Technology

We&re excited to announce a new community perk for Extra Crunch. Starting today, annual and two-year Extra Crunch members located in the United States can get free access to Avodocs from AXDRAFT.

Avodocs provides free legal documents for startups, including NDAs, privacy policies, founders& agreements, employee onboarding documents, terms of service and more. Founders and startup teams often waste tons of time searching Google and asking friends for legal help. Avodocs provides the necessary documents for early-stage companies in minutes.

Avodocs is used by more than 4,000 startups, including alumni from Y Combinator, 500 Startups and Techstars. Users of Avodocs enjoy having documents ready for signature in less than 10 minutes, plain English description of the implications, a simple Q-A process for creating a document, the ease of editing and personalizing documents after download and the fact that Avodocs works on any device. Users of Avodocs also get access to extra content, such as a consulting agreement and advisory agreement, as well as document storage and DocuSign integration.

Extra Crunch is a membership program from TechCrunch that features how-tos and interviews on company building, intelligence on the most disruptive opportunities for startups, an experience on TechCrunch.com thatfree of banner ads, discounts on TechCrunch events and several community perks like the one mentioned in this article. Our goal is to democratize information about startups, and we&d love to have you join our community.

You can sign up for Extra Crunch here.

After signing up for an annual or two-year Extra Crunch membership (U.S. users only), you&ll receive a welcome email with a link to sign up for Avodocs. If you are already an annual or two-year Extra Crunch member, you will receive an email with the offer at some point today. If you are currently a monthly Extra Crunch subscriber and want to upgrade to annual in order to claim this deal, head over to the &my account& section on TechCrunch.com and click the &upgrade& button.

This is one of several community perks we&ve launched for Extra Crunch members. Other community perks include a 20% discount on TechCrunch events, 100,000 Brex rewards points upon credit card sign up and an opportunity to claim $1,000 in AWS credits. For a full list of community perks from partners, head here.

If there are other community perks you want to see us add, please let us know by emailing This email address is being protected from spambots. You need JavaScript enabled to view it..

To sign up or learn more about all the benefits of Extra Crunch, head here.

Disclaimer:

Documents on Avodocs were created for startups operating in the United States. Avodocs provides self-help services at customerspecific direction. Avodocs is not a law firm or a substitute for an attorney or law firm.

Communications between customer and Avodocs are protected by Avodocs Privacy Policy, but not by the attorney-client privilege. Avodocs does not provide any kind of advice, explanation, opinion, or recommendation about possible legal rights, remedies, defenses, options, selection of forms, or strategies.

Access to Avodocs is subject to its Terms of Service.

This offer is provided as a partnership between TechCrunch and Avodocs, but it is in no way an endorsement from the TechCrunch editorial team. TechCrunchbusiness operations remain separate to ensure editorial integrity.

- Details

- Category: Technology

Read more: Extra Crunch members get free startup legal documents from Avodocs

Write comment (93 Comments)In the wake of WeWork&sembarrassing IPO rout, you might imagine that startups working in similar markets would cool it for a bit. Perhaps they could work on cutting spending, improving their gross margins, and, say, shooting for profitability.

Not so, at least in one case. Instead of doing those things, China-based Ucommune filed to go public in America this month. The WeWork competitor is mostly a co-working business. Italso a marketing company. And it has some of the worst economics we&ve seen in a company since WeWork.

Why this company is trying to go public isn&t hard to understand. It needs the cash. But at the same time, the chance of it debuting at a price it likes seems slim, given the marketrecent history — as well as Ucommune own.

Introductions

Before we chat about the business fundamentals of Ucommune, a primer on the company itself.

Founded in 2015, according to Crunchbase data, Ucommune has raised over hundreds of millions. In 2018 alone the company raised a venture roundand its Series C and its Series D. Prior investors include Gopher Asset Management, Aikang Group, Tianhong Asset Management, All-Stars Investment and Longxi Real Estate.

TechCrunch reported that its final private round valued Ucommune at $3 billion.

