Technology

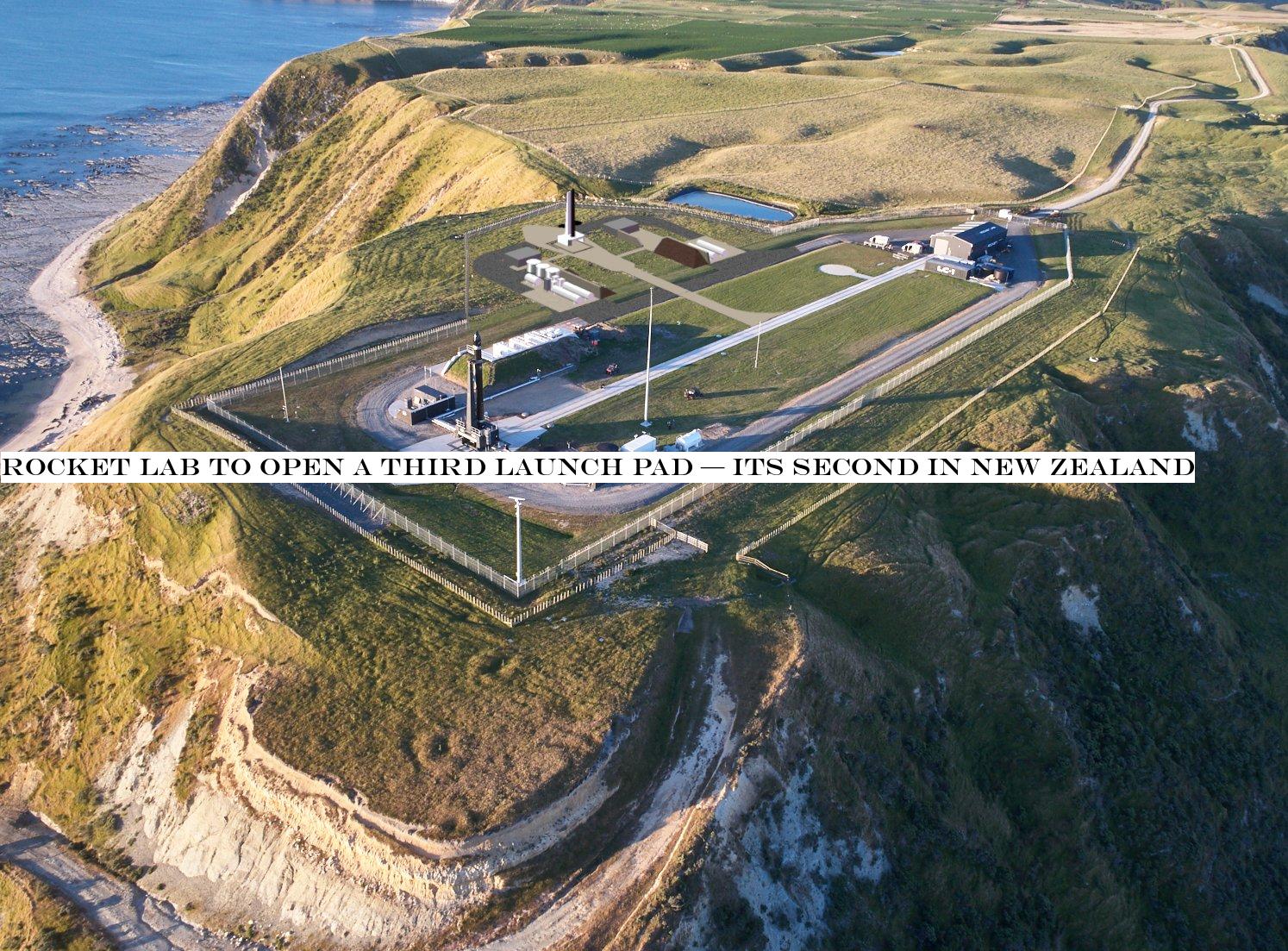

Small-satellite launch company Rocket Lab just officially declared its second launch pad open, but it has already broken ground on a third. The new one will be located in New Zealand on the Mahia peninsula, right next to its first launch pad at the companyoriginal launch facility — which is already the first and only privately owned and operated rocket launch facility on Earth.

Rocket Labnew launch pad at Launch Complex-1 (LC-1) will provide it with the ability to launch with even more frequency. Already, the company intends its LC-1 to be the locus of its rapid response and high-volume business, while its new launch pad on Wallops Island in Virginia is primarily designed to unlock access to clients who require U.S.-based launch operations from American providers (Rocket Lab is now officially headquartered in LA).

The company has been doing a lot of work to increase its ability to launch multiple missions in quick succession — this year, it unveiled a new room-sized carbon composite manufacturing robot that can turn parts of its Electron launch vehicle construction process, which used to take weeks, into something that is done in just hours. Italso now in the process of developing a way to recover the first-stage booster of Electron, which would save it even more time and money on building new ones between missions.

Ultimately, Rocket Lab wants to get turnaround time between missions to mere days, and having two active pads at the same site will mean it has a lot more flexibility to do things like bumping a customer up the queue should conditions allow, or adding a new customer with tight timelines on an ad hoc basis.

- Details

- Category: Technology

Read more: Rocket Lab to open a third launch pad — its second in New Zealand

Write comment (94 Comments)The Daily Crunch is TechCrunchroundup of our biggest and most important stories. If you&d like to get this delivered to your inbox every day at around 9am Pacific, you can subscribe here.

