Technology

While Facebook CEO Mark Zuckerberg seemed cheerful and even jokey when he took the stage today in front of journalists and media executives (at one point, he described the event as &by far the best thing& he&d done this week), he acknowledged that there are reasons for the news industry to be skeptical.

Facebook, after all, has been one of the main forces creating a difficult economic reality for the industry over the past decade. And there are plenty of people (including our own Josh Constine) who think it would be foolish for publishers to trust the company again.

For one thing, therethe question of how Facebookalgorithm prioritizes different types of content, and how changes to the algorithm can be enormously damaging to publishers.

&We can do a better job of working with partners to have more transparency and also lead time about what we see in the pipeline,& Zuckerberg said, adding, &I think stability is a big theme.& So Facebook might be trying something out as an &experiment,& but &if it kind of just causes a spike, it can be hard for your business to plan for that.&

At the same time, Zuckerberg argued that Facebookalgorithms are &one of the least understood things about what we do.& Specifically, he noted that many people accuse the company of simply optimizing the feed to keep users on the service for as long as possible.

&Thatactually not true,& he said. &For many years now, I&ve prohibited any of our feed teams … from optimizing the systems to encourage the maximum amount of time to be spent. We actually optimize the system for facilitating as many meaningful interactions as possible.&

For example, he said that when Facebook changed the algorithm to prioritize friends and family content over other types of content (like news), it effectively eliminated 50 million hours of viral video viewing each day. After the company reported its subsequent earnings, Facebook hadthe biggest drop in market capitalization in U.S. history.

Zuckerberg was onstage in New York with News Corp CEO Robert Thomson to discuss the launch of Facebook News, a new tab within the larger Facebook product thatfocused entirely on news. Thomson began the conversation with a simple question: &What took you so long?&

The Facebook CEO took this in stride, responding that the question was &one of the nicest things he could have said — that actually means he thinks we did something good.&

Zuckerberg went on to suggest that the company has had a long interest in supporting journalism (&I just think that every internet platform has a responsibility to try to fund and form partnerships to help news&), but that its efforts were initially focused on the News Feed, where the &fundamental architecture& made it hard to find much room for news stories — particularly when most users are more interested in that content from friends and family.

So Facebook News could serve as a more natural home for this news (to be clear, the company says news content will continue to appear in the main feed as well). Zuckerberg also said that since past experiments have created such &thrash in the ecosystem,& Facebook wanted to make sure it got this right before launching it.

In particular, he said the company needed to show that tabs within Facebook, like Facebook Marketplace and Facebook Watch, could attract a meaningful audience. Zuckerberg acknowledged that the majority of Facebook users aren&t interested in these other tabs, but when you&ve got such an enormous user base, even a small percentage can be meaningful.

&I think we can probably get to maybe 20 or 30 million people [visiting Facebook News] over a few years,& he said. &That by itself would be very meaningful.&

Facebook is also paying some of the publishers who are participating in Facebook News. Zuckerberg described this as &the first time we&re forming long-term, stable relationships and partnerships with a lot of publishers.&

Several journalists asked for more details about how Facebook decided which publishers to pay, and how much to pay them. Zuckerberg said itbased on a number of factors, like ensuring a wide range of content in Facebook News, including from publishers who hadn&t been publishing much on the site previously. The company also had to compensate publishers who are taking some of their content out from behind their paywalls.

&This is not an exact formula — maybe we&ll get to that over time — but itall within a band,& he said.

Zuckerberg was also asked about how Facebook will deal with accuracy and quality, particularly given the recent controversy over its unwillingness to fact check political ads.

He sidestepped the political ads question, arguing that itunrelated to the daytopics, then said, &This is a different kind of thing.& In other words, he argued that the company has much more leeway here to determine what is and isn&t included — both by requiring any participating publishers to abide by Facebookpublisher guidelines, and by hiring a team of journalists to curate the headlines that show up in the Top Stories section.

&People have a different expectation in a space dedicated to high-quality news than they do in a space where the goal is to make sure everyone can have a voice and can share their opinion,& he said.

As for whether Facebook News will include negative stories about Facebook, Zuckerberg seemed delighted to learn that Bloomberg (mostly) doesn&t cover Bloomberg.

