Technology

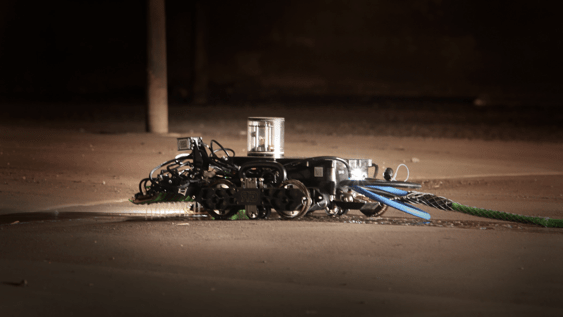

Gecko Robotics has landed $40 million in financing as it looks to build an additional 40 robots over the next year to meet what the company sees as growing demand for its safety and infrastructure monitoring services.

&We are growing fast solving critical infrastructure problems that affect our lives, and can even save lives,& says Jake Loosararian, Gecko Robotics& 28-year-old co-founder and chief executive officer, in a statement. &At our core, we are a robot-enabled software company that helps stop life-threatening catastrophes. We&ve developed a revolutionary way to use robots as an enabler to capture data for predictability of infrastructure; reducing failure, explosions, emissions and billions of dollars of loss each year.&

In the three years since its launch in 2016, Gecko Robotics has managed to grow from a small team of Pittsburgh robotics experts hailing from Carnegie Mellon. Indeed, the company has added more than 100 new employees. The hiring push has been largely around creating a team of qualified experts in particular market segments who can operate the robots that Gecko deploys to industrial work sites.

Therebeen something of a robotics revolution in the safety and compliance market over the past few years. From automated assembly lines to warehouses and now to chemical plants and refineries, robots are making their presence felt.

And Gecko isn&t the only company thattrying to tackle the market. Other companies like Invert Robotics, a Christchurch, New Zealand-based company, has built its own competitive robotic safety inspector.

The initial pitch from Gecko managed to attract angel investors like Mark Cuban, Deep Nishar (a managing partner at SoftBank), Josh Reeves and Jake Seid, the managing director at Stone Bridge Ventures.

Now the company adds the Midwestern venture capital juggernaut Drive Capital to its stable of investors.

&We are very excited for the future of robotics in industrial inspection. The Gecko Robotics team are revolutionizing an industry that is in need of a real upgrade and will save lives,& said Mark Kvamme, lead investor and partner at Drive Capital. &I see amazing potential for Geckobusiness model, they are on the path to become a market leader in their industry.&

Gecko Robotics has already opened a 20,000-square-foot office in Houston, and has offices in Houston, Austin and Pittsburgh.

&The robots are amazing, but they&re not going to be able to complete the job done by these experts who have experience of 30 to 40 years,& says Loosararian. &We have thought leaders who go out in the field… they take the robots out and they use their own manual ability and knowledge to provide the expertise to the clients.&

Gecko currently has 60 robots in its stable of robots and will add at least another 40 over the course of the year. &The product at the end is the software license that they pay for annually,& Loosararian says.

- Details

- Category: Technology

Read more: Building robotic safety inspectors nabs Gecko Robotics $40 million

Write comment (99 Comments)Hello and welcome back to our regular morning look at private companies, public markets and the grey space in between.

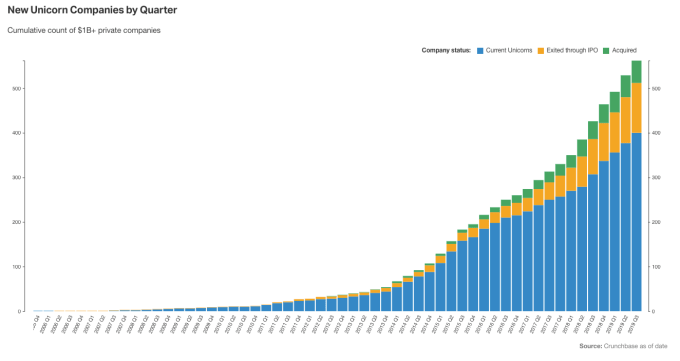

Today we&re digging into unicorns: how many will find an exit through an acquisition (selling themselves to a larger company) or an IPO (starting to trade as a public company) before the market turns?

When the business cycle does eventually turn ill, itgenerally expected that private capital will become scarcer, something that could harm yet-unprofitable unicorns. In turn, backers of private companies worth at least $1 billion could see the value of their investments decline or implode. The number of unicorns that manage to exit before a market turn is, therefore, something to keep an eye on.

This is doubly true as the number of un-exited unicorns continues to rise. Despite unicorn IPOs and acquisitions (more on that in a moment), the number of private companies worth $1 billion (unicorns that need an eventual exit to return capital to their backers who expect eventual, profitable liquidity) has risen each quarter for years now.

This has led to hundreds of unexited unicorns worth more than $1 trillion in total, according to the Crunchbase leaderboard. Thata lot of corporate value to shift before the business cycle heads negative, possibly closing the IPO window and bringing winter to the sort of private finance that unicorns have long depended on.

Scale

In Q3 of 2017, there were 250 unexited unicorns according to the leaderboard, 39 unicorns that had gone public and 24 more that had been acquired. A year later those numbers rose to 307 unexited unicorns, 79 unicorns that had gone public and 40 more that had been sold.

In its most recent update for Q3 2019, the same dataset indicates that there are 400 unexited unicorns, 112 that have gone public and 50 that have been sold.

