Technology

For many founders, building and selling a successful venture-backed company for cash is the ultimate goal. However, the reality is that some companies will instead receive an equity-funded acquisition proposal in which equity of another private venture-backed company, rather than cash, represents all or a significant portion of the purchase price.

Because all equity is not created equal, it is important for founders to understand how to negotiate for better equity in the context of such an acquisition proposal. This article explores what better equity looks like and some strategies founders can use to negotiate for that equity.

What is &better& equity?

To know what &better& equity is for the seller, it is necessary to understand what the &worst& and &best& stock is in the context an equity-funded acquisition by a private company buyer. The &worst& stock is plain common stock which does not enjoy any special rights and is subject to contractual restrictions which diminish its liquidity profile. Common stock sits at the bottom of the priority stack (after debt and preferred equity) in the event the company dissolves or is sold — thus, it is least valuable. Variations of transfer restrictions (e.g., a prohibition on private secondary sales) may further diminish the desirability of common stock by making it difficult or impossible for the holder to achieve liquidity outside of an M-A event or initial public offering (IPO).

In contrast, the &best& stock is (1) the acquirermost senior series of preferred stock, coupled with (2) additional contractual rights enhancing such stockliquidity profile. For our purposes here, we&ll call this &enhanced preferred stock.& All things being equal, founders and VCs should have a strong preference for enhanced preferred stock in an equity-funded acquisition for several reasons:

- Usually, the most senior series of preferred stock will enjoy a liquidation preference ensuring that a certain amount of proceeds (commonly equal to invested capital) from a sale of the company flow to stockholders of that series before proceeds are distributed to junior preferred and common stockholders.

- Unique contractual rights not shared by common stockholders, like special voting rights with respect to major events and transactions, unique information rights, pro rata investment rights with respect to future financings, rights of first refusal and co-sale rights, increase the stockrelative value.

- Beyond the standard set of rights that are usually enjoyed by all preferred stockholders, additional contractual rights of and reduced restrictions on enhanced preferred stock make it more likely that the holder of such equity will achieve liquidity of some or all of its holdings prior to an M-A event or IPO. Such additional rights may include one or more of the following: time or event-based redemption rights (i.e., the right to force the acquirer to redeem equity at a specified price in the future), other liquidity rights tied to future financings or commercial transactions (e.g., the right to sell stock to the investors in the next equity financing), covenants of the acquirer to permit and support private secondary sales and registration rights (i.e., the right to force the acquirer to register stock with the SEC, thereby allowing for unrestricted resale by the holder).

&Better& stock lies somewhere on the continuum between the common stock and enhanced preferred stock poles, with the type of stock and bundle of rights associated with such equity determining its precise location. Additional contractual rights and reduced restrictions may significantly improve the desirability of common stock and perhaps place the holder in a better position than it would have been as a preferred stockholder. For example, a seller able to negotiate the right to sell a certain amount of common stock to investors in the acquirernext preferred stock equity financing could be more favorably positioned than the holder of senior preferred stock without any enhanced preferred rights.

Negotiating for better stock. With a framework for understanding what better stock means, below are several strategies sellers can employ in M-A negotiations to obtain better stock than that initially offered by the buyer.

Avoiding dire situations and preserving leverage.Leverage matters in every negotiation and any strategy that ignores this reality is doomed to fail. To state the obvious, the first strategy to negotiate for better stock in an equity-funded acquisition is the first strategy in preparing for any M-A event: companies should do all they can to avoid being in a dire fire sale situation when a buyer comes knocking on their door. If the seller is a failing company seeking a sale as a last ditch effort to avoid shutting its doors, even the best strategies may be useless in negotiation since as soon as the buyer says &no&, the seller will likely fold its hand and agree to the deal offered.