&I didn&t know that was a thing a person could do,& he joked. More seriously, he said, &For better or worse, we&re a prominent part of a lot of the news cycles. I don&t think it would be reasonable to try to have a news tab that didn&t cover the stuff that Facebook is doing. In order to make this a trusted source over time, they have to be covered objectively.&

- Details

- Category: Technology

Read more: Mark Zuckerberg makes the case for Facebook News

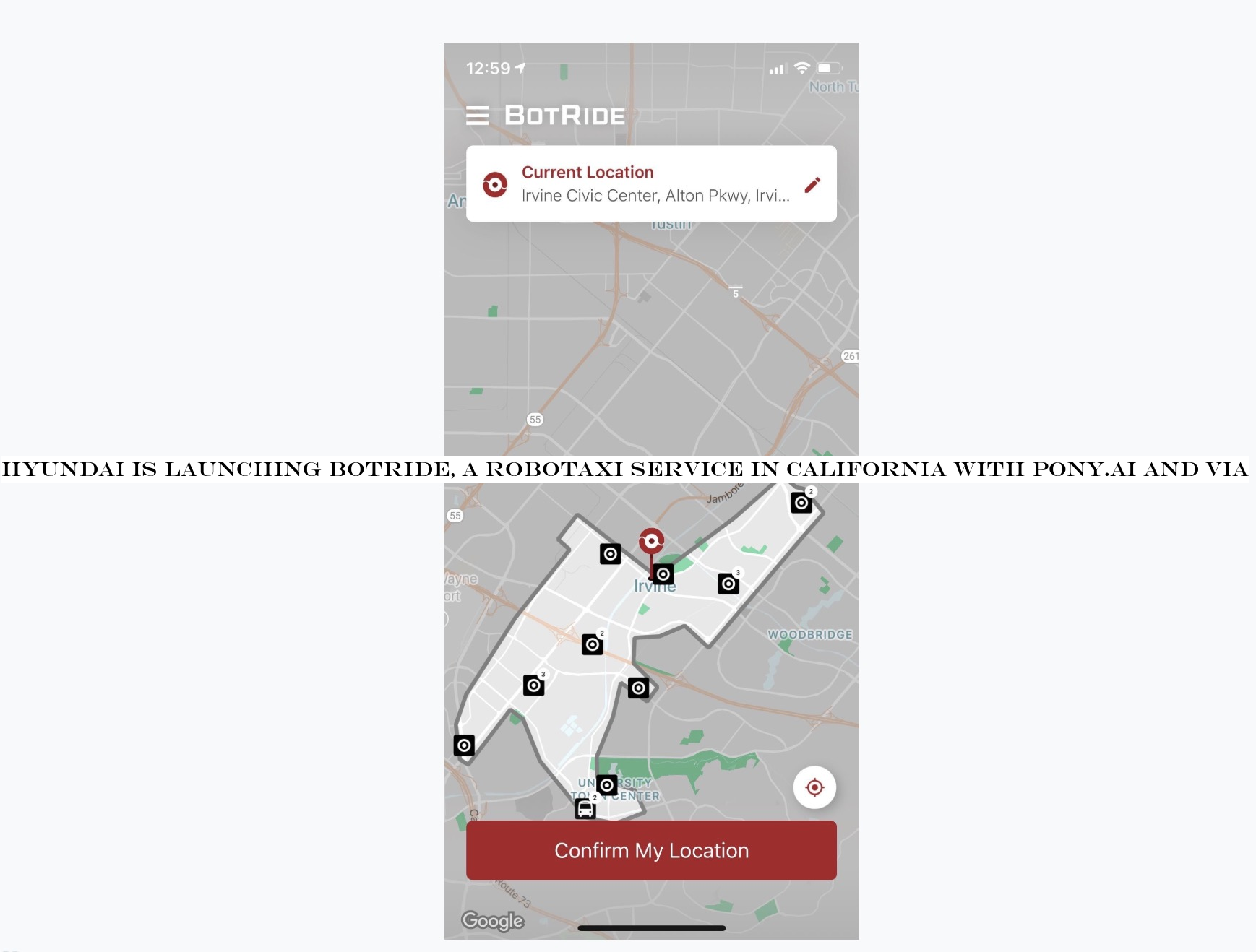

Write comment (90 Comments)A fleet of electric, autonomous Hyundai Kona crossovers — equipped with a self-driving system from Chinese autonomous startup Pony .ai and Viaride-hailing platform, will start shuttling customers on public roads next week.

