Technology

While French President Emmanuel Macron and U.S. President Donald Trump initially reached a deal on Francetax on tech giants, the U.S. is moving forward with retaliation tariffs that could be as high as 100% on French goods (wine, cheese, handbags…).

The United States Trade Representative published a report following an investigation into the French tax. In a separate press release, it also recommends new tariffs and says that there could be more investigations into the digital taxes of Austria, Italy and Turkey.

&FranceDigital Services Tax (DST) discriminates against U.S. companies, is inconsistent with prevailing principles of international tax policy, and is unusually burdensome for affected U.S. companies,& the U.S. Trade Representative says.

French Finance Minister Bruno Le Maire already said on French radio that such tariffs could lead to a &strong European riposte.&

Earlier this year, France voted in favor of a new tax on tech giants. In order to avoid tax optimization schemes, big tech companies that generate significant revenue in France are taxed on their revenue generated in France.

If you&re running a company that generates more than €750 million in global revenue and €25 million in France, you have to pay 3% of your French revenue in taxes.

This tax is specifically designed for tech companies in two categories — marketplace (Amazonmarketplace, Uber, Airbnb…) and advertising (Facebook, Google, Criteo…). While it isn&t designed to target American companies, the vast majority of big tech companies that operate in France are American.

This summer, Trump criticized Franceplans on Twitter. &France just put a digital tax on our great American technology companies. If anybody taxes them, it should be their home Country, the USA,& he wrote. &We will announce a substantial reciprocal action on Macronfoolishness shortly. I&ve always said American wine is better than French wine!&

During the Group of Seven summit, it felt like the French government and the Trump administration found a compromise. The OECD is working on a way to properly tax tech companies in countries where they operate, with a standardized set of rules.

France promised to scrap its French tax as soon as the OECD implements its framework and pay back companies that overpaid before the OECD framework. For instance, if Facebook pays a lot of taxes in 2019 due to the French tax on tech giants and if they would have paid less under the OECD framework, France will pay back the difference.

But we&re back to square one and tariffs could jeopardize the OECDwork.

- Details

- Category: Technology

Read more: US could impose 100% tariffs on French goods following France’s tax on tech giants

Write comment (98 Comments)Vancouver based mobility startup Damon Motorcycles has entered the EV arena with a preview of its first e-moto, the Hypersport Pro.

The seed-stage company had previously focused on creating digital safety technology — like its 360 degree radar detection system — to augment two-wheelers made by other manufacturers.

Damon has determined to create its own EV model designed to overcome common flaws it sees in existing motorcycle offerings.

&We are for the first time being black and white about the fact that we are a full on producer and we have a motorcycle we&re going to unveil at CES,& Damon Motorcycle founder and CEO Jay Giraud told TechCrunch.

That machine is the fully electric Damon Hypersport Pro. The news is a pre-announcement ahead of the full January debut, so Giraud would not offer much in the way of core specs — such as price, range, charge-time, and performance.

He was clear the motorcycle is meant to be a direct competitor to the latest e-motos released by Harley Davidson and California based venture Zero Motorcycles — and to the gas-motorcycle market overall.

&We&ve come at this and the motorcycle problem in a way that no other company has,& Giraud explained.

&We&re trying to change the industry by addressing the issues of safety and handling and comfort and the problems that have persisted with everyone in the industry, including all the e-moto companies today.&

DamonHypersport Pro is designed around the companyCoPilot system, which uses sensors radar and cameras to detect and track moving objects around the motorcycle, including blindspots, and alert riders to danger.

Damon has also taken on the problem of one-size fits all in motorcycle design, integrating a system on its Hypersport Pro that allows for adjustable ergonomics. The startupdebut model will allow riders to electronically shift the motorcyclewindscreen, seat, footpegs, and handlebars to accommodate for different positions and conditions — from more upright city riding to more aggressive high-speed runs.

Damon Motorcycles is taking pre-orders for its Hypersport Pro and will skip dealers, opting to use a direct-sales and service model similar to Tesla . The startupVancouver facility is equipped to build 500 motorcycles a year, according to Giraud.

The company recently brought on Derek Dorresteyn, the former CTO of e-moto startup Alta, as its COO. Full specs of the Hypersport Pro will come next month at CES, but Giraud did offer a glimpse, saying it would be more competitive and more powerful than existing e-moto offerings.

