Technology

Robots are coming. Are they overlords or friendly companions designed to help us perform the mundane tasks of our respective days Perhaps itboth. Whatever the purpose, they&re no longer part of some vague future we can&t quite fathom. They&re here now, and we got to meet a few of them at TC Sessions: Robotics at UC Berkeley.

Boston Dynamics

[gallery ids="1638722,1638723,1638151,1638152"]Boston Dynamics CEO Marc Raibert announced onstage that the company66-pound SpotMini robot will be available for purchase by the normals in 2019. Yes, one day you, too, will be able to have a dog robot perform services for you at the office or home.

Mayfield Robotics

[gallery ids="1638299,1638301,1638300"]This cute little robot from Mayfield Robotics can blink, play music, turn its head and recharge itself. It can also just stay put to take pictures of you and live-stream your daily life. Yep. It watches you. Its name is Kuri and it can be your little buddy to always remind you that you never have to be alone.

Agility Robotics

[gallery ids="1638336,1638334,1638335,1638298"]Agility Robotics&bipedal humanoid robot was designed with bird legs in mind. But it wasn&t yet designed with arms. The companyCTO Jonathan Hurst says those are to come. It&ll cost you $35,000 when itin full production mode. Custom deliveries started in August 2017 to a select few universities — University of Michigan, Harvard and Caltech, and Berkeley just bought its own.

Although we didn&t see an example of this application, Cassie can apparently hold the body weight of a reasonably sized human. No thanks. Below you can see Cassie make an appearance with Andy Rubin .

RoMeLa

[gallery ids="1638572,1638571,1638563,1638765"]Dennis Hong, professor and founding director of RoMeLa(Robotics - Mechanisms Library) of the Mechanical - Aerospace Engineering Department at UCLA, presented the humanoid robots he and his team developed in their lab. They set out to solve a common problem robots have: walking.

Humans are bipedal, so why is it so hard to replicate that in a robot, Hong asks. One of the reasons he said is because the distance between the left and right legs creates a twisting movement that renders forward and backward movement difficult. The resolution is to have them walk sideways. No twisting. So the team developed NABi (non-anthropomorphic biped), a bipedal locomotion robot with no &feet& or &shins.&

To extend the admittedly limited functionality of NABi, the team then created ALPHRED (Autonomous Legged Personal Helper Robot with Enhanced Dynamics). ALPHREDlimbs, as the team calls them (¬ legs, not arms&), form to create multimodal locomotion, because of its multiple types of formations. Depending on the type of movement required of the robot, the limbs change configurations to that of a dog or a horse, or to more of a humanoid, bipedal type.

SuitX

[gallery ids="1638773,1638771,1638769,1638770,1638766,1638764,1638768,1638767,1638564,1638565"]SuitX develops robotic modules that assist humans in performing everyday actions, such as walking, lifting, bending over and squatting. While you won&t suddenly possess the strength and agility of a Marvel superhero, wearing these modules can help you lift things that are ever-so-slightly heavier than you might be used to. The BackX, LegX and ShoulderX serve to minimize the stress we humans tend to place on our joints.

But infinitely more impressive during the conversation with company co-founder Homayoon Kazerooni was the application the audience saw of the companyexoskeleton. Arash Bayatmakou fell from a balcony in 2012 which resulted in paralysis. He was told he would never walk again. Five years later, Arash connected with SuitX, and he has been working with a physical therapist to use the device to perform four functions: stand, sit and walk forward and backward. You can follow his recovery here.

- Details

- Category: Technology

Read more: Here are all the robots we saw at TC Sessions: Robotics

Write comment (91 Comments)As an education investor, one of my favorite sayings is that education is the next industry to be disrupted by technology, and has been for the past twenty years.

When I started my career at Warburg Pincus, I inherited a portfolio of technology companies that senior partners naively believed would solve major problems in our education system.

It would have worked out fine, of course, except for all the people. Teachers weren&t always interested in changing the way they taught. IT staff weren&t always capable of implementing new technologies. And schools weren&t always 100% rational in their purchasing decisions. And so while, given the size of the market, projections inexorably led to $100M companies, sales cycles stretched asymptotically and deals never seemed to close, particularly in K-12 education.

My current firm, University Ventures, began life in 2011 with the goal of funding the next wave of innovation in higher education. Much of our early work did revolve around technology, such as backing companies that helped universities develop and deploy online degree programs. But it turned out that in making traditional degree programs more accessible, we weren&t addressing the fundamental problem.

At the time, America was in the process of recovering from the Great Recession, and it was clear that students were facing twin crises of college affordability and post-college employability. The fundamental problem we needed to solve was to help individuals traverse from point A to point B, where point B is a good first job & or a better job & in a growing sector of the economy.