- Details

- Category: Technology

Read more: Negotiate for ‘better’ stock in equity-funded acquisitions

Write comment (96 Comments)

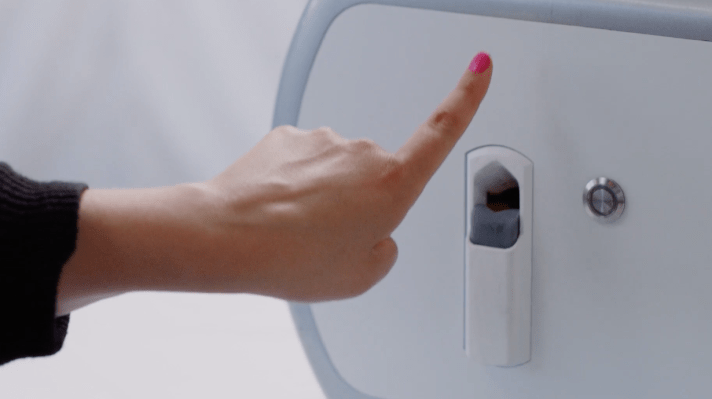

Coral is a company that wants to &simplify the personal care space through smart automation,& and they&ve raised $4.3 million to get it done. Their first goal? An at-home, fully automated machine for painting your nails. Stick a finger in, press down, wait a few seconds and you&ve got a fully painted and dried nail. More than once in our conversations, the team referred to the idea as a &Keurig coffee machine, but for nails.&

Itstill early days for the company. While they&ve got a functional machine (pictured above), they&re quite clear about it being a prototype.

As such, they&re still staying pretty hush hush about the details, declining to say much about how it actually works. They did tell me that it paints one finger at a time, taking about 10 minutes to go from bare nails to all fingers painted and dried. To speed up drying time while ensuring a durable paint job, it&ll require Coralproprietary nail polish — so don&t expect to be able to pop open a bottle of nail polish and pour it in. Coralpolish will come in pods (so the Keurig comparison is particularly fitting), which the user will be able to buy individually or get via subscription. Under the hood is a camera and some proprietary computer vision algorithms, allowing the machine to paint the nail accurately without requiring manual nail cleanup from the user after the fact.

Also still under wraps — or, more accurately, not determined yet — is the price. While Coral co-founder Ramya Venkateswaran tells me that she expects it to be a &premium device,& they haven&t nailed down an exact price just yet.

While we&ve seen all sorts of nail painting machines over the years (including ones that can do all kinds of wild art, like this one we saw at CES earlier this year), Coral says its system is the only one that works without requiring the user to first prime their nails with a base coat or clear coat it after. All you need here is a bare fingernail.

Coralteam is currently made up of eight people — mostly mechanical, chemical and software engineers. Both co-founders, meanwhile, have backgrounds in hardware; Venkateswaran previously worked as a product strategy manager at Dolby, where she helped launch the Dolby Conference Phone. Her co-founder, Bradley Leong, raised around $800,000 on Kickstarter to ship Brydge (one of the earliest takes on a laptop-style iPad keyboard) back in 2012 before becoming a partner at the seed-stage venture fund Tandem Capital. It was during some industrial hardware research there, he tells me, when he found &the innovation that this machine is based off of.&

Vankateswaran tells me the team has raised $4.3 million to date from CrossLink Capital, Root Ventures, Tandem Capital and Y Combinator . The company is part of Y Combinatorongoing Winter 2020 class, so I&d expect to hear more about them as this batchdemo day approaches in March of next year.

So whatnext? They&ll be working on turning the prototype into a consumer-ready device, and plan to spend the next few months running a small beta program (which you can sign up for here.)

- Details

- Category: Technology

Read more: Coral raises $4.3M to build an at-home manicure machine

Write comment (92 Comments)2020 will likely be one of the most bitter and hard-fought elections in decades, not just on pulpits and stages, but on the true battleground of modern politics: the internet. And veteran fact-checker Snopes is girding itself for the fight with a crowdfunding effort it hopes will free it from a dependence on internet platforms for which the truth is a secondary consideration.

The last we heard from the company, it was emerging from a — disastrous is too strong a word, but perhaps we could say ineffectual — fact-checking partnership with Facebook. The obvious mismatch in priorities made Snopes think hard about its future and how to guarantee it could pursue its mission without begging for coins from companies that so obviously cared little for what they could provide.

The new plan is to see whether the sitesizable readership will be willing to put a bit of cash on the table for a service they may have been using for years for free. Right now therea standard rewards-based backing scheme ($40 gets you a shirt and mug, etc.), but subscriptions and other means of support are coming soon.