1. Amazon, Apple, Google and Zigbee join forces for an open smart home standard

The Connected Home over IP project seeks to create a connectivity standard designed to increase compatibility across companies and devices. The landscape is pretty scattered at the moment, with each player digging pretty heavily into their own standard and forcing many smaller third-party players to pick sides.

So the biggest names in the connected home category are reaching across the aisle to create an open-source standard. And while the names in the headline are leading the charge, Ikea, Legrand, NXP Semiconductors, Resideo, Samsung SmartThings, Schneider Electric, Signify (nee Philips Lighting), Silicon Labs, Somfy and Wulian are also on the board.

2. SAP spinout Sapphire Ventures raises $1.4B for new investments

The firm, which focuses primarily on enterprise tech companies in the U.S., Europe and Israel, writes checks to Series B through pre-IPO businesses. Its portfolio includes 23andMe, Sumo Logic and TransferWise.

3. Europespace agency just launched a satellite to study planets outside our solar system

CHEOPS will specifically be looking to spot exoplanets as they pass in front of their stars — at which point they become observable because they block some of the light emitted from the distant suns.

4. ‘The Rise of Skywalker& delivers a messy but satisfying finale to the new Star Wars trilogy

How could any single movie live up to 40 years of theories and daydreams from millions of Star Wars fans? (Itstill worth watching, though.)

5. Political ‘fixer& Bradley Tusk closes second fund on $70M

Tusk, before launching Tusk Ventures, served as campaign manager for Mike Bloomberg, as deputy governor of Illinois and as communications director for Senator Chuck Schumer. He also penned the book &The Fixer: My Adventures Saving Startups from Death by Politics.&

6. All tulips must wilt

After recovering somewhat during the summer, the value of bitcoin and other cryptocurrencies are sharply down over the last several weeks.

7. 2019: the year podcasting broke

Brian Heater outlines how podcasting became an overnight success, more than 15 years in the making. (Extra Crunch membership required.)

- Details

- Category: Technology

Read more: Daily Crunch: Smart home giants partner on new standard

Write comment (98 Comments)Welcome to TechCrunch2019 Holiday Gift Guide! Need help with gift ideas? We&re here to help! We&ll be rolling out gift guides from now through the end of December.You can find our other guides right here.

As we reach the end of 2019 and approach crunch time for everyone who has procrastinated holiday gift buying, we wanted to highlight a few more great reads that might add value to your life or are just plain-old fun.

Over the past couple of weeks, we&ve asked Extra Crunch members and the TechCrunch editorial staff for their favorite books of the year. Responses covered a huge mix of genres, narrative structures and formats, with titles that would fit the interests of anyone from your techno-nerd co-founder to your craziest second-cousin that you only see around the holidays.

For our last round of book recommendations, we decided to ask the investors who control the capital in Silicon Valley, help catalyze the industrybiggest winners and ultimately influence what our future will look like. We surveyed a select group of five leading VCs on their top book recommendations for 2019 with the only criteria being that the respondents personally read the title this year and thought it was meaningful. Among our correspondents:

- Josh Wolfe, Lux Capital

- Theresia Gouw, aCrew Capital

- Mamoon Hamid, Kleiner Perkins

- Maha Ibrahim, Canaan

- Jennifer Fonstad, Owl Capital

The books could cover any topic, be fiction or non-fiction and could be old, new or anything in between. Here are the six books that resonated with our panel of investors, all of which they would recommend to you, a friend or a family member looking for a great holiday gift.

This article contains links to affiliate partners where available. When you buy through these links, TechCrunch may earn an affiliate commission.

Josh Wolfe, Lux Capital

Exhalationby Ted Chiang

Knopf / 368 pages / May 2019

This year for me it was Ted Chiang&Exhalation&. The gap between sci-fi and sci-fact keeps shrinking. I contend either our authors are becoming less creative or our scientists more creative. Chiang disproves the former. One of the most provocative stories in this collection is The Truth of Fact, The Truth of Feeling which parallels two protagonists set in the near future and the not-too-distant past. One sub-story centers on a Black Mirror-esque technology that gives high-fidelity perfect recall and recordings of prior experience. The other story is of a tribe that lives by oral tradition that has one member encounter an outsider with the technology of writing. Together they make a provocative poignant point on the distinction between being precise and being right—and the meaning in our lives between them.

Summary: &Exhalation& is the latest composition by acclaimed sci-fi writer Ted Chiang, whose short story titled &Story of Your Life& famously acted as the inspiration for the Oscar-nominated film &Arrival.& Chiangnewest work is a collection of science fiction short stories and novelettes that stray away from the speculative dystopian side of the genre. Using common sci-fi motifs such as aliens and AI proliferation, the selected writings instead dial-in on the characters living in these imagined universes as they examine how societal and technological evolutions impact the ethical, philosophical and cognitive aspects of the human psyche and existence.

Price: $16 on Amazon

Theresia Gouw, aCrew Capital

Alpha Girls: The Women Upstarts Who Took on Silicon ValleyMale Culture and Made the Deals of a Lifetimeby Julian Guthrie

Currency / 304 pages / April 2019

The most interesting book to come out in 2019 that tells the story of tech and venture is &Alpha Girls: The Women Upstarts Who Took on Silicon ValleyMale Culture and Made the Deals of a Lifetime&, by Julian Guthrie. I find it a fascinating read (even if I weren&t included) & with stories that speak to both men and women, to the deals won and lost (Skype, Imperva, F5, Trulia, Facebook, Salesforce and more) and to the history of Silicon Valley through the lens of four outsiders. Despite having to pave their own path, the women jumped in headfirst in the pursuit of their dreams. You will walk away with a different view of how it is to be a woman in this male-dominated industry, and you will get a sense of the important role of male allies. &Alpha Girls& shows that women have long been &hidden figures& behind big companies and key deals. Finally, their stories are being told.