Once we embarked on this journey, we figured out that the education-to-employment missing link was in the &last mile& and conceptualized&last-mile training&as the logical bridge over the skills gap. Last-mile training has two distinct elements.

The first is training on the digital skills that traditional postsecondary institutions aren&t addressing, and that are increasingly listed in job descriptions across all sectors of the economy (and particularly for entry-level jobs). This digital training can be as extensive as coding, or as minimal as becoming proficient on a SaaS platform utilized for a horizontal function (e.g., Salesforce CRM) or for a particular role in an industry vertical. The second is reducing friction on both sides of the human capital equation: friction that might impede candidates from getting the requisite last-mile training (education friction), and friction on the employer side that reduces the likelihood of hire (hiring friction). Successful last-mile models absorb education and hiring friction away from candidates and employers, eliminating tuition and guaranteeing employment outcomes for candidates, while typically providing employers with the opportunity to evaluate candidates& work before making hiring decisions. Today we have eight portfolio companies that take on risk themselves in order to reduce friction for candidates and employers.

The first clearly viable last-mile training model is the combination with staffing. Staffing companies are a promising investment target for our broadened focus because they have their finger on the pulse of the talent needs of their clients. Moreover, staffing in the U.S. is a $150B industry consisting of profitable companies looking to move up the value chain with higher margin, differentiated products.

Because fill rates on job reqs can be as low as 20% in some skill gap areas of technology and health care, there is no question that differentiation is required; many companies view staffing vendors as commodities because they continue to fish in the same small pool of talent, often serving up the exact same talent as competitors in response to reqs.

Adding last-mile training to staffing not only frees the supply of talent by providing purpose-trained, job-ready, inexpensive talent at scale, but also increases margins and accelerates growth. It is this potential that has prompted staffing market leaderAdecco(market cap ~$12B) to acquire coding bootcamp leaderGeneral Assemblyfor $412.5M. The acquisition launches Adecco down a promising new growth vector combining last-mile training and staffing.

We believe that staffing is only the most obvious last-mile training model. Witness the rise of pathways to employment likeEducation at Work. Owned by the not-for-profit Strada Education Network, Education at Work operates call centers on the campuses of universities like University of Utah and Arizona State for the express purpose of providing last-mile training to students in sales and customer support roles. Clients can then hire proven talent once students graduate. Education at Work has hired over 2,000 students into its call centers since its inception in 2012.

Education at Work is the earliest example of what we call outsourced apprenticeships. For years policy makers have taken expensive junkets to Germany and Switzerland to view their vaunted apprenticeship models & ones we&ll never be able to replicate here for about a hundred different reasons.This week, Ivanka TrumpTask Force on Apprenticeship Expansion submitteda reportto the President with a &roadmap… for a new and more flexible apprenticeship model,& but no clear or compelling vision for scaling apprenticeships in America.

Outsourced apprenticeships are a uniquely American model for apprenticeships, where service providers like call centers, marketing firms, software development shops and others decide to differentiate not only based on services, but also based on provision of purpose-trained entry-level talent. Unlike traditional apprenticeship models, employers don&t need to worry about bringing apprentices on-site and managing them; in these models, apprentices sit at the service provider doing client work, proving their ability to do the job, reducing hiring friction with every passing day until they&re hired by clients.

America leads the world in many areas and outsourcing is one of them. Outsourced apprenticeships are an opportunity for America to leapfrog into leadership in alternative pathways to good jobs. All it will take is service providers to recognize that clients will welcome and pay for the additional value of talent provision. We foresee such models emerging across a range of industries and intend to invest in companies ideally positioned to launch them.

All of these next generation last-mile training businesses will deliver education and training & predominantly technical/digital training as well as soft-skills where employers also see amajor gap. They&ll also be highly driven by technology; technology will be utilized to source, assess and screen talent & increasingly via methods that resemble science fiction more than traditional HR practices & as well as to match talent to employers and positions. But they&re not EdTech businesses as much as they arefull-stack solutionsfor both candidates and employers: candidates receive guaranteed pathways to employment that are not only free & they&re paid to do it; and employers are able to ascertain talent and fit before hiring.

While last-mile solutions can help alleviate the student loan debt and underemployment plaguing Millennials (and which put Gen Z in similar peril), they also have the potential to serve two other important social purposes. The first is diversity.

Just as last-mile providers have their finger on the pulse of the skill needs of their clients, they can do the same for other needs, like diversity. Last-mile providers are sourcing and launching cohorts that directly address skill needs, as well as diversity needs.

The second is retraining and reskilling of older, displaced workers. For generations, college classrooms were the sole option provided to such workers. But we&re unlikely to engage those workers in greatest need of reskilling if college classrooms & environments where they were previously unsuccessful & are the sole, or even initial modality. As last-mile training models are in simulated or actual workplaces, they are much more accessible to displaced workers.

