Technology

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

Today the big news that falls into our orbit is about DraftKings, a sports betting service focused on fantasy sports that will go public via a reverse merger. Not too long ago DraftKings and its erstwhile rival FanDuel were ubiquitous on television; now the two are fractions of what they once were.

Letchat about what went wrong and whatnext.

The ascent

Both DraftKings and FanDuel raised modest sums until the latter half of 2014.

FanDuelSeries A was worth just $1.2 million back in 2009. Its $4 million Series B in 2011 almost sounds like a joke. An ensuing 2013 Series C just tipped the scales at just $11 million. Things picked up in Q3 2014.

DraftKingstory is similar, if slightly more aggressive. A $9.8 million Series A in 2013 was followed by a $24 million Series B that same year. Then in Q3 2014 things started to go faster.

In the third quarter of 2014, FanDuel raised a $70 million Series D. In the same three-month period, DraftKings raised $41 million. The next year, FanDuel raised a $275 million round in July. That same month DraftKings raised $300 million. All of a sudden the companies were unicorns, worth a combined $2.2 billion, post-money.

FanDuelfunding history (according to Crunchbase data) then slowed, while DraftKings raised another $150 million in 2016 and $118.7 million in 2017. But the great capital arms race had reached its zenith and fallen for the two companies.

The punishing fight across hundreds of millions of dollars in TV ads for market share between the two led to a merger proposal in 2016. That was called off in 2017. From rising titans blanketing your screens with ads to a failed combination, what went wrong?

The descent

What happened is actually very understandable in light of WeWorkfailure to go public earlier this year: The companies were torching capital in the name of growth.

- Details

- Category: Technology

Read more: As DraftKings finds an exit, a reminder of what could have been

Write comment (90 Comments)

Just in time for Christmas, Lyft has brought back to San Francisco its pedal-assist e-bikes. The plan is to roll out hundreds of bikes each week until it hits 4,000 by the end of April 2020. This comes after Lyft had to pull its e-bikes in light of battery-related fires in July.

&After identifying the root cause of the battery issues, we made the decision to work with a different battery supplier,& Lyft wrote in a blog post last month. &We&re now receiving new batteries, testing them and reassembling ebikes.&

That announcement came along with Lyft reaching a four-year agreement with the San Francisco Municipal Transportation Agency to deploy 4,000 of its e-bikes. The resolution was the result of Lyft suing the city of San Francisco, which led to the court ordering Lyft and the SFMTA to negotiate under the &Right of First Offer& provision.

As part of the agreement, Lyft must provide reliable and redundant services, utilize modular design and pay $300,000 in fees to fund the installation of additional bike racks. If Lyft fails to do this, the SFMTA has the right to permit a second operator. For now, JUMP is still permitted to operate its 500 e-bikes, at least until March 1, 2020, as Lyft rolls out its full fleet.

Until March, Lyft will allow Bay Wheels members to access the e-bikes at no additional cost. Additional pricing will go into effect starting March 1, but Lyft says it&engaging our community partners and members to inform the best approach to pricing ebike rides so we can provide the best service possible, since ebikes have higher operational costs per ride than pedal bikes.&

- Details

- Category: Technology

Read more: After battery fires, Lyft’s e-bikes are back in San Francisco

Write comment (91 Comments)

American automotive technology startup Rivian has raised $1.3 billion in new funding, the company announced today. The new investment is the fourth round of capital announced by the company in 2019 alone, following prior announcements of $700 million led by Amazon, $500 million from Ford (which includes a collaboration on electric vehicle technology) and $350 million from Cox Automotive.

Thata lot of money, but Rivian not your typical startup, as itaiming to bring fully electric vehicles to market, including the R1T pickup truck and the R1S sport utility vehicle. Both of those are consumer cars, which the company aims to bring to market starting at the end of next year — and Rivian is also working with Amazon on all-electric delivery vans, of which the commerce giant has ordered 100,000, with a target of starting deliveries of the first of those in 2021.

Riviannew monster round includes participation from Amazon and Ford Motor Company, along with funds advised by T. Rowe Price Associates and BlackRock, the company said in a release. Itnot adding any new board seats attached to this funding, and itnot sharing any further details on the specific funds involved in the investment at this time.

The company, founded in 2009, has R-D facilities in a number of cities globally, and also has a 2.6-million-square-foot manufacturing facility in Normal, Ill. It debuted its pickup and SUV at the LA Auto Show last November, and the vehicles will launch with higher-end trim levels first, including up to 410 miles of range on a single charge. Base prices for the R1T pickup start at $69,000 before any tax credits are applied, while the R1S SUV starts at $72,500; Rivian has been taking pre-order reservations, available with a $1,000 deposit.

For a company that in many ways has seemed to appear out of nowhere, Riviancapitalization and partnerships make it one of the better existing contenders to take on Tesla, especially in the truck and SUV categories, where Tesla has less presence, with only the high-end Model X actually available to purchase so far.

- Details

- Category: Technology

Read more: Rivian adds $1.3 billion in funding for its electric utility and adventure vehicles

Write comment (93 Comments)

Mastercard announced today that it is acquiring RiskRecon, a Salt Lake City startup that uses publicly available data to build security assessments of organizations. The companies did not share the purchase price.

It has become increasingly important for financial services companies like Mastercard to help customers navigate cybersecurity, and RiskRecon will give customers an objective score of a companyrisk profile.