Summary: Silicon Valleymassive gender gap is no secret, particularly in the notorious &boys and bros& club that is the venture capital industry. In &Alpha Girls: The Women Upstarts Who Took on Silicon ValleyMale Culture and Made the Deals of a Lifetime,& esteemed business journalist, international best-selling author and multi-time Pulitzer nominee Julian Guthrie details the career paths of four leading female VCs (disclosure: our respondent Theresia Gouw is one of them) that have played major roles in shaping todaytech and startup landscape.

Through first-hand accounts, Guthrie explores how Theresia, Magdalena Yesil (Broadway Angels, Salesforce, US Venture Partners), Mary Jane Elmore (Broadway Angels, Institutional Venture Partners (IVP) and Sonja Hoel Perkins (Broadway Angels, Menlo Ventures) first found their way to the male-dominated world of venture capital, the strategies they used to find recurring success and how they navigated the structural disadvantages of an industry built for others.

&Alpha Girls& offers tremendous, difficult-to-find depth around the professional, personal, and familial scenarios underrepresented groups in VC encounter as they look to challenge the status quo, find personal success and redefine an entire industry.

Price: $14 on Amazon

Mamoon Hamid, Kleiner Perkins

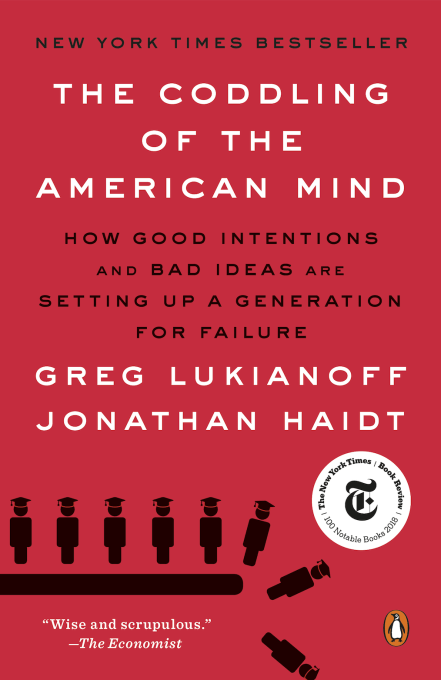

The Coddling of the American Mind by Greg Lukianoff and Jonathan Haidt

Penguin Press / 352 pages / September 2018

Our world is rapidly shifting around us & from evolving social norms, to the external stimuli that impact our well-being. Ita new pace that is acutely felt in how we are raising and educating our kids and young adults. This book deeply explores the societal ramifications, and offers perspective about how we may be doing it all wrong.

Summary: &The Coddling of the American Mind& is a provocative sociological dive into how commonly accepted modern social and parenting practices have led to increased agitation and tension in todayyouth. Written by attorney, public advocate and First Amendment specialist Greg Lukianoff and social psychologist and NYU professor of ethical leadership Jonathan Haidt, &The Coddling of the American Mind& introduces its thesis by examining issues of censorship and free speech on college campuses, which are occurring at a more frequent clip than ever before.

As the authors debate the potential negative impacts that an overly partisan culture of &safety-ism& might have on mental health and development, they retrace the historical social trends and cultural transformations that led to todayconditions.

Price: $17 on Amazon

Maha Ibrahim, Canaan

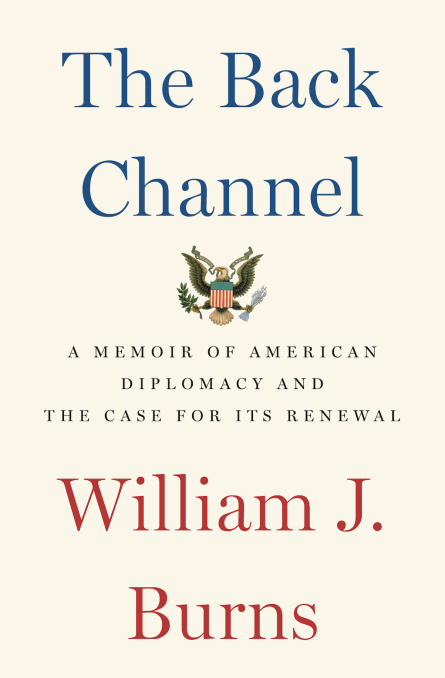

The Back Channelby William Burns

Random House / 512 pages / March 2019

For the last two years, I&ve had the pleasure of serving as a Trustee for the Carnegie Endowment for International Peace where Bill Burns serves as President. Bill is the consummate statesman and has been a central figure in international diplomacy for decades. The depth of his knowledge is a testament to his commitment to international order and peace. &The Back Channel& provides readers with an inside look into his career in foreign service, from the Cold War and Middle East affairs to modern-day Russia. My respect for Bill was immense before I read the book and it only grew bigger with every chapter.

Summary: Throughout his illustrious, nearly thirty-year career in foreign service, William Burns has held titles that include the US ambassador to Russia and the Deputy Secretary of State. Burns& memoirs, &The Back Channel,& focuses on the biggest policy decisions of Burns& tenure.