Finally, the emergence of last-mile full-stack solutions like outsourced apprenticeships raises the question of whether enterprises might not only seek to outsource entry-level hiring, but all hiring. Why even hire an experienced worker from outside the company if therean intermediary willing to source, assess and screen, upskill, match, and provide workers on a no-risk trial basis As sourcing, screening, skill-building, and matching technologies become more advanced, why not offload the risk of a bad hire to an outsourced talent partner Most employers would willingly pay a premium to reduce the risk of bad hires, or even mediocre hires. If the market does evolve in this direction, education investors with a full-stack focus have the potential to create value in every sector of the economy, making traditional investment categories of &edtech& seem not only naïve, but also quaint.

- Details

- Category: Technology

Read more: Broadening education investments to full-stack solutions

Write comment (93 Comments)It4:55pm CentralTime on a Tuesday at Bumble headquarters in Austin, Texas. Whitney Wolfe Herd, the 28-year-old founder and CEO of the woman-led dating app is showing me around the nearly four-year-old startupoffice before we sit down to talk.

Our first stop is the standard startup watering hole, with a few twists. The fridges are stocked with Topo Chico instead of La Croix and the built-in taps are purely for decoration. Maybe one day they&ll be filled with Kombucha or iced coffee, a team member tells me. But no mention of beer. We&re not in Silicon Valley anymore.

As Wolfe Herd pours two glasses of white wine and plops in a few ice cubes, she briefly pauses to ask if I&m okay with the drink selection. Her question quickly caused my mind to wander back to my 21st birthday when a waiter told me men aren&t supposed to drink white wine with ice cubes.

There was perhaps no better way to begin my time with Wolfe Herd than a reminder that no matter how many hundreds of millions of woman-initiated matches have been made on Bumble, the company still exists in a world so ingrained with gender stereotypes that we couldn&t get through pouring a drink before the first one reared its head.

Luckily for me and my unsophisticated palate, I&d soon learn that Whitney Wolfe Herd doesn&t particularly care what people think that she or Bumble are supposed to do, let alone what we should be drinking.

‘I&m not building a dating app&

Bumble isn&t Wolfe Herdfirst exposure to the world of digital dating and connections. She moved to Los Angeles in 2012 and became an early co-founder of Tinder, but eventually left the company amid allegations of sexual harassment and discrimination against another one of the companyco-founders. The lawsuit was settled, and while the past is the past, the history does help set the stage for the idea that would eventually turn into Bumble.

&I was just poof, gone, ceased to exist. It was like leaving behind an abandoned life, fleeing from the storm or whatever it was,& explained Wolfe Herd when talking about leaving Los Angeles after her time at Tinder. &I was experiencing all this, and then the Twitterverse and the Instagram world and the online sphere started attacking me. And I had never really understood online bullying. I didn&t even know what that meant or what it felt like. It made me really depressed.&