All that capital was put to work. According to is F-1 filing, Ucommune operates 197 co-working facilities in 42 cities. The company also claims more than 600,000 members and nearly 73,000 workstations.

The WeWork similarities continue: While discussing itself in its IPO filing, the firm touts an &asset-light model,& which it claims helps property owners &benefit from our professional capabilities and strong brand recognition& as well as allowing its &business to scale at a cost-efficient manner.&

Letsee.

How to lose money

As a primer for all you non-accountants, herehow you make money as a company: First, generate some revenue. Next, deduct the direct costs that that revenue engendered. Whatleft is called &gross profit,& and the relative total of gross profit generated from revenue is called gross margin. From there, subtract your operating costs. If thereanything left over, thatoperating profit. Now take your operating profit and remove taxes and other costs. What remains is net income.

As you can quickly see, the more gross profit a business generates from its revenue, the more money is has left over to pay for operating expenses. So, revenues that generate lots of gross profit — called high-margin revenue — are better than those that don&t.

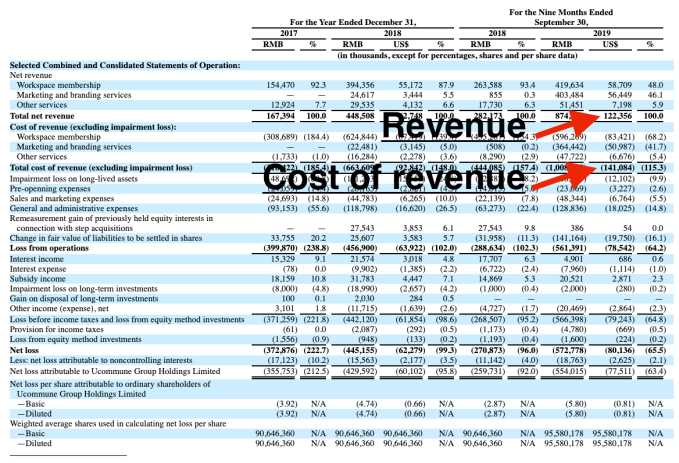

Ucommune, our IPO hopeful, is unique in that its revenue doesn&t generate any gross profit at all. Its revenue doesn&t even pay for itself. The company is gross margin negative.

Herewhat that looks like:

If your cost of revenue is higher than your revenue, your gross profit is negative. And that means that you have no gross margin available to fund operating costs. In turn, that means that your company is super unprofitable.

Ucommune is unprofitable, unsurprisingly. (If it feels like we&re overly focused on gross margins, keep in mind that software companies are worth as much as they are in part because they have very high gross margins.)

Things get a bit worse when we look further.

Yuck

Digging in, Ucommune operates two main businesses. The first enterprise is co-working, which generated just less than half of the companytotal revenue during the first three quarters of 2019. Its second largest business is a marketing effort. Ucommune acquired a company called &Shengguang Zhongshuo& in December of 2018, a deal that lets the company drive revenue by selling &branding services and online targeted marketing services.&

Ucommune is therefore a hybrid co-working and services business. Neither piece of the whole is attractive from a margin perspective. For example, the company$58.7 million in co-working revenue earned during the first nine months of 2019 was nearly entirely offset by lease costs ($49.6 million) alone, before the company staffed and otherwise managed the locations in question.

The companymarketing business is slightly better. Its $56.5 million in revenue from the first three quarters of 2019 was nearly offset by $51.0 million in revenue costs. Ucommuneservices arm, therefore, was more lucrative in terms of generating gross margin for the co-working company than its actual co-working business.

(Bear in mind as we go along that this company wants to gopublic.)

Wrapping our discussion of yuck, lettalk about cash. Ucommune had cash and equivalents of $23.4 million and short-term investments worth $11.0 million at the end of Q3 2019. That$33.4 million in total that the company can access, presuming that every short-term investment is unwindable into cash inside the window in which Ucommune would need to access it.

A window that is closing, mind. Ucommuneoperations burned through $32.4 million in the first three quarters of 2019. If the company kept consuming cash at its prior pace, we can estimate that it will not have enough cash to make it to the end of Q2 2020. Which is why Ucommune is going public.