The robotaxi service called BotRide will operate on public roads in Irvine, California, beginning November 4. This isn&t a driverless service; there will be a human safety driver behind the wheel at all times. But it is one of the few ride-hailing pilots on California roads. Only four companies, AutoX, Pony.ai, Waymo and Zoox have permission to operate a ride-hailing service using autonomous vehicles in the state of the California.

Customers will be able to order rides through a smartphone app, which will direct passengers to nearby stops for pick up and drop off. Viaexpertise is on shared rides, and this platform aims for the same multiple rider goal. Viaplatform handles the on-demand ride-hailing features such as booking, passenger and vehicle assignment and vehicle identification (QR code). Via has two sides to its business. Thecompany operates consumer-facing shuttles in Chicago, Washington, D.C. and New York. It also partners with cities and transportation authorities — and now automakers launching robotaxi services — giving clients access to their platform to deploy their own shuttles.

Hyundai said BotRide is &validating its user experience in preparation for a fully driverless future.& Hyundai didn&t explain when this driverless future might arrive. Whatever this driverless future ends up looking like, Hyundai sees this pilot as a critical marker along the way.

Hyundai said it is using BotRide to study consumer behavior in an autonomous ride-sharing environment, according to Christopher Chang, head of business development, strategy and technology division, Hyundai Motor Company .

&The BotRide pilot represents an important step in the deployment and eventual commercialization of a growing new mobility business,& said Daniel Han, manager, Advanced Product Strategy, Hyundai Motor America.

Hyundai might be the household name behind BotRide, but Pony.ai and Via are doing much of the heavy lifting. Pony.ai is a relative newcomer to the AV world, but it has already raised $300 million on a $1.7 billion valuation and locked in partnerships with Toyota and Hyundai.

The company, which has operations in China and California and about 500 employees globally, was founded in late 2016 with backing from Sequoia Capital China, IDG Capital and Legend Capital.

Italso one of the few autonomous vehicle companies to have both a permit with the California Department of Motor Vehicles to test AVs on public roads and permission from the California Public Utilities Commission to use these vehicles in a ride-hailing service. Under rules established by the CPUC, Pony.ai cannot charge for rides.

- Details

- Category: Technology

Read more: Hyundai is launching BotRide, a robotaxi service in California with Pony.ai and Via

Write comment (100 Comments)The Daily Crunch is TechCrunchroundup of our biggest and most important stories. If you&d like to get this delivered to your inbox every day at around 9am Pacific, you can subscribe here.

1. Facebook starts testing News, its new section for journalism

Facebook news section, which was previously reported to be imminent, is here: The company is rolling out Facebook News in a limited test in the U.S. as a home screen tab and bookmark in the main Facebook app.

Should publishers trust Facebook? Well, Josh Constine argues that none of them have learned the right lessons from the last 10 years.

2. Pixelbook Go review: a Chromebook in search of meaning

The Go is clearly Googleattempt to lead the way for manufacturers looking to explore Chromebook life outside the classroom. It has some nice hardware perks, but itnot the revolution or revelation ChromeOS needs.

3. SpaceX wants to land Starship on the Moon before 2022, then do cargo runs for 2024 human landing

SpaceX president and COO Gwynne Shotwell shed a little more light on her companycurrent thinking with regards to the mission timelines for its forthcoming Starship spacefaring vehicle.

4. After its first earnings miss in two years, Amazon shares get walloped in after-hours trading

Amazon shares fell by nearly 7% in after-hours trading on Thursday after the company reported its first earnings miss in two years.

5. Lawmakers ask US intelligence chief to investigate if TikTok is a national security threat

In a letter by Sens. Charles Schumer (D-NY) and Tom Cotton (R-AR), the lawmakers asked the acting director of national intelligence Joseph Maguire if the app maker could be compelled to turn Americans& data over to Chinese authorities.

6. The SaaS gold rush will become the ‘Hunger Games&

Enterprise software investor Rory O&Driscoll says that while the cloud is obviously here to stay, the next five years in cloud investing will neither be the same nor as easy as the last 10. (Extra Crunch membership required.)

