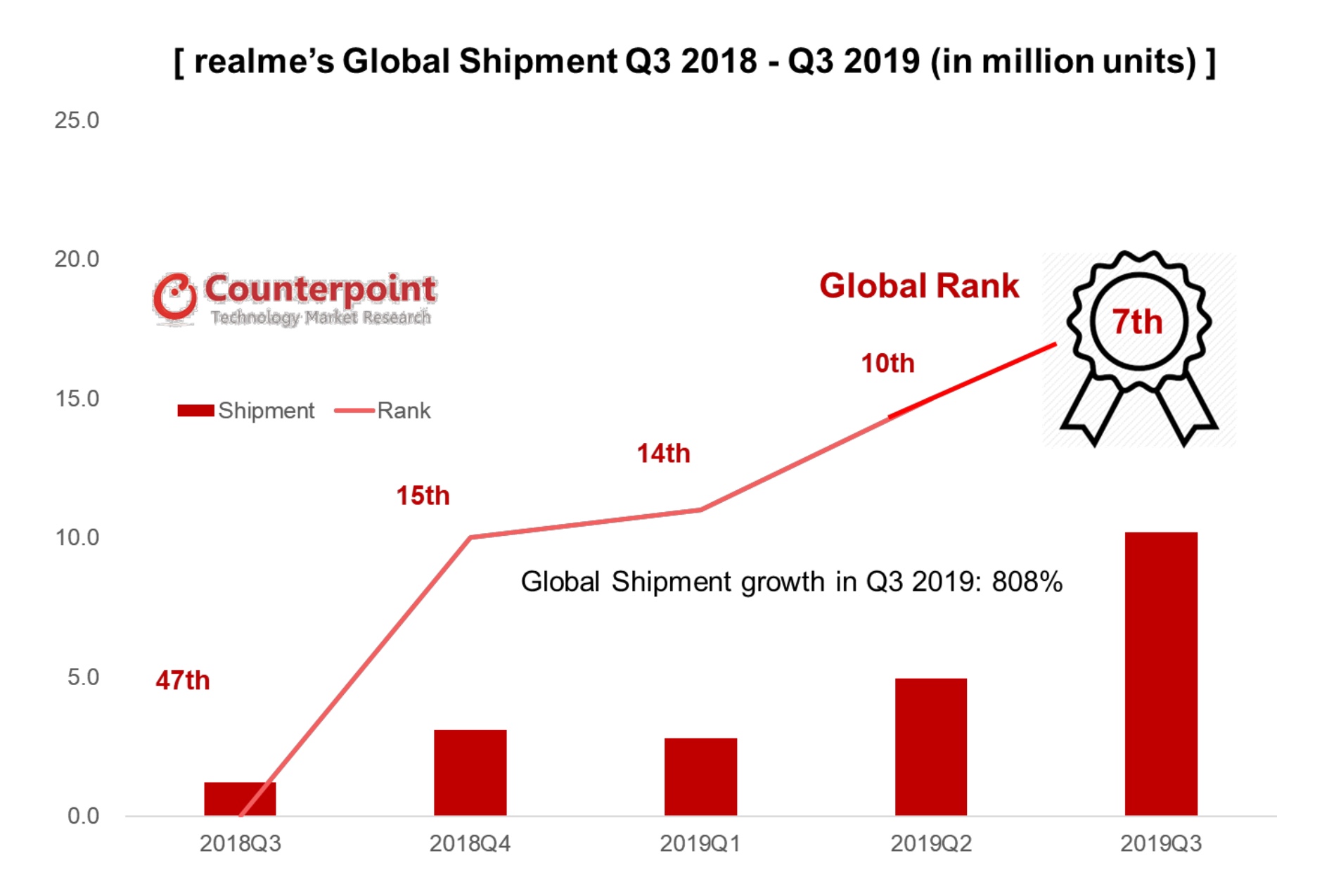

Realme today operates in 18 countries, including its home market China, Indonesia, Malaysia, Pakistan, Vietnam and Egypt. In May this year, the company entered the European region.

In a report Counterpoint shared with its clients recently, the research firm said that based on the number of smartphones that Realme has shipped, the companyrank went from 47th in Q3 2018 to 7th as of September this year. By shipping more than 10 million smartphones, the Chinese firmshipment grew by a whopping 808% during this period, the research firm said.

India and Indonesia accounted for more than 80% of smartphones that Realme has shipped to date, according to Counterpoint.

&We expect realme to become a serious contender in the market next year as growth will continue in emerging markets and online channels. The value for money proposition is also powerful in times of stagnant economic growth globally,& Counterpoint analysts wrote.

The aggressive growth of Realme hasn&t gone unnoticed with Xiaomi. The two companies have already exchanged testy words with one another and made allegations.

And you thought smartphone wars were over.

- Details

- Category: Technology

Read more: Smartphone maker Realme is taking India and other emerging markets by storm

Write comment (95 Comments)

Uber CEO Dara Khosrowshahi comments during an interview with Axios — and his subsequent apology — have done more than hand the companycritics more ammunition in the renewed #boycottUber campaign. (Although, mission accomplished on that front.)

