Technology

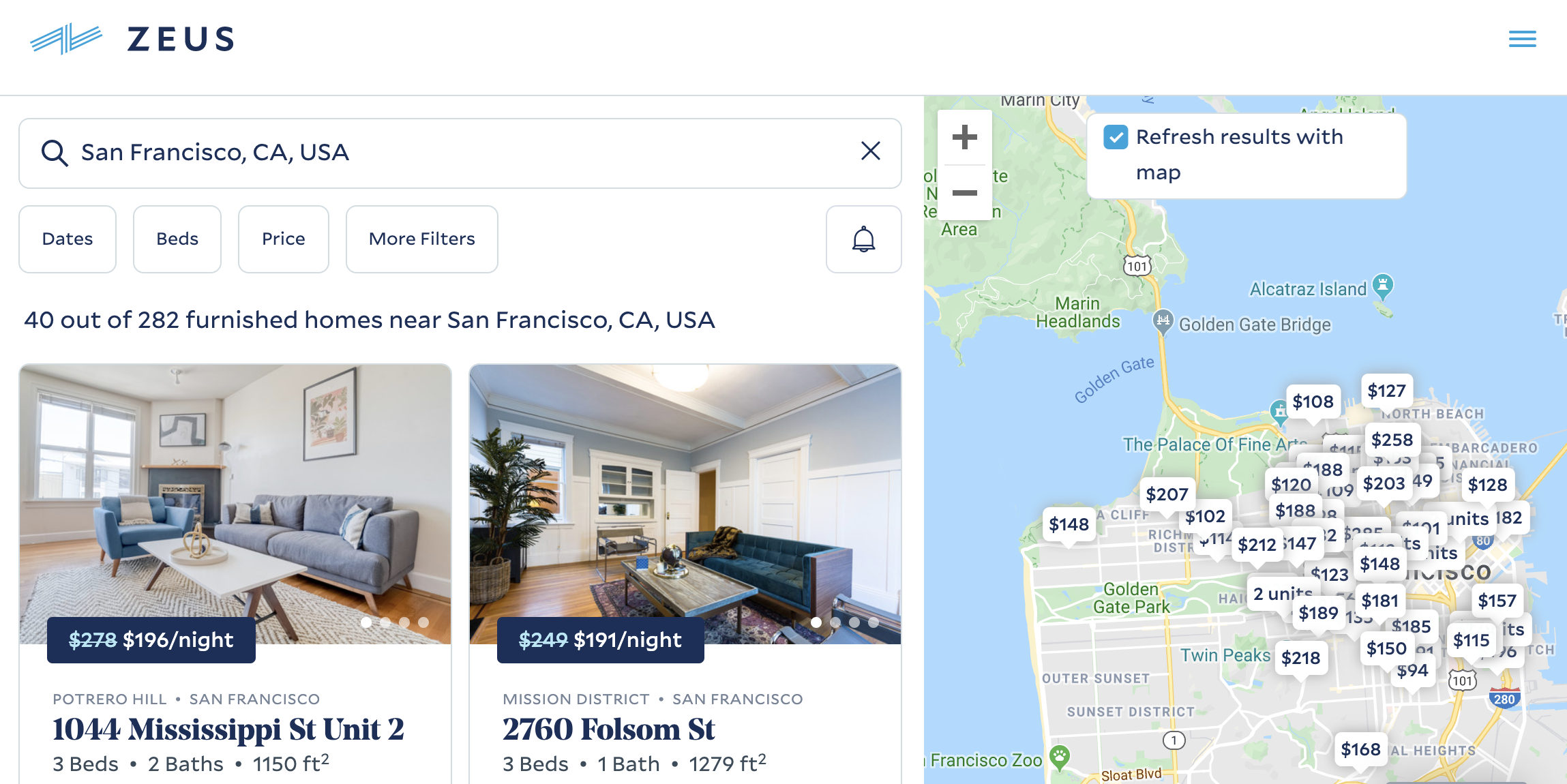

As Airbnb absorbs more and more of the demand for housing, itexploring how to monetize opportunities beyond vacation rentals. A marketplace for longer-term corporate housing could be a huge business, but rather than build that itself, Airbnb is making a strategic investment in one of the market leaders called Zeus Living, which will list its homes on the Airbnb site.

