Technology

- Details

- Category: Technology

Read more: Good tech talent is still hard to find (how to bridge the gap)

Write comment (95 Comments)

This big bank has its DR/BCP systems located across the river, and it decides to move the IT portion from one city to another several miles away, says pilot fish. The vendor in charge of this move says itgoing to take a few months to get the new comms lines up, and thenit will order a new set of servers for the new site, and thenit will set them up — all of which will take a few moremonths.

Once the lines are in, fish has friendly chat with a systems engineer at the vendor, a take-charge type of guy. They conspire to meet at the old site, where they disconnect servers and cart them down to the engineerown car. Once itloaded to the ceiling, they head off to the new site. There, they cart it all up to the new DR cage and hook it all up to the new lines. The engineer logs in, makes IP address adjustments, and soon the bank has one of its two backup systems up and running in the new location.

To read this article in full, please click here

- Details

- Category: Technology

Read more: Sometimes you win one

Write comment (94 Comments)

MicrosoftWord mobile app passed a milestone over the summer: the Android version has been downloaded more than one billion times, according to the Google Play Store. Apple doesn&t provide download figures on its App Store, but with more than 608,000 ratings, the iOS version of Word is clearly popular as well.

How to share a document

To read this article in full, please click here

(Insider Story)- Details

- Category: Technology

Read more: Microsoft Word for Android (and iOS) cheat sheet

Write comment (96 Comments)Marvel has a trailer out for Black Widow, the story focused on the member of the Avengers team played by Scarlett Johansson. This preview of the movie features a lot of heart-pumping action, and an all-star cast that includes Rachel Weisz, Florence Pugh, David Harbour, and of course, Johansson herself.

What we get in this trailer is a look at a movie that appears to span multiple genres & it starts off looking very much like a Bourne-esque spy thriller with exciting, somewhat gritty hand-to-hand fight scenes. Later on, though, it seems to show more superhero vibes in the tradition of the big and glossy Marvel cinematic universe, though leaning more towards Captain America: Winter Soldier than the big tent circus set pieces of the core Avengers lineup, or the wacky, neon glare of the Guardians franchise and the most recent Thor.

Black WidowRussian spy background is clearly on display here, and it looks like theregoing to be a very weird ‘family reunion& on display with some Russian heroes. Overall, it looks entertaining as heck & and it has a lot to live up to, as the first Marvel Studios film after Avengers: Endgame (Spider-Man: Far From Home only gets partial credit because of the shared character ownership with Sony).

- Details

- Category: Technology

Read more: Marvel’s new ‘Black Widow’ trailer teases the spy thriller Natasha Romanoff deserves

Write comment (100 Comments)Cyber Monday — the final day of the extended Thanksgiving weekend that traditionally kicks off holiday season spend — broke another e-commerce record: US shoppers racked up a total of $9.2 billion in online sales, according to figures from Adobe.

To put that number into some perspective, at its peak, consumers were spending $11 million per minute; this was the first day to see sales via smartphones break the $3 billion mark; and this was $1.3 billion more than shoppers spent on Cyber Monday a year ago (remember the days when breaking $1 billion was a big deal?). There has so far been just over $72 billion spent online since the beginning of November.

On the other hand, there is an undercurrent of more sluggish buying than had been anticipated. Following the pattern set during Thanksgiving and Black Friday — the total actually just fell short of what Adobe had expected for the day, which was $9.4 billion. Adobe expected an increase of nearly 19%; in the end it was more like 16.5%.

(And it should be noted that a forecast for sales Salesforce was even more conservative: it projected that Cyber Monday sales would total $8 billion in U.S. sales and $30 billion worldwide — representing 15% and 12% year-over-year growth, respectively.)