Growth?

The only counterargument to the mess that is Ucommunebusiness is that it is growing quickly. Thattrue. The companyrevenue grew from ¥282.2 million in the first three quarters of 2018 to ¥874.6 million over the same time period this year. Thatquick!

But instead of demonstrating operating leverage (losing less money as its revenue grew), the company lost more money this year than the last, making its business appear likely to keep burning acres of cash while it grows. And you have to ask yourself if it is a good business, why are its private investors pushing it onto the public markets instead of giving it more of their own money?

They must have known, landing this close to WeWork, how this was going to look. And thatnot confidence-inspiring.

- Details

- Category: Technology

Read more: Why is WeWork 2.0 trying to go public

Write comment (99 Comments)When you play games on your PS4, itfair to say that your thumbs and index fingers are generally doing most of the work. Why not put the rest of your lazy digits to work with this accessory that puts two programmable buttons on the rear of the DualShock 4 controller?

Called, imaginatively, the Back Button Attachment, the gadget plugs into the PS4accessory port and adds three interactive items to the back end of the controller. There are two paddle-style buttons that seem suited for middle fingers to hit easily, each of which can be programmed to be any of the ordinary buttons.

Therealso a little OLED screen that provides &real-time& information on what the buttons are set to. It doesn&t seem like thereever much urgency to find that information out or show others, but hey. The screen also doubles as a button for switching between configurations or changing the settings on the fly.

Great idea from Sony, right? Wrong! The rear button thing has been done for some time by high-end third-party controller makers like Scuf and Astro, which with their customizable sticks and buttons have been adopted widely by pro gamers. (Microsoft, for its part, has a patent for a Braille display and input on the back.)

It doesn&t look good to have all the performance-oriented gamers using third party gear, but with the PS5 around the corner and a new controller coming with it, it doesn&t make much sense to put out a stopgap &DualShock 4.5& with extra buttons. So this accessory makes a lot of sense. (Don&t worry, it has a 3.5mm headphone jack pass-through, so you can still use a headset.)

And the price is reasonable, too: $30. That makes it a fairly easy impulse buy for anyone who likes the idea of the extra buttons but doesn&t want to drop a bill or more on a Scuf or Astro controller.

The Back Button Attachment won&t be available in time for the holidays, though — not until January 23. Chances are we&ll see it on display at CES before that, though.

- Details

- Category: Technology

Read more: Need more buttons for your PS4 controller This gadget adds two on the caboose

Write comment (99 Comments)Despite the proliferation of recipe websites and apps, finding and organizing the recipes you want to cook has somehow become more difficult over the years. Recipe sites are overrun with ads and long-winded personal stories, while many apps ignore the fact that many of todayconsumers want to shop for groceries online, not by making a shopping list to take to the store. Today, a company called Whisk is launching a new meal planning and recipe finding service that helps you better organize your recipe collection, as well as easily shop for recipe ingredients from a range of grocery delivery providers, including Walmart, Amazon Fresh, Instacart and others.

Whisk itself was acquired by Samsung NEXT in March of this year, after tripling its revenue, achieving profitability and powering more than half a billion recipe interactions per month.

Now, itout with its new cross-platform experience, which includes a website, mobile apps and a voice assistant, all designed to make it easier to meal plan, make and share lists and, finally, shop.

To be clear, Whisk is not another recipe site. Instead, ita way to save the recipes you find elsewhere.

The recipe site clutter has gotten so bad, itgained media attention and outcry from users. And while many people today still pin to Pinterest recipes they like, I&ve personally gotten so fed up with the mess that I&ve taken to just copying into Apple Notes the recipe text and a photo instead. Whisk, however, has me reconsidering my current system.

After signing up for Whisk, which can be as simple as providing an email or phone number if you don&t want to use Facebook or Google login, you get started by adding a URL of a recipe you found on the web.