Burns uses his own notes, declassified State Department documents and primary-source, first-hand analysis to offer up some inside baseball and help readers understand the strategic rationale and key considerations behind some of the most important U.S. foreign policy decisions that have shaped the global geopolitical landscape over the last two decades.

Price: $13 on Amazon

The Education of an Idealistby Samantha Power

Dey Street Books / 592 pages / September 2019

Ambassador Power is an icon of courage, compassion and resolve. During her recent book tour, I was fortunate enough to interview her and was struck by her humanity. The stories she writes about her impressive career are both powerful and personal. Ambassador Power immigrated to the US as a child and has since dedicated her life to human rights and equality. She is my age and has accomplished so much in her life, most recently as US Ambassador to the UN under President Obama. I don&t know anyone who, at 22, would voluntarily become a war correspondent (in Bosnia). I suspect she will one day run for political office and I will be a big supporter.

Summary: &Education of an Idealist& is the memoir of former US Ambassador to the United Nations and Pulitzer-award-winning author Samantha Power, detailing her journey from a child in Ireland, to an immigrant growing up in the US, through her Ivy League undergrad and legal education, all the way through her careers in journalism and public advocacy and her time working as a senior advisor to President Barack Obama. Even from a purely narrative perspective, Powerlengthy journey, which brought her across the globe through war zones and revolutions long before her career in politics, is incredibly compelling on its own.

But Ambassador Powerreflection offers even more value as she recounts how she overcame personal, professional and internal struggles as she traversed different geographies, environments and stages of her career and life.

Additionally, Powerwriting also offers up valuable lessons for those in the startup world. Powermove from an external public advocate to a government policymaker, in a roundabout way (or at least in the eyes of startup nerds like us), provides a unique look into the transition, differences and challenges one may come across when moving from an externally focused role to an operational one.

Price: $18 on Amazon

Jennifer Fonstad, Owl Capital

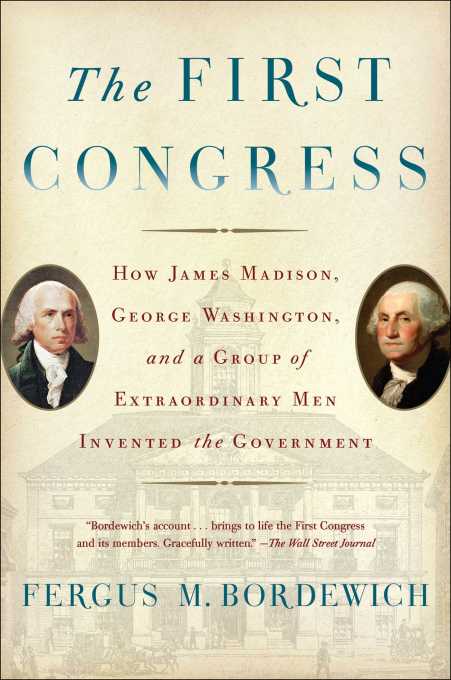

The First Congress: How James Madison, George Washington, and a Group of Extraordinary Men Invented the Governmentby Fergus M. Bordewich

Simon - Schuster / 416 pages / February 2017

As I read about impeachment proceedings, presidential elections, and racial tensions in todaypolitical climate, it begged the question & how did we get here?

While not knowing exactly what I was undertaking, I recently read the book, &The First Congress.& The book was a remarkable story about how both ordinary and extraordinary people took the ‘startup& that was the United States in 1789 and launched us on a remarkable ride.

The book takes us through the critical decisions made by the countryvery first Congress, 1789-1791. This includes establishing the Supreme Court, passing the first 10 Amendments to the Constitution (later called the Bill of Rights), establishing the countryfirst revenue ‘stream,& and picking the location of the nationcapital (putting our countryhero & George Washington, in a different light).

Ithard to fathom our nation as a startup. The country was fresh off of its failure as a Confederation of States, deeply in debt, with no source of revenue yet established. Two of the states had not yet ‘signed on& to the whole enterprise. And while the Constitution put forth certain operating principles, it fell to this group of men (yes, all men and all white) to put many of the mechanisms in place that still guide and define us today. As one always trying to do what I do better and learn from the past, this was a terrific lesson in both getting this startup off the ground as well as the intended and unintended consequences of those decisions.

Summary: Writer and historian Fergus Bordewich&The First Congress& puts us in the room for the First Congress in our countryhistory, which saw the admission of several states into the union, the passing of the Bill of Rights and several other of the biggest decisions that shaped the United States.

The book details how the founding fathers debated the United States& structural and operational systems, including the American legal system and national banking system. Additionally, &The First Congress& highlights an interesting yet often overlooked period of US history, where the country was essentially functioning like a startup, grinding and building from scratch, having to create mission statements, organizational hierarchies, operational systems or otherwise for the very first time.

Price: $12 on Amazon

- Details

- Category: Technology

Read more: Gift Guide: Leading VCs recommend their favorite reads from 2019

Write comment (93 Comments)One of the more notable startups using artificial intelligence to understand and fight cancer has raised $45 million more in funding to continue building out its operations and inch closer to commercialising its work.

Paige — which applies AI-based methods such as machine learning to better map the pathology of cancer, an essential component of understanding the origins and progress of a disease with seemingly infinite mutations (its name is an acronym of Pathology AI Guidance Engine) — says it will be use the funding to inch closer to FDA approvals for products it is developing in areas such as biomarkers and prognostic capabilities.