7. Learn how to raise your first euros at TechCrunch Disrupt Berlin

Startup funding experts — including Forward Partners managing partner Nic Brisbourne, Target Global partner Malin Holmberg and DocSend co-founder and chief executive officer Russ Heddleston — will sit down together on the Extra Crunch Stage at TechCrunch Disrupt Berlin.

- Details

- Category: Technology

Read more: Daily Crunch: Facebook launches its News section

Write comment (100 Comments)With cross-platform experiences like Fortnite and PUBG, in-game socializing environments, and subscription-based cloud gaming services from Playstation, Google, Amazon, and others, the gaming industry is entering a new era beyond mobile.

These days, the industry is at the center of social media and entertainment trends; gaming is expected to earn $152 billion in global revenue this year, up 9.6% year over year.

Given my recent writing on Unity, the most-used game engine, and ongoing research into interactive media trends, I wanted to find out how top gaming-focused VCs are assessing the market right now. I asked ten of them to share which trends they are most excited about when it comes to finding investment opportunities:

- David Gardner, Partner at London Venture Partners

- Henric Suuronen, Partner at Play Ventures

- Samuli Syvähuoko, Partner at Sisu Game Ventures

- Jay Chi, Partner at Makers Fund

- Peter Levin, Managing Director at Griffin Gaming Partners

- Gigi Levy-Weiss, Partner at NFX

- Ethan Kurzweil, Partner at Bessemer Venture Partners

- Jonathan Lai, Partner at Andreessen Horowitz

- Blake Robbins, Partner at Ludlow Ventures

- Jon Goldman, General Partner at GC Tracker - Board Partner at Greycroft Partners

Amid the mix of predictions, there were several common threads, such as optimism about the rise of games as broader social platforms, opportunities to invest directly in new studios, and skepticism about near-term investments in augmented or virtual reality and blockchain.

Here are their responses.

David Gardner, Partner at London Venture Partners

&PC Games are back. Great place to start new IP to then migrate a success to multiple platforms. There is more innovation in business models and more open distribution on PC to facilitate audience growth without the punishment of mobile CPIs.

VR - AR remain out. We stood away from VR in the beginning and extend that to AR while the user experience for games remains a disappointment. Lethope those new Apple glasses do the trick!

Crypto remain a theological war zone, but honestly everything on offer has been available in the cloud world, but the real consumer benefit isn&t showing up.

We love games that are expanding audience demographics and are sensitive to less hardcore audiences. For example, women players are estimated to account for 1 billion gamers.&

Henric Suuronen, Partner at Play Ventures

&At Play Ventures, we believe we have just entered the golden era of mobile gaming. Who would have believed 10 years ago that Nintendo and games like Fortnite and Call of Duty would all be on mobile. Mobile is not just a games platform anymore, it is THE games platform of choice for casual and core players alike. Consequently, in the next 2-3 years we will invest in 30-40 mobile games studios across the globe.&

Samuli Syvähuoko, Partner at Sisu Game Ventures

&We at Sisu Game Ventures have been investing in many sectors since 2015 including free-to-play mobile games (especially big here in Finland), VR, AR, PC, console, instant messenger, hypercasual, audio and most recently cloud-native games as well. In addition to game studios, around a third of our investments are into games related tech/infrastructure.

We&ve so far not dipped our toes into blockchain or eSports and our appetite for doing more investments in VR and AR is nil. To me, the most interesting mega trends lie with the promise of cloud gaming when utilized to its full potential. Another term that encapsulates my excitement is games-as-a-social-hobby. Put this and the extreme accessibility of the cloud together and you&ll have a game with revolutionary potential.&

Jay Chi, Partner at Makers Fund

&We are looking closely at ‘Gaming as Media& related content and platforms — the emergence of new interactive experience centered on ‘viewers as participants.& Gaming as social media falls under this thesis. We are also looking for MMO and Metaverse enablers given increased demand for specialized, scalable and affordable technologies that empower lean startup teams to create and operate large-scale worlds and novel gameplays.

