Technology

Ualá, an Argentine personal finance management app, has raised a $150 million Series C led by Tencent and SoftBankLatin America-focused Innovation Fund.

Ualá is a mobile banking app and lending platform with services similar to Revolut, Monzo and Nubank. However Ualá has no intention of actually becoming a bank itself.

Founder and CEO Pierpaolo Barbieri, a Buenos Aires native and Harvard University graduate, says his ambition was to create a platform that would bring all financial services into one app linked to one card. As it exists now, Ualá is linked to a prepaid, global Mastercard and allows users to transfer money, invest in mutual funds, request loans, pay bills and top-up prepaid services.

Although SoftBank has rapidly deployed its Latin America-focused Innovation Fund (most recently witha $140 million investment in VTEX, a Brazilian e-commerce platform used by Walmart), UaláSeries C marks SoftBankentry into Argentina. While Argentina is well known developer talent and high entrepreneurial spirit, the country has remained under-capitalized.

Argentina is in the midst of a presidential leadership shift, as well as a $330 billion debt uncertainty. However personal mobile banking services like Ualá that promote a financial system that is more open, inclusive and competitive, are resonating with both the market and investors.

Barbieri doesn&t have his sights set on expanding Ualá into any other Spanish-language countries at this time. Ualá has 1.3 million issued cards in a market of 45 million people & so therestill a lot more work to be done in Argentina alone.

Buenos Aires-based Ualá closes a $150 million Series C

What exactly does Tencent gain by partnering with these country-specific fintechs? The Shenzhen-based internet giant and WeChat parent company wrote the playbook on mobile payments and has strategically invested in other Latin America fintechs like Nubank. Tencent clearly wants a granular understanding of the Latin America consumer spending behavior and market & and has the capital in the form of large and consistent checks to back it up.

While itunclear if there are any WeChat/Ualá collaborations on the product roadmap, Barbeiri explains that working with Tencent will help them learn how to create a product that drives daily engagement.

When it comes to capital deployment, Barbieri tells me that the money will be used to triple the company in size, hiring about 400 people between operations and technical roles. The new capital will be used to scale the teams that touch partnerships and business development, too. Ualá has existing partnerships with tech companies like Netflix, Rappi and Spotify, and intends to strengthen and expand similar deals over time.

The fintech launched in October 2017, and last raised $34 million in 2018 led by Goldman Sachventure unit, along with Ribbit Capital and Monashees. Tencent also invested an undisclosed amount earlier this year in March. The most recent round brings Ualátotal funding to $194 million. Barbieri declined to comment or benchmark Ualávaluation.

- Details

- Category: Technology

Read more: Argentine fintech Ualá raises $150M led by Tencent and SoftBank

Write comment (92 Comments)There has been a mountain of press lately about how investors are souring on unprofitable unicorns.

We&ve seen this movie before; for a while, itall about growth, and profits be damned, then the winds change, and everyone focuses on &capital efficiency,& or similar jargon meaning, &how can I get big returns without having to put much money at risk?&

The winds blow back and forth. Until very recently, everyone was in love with consumer unicorns again. Now investors are licking their wounds, except for those who eschewed the name brands and went for boring old B2B and infrastructure companies. They are doing just fine, thank you.

Why are investors overpaying for household-name unicorns? Is it that they really believe they are good assets, or are other factors at play? The fact is that venture funds and private equity funds are competing for investment funds themselves. I am personally an investor in several venture funds, and I have heard the pitch, &we were investors in Facebook, Instagram, Uber, Twitter (or whatever), and we can get you access to these deals.& Sounds good, but what they don&t tell you is how much they paid (or overpaid) to be part of these deals. Itsuch nonsense and the perennially poor returns delivered by the ego-driven venture capital industry are its just rewards.