It also plans to use the funding to continue developing better ways of diagnosing and ultimately fighting the disease, as well as exploring further commercial opportunities for its work, specifically within the bio-pharmaceutical industry.

This round is being led by Healthcare Venture Partners, with previous investor Breyer Capital, Kenan Turnacioglu and other funds participating. The company is not disclosing its valuation, but PitchBook noted that a first close of this round (when it raised $33 million) put the valuation at $208 million. That would value Paige now at about $220 million with the $45 million close, more than three times its valuation in its previous round.

Paige first emerged from stealth back in 2018 — with a bang.

Paige.AI — as it was known at the time — was hatched inside the Memorial Sloan Kettering Cancer Center, one of the worldforemost institutions both for working on cancer therapies and treating cancer patients, and along with a $25 million investment led by Jim Breyer, Paige had secured exclusive access to MSK25 million pathology slides as well as its intellectual property related to the AI-based computational pathology that underpinned its work. These slides make up one of the biggest repositories of its kind in the world, and as all solutions and services built on machine learning are only as good as the data thatfed into them, they were critical to the startupbeginnings.

The startup also launched with some serious talent behind it.

Much of the computational pathology being used by Paige had been developed by Dr Thomas Fuchs, who is known as the&father of computational pathology& and is the director ofComputational Pathology in The Warren Alpert Center for Digital and Computational Pathology at Memorial Sloan Kettering, as well as a professor of machine learning at the Weill Cornell Graduate School of Medical Sciences.

Fuchs co-founded Paige with Dr David Klimstra, chairman of the department of pathology at MSK, and Fuchs had originally started out as the CEO of Paige, but was replaced earlier this year by Leo Grady, who joined from another bio-startup, Heartflow (another company backed by Healthcare Venture Partners). Fuchs is still supporting the company, but no longer in an executive role.

In the nearly two years since it launched, there have been some milestones reached. The company, which has around 30 employees today, has been the first to get an FDA breakthrough designation (which helps expedite the long process of drug approvals in urgent areas where there are few or no other options for patients) for using AI in oncology pathology. Italso the first to get a CE mark in the same category, which opens the door to working in Europe, too. Paige has so far ingested 1.2 million images into its slide database and is using them — in algorithms that also take in genomic data, drug response data and outcome data — to work on developing diagnostic solutions.

But as with all new medical products, progress is not measured in quarters as it might be with a more typical tech startup. Moving fast and breaking things is something to be avoided. So even with all of the above advances, there has yet to be any commercial products launched, nor is Grady giving any specific time frames for when they will. And when the company came out of stealth in 2018, it said it would be focusing on breast, prostate and other major cancers, although today itnot as quick to specify what its targets will be when it does launch commercial products.

Similarly, italso expanding its remit from primarily clinical environments to pharmaceutical ones.

&The clinical side is still our focus, but this is an expansion and realisation that this has a broader impact, and that includes pharmaceutical customers,& Grady said.

And the dropping of the .AI in its name was also intentional, in part a reaction it seems to how much AI gets thrown around today.

&There is a fundamental misconception, which is thinking of AI as a product and not a technology,& said Grady. &Ita technology set that can allow you to do many things that could not have been done in the past, but you need to apply it in a meaningful way. Developing a good AI and putting that on the market will not cut it in terms of clinical adoption.&

The funding round, Grady said, saw a lot of interest from strategic investors, although the company intentionally has stayed away from these.

&We were approached by all of the scanner vendors and some of the biopharmaceutical companies,& he said. &But we made the decision to not take a strategic investment with this round because we wanted to be neutral with hardware vendors and not be too tied with any one.&

He also pointed to the challenges of talking to investors when you are working in a cutting-edge area (a challenge that has foxed many an investor also into backing the wrong horses, too, such as Theranos).

&We&re at the intersection of three areas: tech, medical devices and clinical medicine, and life sciences and biotech,& he said. &Many investors sit squarely in one and don&t feel comfortable in others. That makes the conversations challenging and short. But there has been an increasing blend between those three sectors.&

Thatwhere Healthcare Venture Partners fits into the mix. &Paige exemplifies the benefits of digital pathology and represents the bright future of AI-driven medical diagnosis,& said Jeff Lightcap of Healthcare Venture Partners, in a statement. &As hospitals embark on digital transformations, they will face challenges associated with these transitions. We believe Paige addresses many of these issues by enhancing the ability of clinical teams and pathologists to collaborate. We&re confident in Paigefuture and believe they will continue to develop cutting-edge technologies that enable pathology departments to transform their practices, which have changed little in the last century.&

&We applaud Paigecommitment to building clinical AI products that will improve the diagnostic process and patient care,& added Jim Breyer of Breyer Capital, in a statement. &This is a critical time for Pathology, as pathologists are carrying a heavier workload than ever before. Paige understands their needs and the team has built cutting-edge technologies to address them. Paige represents the future of computational pathology and we look forward to their continued growth and success.&