The company recently brought on Derek Dorresteyn, the former CTO of e-moto startup Alta, as its COO. Full specs of the Hypersport Pro will come next month at CES, but Giraud did offer a glimpse, saying it would be more competitive and more powerful than existing e-moto offerings.

Harley Davidson released its first e-motorcycle — the $29K LiveWire — in 2019 and California EV startup Zero Motorcycles launched its $19K SR/F, both in bids to go take e-motos mass-market. Aside from the price-gap, both have comparable charge-times (about an hour), performance, and range (around 100 miles for combined city and highway riding).

The U.S. motorcycle industryhas been in pretty bad shape since the recession. New sales dropped by roughly 50% since 2008 — with sharp declines in ownership by everyone under 40 — and have never recovered.

Harley DavidonEV pivot is likely to bring e-moto offerings from the other large gas manufacturers, such as Honda and Yamaha, who are also attempting to revive sales to younger riders.

Harley DavidsonLiveWire

With Damonpivot to e-moto production, the startup is not alone. ItalyEnergica is expanding distribution of its high-performance EVs in the U.S. Other competitors include e-moto startupFuell, with plans to release its $10K, 150-mile range Flow in the near future.

Of course, therealready been some speed-bumps and market attrition, with three e-moto startups —Alta Motors, Mission Motors and Brammo — forced to power down over the last several years.

So how does Damon Motors plan to succeed as a new entrant in a motorcycle market with stagnant new bikes sales and increased EV competition from established OEMs and startups?

&We have so many advantages the others don&t have and we&re leveraging everyone of their weaknesses,& founder Jay Giraud said. The companydirect-sale model will lend to more competitive pricing and higher margins for R-D, he said.

Then there are what Damon Motorcycles sees as its Hypersport Propurposely designed comparative advantages over existing manufacturers.

&You&re gonna love the horsepower and range and all that good stuff, but thatnot what makes Damon different from every one else,& explained Giraud.

&Whatdifferent is that ita safer motorbike with the safety features and transforming ergonomics that will keep you from smashing into someonecar,& he said.

Not crashing into other peoplecars is certainly a compelling feature to offer in a motorcycle. Time and sales will ultimately tell how Damon fares in the inevitable cycle of events — profitability, failure, acquisition — that will play out in the increasingly competitive e-moto space.