In just four years of redecorating landlords& homes and renting them to relocated workers for 30-day stays (or longer), Zeus Living has grown to a $100 million revenue run rate. It boosted revenue 300% in 2019, and now has 250 employees and more than 2,000 homes under management. Zeus makes money by charging landlords one free month of usage, and marking up the rent charged to customers. It could rent out a $4,000 per month home for $5,000 plus take the extra month to earn $16,000 in a year.

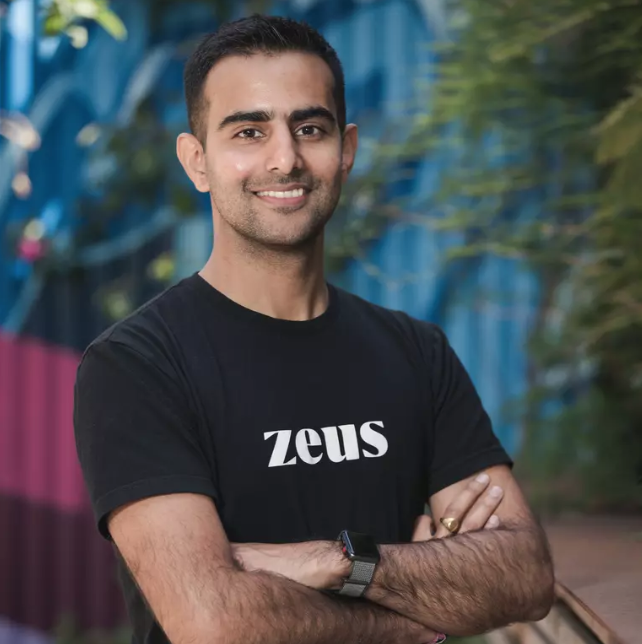

Zeus CEO and co-founder Kulveer Taggar tells me, &I fundamentally believe that a lot of human potential is bound by location. At Zeus, we&re deeply committed to making it easier for people to live where opportunity takes them.& Italready hosted 27,000 residents for a total of 650,000 nights.

Strong margins, swift momentum and that megatrend of more mobile workforces have earned Zeus Living a new $55 million Series B round itannouncing on TechCrunch today. The funding comes from Airbnb, Comcast, CEAS Investments and TI Platform Management, plus existing investors Alumni Ventures Group, Initialized Capital, NFX and Spike Ventures. The funding comes at a $205 million post-money valuation.

&The opportunity here is huge, consumer spend is going toward housing and everyone needs to stay somewhere. But itKulveer and Zeus& go-to-market strategy that is impressive,& says Initialized co-founder and managing partner Garry Tan. &Zeus decided to start with corporate rentals, which we believe is the best go-to-market since it is the highest margin, and capital efficiency wins in a space with many competitors. Corporate needs are longer term, consistent and predictable, and partnering with Airbnb strengthens this approach as they expand to build a platform for every city.&

Zeus co-founder and CEO Kulveer Taggar

Zeus previously raised a $2.5 million seed and then an $11.5 million Series A led by Initialized, as well as $10 million in debt to cover taking on properties in the San Francisco Bay Area, Los Angeles, New York, Seattle and D.C. Now that itscaling up, Zeus could add a sizable debt facility to cover the risk of filling apartments with employees from clients like Brex, Disney, ServiceTitan and Samsara.

Push-button housing

Instead of moving into a bland corporate housing block, struggling to find a place themselves or ending up in expensive long-term Airbnbs, workers moving to new cities can go to Zeus. It takes over apartments, handles maintenance and fills them with branded comforts like Parachute bedding and Helix mattresses that Zeus gets at bulk rates. The startup is betting that as workers move between jobs and cities more frequently, fewer will own furniture and instead look for furnished homes like those Zeus offers.