We also see potential for new start-ups to emerge in hypercasual games with midcore/social meta — no one has truly cracked this genre yet.&

- Details

- Category: Technology

Read more: Here’s where top gaming VCs are looking for startup opportunities

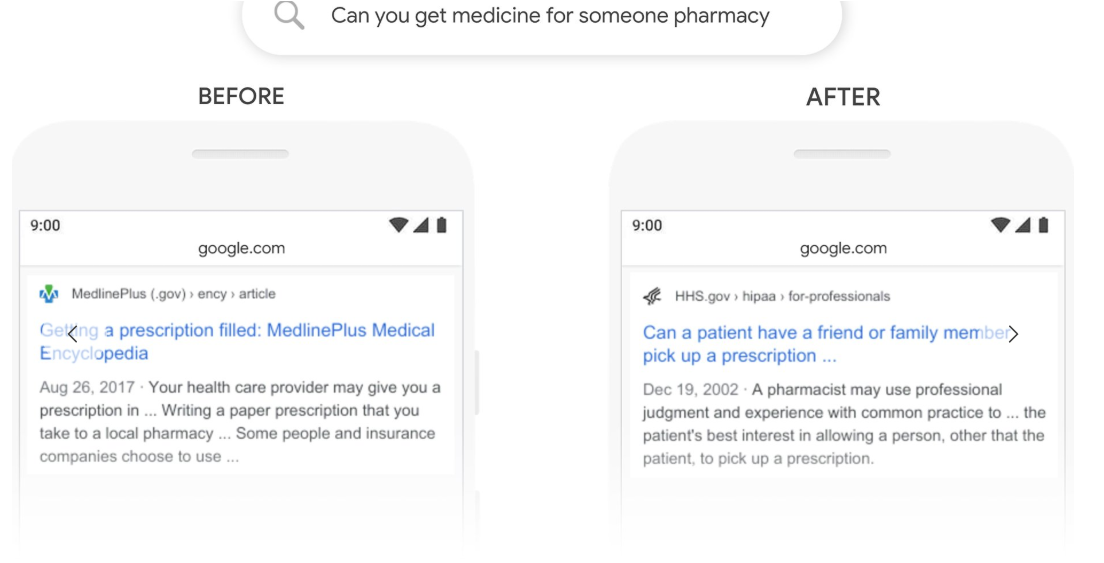

Write comment (93 Comments)Google today announced one of the biggest updates to its search algorithm in recent years. By using new neural networking techniques to better understand the intentions behind queries, Google says it can now offer more relevant results for about one in 10 searches in the U.S. in English (with support for other languages and locales coming later). For featured snippets, the update is already live globally.

In the world of search updates, where algorithm changes are often far more subtle, an update that affects 10% of searches is a pretty big deal (and will surely keep the worldSEO experts up at night).

Google notes that this update will work best for longer, more conversational queries — and in many ways, thathow Google would really like you to search these days, because iteasier to interpret a full sentence than a sequence of keywords.

The technology behind this new neural network is called &Bidirectional Encoder Representations from Transformers,& or BERT. Google first talked about BERT last year and open-sourced the code for its implementation and pre-trained models. Transformers are one of the more recent developments in machine learning. They work especially well for data where the sequence of elements is important, which obviously makes them a useful tool for working with natural language and, hence, search queries.

The technology behind this new neural network is called &Bidirectional Encoder Representations from Transformers,& or BERT. Google first talked about BERT last year and open-sourced the code for its implementation and pre-trained models. Transformers are one of the more recent developments in machine learning. They work especially well for data where the sequence of elements is important, which obviously makes them a useful tool for working with natural language and, hence, search queries.

This BERT update also marks the first time Google is using its latest Tensor Processing Unit (TPU) chips to serve search results.

Ideally, this means that Google Search is now better able to understand exactly what you are looking for and provide more relevant search results and featured snippets. The update started rolling out this week, so chances are you are already seeing some of its effects in your search results.