- Details

- Category: Technology

Read more: Mobility startup Damon Motors enters e-moto arena with EV debut

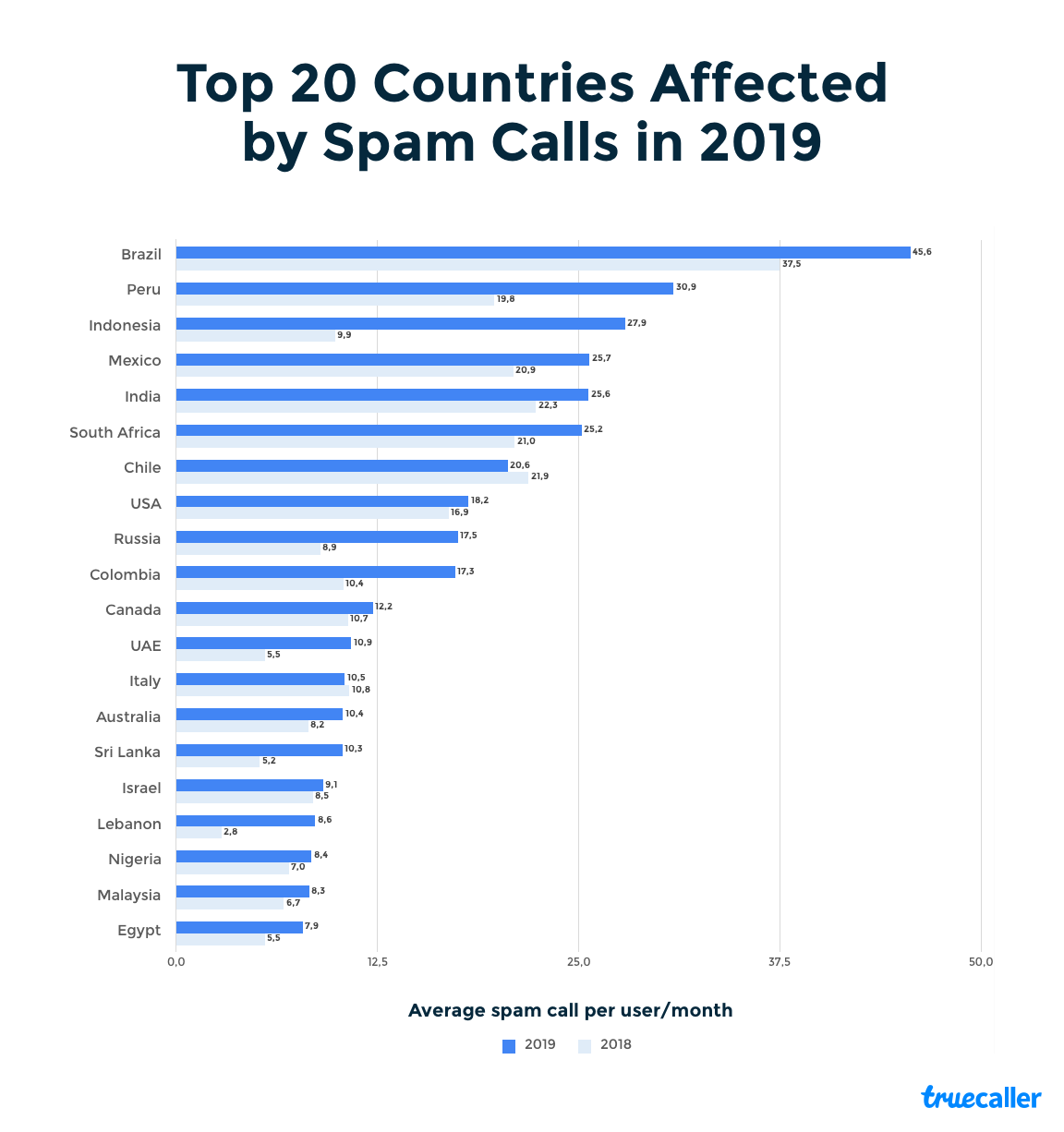

Write comment (98 Comments)Do you feel you have been receiving more spam calls of late? You are probably not wrong — or alone.

The volume of spam calls has grown by 18% globally this year, according to Truecaller. In its annual report published Tuesday, the Stockholm-based firm said users worldwide received 26 billion spam calls between January and October this year — up from 17.7 billion during the same period last year.

The United States remains the eighth most spammed country, where the volume of robocalls increased by 35% this year. In a separate report earlier this year, Truecaller estimated that 43 million Americans were scammed last year and lost about $10.5 billion. The growth is despite the efforts local carriers and authorities have made in the country.

Brazil again topped the list for the most spammed country. The culprit behind the increasingly growing spam calls in the country are its own telecom operators and internet service providers. Truecaller said that in the last 12 months, calls from the operators have increased from 32% to 48%.

&These calls are typically seeking to provide special offers and upselling data plans amongst other services. Scam calls continue to be a big problem in Brazil. Two years ago, only 1% of all the top spammers were scam related, last year it went up to 20% & and this year it is up to 26%,& it said.

One of the takeaways from the report is just how complex it is to understand the nature of these spam calls. There is no common thread — or culprit — behind these calls. In some markets, such as South Africa (ranked sixth in the report), spammers are mostly making fraudulent tech support calls and conducting job offer scams.

In some other markets, like Chile (placed seventh in the report), itdebt collectors that are placing 72% of all spam calls in the nation. In UAE, ranked 12th in the report, like Brazil, telecom operators were the ones making most of these pesky calls.

Peru, ranked second, and Indonesia, ranked third, have seen spam calls explode in the nation. In Peru, users received more than 30 spam calls in the month. Most of these calls were made by financial services that are looking to upsell credit cards and loans.

