Technology

Over the past several years, ‘fintech& has quietly become the unsung darling of venture.

A rapidly swelling pool of new startups is taking aim at the large incumbent institutions, complex processes and outdated unfriendly interfaces that mar billion dollar financial services verticals, such as insurtech, consumer lending, personal finance, or otherwise.

In just the past summer, the startup community saw a multitude of hundred-million dollar fintech fundraises. In 2018, fintech companies were the source of close to 1,300 venture deals worth over $15 billion in North America and Europe alone according to data from Pitchbook. Over the same period, KPMG estimates that over $52 billion in investment pour into fintech initiatives globally.

With the non-stop stream of venture capital flowing into the never-ending list of spaces that fall under the ‘fintech& umbrella, we asked 12 leading fintech VCs who work at firms that span early to growth stages to share where they see the most opportunity and how they see the market evolving over the long-term.

- Charles Birnbaum, Partner at Bessemer Venture Partners

- Ian Sigalow, Co-founder - Partner at Greycroft

- Matt Harris, Partner at Bain Capital Ventures

- Angela Strange, General Partner at Andreessen Horowitz.

- Adam Valkin, Managing Director at General Catalyst

- Rob Moffat, Partner at Balderton Capital

- Brendan Dickinson, Partner at Canaan Partners

- Manuel Silva, Partner at Santander InnoVentures

- Ruth Foxe Blader, Managing Director at Anthemis

- Sean Park, Chief Investment Officer at Anthemis

- Amol Helekar, Principal at TCV

- Jim Robinson, General Partner at RRE Ventures

The participants touched on a number of key trends in the space, including rapid innovation in fintech infrastructure, fintech companies embedding themselves in specific verticals and platforms, rebundling and unbundling of financial services offerings, the rise of challenger banks and the state of fintech valuations into 2020.

Charles Birnbaum, Partner, Bessemer Venture Partners

The great ‘rebundling& of fintech innovation is in full swing. The emerging consumer leaders in fintech — Chime, SoFi, Robinhood, Credit Karma, and Bessemer portfolio company Betterment — are moving quickly to increase their share of wallet with their valuable customers and become a one-stop-shop for peoplefinancial lives.

In 2020, we anticipate continued entrepreneurial activity and investor enthusiasm around the infrastructure and middleware layers within the fintech ecosystem that are enabling further rebundling and a rapid convergence of product themes and business models across the consumer fintech landscape.

Many players now look like potential challenger bank models more akin to what we have seen unfold in Europe the past few years. Within consumer fintech, we at Bessemer are more focused on demographically-specific product offerings that tap into underserved themes, whether that be the financial problems facing the aging population in the US or new models to serve the underbanked or underserved population of consumers and small businesses.

Ian Sigalow, Co-founder - Partner, Greycroft

What trends are you most excited in fintech from an investing perspective?

I suspect that many enterprise software companies become fintech companies over time — collecting payments on behalf of customers and growing revenues as your customers grow. We have seen this trend in many industries over the past few years. Business owners generally prefer a model that moves IT expenditures from Operating Expenses into Cost of Goods Sold, because they can increase prices and pass their entire budget onto the customer.

On the consumer side, we have already made investments in branchless banking, insurance (auto, home, health, workers comp), cross-border payments, alternative investments, loyalty cards/services, and roboadvisor services. The companies we funded are already a few years old, and I think we will have some interesting follow-on activity there over the next few years. We have been picking spots where we think we have an unfair competitive advantage.

Our fintech portfolio is also more global than other sectors we invest in. This is because there are opportunities to achieve billion dollar outcomes in fintech, even in countries that are much smaller than the United States. That is not true in many other sectors.

We have also seen trends emerge in the US and move abroad. As an example we seeded Flutterwave, which is similar to Stripe, and they have expanded across Africa. We were also the lead investor in Yeahka, which is similar to Square in China. These products are heavily localized —tin for instance Yeahka is the largest processor of QR code payments in the world, but QR code payments are not popular in the US yet.

How much time are you spending on fintech right now? Is the market under-heated, over-heated, or just right?

Fintech is about a quarter of my time right now. We continue to see interesting new ideas and the valuations have been more or less consistent over time. The broader market doesn&t impact us very much because we tend to have a 10 year holding period.

Are there startups that you wish you would see in the industry but don&t?

- Details

- Category: Technology

Read more: Where top VCs are investing in fintech

Write comment (94 Comments)

- Details

- Category: Technology

Read more: PlayStation 5 will 'eliminate unnecessary loading time', developer claims

Write comment (100 Comments)

A premature pre-order listing of the Canon EOS Ra by US retailer Adorama has all but confirmed that the astrophotography-focused camera will soon be officially announced.