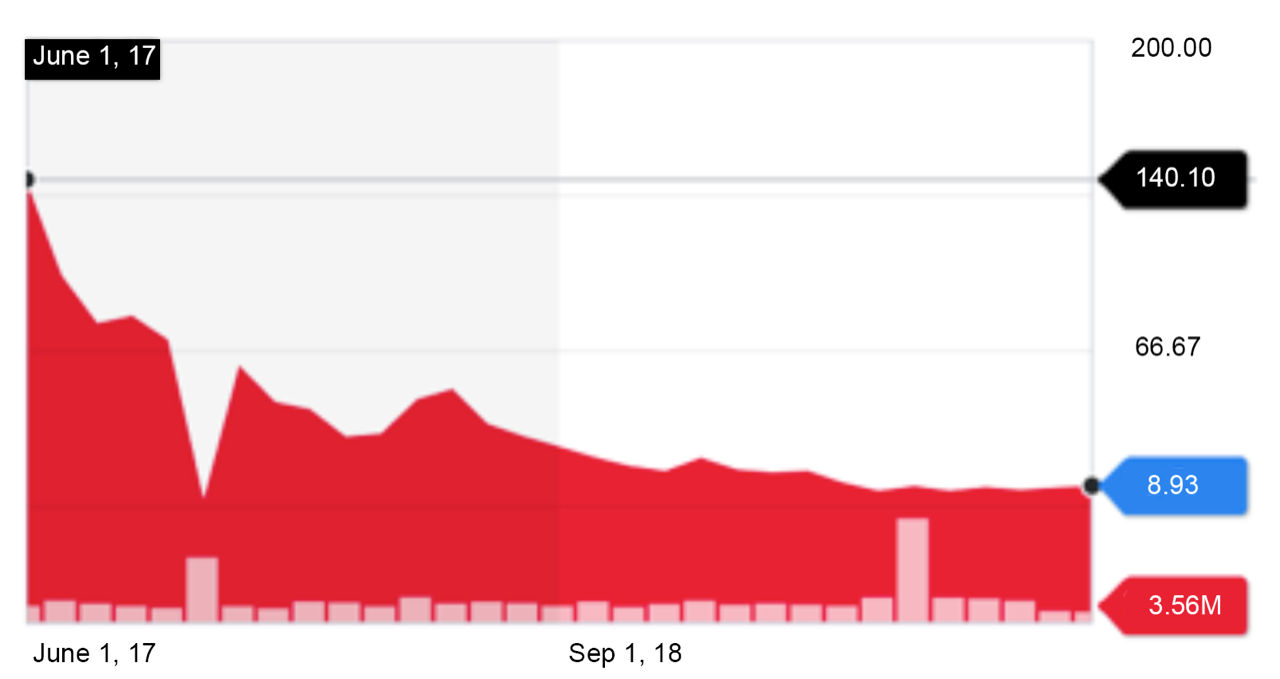

Downward stock valuations of unicorns post-IPO. (Yahoo Finance)

Investors who bid up the valuations of high-profile unicorns are of course hoping that an IPO will eventually bail them out. The problem is that public fund managers, like Fidelity or Blackstone, who control most of post-IPO stocks, look at the value of a company quite differently. They see a company&value& as the sum total of all the companyfuture profits. They can&t offer their clients &exclusive& access to hot deals. We&re talking public stocks that anyone can buy.

If nobody can see a clear road to profitability, then this hard-nosed approach to valuation will lead to stocks tanking after an IPO. Thatrecently been the case with We, Uber, and numerous others.

From 2010 to the first quarter of 2015, investors collectively poured $9.4 billion into the on-demand economy, according to data from CB Insights. Uber accounted for 58% of the $4.12 billion raised in 2014. Whatalso striking is how quickly the industry piled onto the latest thing between 2013 and 2014. Since its IPO in May of 2019, Uberstock has fallen nearly 40% from its peak, Lyft is down even more, and Softbankmost recent investment in We appears to have wiped out nearly 80% of its previous private valuation. Masayoshi Son has been publicly apologizing for his investment in We: &My investment judgment was poor in many ways,& said Son.