In Indonesia, spam call volume has doubled in one year. As the nation goes through tough times, scammers have tried to leverage on it, the report said. &One of the more common scams are the ‘one ring scam or Wangiri scam&. Another scam that has been going on lately is the fake hospital/injury call where someone would call and tell you that a family member or a friend is hospitalized and need immediate treatment, and you need to send them money in order for them to treat the patient.&

The position of India, where the number of mobile subscribers has ballooned from 1 million to more than a billion in two decades, is fifth on the table. Itbetter than before, but spam calls are still growing in the nation. In India, too, itthe telecom operator and telemarketers that are together making up for more than 80% of all spam calls.

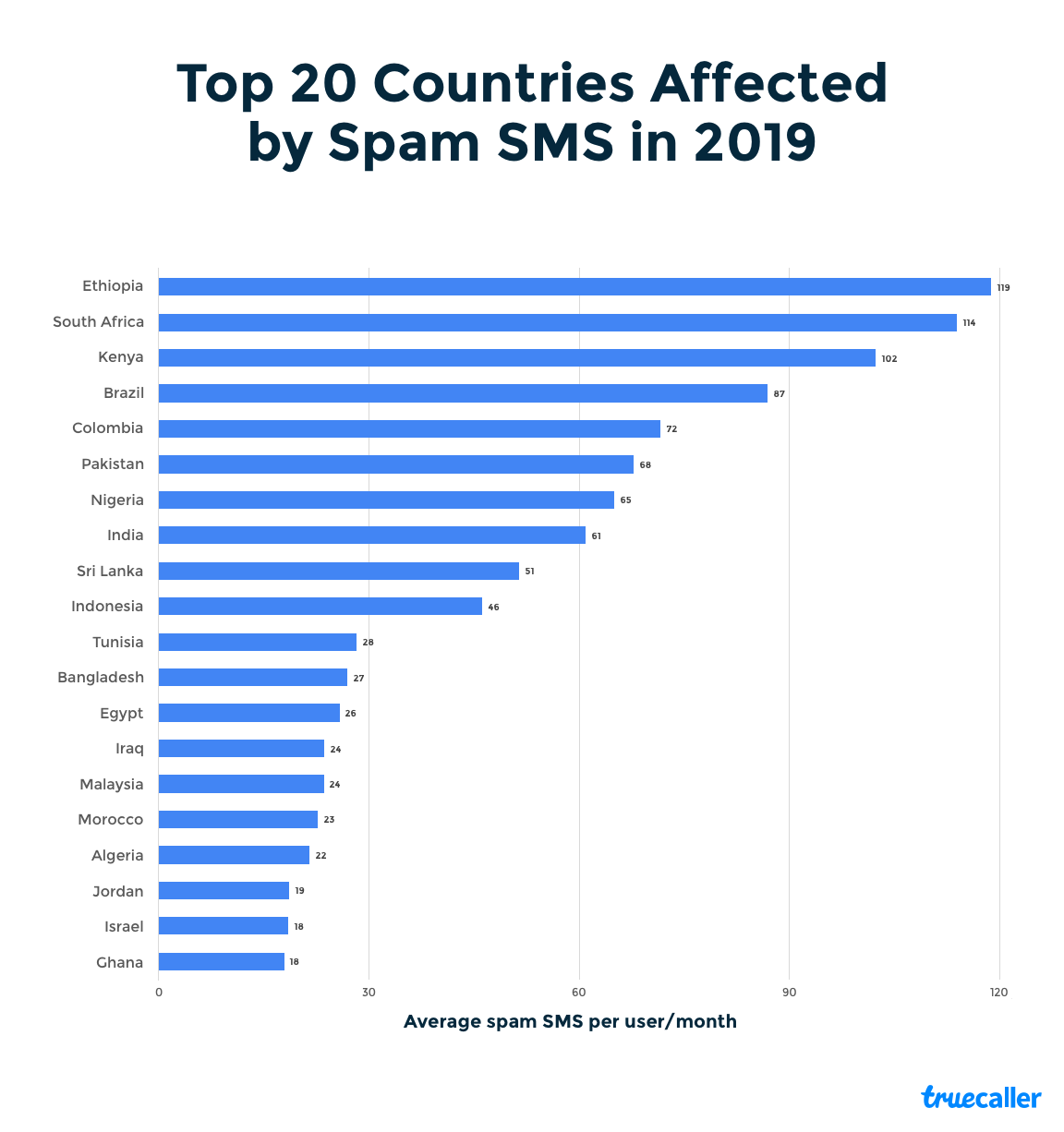

Truecallerreport also noted that users worldwide received more than 8.6 billion spam texts this year. Below is a chart that looks at the markets that are most affected with spam SMSs.