Doing the math, in Q3 2017 80 percent of unicorns were still private and independent (unexited). In Q3 2018, that improved to 72 percent. And, at the end of Q3 2019, the percent improved modestly to a little over 71 percent.

We can see, then, that the portion of unicorns that have managed to find an exit has improved over the last few years. Less encouraging, however, is that the raw number of unicorns still in hunt of an exit has grown by leaps and bounds.

In chart form, it looks like this:

- Details

- Category: Technology

Read more: How many unicorns will exit before the market turns

Write comment (92 Comments)

In the race between the two major TV giants, LG has sprung ahead of Samsung and nabbed itself the right to claim the world’s first '8K Ultra HD' TV, as certified by industry standards.

Specifically, this means that LG is the first to be using the “8K Ultra HD” logo (below) and definition set in place by the Consumer Technology Association (CTA), sta

- Details

- Category: Technology

Read more: LG beats out Samsung with first industry-certified 8K Ultra HD TV

Write comment (99 Comments)

Just a handful of years ago, dramatized films about the rise of global tech giants were all the rage, with David Fincher's Facebook movie The Social Network and Danny Boyle's Apple-centric Steve Jobs biopic earning copious critical acclaim and awards recognition.

Now, Netflix is looking to bring 'big tech' to the small screen, with the streaming

- Details

- Category: Technology

Read more: Netflix to document the rise of Spotify in new original series

Write comment (99 Comments)

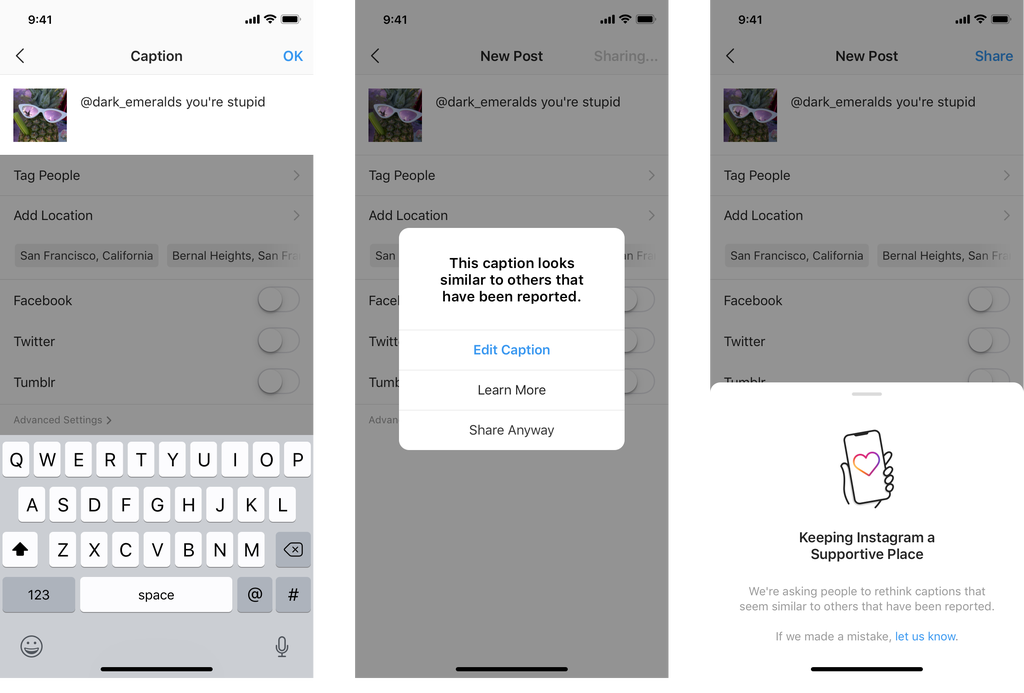

In part of an ongoing effort to minimize online bullying, Instagram today announced that it’s rolling out a new feature which will notify users when they’ve written a caption that “may be considered offensive” on a photo or video.

The alerts will be powered by a new AI developed specifically for the task, which works by comparing captions to a

- Details

- Category: Technology

Read more: Instagram takes aim at ‘offensive’ captions with new warning prompts

Write comment (98 Comments)

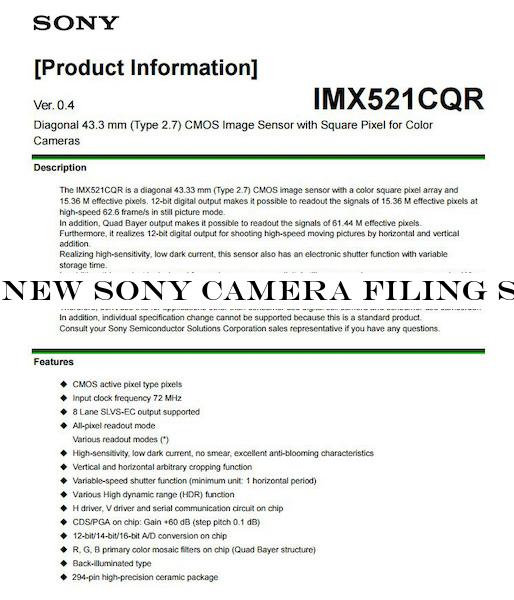

It's been over four years since the launch of the critically lauded Sony Alpha A7S II – and yet, surprisingly, there's still no official word on a successor to the superb video-centric camera. And, in fact, the Alpha A7S III has been rumored for so long that it's earned a somewhat mythical status of its own.

Chatter around the oft-rumored camera

- Details

- Category: Technology

Read more: New Sony camera filing suggests its Alpha A7S III may finally see the light of day

Write comment (92 Comments)Page 116 of 5614

6

6