&Everything about the site since its inception has been a long, slow, evolutionary process, from what it looked like to the material we covered to how it was funded. This is just another part of that process,& said founder David Mikkelson. &We&re just going where the road leads us.&

And the last couple of years have made it clear that the road leads nowhere near the sites that actually deliver news to users: Google, Facebook, Apple and so on.

VP of operations Vinny Green, who spearheaded the new direction Snopes is headed, called what those companies are doing right now &credibility theater.&

&The fact that Facebook has more people on their PR staff than there are formal fact checkers in the world demonstrates the disproportionality of the situation,& he said. &Apple News and Google News don&t have the mission or the mandate to ensure we have a healthy discourse online. Someone has to step up who has an interest in making sure the content flowing through the pipes is credible and reliable — so we&re stepping up. But our only access to capital and reach is what we grow ourselves.&

To that end, Green and the team at Snopes have put together their own crowdfunding infrastructure, eschewing the likes of Kickstarter and Patreon to make something that fits their purposes better. The resulting product will be familiar to anyone who has backed a project on those other sites, but is extensible on their side to serve as an all-purpose system for soliciting from and rewarding their community.

They&ve had a thousand backers already since the campaign launched a couple days ago, only half of which wanted anything in return. This first effort is intended to get the word out and shake the bugs out, while subscriptions and new project-specific funding options will appear early in 2020.

&There are fact-checking organizations, but there aren&t a lot of fact-checking businesses,& he said. Companies tend to give their information away or meekly agree to &partnerships& like Facebook&s, where the fabulously rich and influential company paid a pittance of money and attention so it could claim to be taking a stand against disinformation.

&You really have to wonder, why is the multi-billion-dollar platform paying fact checkers, you know, like $30,000 a month to check 30 things?& said Mikkelson. &Itclear that the primary objective of the Facebook fact-checking partnership was not to curb the appearance or reach of false information on that platform. That was a secondary or tertiary objective. Presenting only credible information is contrary to their business model… while itexactly inline with ours.&

The traffic and feedback show that Snopes is valued by many people out there — why can&t it support itself directly?

&2020 is going to be bonkers in terms of debunking this information, but the business model isn&t going to get better,& said Green. &There will be increased traffic and it&ll be bigger in traditional metrics, but I think there will also be an appetite for a venue online where you can consume information without vitriol or spin.&

A browser extension is also planned

To that end they hope that the crowdfunding infrastructure will allow for a few things. First, it could directly support investigative work like the recent report on a fraudulent network of Facebook pages and fake accounts seemingly linked to right-wing outlet the Epoch Times. Facebook today announced it was taking the network down, saying &our investigation linked this activity to Epoch Media Group, a US-based media organization, and individuals in Vietnam working on its behalf.&

No mention of Snopes, though the company points out its email describing the network was opened &hundreds& of times. That should give you an idea of relations between the companies.

Having readers chip in $5 toward a follow-up or expenses related to an investigation like this could be a great way to create small but noticeable change. They could also submit relevant information and tips.

Second, it could justify and power a news aggregator curated by Snopes staff, who sort through an immense amount of information for their work. &Itnot going to be comprehensive, but what we do put in there, we can back,& Green said. An early version will launch in the spring.

Other improvements are on the roadmap, such as a progressive web app version of the site and a better method for feedback and sourcing data from the community.

&We don&t have 2 billion users, we may not be some unicorn company, but damn, we can be something,& he said.

If ad revenue is drying up and the site finds itself in an adversarial relationship with potential funders, what are the other options? With less than a dozen people in its newsroom, Snopes is a pretty small operation. It may be that thereroom in the overtaxed hearts of users for one more subscription, if itfor a service they&ve been using on and off already for two decades.

- Details

- Category: Technology

Hello and welcome back to our regular morning look at private companies, public markets and the grey space in between.

Today, we&re weighing a standard bit of startup wisdom that recently reemerged against some surprising, contrasting evidence. Does too much money hurt a startup more than it helps, or is that standard view actually mistaken? We&ll start with the traditional view, which was re-upped this month by venture capitalist Fred Wilson, along with some supporting arguments proffered by a Boston-based venture firm.

Afterwards, we&ll dig into a grip of contrasting data that should provide plenty to chew on over the holidays. Ready?