Thatdespite very aggressive pricing on the part of online sellers. &Retailers unlocked sales earlier to combat a shorter shopping season, while continuing to drive up promotion of the big branded days including Black Friday and Cyber Monday,& said John Copeland, head of Marketing and Consumer Insights at Adobe, in a statement. &Consumers capitalized on deals and ramped up spending, especially on smartphones, where activity increased on days when shoppers were snowed or rained in.&

Top items sold on the day included Frozen 2 Toys, L.O.L Surprise Dolls, NERF products, Madden 20, Nintendo Switch, Jedi Fallen Order, Samsung TVs, Fire TV, Airpods and Air Fryers. One report claims Apple may have sold as many as 3 million pairs of AirPods from Black Friday until Cyber Monday. (RIP my bank account.) The best deals on the day were for TVs (19% savings on average).

The final figures for the day might have a slight shift as Adobe finishes all of its tallies. It follows a morning total of $473 million, and sales passing the $5 billion mark at 5pm Pacific time — a sign of just how much shopping online — more than $4 billion — happens in the evening hours (indeed, some refer to them as the &golden hours& of retail).

(Adobeforecasts and reports are based on over 1 trillion visits to U.S. online retail sites and 55 million SKUs. And its Adobe Analytics service is able to measure transactions from 80 of the top 100 U.S. retailers.)

While Black Fridayonline shopping has seen brick-and-mortar stores competing for the same shoppers, and Thanksgiving still has a seam of tradition underpinning it that keeps some people away from consumerism, Cyber Monday is the day of sales and shopping perhaps most dedicated to the pursuit of product procurement via the web. Folks are back at work, and less likely to go into physical stores, but they&re still shopping for holiday bargains.

The $3 billion of products purchased via smartphones accounted for about one-third of all sales. In itself, this is huge, as smartphone growth was up 46%: in other words, smartphone growth is outpacing and very much driving overall growth of online sales.

Browsing continues to also be popular but is growing less fast: smartphones drove 54% of all site visits, up 19% on a year ago. This makes sense since people might casually look for deals while on the go, but when it comes to sitting down and doing all the fiddly parts of entering card numbers and addresses, people opt for more comfortable keyboards and larger screens.

Some of the trends that Adobe picked up in the days leading up to Cyber Monday are continuing to be played out. These include the fact that the big are getting bigger. That is to say, larger e-commerce giants, with sales of over $1 billion annually, continue to make the most during these huge promotional periods.

Their sales have gone up 71% this year, compared to smaller retailers& share going up by just 32%. They saw a 71% boost in revenue so far, while the smaller online retailers saw a 32% boost.

Part of the reason for this is because larger retailers can give bigger discounts; because they simply have larger ranges of items; and lastly because they have a more flexible range of choices when it comes to delivery. Adobe noted that the trend of &buy online, pickup in-store/curbside& services was up 43% over last year.

Through this weekend, consumers spent $7.4 billion, including &Small Business Saturday& and &Super Sunday,& which are newer terms for the big shopping days after Thanksgiving and Black Friday.

In addition to the usual factors that influence Cyber Monday sales, this yearshopping period may get a boost from the bad weather, too (storms are currently swirling around different regions of the US). When extreme weather arrives, shoppers tend to stay indoors and shop at home. On Black Friday, for example, states that recorded more than two inches of snow saw a 7% bump in online sales.

&Online shopping received some unexpected boosts this holiday season. Retailer fears of a shorter season meant that deals came much sooner than usual, and consumers took notice. In some areas of the country, adverse weather in the form of snow and heavy rain meant that many opted to stay home instead and grabbed the best deals online. Just look at Black Friday, which brought in $7.4 billion online and is just below last yearCyber Monday at $7.9 billion,& said Taylor Schreiner, principal analyst and head of Adobe Digital Insights.

&Consumers are reimagining what it means to shop during the holidays, with smartphones having a breakout season as well. We expect that consumers will spend $14 billion more this holiday season via their phones,& Schreiner added.

Last but not least, another trend Adobe is tracking points to why the biggest online retailers like Amazon are getting increasingly involved in the advertising business. Adobe notes that paid search accounted for 24.4% of sales (up 5.2% on last year), more than three percentage points more than actual direct traffic (21.2% and declining). &Natural& search accounted for 18.8% of sales, while email accounted 16.8% (up 8.9% YoY). Social media, as a category, has &minimal impact& when it comes to driving online sales (just 2.6%) but — true to form — itproving to be a big influencer, driving some 8% of visits and up 17.5% over a year ago.