- Details

- Category: Technology

Read more: Paige raises $45M more to map the pathology of cancer using AI

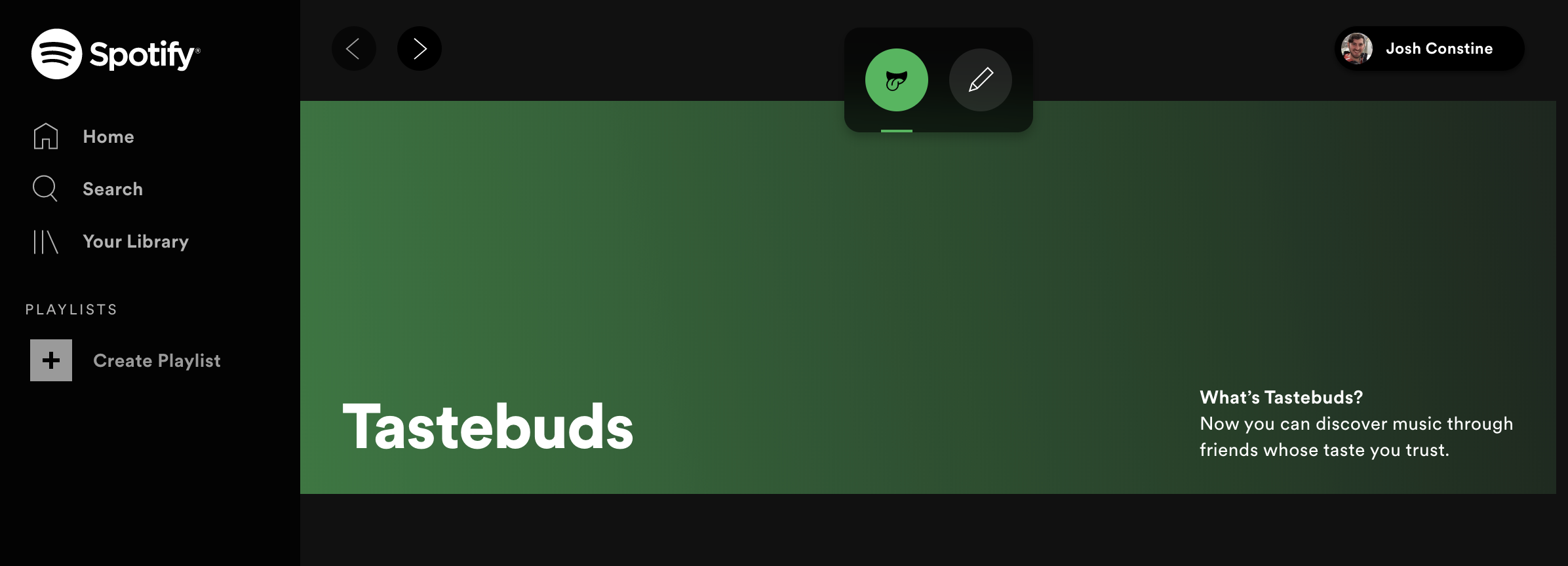

Write comment (90 Comments)Spotify is prototyping a new way to see what friends have been listening to, called &Tastebuds.& Despite how discovering music is inherently social, Spotify has no features for directly interacting with friends within its mobile app after axing its own inbox in 2017 and keeping its Friend Activity ticker restricted to desktop.

It seemed like Spotify was purposefully restricting social features to force users to rely on the companyown playlists and discovery surfaces. This gave Spotify the power to play king-maker, massively influencing which artists got featured and rose to stardom. This in turn gave it leverage in its combative negotiations with record labels, which worried their artists might get left off playlists if they don&t play nice with Spotify in terms of sustainable royalty rates and access to exclusives.

That strategy seems to have paid off with Spotify improving its licensing deals and becoming a critical promotional partner for the labels, paving the way to its IPO. Spotifyshares sit around $152, up from its direct listing price of $132, though down from its first-day pop that saw it rise to $165. More comfortable in its position, now Spotify seems ready to relinquish more control of discovery and enable users to be better inspired by what friends are playing.