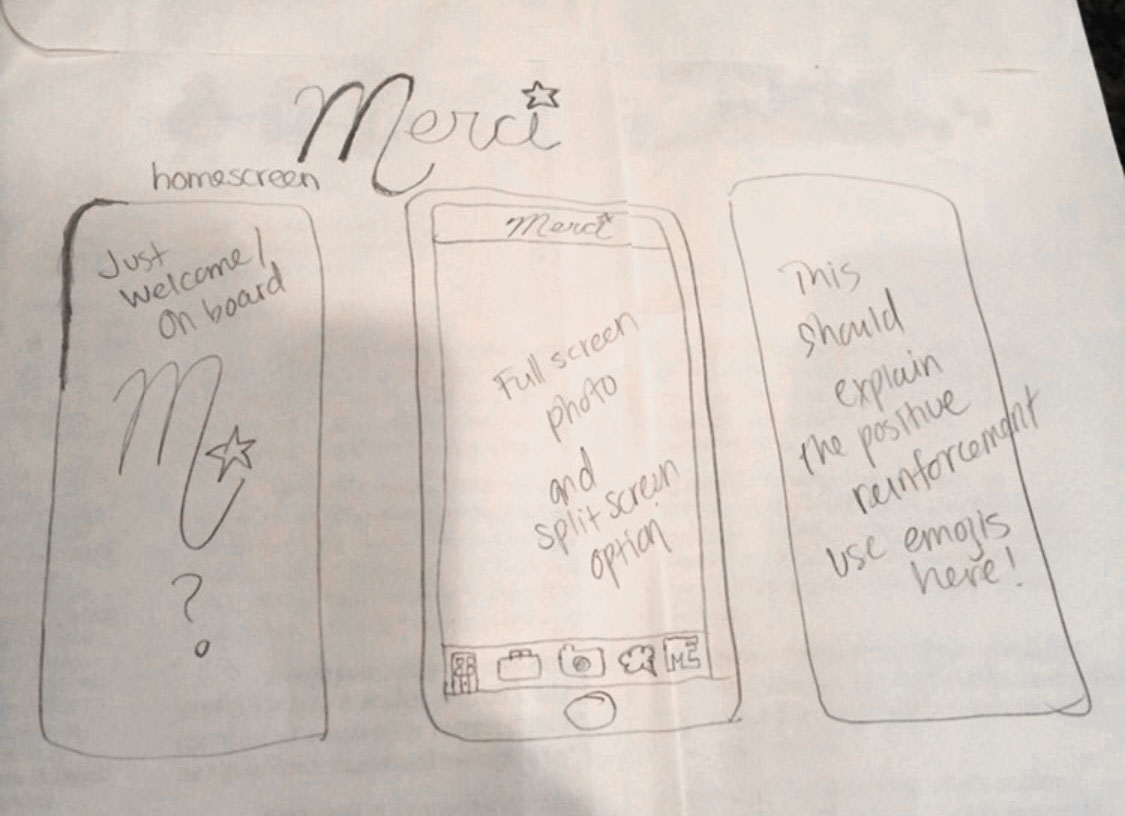

As successful entrepreneurs are known to do, Wolfe Herd soon began figuring out a way to leverage these closely held personal experiences into a new product. Her solution was Merci, a female-only social network &rooted in compliments and kindness and good behavior.&

Original mockup of Bumble, then known as Merci

While she was building out the idea, Andrey Andreev, founder and CEO of Badoo, the largest dating platform in the world, contacted her. Little did Wolfe Herd know, but Andreev saw her departure from Tinder as an opportunity, inviting her to meet the Badoo team in London where it had been based for more than 10 years. After some reluctance on Wolfe Herdpart, she decided to go for it. After all, she was looking for feedback on her Merci idea, and worst-case she&d at least leave with a better idea of what she wanted to build next.

But Andreev had other plans. During their first meeting he frankly asked Wolfe Herd to become the chief marketing officer of Badoo.

She didn&t even consider the offer. First, it would have required her to move to London and, more importantly she was adamant about never working in the dating world again. With the CMO offer in the meetingrearview mirror, Wolfe Herd shifted the conversation to Merci, and gave Andreev a deep dive into her idea for a woman-only social network grounded in compliments and positive feedback.

&I love it,& Andreev said. &We&re going to name the dating app Merci.&

She was aghast, even in her retelling of the story.

&The what What are you talking about Did you hear what I said I&m not building a dating app. Merci is the name of my female-only social network.&

Andreev clarified: &I love your vision for a female-first platform, but you need to do this in dating.&

He essentially offered her the funding she needed to get the app off the ground, and, perhaps more importantly, full access to Badootechnical team to build and ship it. Plus, full creative control and decision-making ability regarding the direction of the new company.

From L-R: Whitney Wolfe Herd, Andrey Andreev and Sarah Jones Simmer, BumbleCOO

But Wolfe Herd had no interest in building such an app, and Andreev had no interest in getting involved with a new social network. So she headed home, all the more determined to make Merci the next big thing. But the offer from Andreev was still lingering in the back of her mind.

&My husband, boyfriend, whatever you want to call him — Michael, we&ll just call him Michael,& Wolfe Herd told me. &Michael was like, ‘Whit, this opportunity doesn&t strike twice. You&re going to try and raise money right now You&re literally a scorned seductress, according to the VC community right now. Good luck to you. I know you don&t have the backbone right now,& because I had been so depleted and I was so low on myself.&

With the encouragement of her then-boyfriend (now husband) Michael Herd, she decided that Andreevoffer was too good to pass up, and headed back to London, where she essentially made a handshake deal with him to build this new woman-first dating app.

Bumble was born

The company would exist as a new entity with 20 percent ownership belonging to Wolfe Herd, 79 percent to Badoo and 1 percent divided between Christopher Gulczynski and Sarah Mick, two early consultants who went on to join full-time after the company was up and running. Briefly named Moxie, the group settled on Bumble after a trademark search turned up conflicts.

Bumble would be run independently from Austin, Texas, with the ability to tap into Andreev and Badooyears of experience in the dating industry when needed. It certainly wasn&t a typical arrangement, especially in the world of tech startups where, in order to build a successful company, you&re supposed to rally a group of two to three co-founders, raise a seed round, then a Series A and so on.