Updated with final figures from Adobe

- Details

- Category: Technology

Read more: Cyber Monday totalled $9.2B in US online sales, smartphones accounted for a record $3B

Write comment (97 Comments)Xiaomi, the top smartphone vendor in India, today joined a growing wave of fintech startups in the nation that are offering credit to aspirational young professionals and millennials.

The Chinese electronics giant said today it is launching Mi Credit, its curated marketplace for digital lending, that offers users credit between Rs 5,000 ($70) and Rs 100,000 ($1,400) at &low& interest rate.

Xiaomi said it has partnered with a number of startups such as Bangalore-based ZestMoney, CreditVidya, Money View, Aditya Birla Finance Limited, and EarlySalary to determine who should get a credit and then finance it.

Users are required to let Mi Credit app access their texts and call logs to look for transactional information and some other details to assess whether they are credit-worthy. This whole process takes just a few minutes and eligible users can walk out with some credit,said Manu Jain, Vice President of Xiaomi, at a conference in New Delhi.

He added that having multiple partners for the crediting platform ensures that the likeliness of a user securing a loan is high. Once a user has secured a credit from the app, they can avail more credit in the future with a single click, the company said.

For startups that have partnered with Xiaomi, the big draw is access to a large user base, an executive with one of the partner startups told TechCrunch.

Xiaomi, which has been the top smartphone vendor in India for nine consecutive quarters, has an install base in tens of millions in the country. The company has shipped more than 100 million smartphones in the country, it recently revealed.

Xiaomi said the Mi Credit app will be preinstalled on all Xiaomi smartphones running Android -based MIUI operating system. The app is also available for non-Xiaomi Android smartphone users from the Google Play Store. (Itnot available for iPhone users.)

A wave of fintech firms have emerged in recent years in India to help millions of users secure credit and other financial services for the first time in their lives. The penetration of credit card remains very low in the country (roughly three in 100 people in India have a credit card.) This has meant that very few people in the nation have a traditional credit score.

This void has created an immense opportunity for startups to explore a range of other data points to determine who should get a loan. In emerging markets such as India, where the laws are lax, nobody appears to be alarmed with the idea of a company gleaning a lot of sensitive details.

As of today, Mi Credit is available to users in 1,500 zip codes, or 10 states in India. The company said it plans to extend the credit service to all of India by March next year.

Partner startups involved declined to comment on the financial arrangement they have with Xiaomi. The aforementioned unnamed executive said the agreement would vary with partners and the kind of product they are bringing to the table.

Xiaomi said it has deeply integrated its partners& offerings into the app. As a result, users are able to see details such as disbursement of loans, lower interest, and credit score in real time.

The company began testing the app with some users in India last month. During the trial, it disbursed loans of over 280 million Indian rupees ($3.9 million).

For Xiaomi, the new offering would help it make its services ecosystem more engaging to consumers. The company, which recently posted one of its slowest growing quarterly reports, has been attempting to cut its reliance on hardware products and make more money off its internet services and through ads.