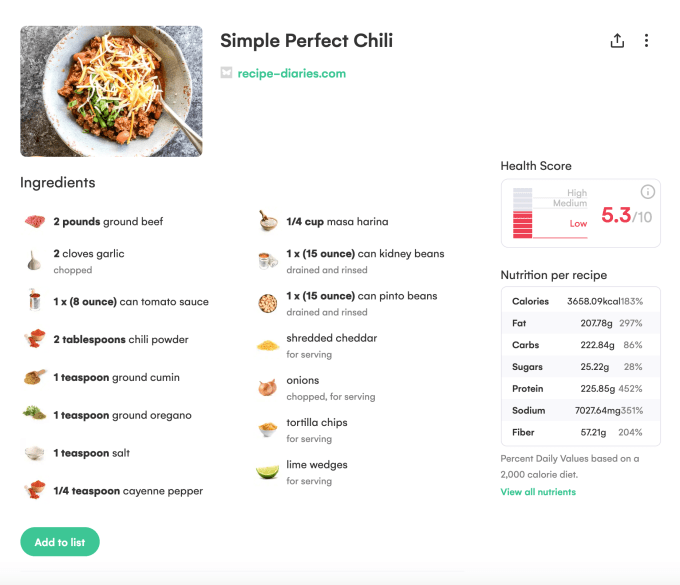

On a site like Pinterest, the link is just saved to your account and you move on. But Whisk goes further. It extracts and structures the pertinent information from the site, like the recipe title, photo, ingredients, serving time and more, and places them into the appropriate fields on its recipe entry form.

Unfortunately, in tests, it doesn&t seem to pick up the recipe instructions, but you can copy and paste these in separately. You can also write a description, add notes or even add, edit or remove ingredients based on your own personal tastes. The recipe, which links back to the original source, can then be saved directly or added to a collection of your own choosing on Whisk.

When you later go to cook the recipe, you can view it without all of the recipe sitemess and advertisements.

To be fair, the process of saving recipes this way takes a little more time than just hitting the &Pin It,& button. In some cases, Whisk doesn&t pick up the photo. Other times, you&ll want to go back to add more details beyond the cooking steps, like a link to the recipeYouTube video, for example.

But there are advantages that come with taking the extra few minutes on the recipe entry. Beyond just the organizational aspects, Whisk also brings its smart technology to the meal planning process. Once added, every ingredient is identified with a small photo icon as a visual reference and Whisk calculates the recipenutritional aspects and gives it a &health score.&

This aspect is powered by Whisk&Food Genome,& a deep learning, natural language-based algorithm that maps ingredients, their relationships and their properties like nutrition, perishability, flavor, category and more. Today the Whisk ecosystem sees more than 500 million monthly interactions, the company says.

Whisk also lets users click a button to scale up or down the recipes to different serving sizes without having to do the kitchen math in your head (or a lot of googling.)

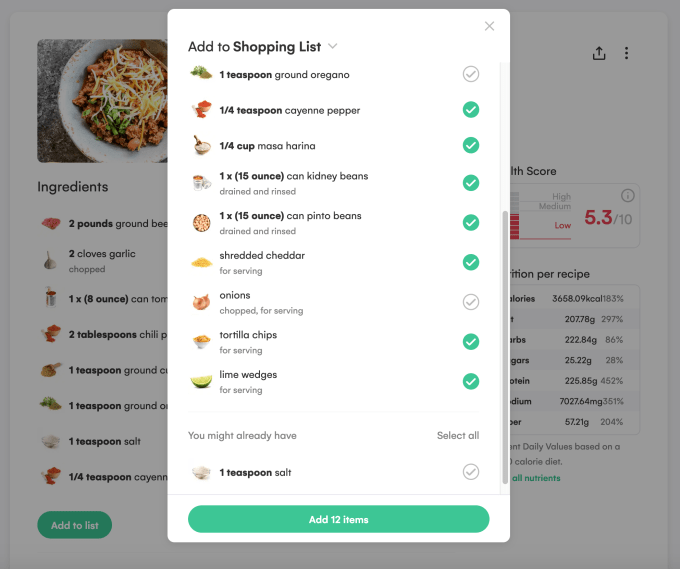

And when you&re ready to shop the ingredients, you just tap a button to create a list where you can select and deselect the individual items you need. This list can be shared over SMS, email or by URL, allowing others to view, edit or save and shop the items you need. Whiskvoice apps, including those for Bixby, Alexa and Google Assistant, also let you add items to your list, hands-free.