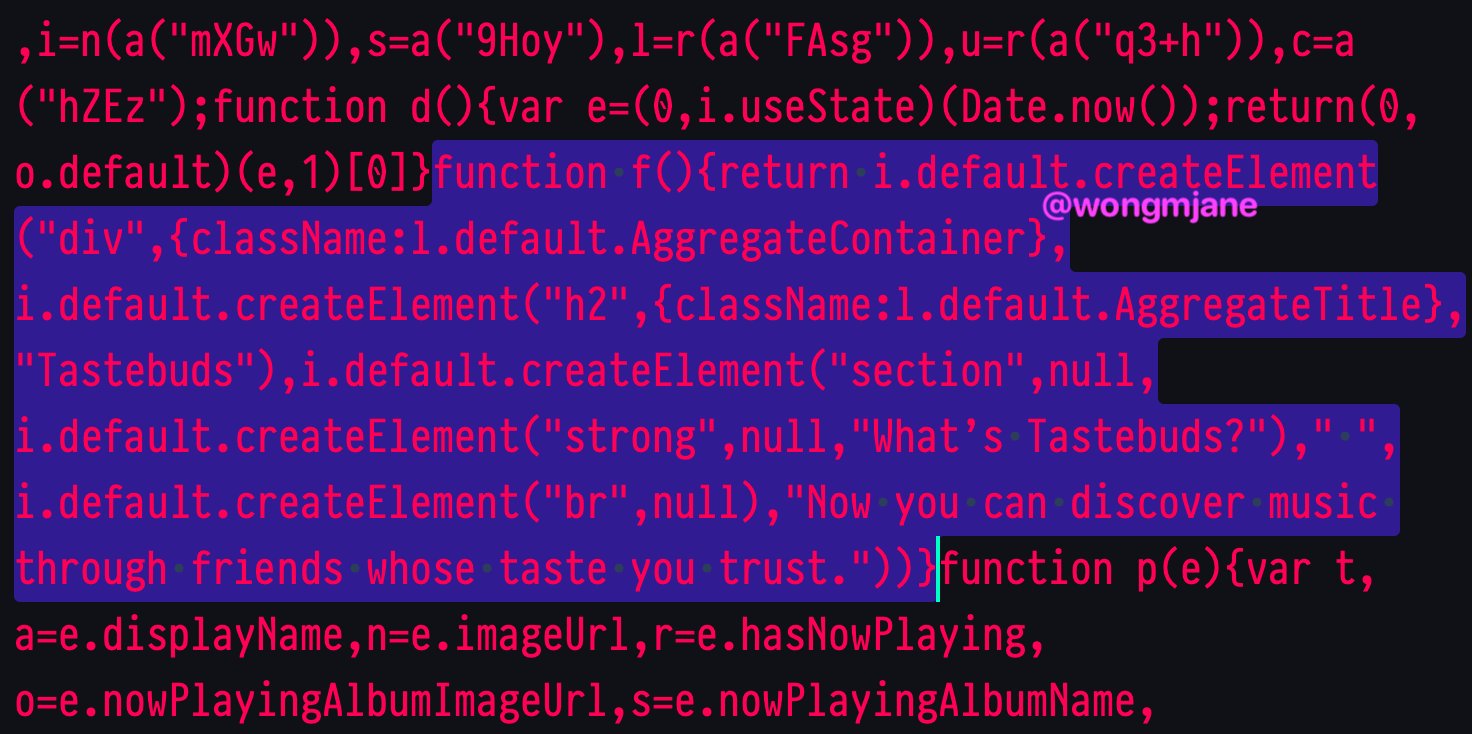

Spotify Tastebuds code via Jane Manchun Wong

Tastebuds is designed to let users explore the music taste profiles of their friends. Tastebuds lives as a navigation option alongside your Library and Home/Browse sections. Anyone can access a non-functioning landing page for the feature at https://open.spotify.com/tastebuds. The feature explains itself, with text noting &WhatTastebuds? Now you can discover music through friends whose taste you trust.&

The prototype feature was discovered in the web version of Spotify by reverse engineering sorceress and frequent TechCrunch tipster Jane Manchun Wong, who gave us some more details on how it works. Users tap the pen icon to &search the people you follow.& From there they can view information about what users have been playing most and easily listen along or add songs to their own library.

Without Tastebuds, there are only a few buried ways to interact socially on Spotify. You can message friends a piece of music through buttons for SMS, Facebook Messenger and more, or post songs to your Instagram or Snapchat Story. Spotify used to have an in-app inbox for trading songs, but removed it in favor of shuttling users to more popular messaging apps. On the desktop app, but not mobile or web, you can view a Friend Activity ticker of songs your Facebook friends are currently listening to. Or you can search for specific users and follow them or view playlists they&ve made public, though Spotify doesn&t promote user search much.