- Details

- Category: Technology

Read more: Spam calls grew 18% in 2019

Write comment (96 Comments)

Canadian venture capital firm Portag3 Ventures has closed a second fund focused on investing in fintech startup, with final commitments from institutional and strategic LPs totally $427 million CAD (around $320 million USD). The fund will before costing on early stage investments, and it&ll look to invest in companies globally, but with a particularly focus on Canada, the U.S., Europe and some markets in the Asia-Pacific region.

&We&re on a mission to build global champions from a Canadian base,& Portag3 CEO Adam Felesky told TechCrunch regarding the firmbase of operations and investment targets. &Canada has the talent, the expertise and one of the biggest markets in the world directly to our south. All the ingredients are there, we just need more success stories & and we are on our way to getting them. Success will breed more success. In order to understand what it takes to succeed globally, you need to invest and work with the best of the best from around the world. Many of the early fintech unicorns are based in Europe on the back of substantive, helpful policy changes. Canada needs to learn from these examples so we get the right ingredients for building a leading, vibrant ecosystem & and we slowly but surely are.&

Contributors to this new fund include Alterna Savings and Credit Union, Aviva France, BDC Capital, Caisse de dépôt et placement du Québec, CNP Assurances, The Co-operators, Eldridge Industries, Green Shield Canada and more. The list includes a lot of strategic investors, including LPs from Portag3first $198 million CAD ($149 million USD) close for this fund, which was announced in October 2018.

Portag3Fund II has already been making investments prior to this final closing, and has already put money into KOHO, Clark, Integrate.ai and startup-builder Diagram Ventures, along with 13 other startups. Its first fund invested in a number of fintech-related companies including Clearbanc, Drop, League, and Wealthsimple, as well as some companies that have already exited including Wave, Quovo and Zensurance.

Alongside the close of this funding, Portag3 has also recently set up a new group of senior advisors to work with the companies itinvesting in, and those advisors include financial industry heavyweights like Rockefeller Capital Management CEO and president Gregory J. Fleming, as well as former AIG president and CEO Peter Hancock.

- Details

- Category: Technology

Read more: Portag3 Ventures closes $320 million second fund focused on fintech investment

Write comment (97 Comments)

Xometry, the U.S.-based marketplace for on-demand manufacturing that raised $55 million in Series D funding this summer, has acquired Munich-based Shift as a path to European expansion.

Exact terms of the deal remain undisclosed, although the exit sees at least some of Shiftinvestors, such as Cherry Ventures, picking up shares in Xometry . I also understand the Shift team is staying on and the companyfounders, Albert Belousov, Dmitry Kafidov and Alexander Belskiy, will now be heading up Xometrynewly formed European business.

Specifically, via this acquisition, Xometry says will accelerate international expansion into 12 new countries, leveraging a now worldwide network of over 4,000 manufacturers. The companyon-demand manufacturing marketplace is already used by global companies like BMW and Bosch, which are Europe-based, and so it makes sense to have a much stronger operations in the continent.

&We&re eager to leverage Xometrytechnology to continue to scale our business in Europe,& says ShiftKafidov in a statement. &We look forward to providing our customers additional manufacturing capabilities, including additive manufacturing and injection molding&.

Shift claims to have built the largest on-demand manufacturing network in Europe and a customer base that includes some of the leading manufacturing companies in the region. Now operating as Xometry Europe, the subsidiary will continue to be headquartered in Munich in Germany, an area known for its manufacturing heritage.

Cue statement from Christian Meermann, Founding Partner, Cherry Ventures: &The custom manufacturing industry is a massive global market of over $100 billion. We&re excited for Shift to utilize Xometryindustry-leading technology as well as leverage the global manufacturing expertise from other Xometry investors, including BMW i Ventures and Robert Bosch Venture Capital&.