Fit to burst

Union Square Ventures‘ Fred Wilson wrote earlier in December(citing an excellent Crunchbase News piece by occasional TechCrunch contributor Jason D. Rowley) that he was curious if startups that raise huge ($100 million and greater) early-stage rounds do better or worse than their cohorts that raised only smaller sums.

Underpinning his question is Wilsonbelief that &performance of VC backed companies is inversely correlated to how much money they raise.& This makes good sense. And if anyone has enough anecdotal evidence to support the view, itWilson who has been a venture capitalist since the late 1980s.

The idea that too much money is bad for startups isn&t hard to understand: startups need to focus and run fast; too much money can lead to both bloated operations, diffuse product direction and useless dalliances in cruft.

Startups also die when they have too little money, of course. But the concept that there is a midpoint between insufficient funds and an ocean of capital that is optimal has lots of credibility amongst the venture class. (I believe this is my favorite phrasing of the concept, that &more startups die of indigestion than starvation.&)

A 2016-era TechCrunch article written by some of the folks from Founders Collective makes the point plainly:

By examining the technology IPOs of the past five years, we found that the enriched (well capitalized) companies do not meaningfully outperform their efficient (lightly capitalized) peers up to the IPO event and actually underperform after the IPO.

Raising a huge sum of money is a requirement to join the unicorn herd, but a close look at the best outcomes in the technology industry suggests that a well-stocked war chest doesn&t have correlation with success.

In the spirit of fairness, I&ve long agreed with the above views.

My views on the question of too much money ruining organizations came from a different field, but are worth sharing for context. My father once told me an analogous story about a small poetry magazine, a publication that operated on the proverbial shoestring and was always weeks away from shutting down. But it limped along, barely keeping the lights on as it produced brilliant work.

Then, someone died and left the magazine a pile of money in their will — but the sudden influx of capital wrecked the publication and it eventually shut down.

In many cases, raising too much money too early can hurt a team or cause it to lose track of its mission. But for tech startups, on average, is that really correct?

Maybe not

- Details

- Category: Technology

Read more: Do more startups die of indigestion or starvation

Write comment (97 Comments)Six months after warning that the real-time bidding (RTB) component of programmatic online advertising is wildly out of control — i.e. in a breaking the law sense — the U.K.data protection watchdog has marked half a yearregulatory inaction with a blog post that entreats the adtech industry to come up with a solution to an &industry problem.&

Casual readers of the ICOpre-Christmas message for European law-flouting adtech might be forgiven for thinking it looks a lot like the regulator telling the industry to &keep calm and carry on regulating yourselves.&

More informed readers, who understand that RTB is a process which (currently) entails systematic, privacy eviscerating high-velocity trading of peoplepersonal data for the purpose of targeting them with ads, might feel moved to point out that self-regulation is a core part of why adtech is in the abject mess itin.

Ergo, a data protection regulator calling for more of the same systemic failure does look rather, uh, uninspiring.

In the mildly worded blog post, Simon McDougall, the ICOexecutive director for technology and innovation — who does not appear to work anywhere near an enforcement department — includes such grand suggestions for adtech law-breakers as: &keep engaging with your trade associations.&

You&ll have to forgive us for not being overly convinced such a step will lead to any paradigm tilts to privacy — or &solutions that combine innovation and privacy,& as McDougall puts it — given episodes like this.

Another of the big ideas he has for the industry to get with the legal program is to suggest people working in adtech &challenge& senior management to &review their approach.&

Now we know employee activism is rather in vogue right now — at least at certain monopolistic tech giants who&ve scaled so big, and employ such large armies of lawyers, they&re essentially immune to moral and societal operational norms — but we&re not sure itthe greatest look for the U.K.data watchdog to be encouraging adtech professionals to put their own jobs on the line instead of, y&know, doing its job and enforcing the law.

Itpossible that McDougall, a relatively recent recruit to the regulator, may not yet know it from his perch in the &technology and innovation& unit, but the ICO does have a powerful toolbox at its disposal these days. Including the ability, under the pan-EU General Data Protection Regulation framework, to levy fines of up to 4% of global turnover on entities it finds seriously violating the law.

It also can order a stop to law-violating data processing. And what better way to end the mass-scale privacy violations attached to programmatic advertising than by ordering personal data be stripped out of RTB requests, you might wonder?