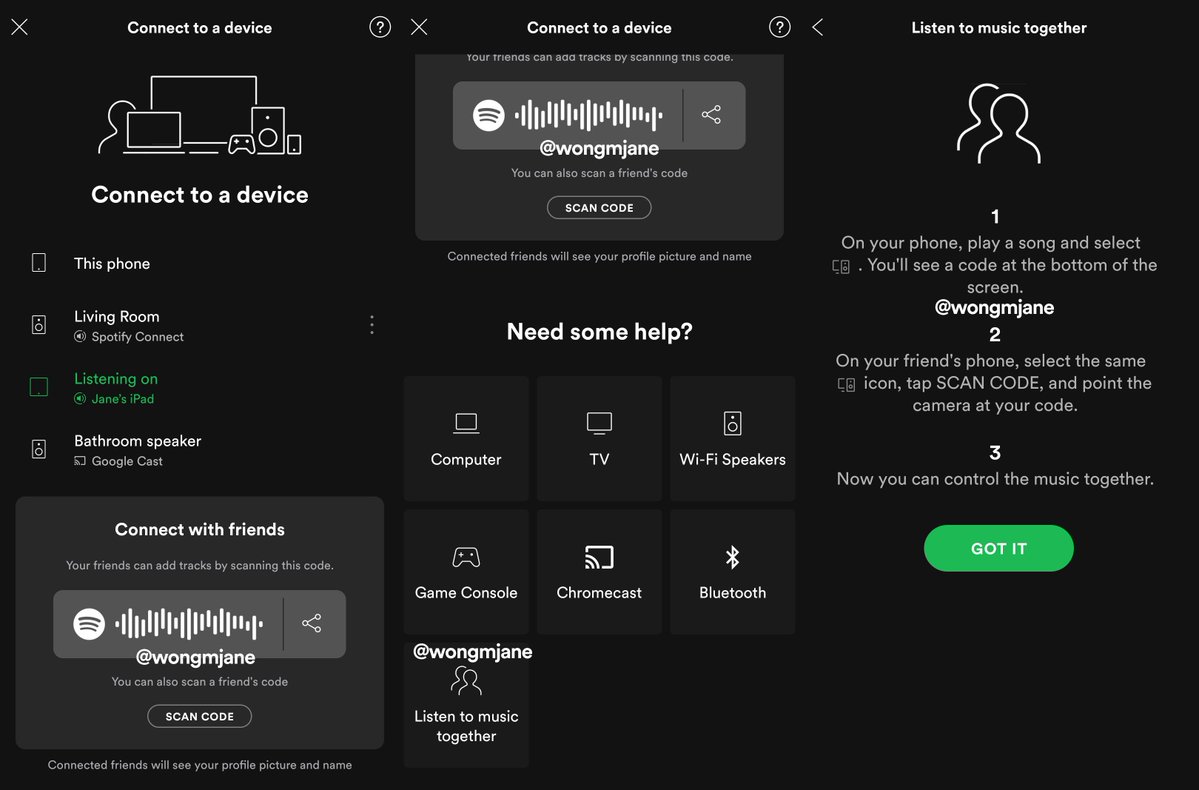

Spotify has a few other social features it has experimented with but never launched. Those include a Friends Weekly playlist spotted last year by The VergeDani Deahl. Then this May, we reported Wong had spotted a shared-queue Social Listening feature that let you and friends play songs simultaneously while apart. Back in 2014, I wrote that Spotify should move beyond blog-esque browsing to create a &PlayFeed& playlist that would dynamically update with algorithmic recommendations, new releases from your top artists and friends& top listens. It has since launched Discovery Weekly and Release Radar, and Tastebuds could finally bring in that final social piece.

Spotifysimultaneous social listening prototype

The result is that you can only see either a myopic snapshot of friends& current songs, the few and often outdated playlists they manually made public or you message them songs elsewhere. There was no great way to get a holistic view of what a friend has been jamming to lately, or their music preferences overall.

We&ve reached out to Spotify seeking more information about how Tastebuds works, how privacy functions around who can see what and if and when the feature might launch. We&re also interested to see if Spotify has any deal in place with a music dating startup called Tastebuds.fm which launched way back in 2010 to help people connect and flirt through song sharing. [Update: A Spotify spokesperson confirms that &We&re always testing new products and experiences, but have no further news to share at this time.& They also said this is not related to the Tastebuds.fm startup.]

Social is a huge but under-tapped opportunity for Spotify. Not only could social recommendations get users listening to Spotify for longer, thereby hearing more ads or becoming less likely to cancel their subscription, it also helps Spotify lock in users with a social graph they can&t find elsewhere. While competitors like Apple Music or YouTube might offer similar music catalogs, users won&t stray from Spotify if they become addicted to social discovery through Tastebuds.

- Details

- Category: Technology

Read more: Spotify prototypes Tastebuds to revive social music discovery

Write comment (96 Comments)Hello and welcome back to our regular morning look at private companies, public markets and the grey space in between.

Today we&re exploring the 2019 IPO cohort from a capital-in perspective. How much did tech companies going public in 2019 raise before they went public, and what impact that did that have on their valuation when they debuted?

Looking ahead, the tech startups and other venture-backed companies expected to go public in 2020 will include a similar mix of mid-sized offerings, unicorn debuts and perhaps a huge direct listing. What we&ve seen in 2019 should be a good prelude to the 2020 IPO market.

With that in mind, letexamine how much money tech companies that went public this year raised before their IPO. Spoiler: Ita lot more than was normal just a few years ago. Afterwards, I have a question regarding what to call companies in the $100 million ARR club (more here) that we&ve been exploring lately. Letgo!

Privately rich

According to CBInsights& recent IPO 2020 IPO report, therea sharp, upward swing in the amount of capital that tech companies raise before they go public. Itso steep that the data draw a nearly linear breakout from a preceding, comfortable normal.

Herethe chart:

There are two distinct periods; from 2012 to 2015, raising up to $100 million was the norm (median) for tech companies going public. Thatstill a lot of cash, mind.

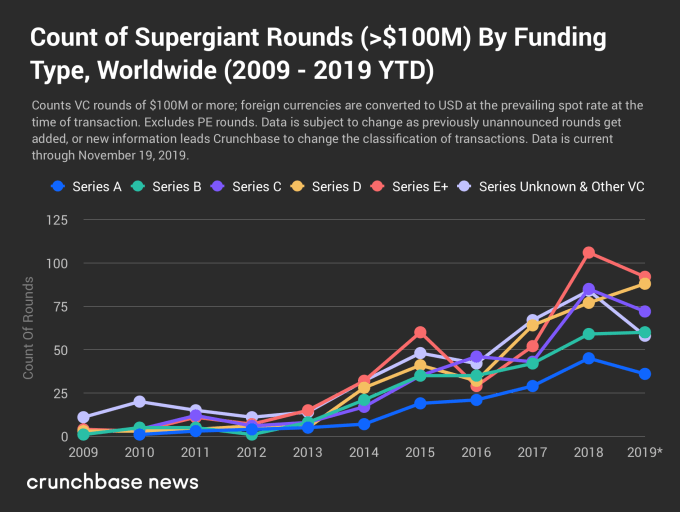

The second period is more exciting. From 2016 on we can see a private capital arms race in which tech companies going public stacked ever-greater sums under their mattresses before debuting. This is generally consistent with a different trend that you are also aware of, namely the rise of $100 million financings.

Before we turn back to the CBInsights data, letobserve a chart from Crunchbase News that underscores the simply astounding rise of $100 million financings that was published just a few weeks ago. As you look at this chart, remember that prior to 2016, more than half of venture-backed technology companies going public had raised less than $100 million total:

Now, compare the two data sets.

- Details

- Category: Technology

Read more: Tech startups going public raise 3x more today than in 2015

Write comment (97 Comments)Page 94 of 5614

10

10