Technology

Google is launching a number of updates to its G Suite tools today that, among other things, brings to Google Docs an AI grammar checker, smarter spellchecking and, soon, spelling autocorrect. The company is also launching the ability for G Suite users to use the Google Assistant to read out a calendar schedule and, maybe even more importantly, create, cancel and reschedule events. Google is also adding new accessibility features to the Assistant for use during meetings.

In addition, Google yesterday announced that Smart Compose would soon come to G Suite, too.

Itmaybe no surprise that Google is adding its new grammar suggestions to Docs. This feature, after all, is something Google has talked about quite a bit in recent months, after it first introduced it back in 2018. Unlike other grammar tools, Googleversion utilizes a neural network approach to detect potential grammar issues in your text, which is quite similar to the techniques used for building effective machine translation models.

Google is also bringing to Docs the same autocorrect feature it already uses in Gmail. This tool uses Google Search to learn new words over time, but in addition, Google today announced italso introducing a new system for offering users more customized spelling suggestions based on your documents. That includes commonly used acronyms that may be part of a companyinternal lingo.

The new Assistant calendaring features are now in beta and pretty self-explanatory. Indeed, itsomewhat surprising that it took Google so long to offer these abilities. In addition to managing their calendar by voice, the company is now also making it possible to use the Assistant to send messages to meeting attendees and even join calls (&Hey Google, join my next meeting&). Surely thata handy feature when you&re once again running late to work and need to join an 8am call from your car while driving down the highway.

- Details

- Category: Technology

Read more: G Suite users get more AI writing help, Google Assistant calendar integration and more

Write comment (93 Comments)Michael Grimes has been called &Wall StreetSilicon Valley whisperer& for landing a seemingly endless string of coveted deals for his bank, Morgan Stanley. In more recent years, it has served as the lead underwriter for Facebook, Uber, Spotify and Slack. Grimes, who has been a banker for 32 years — 25 of them at Morgan Stanley — has also played a role in the IPOs of Google, Salesforce, LinkedIn, Workday and hundreds of other companies.

Because some of these offerings have gone better than others, Morgan Stanley and other investment banks are now being asked by buzzy startups and their investors to embrace more direct listings, a maneuver pioneered by Spotify and copied by Slack wherein rather than sell a percentage of shares to the public in a fundraising event, companies are essentially moving all their stock from the private markets to public ones in one fell swoop.

They cost the companies less money in banking fees. They also immediately free everyone on a companycap table to share their shares if they so choose, which has made the concept especially popular with VCs like BIll Gurley and Michael Moritz — though investors also cite the money that companies have been leaving on the table with traditional IPOs. Gurley specifically has talked publicly about underpriced offerings costing newly public outfits $170 billion over the last 30 years.