But now, four years and 30 million users later, Bumblecap table looks exactly the same as it did the day the company was founded. Wolfe Herd20 percent undiluted founderstake is evidence that an atypical path was right for Bumble.

A startup office with no engineers

It quickly becomes apparent to me as a technology writer walking through BumbleAustin headquarters that this isn&t your typical startup office. It looks and feels much more like a living room than any sort of standard tech office environment.

For a small space that is now overflowing with more than 50 employees, there are only about 25 desks, and most of those remained empty during my two-day visit. Everyone seems to prefer rotating through conference rooms, counters, coffee tables, floors and the largest couch I&ve ever seen, which sits in a semicircle ready to comfortably fit upwards of 30 people, if needed.

&I believe in taking people away from their desks and making them feel collaborative and inspire one another instead of being siloed,& she explained.

While the setup may not work for some companies, it certainly does for Bumble. But that doesn&t mean everyone agrees. Wolfe Herd explained that they had to rotate through multiple designers before settling on one that aligned with her vision.

&So many people wanted to make it hyper functional and minimalistic and stark…almost cold,& she told me. &I didn&t want it to feel that way. I wanted it to feel welcoming and warm and do it differently.&

The design isn&t the only thing that stands out when walking through Bumbleoffice. It also doesn&t have a single engineer.

Just like Andreev promised Wolfe Herd when they first decided to build Bumble, all engineering is still handled in BadooLondon offices. While some technology veterans may bash Bumble for offloading their engineering to their parent company, she is unapologetic about the benefits and practicality of the arrangement.

&Had I gone out and tried to do this on my own with no tech support, Bumble would be a year-and-a-half behind. Think of all the marriages and babies and connections we&ve made [in that time],& explained Wolfe Herd.

She continued: &Itlike building a road. If you can get the materials from someone quicker that will make peoplelives easier, why would you say, ‘No, I want to build this with my own two hands,& just to be able to say I did&

I asked Wolfe Herd if there are ever times when their team has wished that their developers were sitting in the next room, standing by for a product consultation or roadmapping session.

But Wolfe Herd actually attributes much of Bumblesuccess to working in an environment devoid of a dev team. Specifically, she explained that it gave her team the creative freedom to allow Bumblemessage and brand to drive the product, and not vice versa. By letting branding take the front seat instead of product, Bumble leapfrogged the &connections app& phase and became a lifestyle brand.

&How do you have different touch points in a userlife How do you reach them on their drive home from work How do you talk to them on social media How do you make them feel special How do you add your brand into their different touch points& Wolfe Herd says. Her original vision was to build a social network rooted in positivity and affirmations, but asking (and answering) these questions has allowed her to help in building a whole world for Bumble users rooted in positivity and affirmations.

Versace, Balenciaga, Bumble

Last summer if you happened to be walking through New Yorktrendy Soho neighborhood you may have noticed a new tenant sandwiched between Versace and Balenciaga on Mercer Street.

In a first for a dating app and pretty much any social app, Bumble opened a physical space as an attempt to formalize the community that was naturally forming around it. At the time she told me that the opening coincided with Bumblebrand becoming something that people are now proud to associate with in real life.

BumbleNew York City Hive

This message was repeatedly echoed to me by others around Wolfe Herd, and it seems to be one of the internal barometers the company uses to track its success. Samantha Fulgham, Bumblesecond employee who now leads campus marketing and outreach, explained how male college students are now applying to become ambassadors, interns and even full-time employees.

&We tried to [have male students be campus ambassadors] in the U.S. probably two years ago. They didn&t really want to do it, because they thought it was a girl thing. Now we&re trying it again in Canada and we&ve already had so many guys asking how they can work for Bumble… saying, ‘I want to be a part of this company.&&

And itnot just college students champing at the bit to associate themselves with the brand. When Bumble launched its business networking product last fall, the startupNY launch party was attended by Priyanka Chopra, Kate Hudson and Karlie Kloss, while the L.A. event hosted Gwyneth Paltrow, Jennifer Garner and Kim Kardashian West.

Bumble BizzNYC Launch Party. From L-R: Whitney Wolfe Herd, Priyanka Chopra, Karlie Kloss, Fergie and Kate Hudson. By Neil Rasmus/BFA.com.

A digital response to a real problem

Bumble has been able to grow into the company it is today because it was founded on the basic principle of taking a stance on a contested issue: Women were never supposed to make the first move. But Bumble didn&t stop there, and under Wolfe Herd the startup has been very vocal about making sure they are using their voice to address issues that other companies are taught to avoid taking a stance on.

In the wake of the Stoneman Douglas school shooting, Bumble did something that breaks just about every rule taught in marketing and PR 101: The dating app very publicly decided to insert itself right in the middle of our nationongoing gun debate by banning images of guns on its platform.