Thanks to the premium stays it provides, Zeus can charge clients a lucrative rate, while Taggar claims his service is still about half the price of standard corporate housing. For property owners, Zeus makes it easy to get a consistent rent paycheck with none of the traditional landlord work. Zeus takes care of cleaning and key exchanges so owners don&t need to do any chores like if they were running an Airbnb. Its goal is to get the first renters in within 10 days of taking on a property.

The new funding will help Zeus expand to more neighborhoods and cities while retaining a focus on breadth within each market so clients have plenty of homes from which to choose. The startup will be revamping its booking and invoicing tools for enterprise partners, and improving how it sources real estate. Meanwhile, it will be investing in customer care to maintain its high 70s NPS scores so relocated workers brag to their colleagues about how nice their new place is.

&Finding housing is stressful and time-consuming for both individuals and employers. As someone who has moved countries four times, I&ve lived through that tension,& says Taggar. &Zeus Living has built technology to remove complexity from housing, turning it into a service that enables a more mobile world.&

Taggar got into the real estate business early, remortgaging his momhouse to buy a condo in Mumbai to rent out. After moving to the U.S., he built and sold Y Combinator-backed auction tool Auctomatic with co-founder and future Stripe starter Patrick Collison. It was while working on NFC-triggered task launcher Tagstand that Taggar recognized the hassle of both finding new corporate housing and reliably renting out onehome. With Uber, Stripe and more startups growing huge by simplifying processes that move a lot of money around, he was inspired to do the same with Zeus Living.

The property tech wars

&Modern professionals travel more frequently, stay longer and seek accommodations that feel like home. As more companies look to Airbnbfor Work for extended-stay and relocation solutions, this segment remains a key focus forAirbnb,& says David Holyoke, global head of Airbnb for Work.

&We have great alignment with the Airbnb team in terms of serving the changing needs of business travelers that want the comforts of home when traveling for extended 30-day stays for work or a project,& Taggar follows. Airbnb can help Zeus drive demand thanks to all its inbound traffic, while Zeus offers Airbnb more supply for customers seeking longer stays.

Zeus Livingco-founders

Zeus& biggest threat is that it could get overextended, misjudge demand and end up on the hook to pay rent for two-year leases it can&t fill. And now with more funding, there will be added scrutiny regarding its margins, especially in the wake of the WeWork implosion.

Taggar recognizes these threats. &This is a business where we have to be focused on maximizing the gross profit we generate for the investments we make, with the least amount of risk. At Zeus Living, we&re continuously improving the ways we predict and secure demand.& Healso building out teams on the ground in different markets to ensure regulatory compliance and push for more conducive laws around 30-day (or longer) rental stays.

Property tech has become a heated space, though, so Zeus will have heavy competition. There are traditional corporate housing providers, pure marketplaces that don&t deal with logistics and direct competitors like $66 million-funded Domio and juggernaut Sonder, which has raised a whopping $360 million. Zeus might also see its model copied abroad before it can get there. Over time, landlords and real estate investment trusts like Blackstone could force Zeus, Sonder and others to compete to pay them the most for leases, eating into all the startups& margins.

At least with Airbnb as an investor, Zeus won&t have to fear a bitter battle with the tech giant over corporate housing. Instead, Airbnb could keep investing to coin off this adjacent market while listing Zeus properties, or potentially acquired the startup one day. For now though, Taggar just wants to prove startups can be accountable in the real world, acknowledging that taking over peoplehomes is &a lot of responsibility! Our homes represent hundreds of millions of dollars of assets we manage and we take that very seriously.&

- Details

- Category: Technology

Read more: Airbnb invests as Zeus corporate housing raises $55M at $205M

Write comment (94 Comments)Roku is unlocking premium content from HBO for the first time without a subscription, with its second-annual holiday streaming fest, Stream-a-thon. The promotion will see Roku offering the full first season of HBO&Game of Thrones& for free to anyone with a Roku device. Also included during the event are full seasons and select episodes from other premium channels like Cinemax, Showtime, Starz and others.

The Stream-a-thon is a promotional effort aimed at capturing viewership at a time when many people are off work and relaxing at home, often watching TV. This year, the Steam-a-thon runs from December 26, 2019 through January 1, 2020.