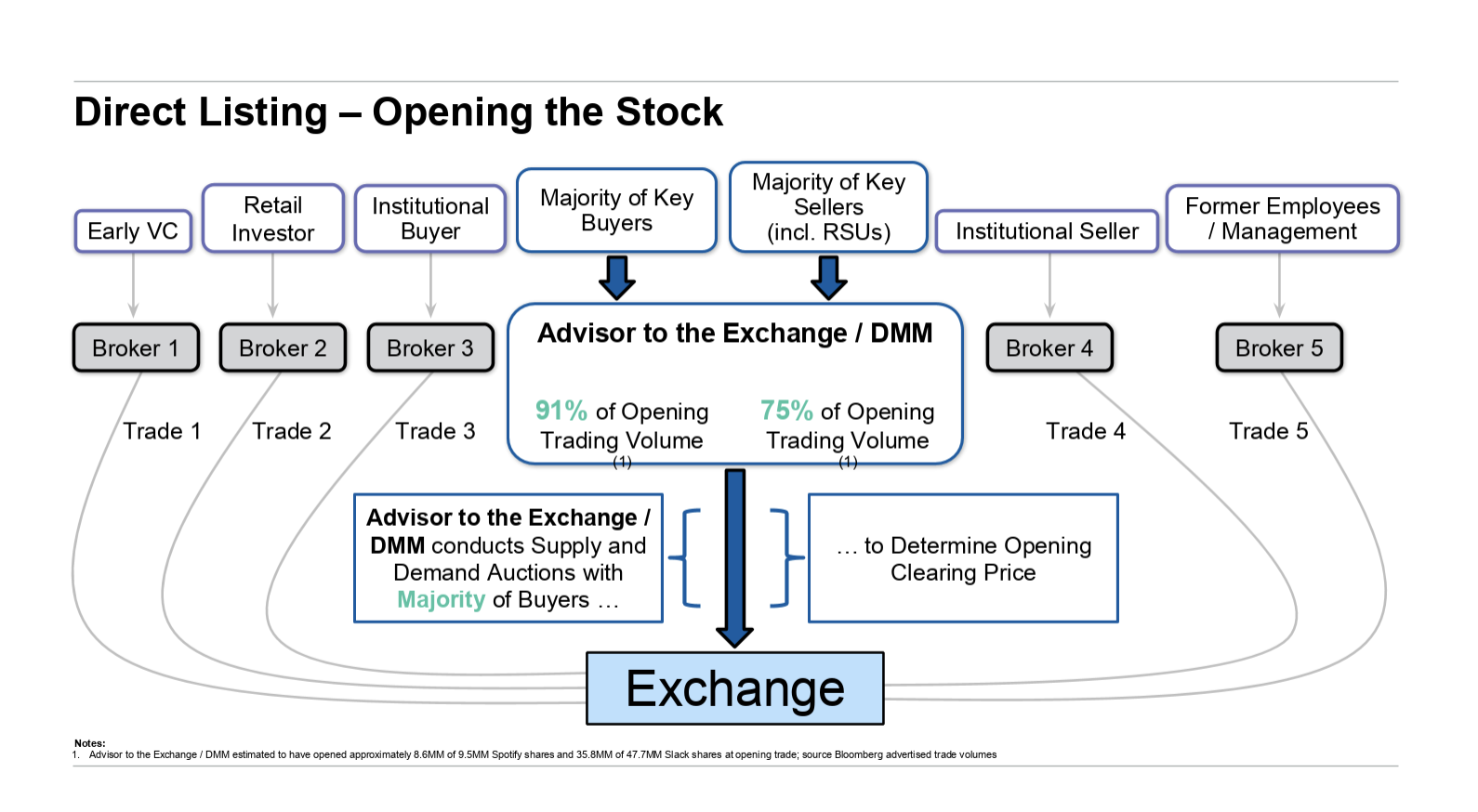

Grimes, in a rare public appearance last week at a StrictlyVC event, said he supports direct listings completely, calling the &pricing mechanism& more efficient, &absolutely.& He has reason to be a proponent of this new &product.& Both Spotify and Slack turned to Morgan Stanley to organize their direct listings — a process that involves running simultaneous auctions to determine the price at which demand and supply meet — and to ensure there would be enough liquidity for the listings to go smoothly.

Given the success of both, the bank is now better positioned than any to continue orchestrating direct listings for potential issuers, including, reportedly, Airbnb and DoorDash. (Grimes wouldn&t confirm the plans of any companies with which Morgan Stanley plans to work.)

Still, during last weeksit-down, we wanted to know more about how they work and whether therea chance that banks will eventually try to thwart the process, given that they require just as much work, are potentially less lucrative, and keep banks from rewarding some of their best customers — meaning the institutions that are accustomed to being funneled IPO shares ahead of retail investors in traditional offerings.

Grimes patiently sat through roughly 40 minutes of questions, all of which you can read tomorrow if you&re a subscriber of Extra Crunch, where much more of the transcript is being published. In the meantime, here are some highlights from our conversation:

Morgan Stanley was the lead underwriter for Uber. You don&t think Uber went public too late? It seems like it was enjoying a lot of momentum last year, so much so that it was reportedly told by bankers that it could be valued at $120 billion in an IPO — which is nearly triple where itvalued right now. Did you think it would go out at that number?

MG: If you look at how companies are valued, at any given point of time right now, public companies with growth prospects and margins that are not yet at their mature margin, I think you&ll find on average price targets by either analysts who work at banks or buy-side investors that can be 100%, 200%, and 300% different from low to high. Thata typical spread. You can have somebody believe a company will be worth $30, $60 or $80 per share three years out. Thata huge amount of variability.

So that variability isn&t based on different timelines?

MG: Itbased on penetration. Letsay, what, 100 million people or so [worldwide] have have been monthly active users of Uber, somewhere in that range. So what percentage of the population is that? Less than 1% or something. Is that 1% going to be 2%, 3%, 6%, 10%, 20%? Half a percent, because people stop using it and turn instead to some flying [taxi]?

So if you take all those variable, possible outcomes, you get huge variability in outcome. So iteasy to say that everything should trade the same every day, but [look at what happened with Google]. You have some people saying maybe that is an an outcome that can happen here for companies, or maybe it won&t. Maybe they&ll [hit their] saturation [point] or face new competitors.

Itreally easy to be a pundit and say, ‘It should be higher& or ‘It should be lower,& but investors are making decisions about that every day.

Is it your job to be as optimistic as possible about the pricing? How are you coming up with the number, given all these variables?

MG: We think our job is to be realistically optimistic. If tech stops changing everything and software stops eating the world, there probably would be less of an optimistic bias. But fundamentally — it sounds obvious but sometimes people forget — you can only lose 100 percent of your money, and you can make multiples of your money. I don&t think VCs are as risk-averse as they say, by the way. Some 80% or 90% of investments end up under water, and 5% or 10% produce 10 or 20 or 30x and so thatthe portfolio approach. Itnot as pronounced with institutional investors investing at IPOs, but itthe same concept: you can only lose 100 percent of your money.

Letsay you put five equal quantums of investment out to work in five different companies and one of them grows tenfold. Do I even need to tell you what happened with the other four to know you made money? Worst case, you&ve more than doubled your money, and therefore you&re probably going to lean into that again. So generally speaking, therean upward bias, but our job is to be realistic and to try to get that right. We view it as a sacred obligation. Therevariability and volatility within that. We try to give really good advice on receptivity. And when the process works as intended, we have predicted it as well as you can within a range of high variability.