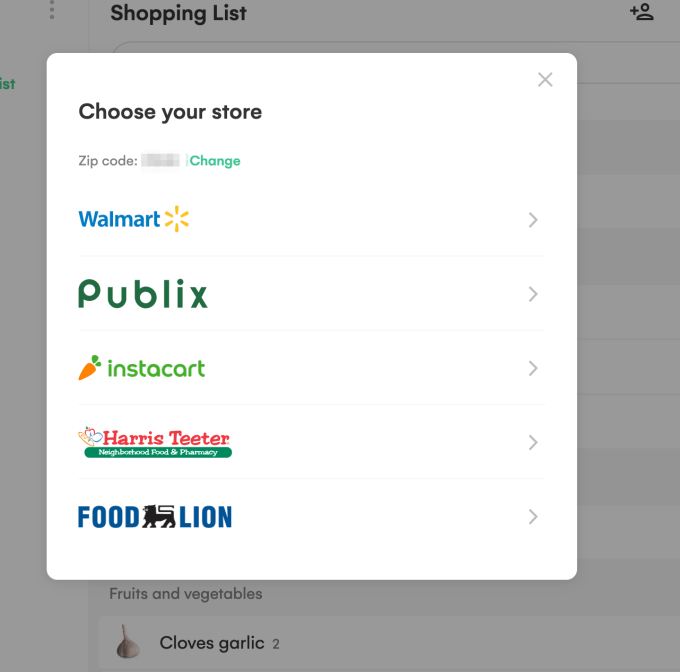

You can then select from which store to shop, based on the online grocery delivery services available in your region. This is an area where Whisk outshines many recipe app competitors, which tend to overlook this final step.

At launch, Whisk supports 29 online grocers globally, including major companies like Walmart, Instacart, Amazon Fresh and PeaPod in the U.S., plus Tesco, Ocado, Waitrose, ASDA and Amazon Fresh in the U.K., as well as GetNow, Woolworths, REWE and others in various overseas markets.

&Over half of the U.S. population still makes shopping lists using pen and paper, yet most people are looking for food inspiration digitally,& said Nick Holzherr, head of Product, Whisk at Samsung NEXT, in a statement about the applaunch. &Hours are spent looking for food content online — seeking new and healthier meals. However, the data shows people generally end up cooking the same 7-9 dishes on repeat. Therea fundamental disconnect between the online and offline that Whisk can help connect,& he added.

The company also notes that 70% of the U.S. population is expected to buy from online shopping services by 2025.

As more people shop online, Whisk will grow its servicerevenues as it takes an affiliate commission on some grocery checkouts.

Today, Whisk is available online, as a Chrome extension and on Android, Alexa, Google Assistant, Bixby and soon iOS.

- Details

- Category: Technology

Read more: Whisk’s AI-powered recipe app lets you send the ingredients to your door

Write comment (95 Comments)Airbnb has well and truly disrupted the world of travel accommodation, changing the conversation not just around how people discover and book places to stay, but what they expect when they get there, and what they expect to pay. Today, one of the startups riding that wave is announcing a significant round of funding to fuel its own contribution to the marketplace.

Domio, a startup that designs and then rents out apart-hotels with kitchens and other full-home experiences, has raised $100 million ($50 million in equity and $50 million in debt) to expand its business in the U.S. and globally to 25 markets by next year, up from 12 today. Its target customers are millennials traveling in groups or families swayed by the size and scope of the accommodation — typically five times bigger than the average hotel room — as well as the price, which is on average 25% cheaper than a hotel room.