While the original listing has since been taken down, it was picked up by many photography publications who assumed Canon has quietly launched its third full-frame mirrorless

- Details

- Category: Technology

Read more: Canon EOS Ra arrival confirmed by early pre-order listing on US retailer site

Write comment (98 Comments)

- Details

- Category: Technology

Read more: YouTube superstar banned for life from Fortnite for cheating

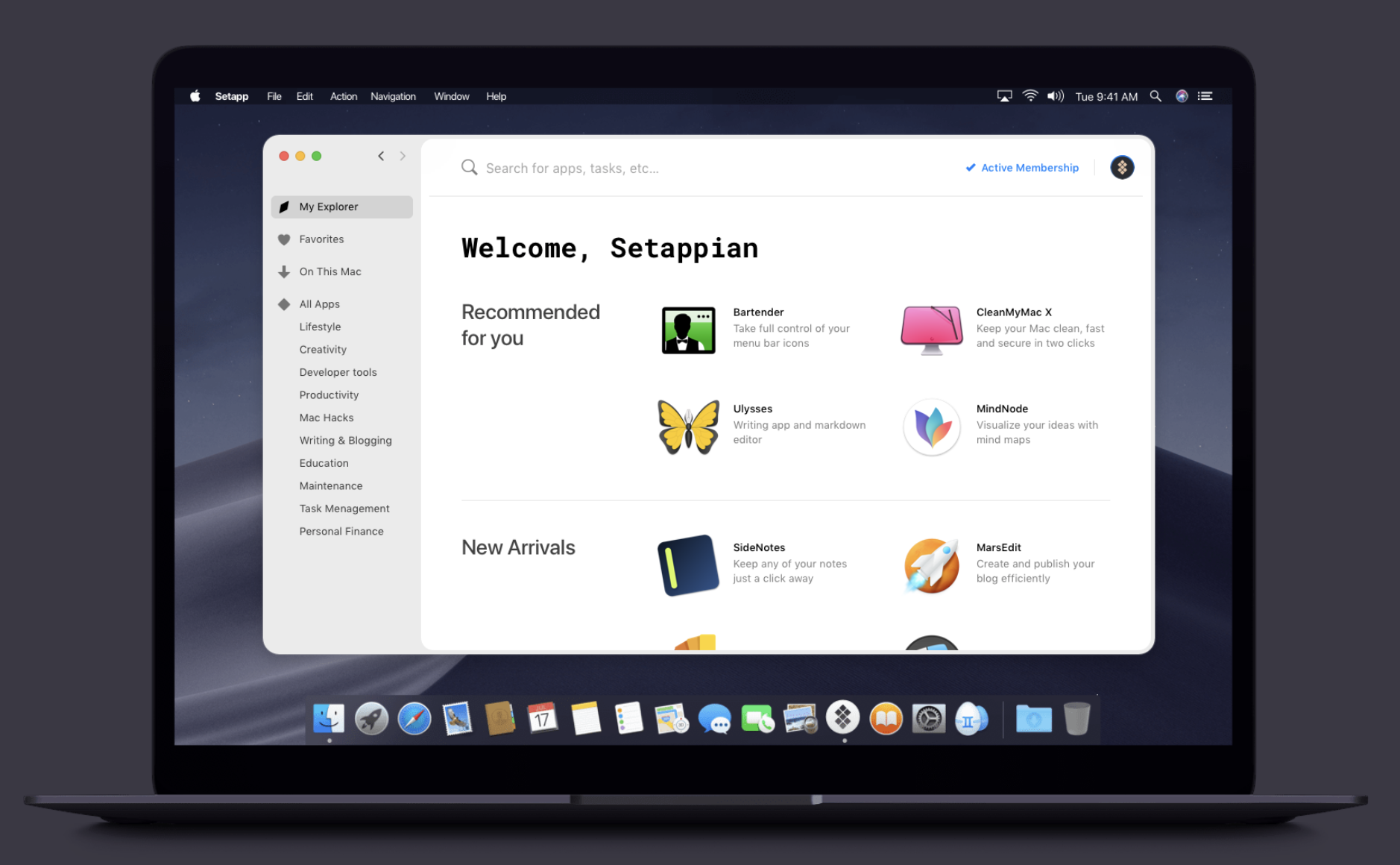

Write comment (91 Comments)Setapp, the Spotify of Mac apps, is launching a new subscription plan specifically designed for teams. It is currently available as a public beta. As a reminder, Setapp lets you download and use 160 apps for a flat subscription fee. You don&t need to pay for major updates and thereno in-app purchase.

Anybody can sign up to a Setapp account for $9.99 per month, or $8.99 per month with annual subscriptions. There are also family plans for three users and five Macs for $19.99 per month.

As the name suggests, Setapp for teams is a new offering specifically designed for companies. It costs $8.99 per user per month. You&ll find the same app library whether you have an individual Setapp account or a business account.

The new offering makes it easier to manage software licenses. Therea unified billing and administration panel that lets you add and remove users over time.

Apps include Ulysses, PDFpen, ForkLift, Mindnode, iStat Menus, etc. It has become a sort of mini Mac App Store without any paid download. Every time you need a new app to achieve a specific task, you can open Setapp and search the app library to see if therean app that can do that for you.

- Details

- Category: Technology

Read more: Subscription service for Mac apps Setapp extends to teams

Write comment (99 Comments)

Zscaler has announced the results from the first industry survey to examine enterprise adoption of Zero Trust Network Access (ZTNA), revealing that businesses have already started to replace VPNs with ZTNA.

The firm's 2019 Zero Trust Adoption Report, which was conducted by Cybersecurity Insiders, found that 15 percent of organizations have already

- Details

- Category: Technology

Read more: Businesses are replacing VPNs with zero trust network access

Write comment (97 Comments)Page 435 of 5614

15

15