It wouldn&t mean an end to being able to target ads online. Contextual targeting doesn&t require personal data — and has been used successfully by the likes of non-tracking search engine DuckDuckGo for years (and profitably so). It would just mean an end to the really creepy, stalkerish stuff. The stuff consumers hate — which also serves up horribly damaging societal effects, given that the mass profiling of internet users enables push-button discrimination and exploitation of the vulnerable at vast scale.

Microtargeted ads are also, as we now know all too well, a pre-greased electronic conduit for attacks on democracy and society — enabling the spread of malicious disinformation.

The societal stakes couldn&t be higher. Yet the ICO appears content to keep calm and let the adtech industry carry on — no enforcement, just biannual reminders of &concerns& about &lawfulness.&

To wit: &We have significant concerns about the lawfulness of the processing of special category data which we&ve seen in the industry, and the lack of explicit consent for that processing,& as McDougall admits in the post.

&We also have concerns about whether reliance on contractual clauses to justify onward data sharing is sufficient to comply with the law. We have not seen case studies that appear to adequately justify this.&

Set tone to: &Oopsy.&

The title of the ICOblog post — Adtech and the data protection debate & where next? — also incorporates contradictory framing as if to imply there is &debate& as to whether the industry needs to comply with data protection law. (Given the ICOown findings of &concern& that framing is itself concerning.)

So what can the adtech industry expect the ICO to actually do if it continues to fail to embed a &privacy by design approach in its use of RTB& (another of the blog postbig suggestions) — and therefore keeps on, er, breaking the law?

Well, the ICO plans to make like a sponge over the &coming weeks,& per McDougall, who says it will spend time &absorbing all the information gathered and the rich conversations we&ve had throughout the year& and then shift into first gear — where it will be &evaluating all of the options available to us.&

No rush, eh.

A &further update& will then be put out in &early 2020& which will set out the ICOposition — third time lucky perhaps?!

This update, we are informed, will also include &any action we&re taking.& So possibly still nothing, then.

&The future of RTB is both in the balance and in the hands of all the organisations involved,& McDougall writes — as if regulatory enforcement requires industry buy-in.

U.K. taxpayers should be forgiven for wondering what exactly their data protection regulator is for at this point. Hopefully they&ll find out in a few months& time.

- Details

- Category: Technology

Read more: Adtech told to keep calm and fix its ‘lawfulness’ problem

Write comment (100 Comments)Even when Apple telegraphs its hardware strategy, itproving to be nearly impossible for startups to beat them.

The companyexecutives have been motioning interest in following their runaway success on mobile with hefty investments in augmented reality, something that has led to the rise of dozens of venture-backed startups hoping to beat Apple to the punch by creating their own AR headsets.

In 2019, this vision collapsed for some of the most recognizable AR startups as reality proved less predictable than executives at these startups had imagined. A trio of shutdowns this year painted the root cause — overreach, framed by high burn rates and an overly optimistic attitude toward respective software ecosystems taking off.

My prediction earlier this year of a rough 2019 is exactly what happened.

ODG

At the beginning of the year, I reported on the collapse of Osterhout Design Group. The augmented reality startup was an early pioneer in the AR space that capitalized on industry excitement to raise a $58 million Series A in 2016. Following that raise, the company overreached, expanding its product lines even as it failed to squash manufacturing bugs in its current generation products.

&Thata little bit the story of ODG and Ralph, in general: everything is a prototype, nothing is finished, and before one thing is 60 percent done, you&re already onto the next one,& a former employee told TechCrunch at the time. &I think the heart of ODGdownfall was its lack of focus.&

The company laid off employees as acquisition talks with Facebook and Magic Leap fell through, sources told TechCrunch, before it was forced to sell off assets to an undisclosed buyer earlier this year.

Meta CTO Kari Pulli wearing the companylatest headset.

Meta

One of the more bizarre stories in the AR headset space was the folding and reincorporated unfolding of Meta, a Y Combinator-backed AR headset company that was also an early entrant which decided to ramp up its spending as Apple and others began to invest in the technology.

- Details

- Category: Technology

Read more: The sorry state of AR startups in 2019

Write comment (90 Comments)Page 71 of 5614

11

11