- Details

- Category: Technology

Read more: The herd sours on unprofitable unicorns again

Write comment (91 Comments)

Computer scientists agree that artificial intelligence will have a stunning impact on the future of humanity. And more often than not, futurists depict a dystopian outcome & a world where we are at best subservient to machines and at worst exterminated by them. Computer scientist Stuart Russell, one of the worldtop experts on AI and author of the recently published &Human Compatible: Artificial Intelligence and the Problem of Control,& will join us at TC Sessions: Robotics - AI (March 3 at UC BerkeleyZellerbach Hall) ), to discuss how researchers and founders today will determine AIultimate impact.

At a time when the debate about AI seems to be polarized between the alarmists predicting the imminent &singularity& and those pooh-poohing the advent of human-level AI, Dr. Russell, a professor of computer science at UC Berkeley, cuts through the debate to argue that we still have time to ensure that the doomsayers are proven wrong. As Dr. Russell argues in &Human Compatible,& the key is to ensure that AI designs &will necessarily defer to humans: they will ask permission, they will accept correction, and they will allow themselves to be switched off.&

Dr. Russell believes that super human-level AI is likely a generation or two away, though he allows that unexpected breakthroughs & like Leo Szilardtotally unexpected breakthrough on nuclear chain reactions in 1933 & could hasten the day. Regardless of the timeline, Dr. Russell argues that the current approach to AI is dangerous to the future of humanity. For his part, Dr. Russell is literally re-writing his textbook on AI to advance what he has described as a Jeeves-like humility in future AI systems and spurring related research through organizations like The Center for Human Compatible AI (CHAI).

Join our 4th annual TC Sessions: Robotics - AI on March 3 at UC BerkeleyZellerbach Hall for a remarkable day with the worldtop roboticists, investors, founders, and AI engineers. The day features a full day or programming lead by TechCruncheditors on the main stage, a pitch-off competition featuring early-stage startups, numerous breakout and speaker Q-A sessions, and much more.

Get your early bird pass here. Interested in sponsoring? Please get in touch.

- Details

- Category: Technology

Read more: AI expert Stuart Russell to join TC’s Robotics+AI 2020 at UC Berkeley

Write comment (95 Comments)

Google has terminated Rebecca Rivers, an employee activist the company put on indefinite administrative leave this month, Rivers tweeted this afternoon.

Google declined to comment but confirmed an internal note published by Bloomberg, which said Google fired a total of four employees for repeatedly violating its data-security policies.

Earlier this month, Google put Rivers and Laurence Berland on leave for allegedly violating company policies. At the time, Google said one had searched for and shared confidential documents that were not pertinent to their job, and one had looked at the individual calendars of some staffers.

Protestors on Friday, however, said Google was punishing Berland and Rivers for speaking out against the company. The rally, where both Berland and Rivers spoke, was in protest of their administrative leaves.

Ahead of the rally, organizers said the &attack& on Rivers and Berland &is an attack on all people who care about transparency and accountability for tech.& Organizers pointed to how Rivers helped create the petition to demand Google end its contract with U.S. Customs and Border Protection, and how Berland has participated in a number of worker-organized campaigns, including the one resisting YouTuberole in facilitating hate speech.

Since themassive employee-led walkout last November, organizers say Google has tried to undermine further attempts to organize. In July, walkout co-organizer Meredith Whittakerleft the companyfollowingreports of retaliation in April.Organizers of the rally say both Rivers and Berland were put on leave for &simply looking at openly shared internal information.&

This comes shortly after The New York Times reported Google hired an anti-union firm, ISI Consultants. Google employees, who the Times kept anonymous, discovered Googlerelationship with ISI via internal calendar entries.

- Details

- Category: Technology

Read more: Google employee activist says she’s been fired

Write comment (95 Comments)Update: Elon Musk responded and this might happen. See below.