This is the second year Roku has hosted the event, whose larger goal is to encourage Roku users to sign up for one of the premium channel subscriptions offered through Rokuplatform. The sampling of seasons and shows is meant to get viewers hooked on the content, as well as draw in users to Rokufree content hub, The Roku Channel, where it features ad-supported free movies and shows year-round.

In addition to season 1 of &Game of Thrones,& other full first seasons being made available include Cinemax&Warrior,& Starz&Power& and Showtime&Billions,& &The Affair& and &Ray Donovan,& among others. Several individual episodes are being unlocked as well, including those from HBO&Barry,& &Chernobyl,& &Euphoria,& Sesame Street& and &Succession,& plus Showtime&Kidding& and EPIX&Get Shorty,& &Pennyworth& and &Punk.&

The full list of participants includes Cinemax, CONtv, Dove Channel, EPIX, FitFusion, The Great Courses Signature, HBO, Hallmark Movies Now, Pantaya, Smithsonian Channel Plus, Starz, Showtime, Stingray Karaoke and UP Faith - Family.

HBO also has a deal with Amazon to offer select seasons of its older shows, like &The Sopranos,& &The Wire,& &True Blood,& &Deadwood,& &Boardwalk Empire,& &Oz,& &Six Feet Under& and others which are free to Prime members. But those aren&t actually free to stream because they require an annual Amazon Prime membership to watch.

Related to the launch of Stream-of-thon, Roku is also for the first time offering a combination HBO + Cinemax value pack that discounts the subscriptions to $20.99 per month instead of paying for them separately at $14.99 and $9.99, respectively.

- Details

- Category: Technology

Read more: Roku to stream first season of HBO’s ‘Game of Thrones’ for free

Write comment (91 Comments)Venture capital investment in all-female founding teams hit $3.3 billion in 2019, representing 2.8% of capital invested across the entire U.S. startup ecosystem this year, according to the latest data collected by PitchBook.

While that number may seem insubstantial, ita step up from last yeartotal. In 2018, venture capitalists struck 580 deals worth $3 billion — up from just $2.1 billion in 2017 — for all-female teams, or only 2.2% of all U.S. deal activity. So far, female-founded and mixed-gender teams have raised a total of $17.2 billion, with roughly three weeks remaining in 2019. That11.5% of all venture capital investment, an increase from 10.6% last year, when those groups attracted $17 billion across some 2,000 deals.

Crunchbase, another organization focused on tracking and analyzing fundraising data, reported in October that $20 billion in global capital was invested in female-founded and female co-founded startups so far this year. Three percent of global venture dollar volume was funneled toward female teams, Crunchbase said, and 10% toward teams of women and men.

Despite efforts from female founders, venture capitalists and diversity advocates in Silicon Valley and beyond, female entrepreneurs continue to struggle to raise as much capital as their male counterparts. The lack of equity in VC is in part caused by the lack of women on the other side of the table; venture capital funds still employ very few women.

Although dozens of firms have made concerted efforts to diversify their ranks, fewer than 10% of decision-makers at U.S. VC firms are women, according to a 2019 Axios analysis, which determined just 105 investors out of 1,088 were female. While the study noted an increase from the previous year8.93% and 20177%, it proved venture capital is still very much a male-dominated industry.

Carta, a venture-backed company that provides startups tools to manage their equity, released its second annual gender equity gap study last month, noting that male founders and employees still receive significantly more equity wealth than women. Men have 64% of all startup equity, according to Cartafindings, and represent 80% of cap table millionaires. Carta used data from 320,000 employees, some 10,000 companies and 25,000 founders to determine these results, which paint a disappointing picture for women at startups.

Another venture-backed company, Tide, conducted its own study around female founders this year. The study focused on entrepreneurs in the U.K. and U.S., which both struggle with diversity in entrepreneurship. Tide determined that of the 403 degrees obtained from universities in the U.K. by female founders, roughly a quarter were from the University of Cambridge and the University of Oxford, the countrytop schools. Of the American entrepreneurs included in the study, most went to Stanford University, MIT or Harvard University. The conclusion? Of the female founders who ultimately succeed in raising funding from private investors, most are graduates of elite universities, suggesting a certain socio-economic status. Of course, accessing capital is even more difficult for entrepreneurs who do not attend top universities and who therefore struggle to gain access to investor-friendly networks.