The Series B, which actually closed in August of this year, was led by GGV Capital, with participation from Eldridge Industries, 3L Capital, Tribeca Venture Partners, SoftBank NY, Tenaya Capital and Upper90. Upper90 also led the debt round, which will be used to lease and set up new properties.

Domio is not disclosing its valuation, but Jay Roberts, the founder and CEO, said in an interview that ita &huge upround& and around 50x the valuation it had in its seed round and that the company has tripled its revenues in the last year. Prior to this, Domio had only raised around $17 million, according to data from PitchBook.

For some comparisons, Sonder — another company that rents out serviced apartments to the kind of travelers who have a taste for boutique hotels — earlier this year raised $225 million at a valuation north of $1 billion. Others like Guesty, which are building platforms for others to list and manage their apartments on platforms like Airbnb, recently raised $35 million with a valuation likely in the range of $180 million to $200 million. Airbnb is estimated to be valued around $31 billion.

Domio plays in an interesting corner of the market. For starters, it focuses its accommodations at many of the same demographics as Airbnb. But where Airbnb offers a veritable hodgepodge of rooms and homes — some are peoplehomes, some are vacation places, some never had and never will have a private occupant, and across all those the range of quality varies wildly — Domio offers predictability and consistency with its (possibly more anodyne) inventory.

&We are competing with amateur hosts on Airbnb,& said Roberts, who previously worked in real estate investment banking. &This is the next step, a modern brand, the next Marriott but with a more tech-powered brain and operating model.& These are not to be confused with something like HiltonHomewood Suites, Roberts stressed to me. He referred to Homewood as &a soulless hotel chain.&

&Domio is the anti-hotel chain,& he added.

Roberts is also quick to describe how Domio is not a real estate company as much as it is a tech-powered business. For starters, it uses quant-style algorithms that itbuilt in-house to identify regions where it wants to build out its business, basing it not just on what consumers are searching for, but also weather patterns, economic indicators and other factors. After identifying a city or other location, it works on securing properties.

It typically sets up its accommodations in newer or completely new buildings, where developers — at least up to now — are not usually constructing with short-term rentals in mind. Instead, they are considering an option like Domio as an alternative to selling as condominiums or apartments, something that might come up if they are sensing that there is a softening in the market. &We typically have 75%-78% occupancy,& Roberts said. He added that hotels on average have occupancy rates in the high 60% nationally.

As Domio lengthens its track record — its 12 U.S. markets include Miami, Los Angeles, Philadelphia and Phoenix — Roberts says that they&re getting a more select seat at the table in conversations.

&Investors are starting to go out to buy properties on our behalf and lease them to us,& he said. This gives the startup a much more favorable rate and terms on those deals. &The next step is that Domio will manage these directly.& The most recent property it signed, he noted, includes a Whole Foods at the ground level, and a gym.

Using technology to identify where to grow is not the only area where tech plays a role. Roberts said that the company is now working on an app — yet to be released — that will be the epicenter of how guests interact to book places and manage their experience once there.

&Everything you can do by speaking to a human in a traditional hotel you will be able to do with the Domio app,& he said. That will include ordering room service, getting more towels, booking experiences and getting restaurant recommendations. &You can book your Uber through the Domio app, or sync your Spotify account to play music in the apartment.

Ans there are plans to extend the retail experience using the app. Roberts says it will be a &shoppable& experience where, if you like a sofa or piece of art in the place where you&re staying, you can order it for your own home. You can even order the same wallpaper thatbeen designed to decorate Domio apartments.

Ripe for the booking

Although Airbnb has grown to be nearly as ubiquitous as hotels (and perhaps even more prominent, depending on who you are talking to), the wider travel and accommodation market is still ripe for the taking, estimated to reach $171 billion by 2023 and the highest growth sector in the travel industry.