&We just want to create a community where people feel at ease, where they do not feel threatened, and we just don&t see guns fitting into that equation,& Wolfe Herd told The New York Times after the ban.

She told me at the time that the move shouldn&t be seen as Bumble taking a hard stance against guns or gun owners, but rather taking a hard stance against normalizing violence on their platform.

While an outsider may have been surprised to see such a fast-growing company break the status quo and decide to take a stance on a political issue, those who know Wolfe Herd will say that doing things like this is exactly why Bumble has become so successful in such a short amount of time.

Whatnext

For an industry thatbeen around since the beginning of time, matchmaking sure is having its moment. And even the big players want a piece of the action;Facebook has announced itexpanding into the dating space. So how does Bumble, a barely four-year-old, non-venture-backed company take advantage of all this attention while simultaneously defending itself from the threat of big players entering the space

Over the summer we reported that Tinderparent company Match was set on acquiring Bumble, first at a $450 million valuation, then a few months later at &well over& $1 billion. It would have been an ironic ending for a company that was at least partially founded because of Wolfe Herdnegative experiences surrounding her time at Tinder and Match.

Ultimately negotiations fell through between the two companies, and from there things escalated quickly. In March, Match sued Bumble for &patent infringement and misuse of intellectual property,& and a few weeks later Bumble sued Match for fraudulently obtaining trade secrets during the acquisition process. Both lawsuits are still making their way through the courts, but itsafe to say that a deal between the two is off the table for the foreseeable future.

So whatnext for Bumble The company is profitable and self-sustaining, and has no need to take on capital or sell itself. But Wolfe Herd acknowledged that the right acquirer may allow them to fulfill their goal of &recalibrating gender norms and empowering people to connect globally& at a much faster pace.

Wolfe Herd explained: &If the right opportunity presents itself, we&ll absolutely explore that and we&ll absolutely always explore the best way to take what we&re trying to do and what our mission is and what our values are. If we can be acquired, that will help us scale 10 times faster and thatsomething thatinteresting to us, right&

But she was also clear that cash isn&t what they&re looking for. &We would only ever consider an acquisition of sorts that brings strategic intellectual capital to the table, strategic knowledge of new markets that we have not yet gone into, and added value in ways that supersedes just straight cash,& said Wolfe Herd.

To the casual observer it sounds a lot like Facebook and its 2+ billion active users could do a pretty good job helping Bumble quickly spread its message around the world.

And Bumble seems to agree. After Facebookannouncement about its dating play, Bumble issued a statement saying, &We were thrilled when we saw todaynews. Our executive team has already reached out to Facebook to explore ways to collaborate. Perhaps Bumble and Facebook can join forces to make the connecting space even more safe and empowering.&

In a conversation with me following the announcement, Wolfe Herd said that Facebookexpansion into dating &is actually super exciting for the industry, because if you look at the history of Facebook when it comes to building their own products versus acquiring, they oftentimes attempt to build their own. If those products don&t successfully come to market, thereusually a transition into acquisition. Who knows what will happen&

So if Facebook comes knocking, don&t be surprised if Bumble answers… and quickly.But if they don&t, then current indicators are that Bumble will be just fine.

In just four years the company has flipped the switch on app-based dating, taking something that was once taboo and making it something that users are proud to associate with. So luckily for the more than 30 million women (and men) who have used Bumble to break gender stereotypes and make over 2 billion matches on their own terms, Whitney Wolfe Herd didn&t care what she or her company were supposed to do.

- Details

- Category: Technology

Read more: Whitney Wolfe Herd doesn’t care what she’s supposed to do

Write comment (97 Comments)On a mild Thursday night at the Los Angeles Forum, Nikepublic relations team and a group of journalists from some of the countryleading lifestyle, tech, and general interest websites gathered to see the debut of Nike most ambitious SNKRS stash drop.

Launched in conjunction with Kendrick LamarTop Dawg Entertainment, the collaboration between Nike and Lamar marks a series of firsts for the worldlargest sports and lifestyle brand.

The combined effort is the first capsule collection that Nike has done with a musician. Italso the first time that anyone currently working at the company can remember the apparel company signing on with a musician for select tour merchandise, and the debut of the stash drop through the SNKRS app was the largest the companytech had tried to tackle.

For concertgoers, rolling up to the concert in Supreme sweats, Yeezys, Adidas, Pumas… and, of course, Nikes, the SNKRS stash drop would be a surprise. For folks who had downloaded NikeSNKRS app, they&d be able to buy and reserve a pair of Kendrick Lamarlimited edition Cortez Kenny IIIs at the concert.

At least on the first night, things didn&t go as planned.