The diversity issue in VC expands beyond women. While several funds have cropped up with a mission to back female founders exclusively, including Female Founders Fund, BBG Ventures, Halogen Ventures, Jane VC, Cleo Capital, accelerator program Ready Set Raise or XFactor Ventures, minority entrepreneurs, including men of color, struggle to secure financing. And while companies like PitchBook and Crunchbase track gender, they do not track race, making it difficult to understand the size and scale of the race funding gap.

On a mission to close that gap, firms like Harlem Capital invest in minority entrepreneurs and organizations like BLCK VC seek to provide community for black venture investors. The New York-based team behind Harlem Capital announced a $40 million debut fundraise last month, one of the largest-ever pools of capital for a fund with a diversity mandate. Harlem, similar to BLCK VC, hopes to attract more minorities to venture capital, where the vast majority of deal makers are white or Asian men.

&You need diversity funds like ourselves to get this market anywhere close to parity,& Harlem Capital managing partner Jarrid Tingle told TechCrunch last month.

Other efforts focused on women in VC and technology include All Raise, which hired its first chief executive officer in Pam Kostka earlier this year. 2019 has been a banner year for the nonprofit organization focused on increasing representation across the entire tech ecosystem. Not only did it bring its first official leader and several employees, it announced new chapters in Los Angeles and Boston, launched a program called VC Cohorts and hosted its annual conference, several in-person and virtual fundraising workshops and networking sessions.

&Women are hungry for the support and guidance we provide,& All RaiseKostka told TechCrunch in October. &I think the movement is just gathering momentum.&

Large and growing &unicorn& startups founded by women have also helped move the needle this year, proving companies led by women can gain support from Silicon Valleyelite. PitchBook notes Glossier and Rent the Runway, two companies founded and led by women, as examples of new entrants to the unicorn club (companies with valuations of $1 billion or larger).

Glossier landed a $100 million Series D led by Sequoia Capital, with participation from Tiger Global and Spark Capital in March. The round valued Emily Weiss& business at a whopping $1.2 billion. News of Rent the Runway$125 million round led by Franklin Templeton Investments and Bain Capital Ventures came just a couple of days later. The deal valued the clothing rental company at $1 billion.

The newest data may indicate progress, but all-male teams still raised more than 85% of all U.S. venture capital dollars in 2019, while decision makers at venture capital firms were still more than 90% male. The venture capital industry, as it stands, is still a boyclub.

- Details

- Category: Technology

Read more: US VC investment in female founders hits all-time high

Write comment (100 Comments)

Nearly every startup begins as a lean, scrappy team that works closely in a central hub — itan interesting time when each team member is wearing multiple hats, likely working across several different job titles and is hands on with all aspects of the business.

But as your company grows, you&ll quickly discover that scaling has a unique set of challenges, from hiring those who are the right fit, to transitioning a multi-functional team into specialty areas, to expanding offices cross-country or overseas. I&ve found the latter is a particular challenge for most.

There are numerous benefits to building a team across varying offices and locations — drawing from a larger talent pool being number one. Tapping into major markets across the world opens your startup up to more potential applicants and in turn, helps gain the talent you need to grow.

But these benefits also come with potential challenges, including overcoming communication and language barriers, time zone differences or lack of alignment, just to name a few. Some employees may feel they&re out of sight and out of mind, which can quickly impact culture across the company, particularly if the newer, smaller offices feel like headquarters is dictating the terms.

My co-founders and I have worked through these very same challenges as we&ve scaled our company and have put a lot of thought into how we can best approach office expansion and integration to alleviate these issues and ensure our employees feel seen and connected to the company & whether they&re based ten feet or thousands of miles away.

Create opportunities for team members to connect in person

I can&t stress enough how important it is to invest in face-to-face time, enabling your employees to get to know the people behind the online and phone personas that they work with.