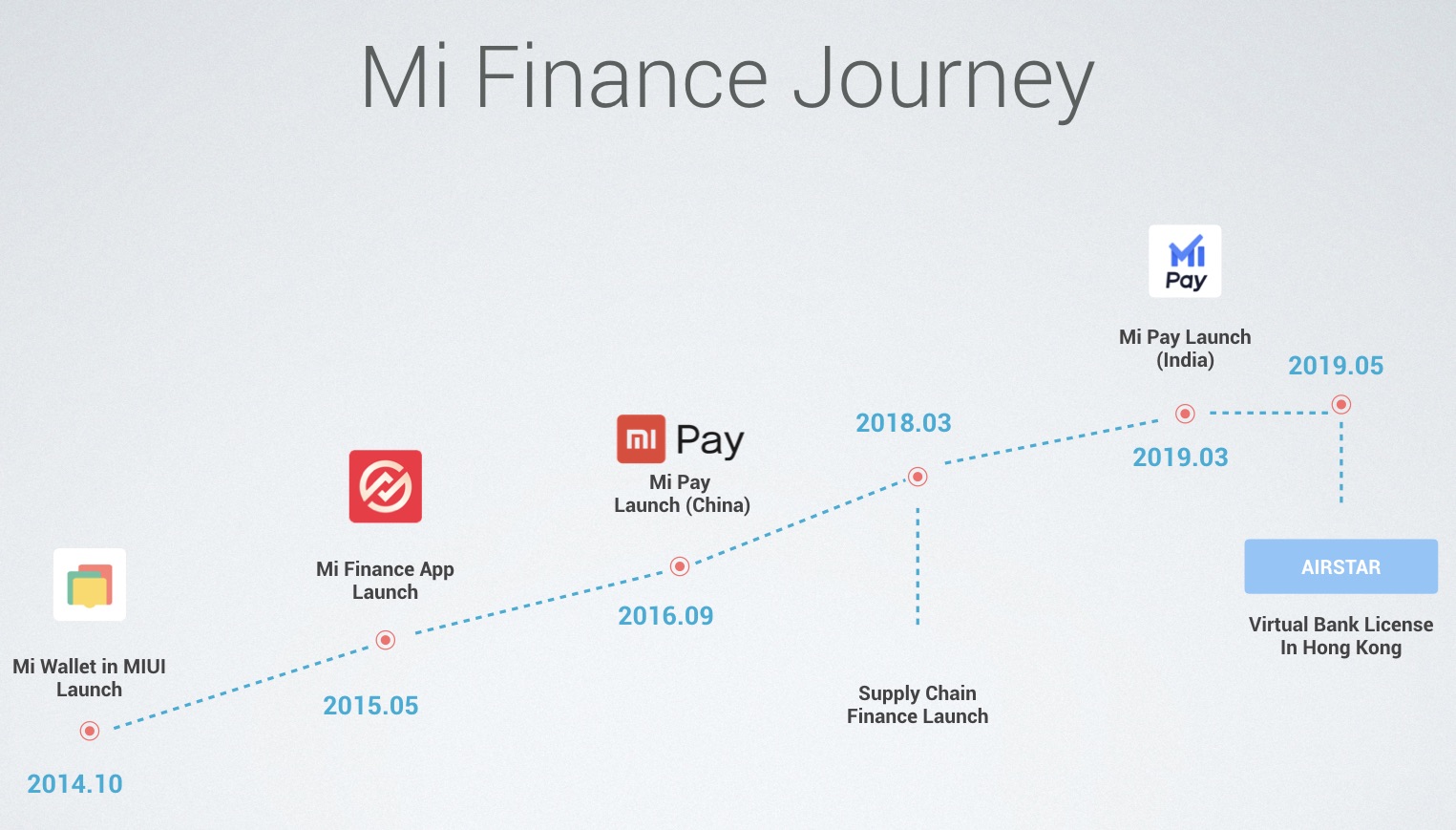

One of the services it is increasingly focusing on is Mi Finance. In a quarterly earnings call earlier this year, the company said, &we are also making it a point of focus to diversify our advertising customer base. We are achieving this diversification through expanding into more vertical industries, such as e-commerce, gaming, finance, education, and small and medium-sized enterprises.&

In March this year, Xiaomi launched Mi Pay, a UPI-powered payments app that is part of its Mi Finance ecosystem, in India. The app has already amassed over 20 million registered users in the country, company executives said today.

Hong Feng, co-founder and senior vice president of Xiaomi, said the company understands the consumption behaviour of its 300 million users.

&It is one of the strengths we aim to leverage to build a stronger Mi Finance business globally. We see a huge opportunity for consumer lending in India with estimations reaching up to $1 trillion dollars in digital lending by 2023, as per a report from BCG. This makes us believe that our Mi Finance business, based on solutions such as Mi Pay and Mi Credit can truly revolutionise the Indian FinTech industry,& he said.

- Details

- Category: Technology

Read more: Xiaomi launches app to offer credit to millennials in India

Write comment (97 Comments)Page 203 of 5614

16

16