- Details

- Category: Technology

Read more: Google brings in BERT to improve its search results

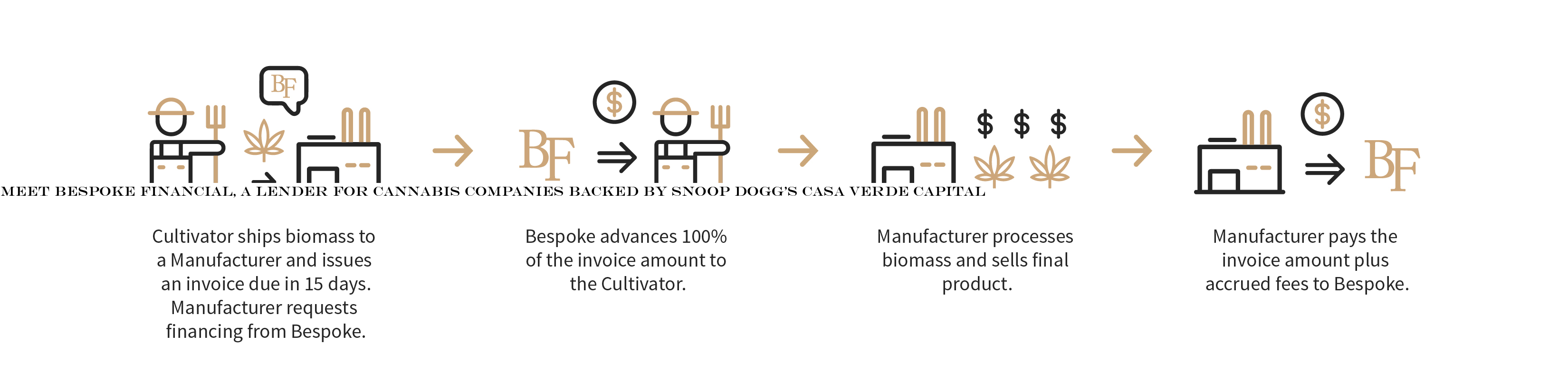

Write comment (94 Comments)Bespoke Financial wants to provide cannabis businesses with the same kind of financial services that other businesses get, but that dispensaries and growers can&t yet access.

The regulations around cannabis operations are so stringent at the local level — and so nebulous at the federal level — that national banks won&t give businesses in the cannabis industry the same basic services (like short-term loans).

Thatwhy one former Goldman Sachs banker has partnered with two entrepreneurs from the traditional agriculture industry to create Bespoke Financial. And itwhy the company has raised $7 million in financing led by Casa Verde Capital — the investment firm launched by legendary cannabis aficionado, Calvin Broadus (AKA Snoop Dogg).

In some ways, George Mancheril is the new face of the cannabis business. The former banker hails from Goldman Sachs and Guggenheim Partners and worked on the desks that dealt with alternative lending.

A transplant to Los Angeles roughly six years ago, Mancheril says he saw the migration of legally sanctioned cannabis begin for recreational use and knew there would be opportunities for new lending businesses.

&Cannabis will become a broad, mature industry just like any other, and if that is going to happen, there needs to be a debt structure that can support that,& Mancheril says.

The biggest impediment to the industrygrowth is the one that Bespoke Financial wants to tackle first — and thataccess to debt.

To build the companyfirst product, Mancheril looked to his co-founderPablo Borquez-Schwarzbeck and Benjamin Dusastre. Borquez-Schwarzbeck and Dusastre previously launchedProducePay, a fintech platform focused on produce farmers that has financed roughly $2 billion in perishable commodities throughout 13 countries. Itbacked by around $200 million in venture capital and debt financing.

What Mancheril and his co-founders have done is take ProducePayunderwriting model and apply it to the cannabis industry. The financial instrument that they&re starting with is known &in the business& as factoring.

Itbasically advancing money to businesses for a contract thatsigned in exchange for a cut of the money once a company gets paid for the goods or services they&ve rendered.

&While the US legal cannabis market is forecasted to grow over 20% annually, reaching $23B by 2022, the industrytrue growth potential is limited by long cash flow cycles throughout the supply chain and a lack of scalable and efficient capital sources,& says Bespoke Financial co-founder and chief executive, George Mancheril, in a statement. &Our approach will dramatically improve cash flow cycles across the supply chain and provide scalable working capital to fuel our clients& growth.&

&In general, in the cannabis industry overall, itdifficult to access any part of the financial system,& says Karan Wadhera, a managing director at Casa Verde. &Now that we&re moving into a place where equity financing is getting expensive, a company like Bespoke plays an important and valuable role in the ecosystem to help young brands and mature brands get access to working capital when they need it the most.&

- Details

- Category: Technology

Page 529 of 5614

7

7