&Through a powerful combination of AI and data-driven advanced technology, RiskRecon offers an exciting opportunity to complement our existing strategy and technology to secure the cyber space,& Ajay Bhalla, president of cyber and intelligence for Mastercard, said in a statement.

RiskRecon CEO Kelly White told TechCrunch in a 2016 interview after the company$3 million seed round that the company looks at information that is readily available on the internet and puts it together to measure a companyoverall security risk:

RiskRecon leverages information that is available on the web from companies operating there as part of the act of doing business. &If you stand up web servers and DNS servers, these are intentionally discoverable because they are providing services on the internet. Systems reveal the software being run and version information from which you can determine security performance.&

White sees joining Mastercard as an opportunity to be a part of a larger organization and all that that entails. &By becoming part of their team, we have an opportunity to scale our solution and help companies in new industries and geographies take steps to better manage their cybersecurity risk,& he said in a statement.

RiskRecon launched in 2015 and has raised $40 million, according to Crunchbase data. Investors included Accel, Dell Technologies Capital, General Catalyst and F-Prime Capital.

Itworth noting that the company was not alone in the space, competing with New York City-based SecurityScoreCard, which launched in 2013 and has raised over $112 million, according to Crunchbase. The last investment came in June for $50 million.

Todaydeal is subject to standard regulatory approval, but is expected to close in the first quarter in 2020.

- Details

- Category: Technology

Read more: Mastercard acquires security assessment startup, RiskRecon

Write comment (98 Comments)

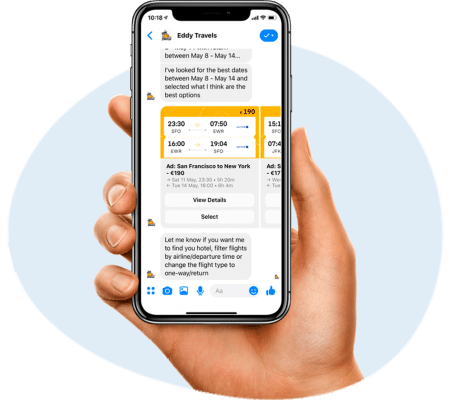

Eddy Travels, an AI-powered travel assistant bot which can understand text and voice messages, has closed a pre-seed round of around $500,000 led by Techstars Toronto, Practica Capital and Open Circle Capital VC funds from Lithuania, with angel investors from the U.S., Canada, U.K.

Launched in November 2018, Eddy Travels claims to have more than 100,000 users worldwide.

Travelers can send voice and text messages to the Eddy Travels bot and get personalized suggestions for the best flights. Because of this ease of use, it now gets 40,000 flight searches per month — tiny compared to the major travels portals, but not bad for a bot that is available on Facebook Messenger, WhatsApp, Telegram, Rakuten Viber, Line and Slack chat apps.

The team is now looking to expand into accommodation, car rentals and other travel services. Eddy Travels search is powered by partnerships with Skyscanner and Emirates Airline.

The founders are from Lithuania: Edmundas Balcikonis, CEO, (previously founded and led as CEO TrackDuck startup, acquired by Invision), Pranas Kiziela and Adomas Baltagalvis. The company HQ is in Toronto, Canada.

- Details

- Category: Technology

Read more: Eddy Travels closes pre-seed round led by Techstars to scale its AI travel assistant

Write comment (97 Comments)

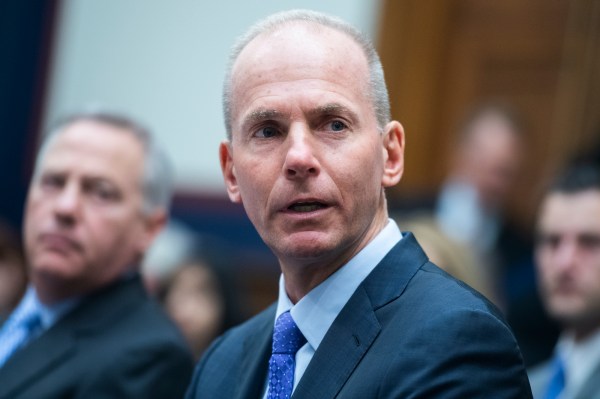

BoeingCEO Dennis A. Muilenburg is CEO no longer, the company announced today. Effective January 13, 2020, current Board Chairman David L. Calhoun takes over the top executive officer spot at the aerospace company, and becomes president, as well.

This is far from a surprising decision: Boeingyear has been marked primarily by its handling of the 737 Max issues it faced, which stemmed from aircraft failures that resulted in crashes and the deaths of passengers. Boeing has taken steps to address the crisis and its fallout, including putting $100 million into a fund to be distributed to the families and communities surrounding the victims of 737 Max crashes. It also recently halted production of new 737 Max aircraft, pending its recertification for service.

In a statement announcing the leadership change today, Boeingnew incoming CEO Calhoun said that he &strongly believes in the future of Boeing and the 737 MAX,& and one of the headline priorities listed by the companies was &safely returning the 737 MAX to service.& The release also declared a &renewed commitment to full transparency, including effective and proactive communication with the FAA, other global regulators and its customers.&

Though not mentioned, Boeing also had another setback just this week, as its Starliner CST-100 commercial crew spacecraft failed to execute an automated maneuver during its first test flight to the International Space Station, resulting in a premature termination of the mission.

- Details

- Category: Technology

Read more: Boeing CEO out following 737 Max fiasco, will be replaced by current board chairman

Write comment (93 Comments)Page 58 of 5614

13

13