You can do this in numerous ways, whether thatbringing everyone together once a year or throughout the year for special projects _ face-to-face time gives your employees an opportunity to build a connection and understand one anotherinterests, work style and strengths on a deeper level. While this is achievable to a certain degree via email or phone, meeting face-to-face expedites this process significantly. In fact, research has shown that face-to-face meetings are 34x more successful than email thanks in large part to the boost from non-verbal cues (which are lost in phone and email interactions).

While Druva is headquartered in Silicon Valley, the majority of our employeesa are across the globe — with 300 employees in the U.S., and more than 500 spread across APAC and EMEA. Whatmore, each region houses a variety of workstreams, so we&ve found itbest to tailor our approach to each team:

- Hosting an annual kick-off: At the start of every fiscal year, we bring our global sales and product teams together for a multi-day meeting near our headquarters in Sunnyvale, CA. This gives us an opportunity to not only ensure that everyone is aligned on the companystrategy and objectives, it also helps create a sense of camaraderie. These are teams that work across the globe and as a result, often communicate over email. Being able to meet in person or meet other members of the team builds connections that are vital for a healthy organization.

- Setting aside budget for site visits: Itnot always practical for employees to travel to other offices regularly — whether thatdue to tight travel budgets or personal commitments — but I encourage every company to allocate travel budget for office visits that empower both headquarter and remote employees to travel and get to know team members. Whether itflying someone to London to meet with their new team lead or sponsoring an extra night stay so an employee on personal travel can visit another office while they&re in the city, encouraging team members to take the opportunity to meet face-to-face — outside of annual events or product launches — not only creates a greater culture but fosters collaboration, which can lead to greater productivity long-term.

- Details

- Category: Technology

Read more: Effective ways to ensure your remote team feels like part of HQ

Write comment (93 Comments)SignalFire, a six-year-old, San Francisco-based venture firm that prides itself on mining what it says is more actionable data about, well, the world, has just raised a pair of funds that total $500 million in capital commitments.

One of the vehicles is a $200 million &seed& fund that SignalFire will use to write checks up to $5 million in nascent startups; the other is a $300 million fund designed to invest in those of the firmportfolio companies that are beginning to pull away from the pack and need growth-stage funding.

Both are a major step up for the young firm, which closed its debut fund with $53 million in 2015 before raising $330 million in capital across two funds in 2017.

According to firm founder Chris Farmer — who founded SignalFire after logging several years at both Bessemer Venture Partners and General Catalyst — the firm also has many more people investing the money. Altogether, SignalFire now employs 30 people across an engineering and data science unit; a unit dedicated to portfolio operations; and a unit that does the actual venture investing.

The latter now features three general partners in addition to Farmer. Among them: Ilya Kirnos, a former software engineer at Oracle, then Google, who joined Farmer at the outset and is also the firmCTO; Wayne Hu, who joined SignalFire in 2015 and today leads many of its seed-stage investments; and Walter Kortschak, who joined the firm in 2016 after spending 26 years at the private equity firm Summit Partners, where he established the firmWest Coast investment practice.

Others associated with the company include Alex Garden, the co-founder and CEO of the food-focused robotics company Zume, and Ross Mason, the British-born founder of MuleSoft, both of whom are venture partners; along with Tawni Cranz, who spent a decade with Netflix, including as its chief talent officer, and is today an advisor who holds the title of venture operating partner with the firm. (Another managing partner, Tony Huie, says on LinkedIn that he left the firm full-time to become the COO of one of its portfolio companies, an online privacy startup called Pango.)

Certainly, SignalFire is a firm that trusts its instincts. Its bets &north of $20 million& or else &in that ballpark,& according to Farmer, include the push notification tools company OneSignal; Jyve, a company that connects retailers with on-demand workers who can stock their shelves; ClassDojo, which makes a communications app for primary schools; Stampli, which makes a cloud-based accounts payable system; and Grammarly, which makes a digital writing assistant.