&Airbnb has taught us that hotels are not the only place to stay,& said Hans Tung, GGVmanaging partner. &Domio is capitalizing on the global shift in short-term travel and the consumer demand for branded experiences. From my travels around the world, there is a large, underserved audience — millennials, families, business teams — who prefer the combined benefits of an apartment and hotel in a single branded experience.&

I mentioned to Roberts that the leasing model reminded me a little of WeWork, which itself does not own the property it curates and turns into office space for its tenants. (The SoftBank investor connection is interesting in that regard.) Roberts was very quick to say that itnot the same kind of business, even if both are based around leased property re-rented out to tenants.

&One of the things we liked about Domio is that is very capital-efficient,& said Tung, &focusing on the model and payback period. The short-term nature of customer stays and the combination of experience/price required to maintain loyal customers are natural enforcers of efficient unit economics.&

&For GGV, Domio stands out in two ways,& he continued. &First, CEO Jay Roberts and the Domio teamemphasis on execution is impressive, with expansion into 12 cities in just three years. They have the right combination of vision, speed and agility. Domiomodel can readily tap into the global opportunity as they have ambition to scale to new markets. The global travel and tourism spend is $2.8 trillion with 5 billion annual tourists. Global travelers like having the flexibility and convenience of both an apartment and hotel — with Domio they can have both.&

- Details

- Category: Technology

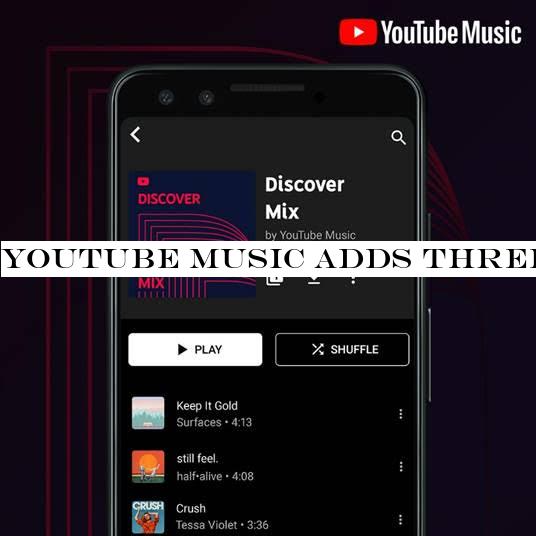

YouTube Music is taking on Spotify, Apple Music and others with the launch of three personalized playlists, including its own version of SpotifyDiscover Weekly, called Discover Mix, as well as a New Release Mix and Your Mix. Discover Mix had been spotted in the wild during testing, but now all three are globally available to YouTube Music users.

The companyplans to introduce these new mixes were announced this fall at TechCrunch Disrupt SF 2019, where YouTube Chief Product Officer Neal Mohan spoke about the serviceplans to utilize a combination of machine learning and human curation to improve the music serviceofferings.

The Discover Mix is very much like SpotifyDiscover Weekly, as it will focus on helping users uncover new artists and music they like, including tracks you&ve never listened to before as well as lesser-known tracks from artists you already love. But unlike on competitor music services, this playlist can leverage historical listening data on both YouTube Music and on YouTube itself.

The mix, which updates every Wednesday, will give listeners 50 tracks per week.

The New Release Mix, as you can guess, focuses on all the recent releases by your favorite artists and others YouTube thinks you&ll like. This one drops every Friday, as most new releases do, but will add other tracks mid-week as needed.

Finally, Your Mix is a playlist that combines the music you love with songs you haven&t heard yet but will probably like, based on your listening habits. This one updates regularly to stay fresh.

Of course, the longer you listen on YouTube Music, the better the mixes will get. But YouTube says it can offer personalized mixes as soon as a user selects a couple of artists they like during the setup process or after they listen to a couple of songs.

The mixes arrive at a time when Google is more heavily investing in its streaming music service. Earlier this fall, it madeYouTube Music the default music app that ships with new Android devices, instead of Google Play Music. And recently, reports indicate that YouTube Music is ahead of Spotify and JioSaavn in India, a key market for Spotify, despite its late entry.

The new mixes are live today on YouTube Music across iOS, Android and the web.

- Details

- Category: Technology

Page 102 of 5614

9

9