Elon Musk took a big swipe at Ford during the unveiling of the Cybertruck. Mid-presentation, he played a video of a Cybertruck pulling an F-150 in what was pitched as a head-to-head contest. Many have questioned if it was a fair fight (I don&t think it was)… including Sundeep Madra, VP of Ford X, the automakerventure incubator.

Madra tweeted to Elon Musk today, calling for TeslaCEO to send Ford a Cybertruck to do an &apples to apples& test.

The test showed by Tesla is questionable on several levels. First, the Cybertruck is dramatically heavier, particularly in the rear-end. The Ford used in the test appears to be in 2-wheel drive mode running on older tires. Without weight on the rear wheels, and the front axle spinning freely, the Ford is at the mercy of the heavier all-wheel drive Cybertruck.

The Ford appears to be a mid-level XLT trim and itimpossible to identify the engine used. However, the truck lacks the badging used with Fordtop-of-the-line 3.5L Ecoboost, which seems to indicate the truck sports a lower-end V8 or Fordsmaller 2.7L Ecoboost. Either way, itnot a fair fight under the hood.

Other factors are at play, too. The Cybertruck pulls first, increasing the Teslatraction and decreasing the Ford&s. (Also, Tesla, when towing a vehicle from a standstill, itcritical to ensure the slack is removed from the line. Itdangerous to do otherwise. That line can snap.)

In the end, though these butt-to-butt pull challenges are fun to watch but don&t prove much relevant to the real world. A better tow test would involve weighted trailers and conclusions based off of range and weight.

Ford is among a handful of automakers developing an electric pickup that will compete against the Tesla Cybertruck. The F-150 is the automakerbest selling vehicle and critical to its balance sheet.

The Cybertruck upends decades of truck styling and functionality by taking the unibody form and function to an extreme. The polarizing design has led to countless memes and digs at Tesla, but also over 200,000 in pre-orders in just a few days.

Looks like astrophysicist Neil deGrasse Tyson has issues with the physics of the situation, as well.

Update: Elon Musk responded. Hopefully this happens. And then happens again when Ford launches its electric F-150 that recently pulled (not towed) over 1 million pounds.

- Details

- Category: Technology

Read more: Ford VP challenges Tesla to a fair F-150 vs Cybertruck tow battle

Write comment (93 Comments)Almost as soon as &Baby Yoda& (or &Yoda Baby&?) debuted on the wildly popular new Disney Plus series &The Mandalorian,& a thousand internet memes bloomed in its wake.

Yet, nearly as quickly as the image took hold everywhere online, it was mysteriously pulled — as if a thousand bounty hunters all got the same tracking fob.

Initially, outlets like Vulture, which had a slew of adorable baby Yoda images, blamed an overabundance of caution from Walt Disney Co. for the disappearance of everyonefavorite new adorable Star Wars alien. But Disney, it turns out, (surprisingly) wasn&t to blame for the disappearance of Yoda Baby.

Rather it was Giphy, the maven of meme generation that was behind the dastardly deed, as initially reported by the BBC.

&Last week, there was some confusion around certain content uploaded to Giphy and we temporarily removed these GIFs while we reviewed the situation,& the company said in a statement. &We apologize to both Disney and Vulture for any inconvenience, and we are happy to report that the GIFs are once again live on Giphy.&

Itthe latest example of the overwhelming sensitivity and general joylessness that surrounds intellectual property and copyright in the age of corporate branding über alles.

TechCrunch has been weighing in on copyright claims and fair use for at least a decade. And for the past decade or more, killjoys have been ruining the remix culture that was part of the internetstrength in the first place. Corporations should lighten up — as some Twitter users have noted; they may be super-pumped with the results.

- Details

- Category: Technology

Read more: Baby Yoda memes return as Giphy stops pulling content over copyright concerns

Write comment (91 Comments)Page 261 of 5614

16

16

https://t.co/H3v6dCZeV5

https://t.co/H3v6dCZeV5