They also exposed a weakness that if left uncorrected threatens to bring back the toxic culture Khosrowshahi promised he would eliminate when he took over as CEO in 2017.

First, a recap. During an interview, Khosrowshahi called the murder of journalist and U.S. resident Jamal Khashoggi by Saudi Arabia a &serious mistake& and compared it to the death of pedestrian Elaine Herzberg who was struck and killed by an Uber self-driving car. And then he added, &People make mistakes, it doesn&t mean that they can never be forgiven.&

Khosrowshahi has tried to reel back those murder-is-forgivable comments. Heissued an apology and Axios editor Dan Primack noted that the CEO called his cell soon after taping the show to express regret for the &language he used& about Khashoggi.

Khosrowshahicomments had a familiar ring to them. And thatbecause he has applied this people-can-change-and-mistakes-happen attitude to serious infractions before.

During an interview in 2018 at TechCrunch Disrupt SF, Khosrowshahi defended Uber COO Barney Harford, who had reportedly made insensitive comments about women and racial minorities. Khosrowshahi described Harford as &an incredible person& and &one of the good people& as it relates to diversity and inclusion.

&I don&t think that a comment that might have been taken as insensitive and happened to report by large news organizations should mark a person,& Khosrowshahi said at the time. &I don&t think thatfair. And I&m sure I&ve said things that have been insensitive and you take that as a learning moment. And the question is, does a person want to change, does a person want to improve? Does a person understand when they did something wrong, and then change behaviors? And I&ve known Barney for years and thatwhy I stand 100 percent behind him.&

This people-make-mistakes stance might not seem like a dangerous position to take. After all, people do make mistakes and forgiveness is supposed to be a virtue, not a vice.

But in a company where toxicity and bad behavior reigned for years, applying the equivalent of &oops!& to serious infractions risks undoing any progress Khosrowshahi has made. If progress was made at all.

This latest incident, as well as concerns around Ubertreatment of its drivers and a new NTSB report that found the companyself-driving system design did not include a consideration for jaywalking pedestrians, begs the question of whether the culture has indeed changed for the better?

- Details

- Category: Technology

Read more: Uber CEO stokes #boycottuber fire with ‘mistakes happen’ comment

Write comment (100 Comments)

An expensive experiment in global distribution has been abandoned by Adidas, which has announced that will close its robotic &Speedfactories& in Atlanta and Ansbach, Germany, within 6 months. The company sugar-coated the news with a promise to repurpose the technology used at its existing human-powered factories in Asia.

The factories were established in 2016 (Ansbach) and 2017 (Atlanta) as part of a strategy to decentralize its manufacturing processes. The existing model, like so many other industries, is to produce the product in eastern Asia, where labor and overhead is less expensive, then ship it as needed. But this is a slow and clumsy model for an industry that moves as quickly as fashion and athletics.

&Right now, most of our products are made out of Asia and we put them on a boat or on a plane so they end up on Fifth Avenue,& said Adidas CMO Eric Liedtke in an interview last year at Disrupt SF about new manufacturing techniques. The Speedfactories were intended to change that: &Instead of having some sort of micro-distribution center in Jersey, we can have a micro-factory in Jersey.&

Ultimately this seems to have proven more difficult than expected. As other industries have found in the rush to automation, iteasy to overshoot the mark and overcommit when the technology just isn&t ready.

Robotic factories are a powerful tool but difficult to quickly reconfigure or repurpose, since it takes specialty knowledge to set up racks of robotic arms, computer vision systems, and so on. Robotics manufacturers are making advances in this field, but for now ita whole lot harder than training a human workforce to use standard tools on a different pattern.

In a press release, Adidas global operations head Martin Shankland explained that &The Speedfactories have been instrumental in furthering our manufacturing innovation and capabilities,& and that for a short time they even brought products to market in a hurry. &That was our goal from the start,& he says, though presumably things played out a bit differently in the pitch decks from 2016.

&We very much regret that our collaboration in Ansbach and Atlanta has come to an end,& Shankland said. Oechsler, the high-tech manufacturing partner that Adidas worked with, feels the same. &Whilst we understand adidas& reasons for discontinuing Speedfactory production at Oechsler, we regret this decision,& said the companyCEO, Claudius Kozlik, in the press release. The factories will shut down by April, presumably eliminating or shifting the 160 or so jobs they provided, but the two companies will continue to work together.

The release says that Adidas will &use its Speedfactory technologies to produce athletic footwear at two of its suppliers in Asia& starting next year. Itnot really clear what that means, and I&ve asked the company for further information.

- Details

- Category: Technology

Read more: Adidas backpedals on robotic shoe production with Speedfactory closures

Write comment (100 Comments)Page 382 of 5614

10

10

pic.twitter.com/y7PovSBuw3

pic.twitter.com/y7PovSBuw3