Xometry has raised $118 million since being founded in 2013. Over the past two years, the company has grown from 100 employees to over 300 while more than doubling revenue each year. Via its partner manufacturing facilities, the company offers CNC Machining, 3D Printing, Sheet Metal Fabrication, Injection Molding, and Urethane Casting.

Contrast that with Shift, which was founded in 2018 and had raised around €4 million (~$4.4m) to date. Sources also tell me that the startup had nearly closed a Series A round before Xometry preempted the investment by making an acquisition offer.

- Details

- Category: Technology

Read more: Xometry acquires European on-demand manufacturing marketplace Shift

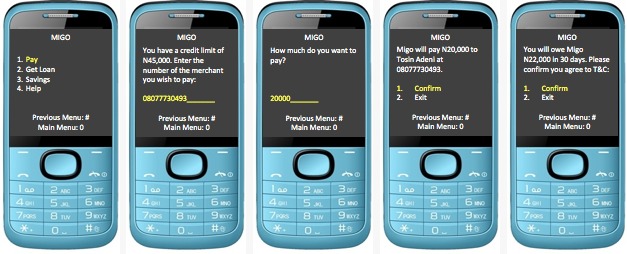

Write comment (98 Comments)After growing its lending business in West Africa, emerging markets credit startup Migo is expanding to Brazil on a $20 million Series B funding round led by Valor Group Capital.

The San Mateo based company — previously branded Mines.io — provides AI driven products to large firms so those companies can extend credit to underbanked consumers in viable ways.

That generally means making lending services to low-income populations in emerging markets profitable for big corporates, where they previously were not.

Founded in 2013, Migo launched in Nigeria, where the startup now counts fintech unicorn Interswitch and Africalargest telecom, MTN, among its clients.

Offering its branded products through partner channels, Migo has originated over 3 million loans to over 1 million customers in Nigeria since 2017, according to company stats.

&The global social inequality challenge is driven by a lack of access to credit. If you look at the middle class in developed countries, it is largely built on access to credit,& Migo founder and CEO Ekechi Nwokah told TechCrunch.

&What we are trying to do is to make prosperity available to all by reinventing the way people access and use credit,& he explained.

Migo does this through its cloud-based, data-driven platform to help banks, companies, and telcos make credit decisions around populations they previously may have bypassed.

These entities integrate MigoAPI into their apps to offer these overlooked market segments digital accounts and lines of credit, Nwokah explained.

&Many people are trying to do this with small micro-loans. Thatthe first place you understand risk, but we&re developing into point of sale solutions,& he said.

Migoclient consumers can access their credit-lines and make payments by entering a merchant phone number on their phone (via USSD) and then clicking on &Pay with Migo&. Migo can also be set up for use with QR codes, according to Nwokah.

He believes structural factors in frontier and emerging markets make it difficult for large institutions to serve people without traditional credit profiles.

&What makes it hard for the banks is its just too expensive,& he said of establishing the infrastructure, technology, and staff to serve these market segments.

Nwokah sees similarities in unbanked and underbanked populations across the world, including Brazil and African countries such as Nigeria.

&Statistically, the number of people without credit in Nigeria is about 90 million people and its about 100 million adults that don&t have access to credit in Brazil. The countries are roughly the same size and the problem is roughly the same,& he said.

On clients in Brazil, Migo has a number of deals in the pipeline — according to Nwokah — and has signed a deal with a big-name partner in the South American country of 290 million, but could not yet disclose which one.

Migo generates revenue through interest and fees on its products. With lead investor Valor Group Capital, new investors Africinvest and Cathay Innovation joined existing backers Velocity Capital and The Rise Fund on the startup$20 million Series B.

Increasingly, Africa — with its large share of the worldunbanked — and Nigeria — home to the continentlargest economy and population — have become proving grounds for startups looking to create scalable emerging market finance solutions.

Migo could become a pioneer of sorts by shaping a fintech credit product in Africa with application in frontier, emerging, and developed markets.

&We could actually take this to the U.S. We&ve had discussions with several partners about bringing the the technology to the U.S. and Europe,& said founder Ekechi Nwokah. In the near-term, though, Migo is more likely to expand to Asia, he said.

- Details

- Category: Technology

Read more: Credit startup Migo expands to Brazil on $20M raise and Africa growth

Write comment (96 Comments)Page 204 of 5614

9

9