Working with live events like concerts, where timing is less regimented than at a typical sporting event (which are marked by tip offs and halftimes that adhere to a pretty regimented schedule), proved too much for the initial rollout of the companystash drop.

Select NikePlus members received an initial push notification of the Stash drop and a card in the SNKRS feed also advertised the special stash drop, in addition to a notification that flashed onscreen between the (amazing) SchoolboyQ set and SZA(equally amazing) performance.

There will be other chances to get the timing down, but for the first concert in Los Angeles, concertgoers were prompted to launch the SNKRS app and try and snag a pair of the limited edition shoes well before the activation actually went live.

Once the shoes did go on sale, the user interface for finding and reserving the shoes didn&t work for everyone there — in fact, only one reporter from the group was able to reserve a pair of the shoes (since that reporter hadn&t saved payment information onto the SNKRS app, those shoes were released).

&I can&t get the app to do what I need,& said one concertgoer trying to snag a pair of shoes.

The team at Nike said the concertlate start caused the miscue. Roughly 30 minutes after the sneakers were supposed to onsale, the activation went live — something journalists were only made aware of when notified by Nikepublic relations team.

Once the sale did go live, the shoes sold out within the first five minutes, although itunclear how many were made available through the stash drop (Nike declined to provide a number).

Nikerepeating the stash drop for shows in Houston, New York, Boston and Chicago.

The SNKRS app is only one example of Nikeinnovative approach to integrating technology and fashion. In April, Nike launched the first sneaker thatintegrated with its NikeConnect technology.

Unveiled earlier this year through a collaboration with the NBA, the NikeConnect app allows users to access information on players and stats through a label enabled with near field communications chips.

NikeAir Force Ones enabled with the NikeConnect tech will open a special limited release sneaker sale opportunity called &The Choice&, but Nike has higher hopes for the technology.

&We would love to be able to award sweat equity with access to exclusive products or a partnership,& said a spokesperson for the company in an interview last year.

&NikeConnect [is] a great way for us to get interesting data about our members and deliver unlocks that are relevant to those members,& the spokesperson said.

Beyond the unlocks for exclusive sneaker offers, Nike is thinking about ways to include all of its technology partners in ways that benefit NikeConnect, NikePlus, and SNKRS users.

&We&re excited to learn how unlocks are being received right now,& said the spokesperson. &There is a pretty comprehensive ecosystem of value that we&ve been building for our members…Members who are really active with us are getting rewards or achievements [and] that could include partners like Apple… that we&ll be bringing to the table to round out your whole holistic sport experience.&

- Details

- Category: Technology

VCinvesting is a game of putting money into a company and hopefully getting more out. In an ideal world, the value placed on a company at acquisition or initial public offering would be some large multiple of the amount of money its investors committed.

As it happens, that multiple on invested capital (MOIC) makes for a fairly decent heuristic for measuring company and investor performance. Most critically, it provides a handy metric to use for answering these questions: For US-based companies, have exit multiples changed in a meaningful way over time And, if so, does this suggest something about the investment landscape overall

Coming up with an answer to this question required a specific subset of funding and exit data from Crunchbase. If you&re interested in the how and why behind the data, check out the Data and Methodology section at the very end of the article. If not, we&ll cut right to the chase.

Exit multiples may be on the rise

A rather conservative analysis of Crunchbase data suggests that, over the past decade or so, exit multiples were on the rise before leveling off somewhat.

Below, you can see a chart depicting median MOIC for a set of U.S.-based companies with complete (as best we can tell) equity funding histories stretching back to Series A or earlier, which also have a known valuation at time of exit. That valuation is either the price paid by an acquirer or the value of the company at the time it went public. In an effort to reduce the impact of outliers, we only used companies with two or more recorded funding rounds. With that throat-clearing out of the way, heremedian MOIC over time:

It should be noted for the record that the shape of the above chart somewhat changes depending on the data is filtered. Including exit multiples for companies with only one reported funding round resulted in slightly higher median figures for each year and a more steady linear climb upward. But thatprobably due to the number of comically-high multiples some companies with single small rounds and large exit values produced. There are surely examples of companies that raised $1 million once and later sold for $100 million, but those are fewer and further between than companies with missing data from later rounds.

What might be driving the rise in exit multiples

The rise in exit multiples may have to do with the fact that more companies are getting acquired at earlier stages.

Crunchbase data suggests that startups earlier in the funding cycle tend to deliver better exit multiples. In an effort to denoise the data a bit, we took the Crunchbase exit dataset and filtered out the companies that raised only one round. (Companies that raised only one round produced a lot of crazy outlier data points that skewed final results.)

This suggests that, in general, the earlier a startup is acquired in the funding cycle the more likely it is to deliver larger multiples on invested capital.