If you&re trying to suss out a theme among these, don&t bother. SignalFire claims to have access to 100 major data sets that its &competitive data nerds& pore over to figure out whathappening in the world — and where things are moving (think talent flows and consumer spending, among other things). In short, it doesn&t &invest in people& or else take a thematic approach, as do many of its venture peers.

What SignalFire doesn&t have yet is a big exit. In fact, Farmer says its only notable exit to date was the sale early last year of TextRecruit, a text message, live online chat and AI platform for hiring, to iCIMS, an applicant tracking system. (Terms were undisclosed.)

Then again, SignalFire looks to be just getting started, as do many of its startups, a growing number of which are highly valued by the private investors who&ve piled into them.

Just one example, the menhealth company Ro, is not quite three yearold yet it was most recently valued at half a billion dollars, on roughly $175 million in funding.

Therealso Zume, which is just four years old and backed by SignalFire and was reportedly valued at $2.25 billion when it closed on a giant round from SoftBank Vision Fund late last year. Itnow reportedly in talks to close more funding at a $4 billion valuation.

- Details

- Category: Technology

Read more: SignalFire, just six years old, has raised $500 million across two new funds

Write comment (94 Comments)Mindstrong Health is tackling one of the most difficult challenges in healthcare: Severe mental illness, commonly referred to as SMI in the healthcare industry. The startup, founded in 2013 by Paul Dagum, Richard Klausner and Thomas Insel, recently brought on former Uber VP of Product Daniel Graf as CEO, and is now announcing a number of new hires to its senior product leadership team as it moves to turn into an even more compelling and user-friendly product the technology and research it has developed over the past six years.

As mentioned, Graf was Mindstrong Health‘s first high-profile hire this year, when the former Uber, Twitter and Google product leader joined in October. Grafturn as the companychief executive is his return to the operational side after spending some time away from building product as an investor. He and Mindstrong have brought in four new C-suite execs to lead the company, including a new CPO, COO and CTO, as well as a new VP of Data Science and new VP of Marketing.

The CPO role is the only one Mindstrong can&t yet disclose, but the incoming person has been a product leader at large tech companies, Graf told me in an interview. Meanwhile, the company is revealing that Brandon Trew (ex Uber, Google) will join as COO, Erik Albair (ex Google Maps, DeepMind) will join as CTO, Kane Sweeney (ex Uber, StubHub) comes in as VP of Data Science and Dena Olyaie (ex Facebook, Oscar Health) joins as VP of Marketing.

&The inflection point we&re going through now is really building out the whole foundation,& Graf told me. &If you look at our [current] app, itnot an app, I would describe us as a consumer and from an experience point of view & ita science app. We basically have to build this whole foundation and platform, so for a technology person, for a product person, for a data scientist, for a marketing person, itkind of a dream. When you look at the planning stage, you look at the mission, with amazing investors, we don&t really have to worry about investments, and we can build this now. We can build this amazing platform and thatwhy all these folks are joining.&

Mindstrong Healthprimary product is a platform that provides remote care on-demand for patients dealing with SMI. This group in particular faces challenges with current healthcare options, because they often face long wait times for appointments with qualified medical professionals, but their issues are pressing, hard to predict and often immediate in nature. Traditional care is also very expensive, and Mindstrongmodel has been shown to drive better results for patients, and to lower cost for insurance companies and other payers. Backed by ARCH Venture Partners, General Catalyst, Bezos Expeditions and more, the company has a number of ongoing trials with healthcare providers and patients, and based on the positive outcomes they&ve seen from this work, the goal now is to refine and prepare the product for commercial use.

Grafnew leadership team also shares a lot of experience building products that benefit from optimization based on interpretation of large data sets, and thatalso not a coincidence. Part of Mindstrongunique approach has been developing a way to quantify SMI issues in a way that makes it possible to anticipate problems based on signals from how a user is interacting with the app, including typing speed an other cues, as compared to an established personal baseline. Ita big data problem, but instead of solving something like routing on-demand transportation, ittackling the issue of delivering reliable, quality care to individuals who are most in need.

- Details

- Category: Technology

Read more: Mindstrong Health hires leadership team with all-star tech product experience

Write comment (99 Comments)Page 154 of 5614

15

15