Now, granted, we&re working off of small sample sets with a fair amount of variability here, particularly for startups on opposite ends of the funding lifecycle. There is going to be some sampling bias here. Founders and investors are less likely to self-report disappointing numbers; therefore, these findings aren&t ironclad from the perspective of statistical significance.

But ita finding that nonetheless echoes aprior Crunchbase News analysis, which found a slight but statistically significant inverse relationship between the amount of capital a startup raises and the multiple its exit delivers to investors and other stakeholders. In other words, startups that raise less money (such as those at seed and early-stage) tend to deliver better multiples on invested capital.

The changing population of companies finding exits

So does the tendency for earlier-stage companies to deliver better investment multiples have anything to do with upward movement in MOIC ratios It could, particularly if more seed and early-stage startups are headed to the exit these days. And as it turns out, our data suggest thathappening.

The chart below shows the breakdown of exits for venture-backed companies based on the last stage of funding the company raised prior to being acquired or going public. We show a decadeworth of funding data, this time including all exits from U.S. companies with known venture funding histories since seed or early stage—some 5,275 liquidity events in all. For 2018, we also include stats for exits through the beginning of May. Given reporting delays and the factthat there are still eight months left in the year, this is certainly subject to change.

Now, to be clear, over the past decade, there has been some notable growth in the overall number of exits for U.S.-based venture-backed companies across all stages.

But, in some ways, the raw number of deals doesn&t much matter. After all, figures from several years ago aren&t really actionable to founders and investors looking for an exit sometime this year. What matters, then, is what the mix of exits looks like, and at least for the set of companies we analyzed here, the past ten years brought an ultimately small but nonetheless notable shift in the mix of companies that get acquired or go public.

Seed and early-stage companies now make up a larger proportion of the population of exited companies now than in the past. And since companies at that stage tend to deliver higher multiples, it is likely responsible for part of the increase over time.

There are certainly other factors besides the influx of seed and early-stage ventures into the mix of exits, but sussing those out will require further investigation.

It should go without saying that any venture-backed company that gets acquired or goes public is a success, at least of some sort. After all, a tiny fraction of new businesses secure outside funding from angel investors or venture capitalists, and onlya small proportion of those get acquired.

Any exit is better than none.

Data and methodology

Letstart by saying that there is probably no canonically correct way to do this sort of analysis and that since Crunchbase News is working off of private company data, what hasn&t been aggregated programmatically is subject to self-reporting bias. Founders and investors are more likely to disclose exit valuations that make them look good, so this may skew our findings higher.

Definition of funding stages

Here, we use the same funding stage definitions as Crunchbase News does in its quarterly reporting.

- Seed/Angel-stage deals include financings that are classified as a seed or angel, including accelerator fundings and equity crowdfunding below $5 million.

- Early stage venture include financings that are classified as a Series A or B, venture rounds without a designated series that are below $15M, and equity crowdfunding above $5 million.

- Late stage venture include financings that are classified as a Series C+ and venture rounds greater than $15M.

- Technology Growth include private equity investments in companies that have previously raised venture capital rounds.

Building the base dataset

Here are the basic process we used:

- We started by aggregating pre-IPO venture funding raised by U.S.-based companies. We focused only on equity funding only (angel, seed, convertible notes, equity crowdfunding, Series A, Series B, etc.), and did not include debt financing, grants, product crowdfunding, or other non-equity funding events. We did include private equity rounds, if and only if PE was the terminal round and the company had raised a seed, angel, or VC round prior to raising PE.

- For each company, we recorded the stage of its first and last known funding rounds.

- We excluded any company whose first round was Series B or later.

- We excluded companies that were missing dollar amounts for any of their equity funding rounds.

- We then retrieved the valuations at acquisition or IPO for each of the companies, again excluding any companies for which terminal private market valuation was not known.

- Finally, for each company, we divided valuation at exit by the amount of known venture funding, resulting in the multiple on invested capital from equity financing events.

In conjunction with choosing to start with Series A and earlier funding events, we believe this produced a set of companies with reasonably complete funding histories. Granted, there are &unknown unknowns,& like later rounds that weren&t captured in Crunchbase, but there is no good way to control for those.

- Details

- Category: Technology

Read more: Looking for a better exit Get out of the game early

Write comment (98 Comments)

Leaked screenshots show the updated features that will be coming on to the MIUI 9, Xiaomi's own user interface based on Android Oreo. They also happen to have aspects similar to Android-P beta. Therefore, it could be assumed that when the MIUI 10 rolls out, it will also have a lot of these features because it will be based on Android P.

MIUI 9

- Details

- Category: Technology

Read more: Latest MIUI 9 build shows features similar to Android P Developer Preview

Write comment (100 Comments)Page 5419 of 5614

19

19