This summer on CNBC, Bill Gurley told viewers that banks, including the top banks, have mispriced IPOs to the tune of $170 billion over the last three years, meaning thatthe amount of money that companies left on the table. Do you think we need direct listings and can you explain why they could potentially be better?

MG: Sure. We think Bill has done a great service by focusing a spotlight on the product, which we innovated with Spotify and then later with Slack . We do love the product, we&re bullish on it.

You&re asking how they work?

TC: Yes, as it relates to price discovery. So in a direct offering, you&re talking to people who own the stock and people who might want to buy the stock to figure out where they meet, which doesn&t sound that different than what goes on with a traditional IPO.

MG: Itactually different in a technical way. In a traditional IPO, therea range, letsay $8 to $10. And the orders we&re taking every day for two weeks, letsay, while the prospectus is filed, we&re taking orders from institutions [regarding] how many shares they want to buy within that range. That means generally within that range, they&re buying. Itnot binding but generally speaking, they&re going to follow through. If itoutside of that range, we have to go back and ask them again. So if therea whole lot of demand and the number of shares being sold is fixed so that supply is fixed . . . the companygoal is for oversubscription because they want an upward bias. They don&t want to trade up too much [and leave] money on the table and they don&t want to trade down at all — even a little bit — and they don&t want to trade flat because that could be [perceived] to be down; they want to trade up modestly. An exception was the Google IPO, which was designed to trade flat and traded up modestly, 14% or something like that.

The range might be moved once, maybe twice — because therenot a lot of time because therea regulatory review to turn it around — so [letsay] itmoved from $8 to 10 to $10 to $12 and therestill much more demand than supply; ita judgment call as to, is that going to price at $14? $15? $12? Some investors might think it should trade at $25 while others think it should trade at $12. So there could be real variability there, and when trading opens, only the shares that were sold the night before in the IPO, some subset of them are trading and thatit, everything else is locked up — the whole cap table. So for six months, itthose same shares trading over and over, other than maybe [a small sampling] or investors of former employees who weren&t locked up.

TC: Okay, so letswitch now to a direct listing.

MG: So with a direct listing, the company is not issuing any shares. There is no underwriting where the banks buy the shares and sell them immediately to institutional and retail investors. But there is market making and the way the trading opens is similar but the size is totally flexible. Thereno lock-up. The whole cap table can essentially sell shares, versus the average IPO right now where I think it16 percent of the cap table is sold in an IPO, and thatdown by half, by the way, from 15 years ago.

TC: So everyone can sell on day one, but are there handshake deals to ensure that not everyone dumps the shares on day one?

MG: No, thereno hidden agreement. They can sell as many shares as they want, but itgoing to depend on the price. The way a direct listing opens trading is a critical function because thereno order book. No one has been taking orders for two weeks. The company has met with investors and done investor education. We&ve helped them write a prospectus, etcetera, but there are no orders, thereno price range, and off we go. With Slack and Spotify, we were the bank responsible for the trading. What that means is on our trading floor in Times Square, our head trader, John Paci, and his team are in touch with anyone on the cap table who might want to sell and institutional investors who might want to buy, and whathappening are two auctions at the same time.

So in the traditional IPO, we were taking orders for size within a range that might move a little bit, [but] this is now any price. So take the buyers. [We&re trying to find out] who will pay $8 who will pay $12. Will anyone pay $16? So you&re taking that demand and sorting it by price. At the same time, you&re taking that supply, asking, ‘VC No. 1, is there a price at which you would sell shares?& If this person says, ‘Yes, but at $20& and we don&t have any demand at that price, then we figure out: who would sell at $18? Maybe VC No. 2 says they would sell 5 percent of their shares at $18. So we have some buyers, but itnot enough to open trading with enough liquidity, which is key to all this. If you had one VC and one buyer, the buyer would go away. They&d say, ‘You didn&t tell me I was going to be trading with myself.& So we have to figure out where a simultaneous demand auction for the highest price, and a supply reverse auction for the lowest price clears and meets. If you can move a billion dollars worth of stock at $14 and get demand for a billion worth of stock, then thatthe price.

Thatthen sent to the exchange where the exchange can take and add any other market maker or bank that has another seller or a buyer — so they add in, call it, another 30 percent from other brokers — and that produces the opening transaction.

Stay tuned tomorrow for much more from that interview, where other discussion areas included whether lock-up periods might eventually be done away with in traditional IPOs, why VCs are suddenly so motivated to bang the drum on direct listings, and what really went wrong with Googleauction-style offering back in 2004.

- Details

- Category: Technology

Exploring a distant moon usually means trundling around its uniquely inhospitable surface, but on icy ocean moons like SaturnEnceladus, it might be better to come at things from the bottom up. This rover soon to be tested in Antarctica could one day roll along the underside of a miles-thick ice crust in the ocean of a strange world.

It is thought that these oceanic moons may be the most likely on which to find signs of life past or present. But exploring them is no easy task.

Little is known about these moons, and the missions we have planned are very much for surveying the surface, not penetrating their deepest secrets. But if we&re ever to know whatgoing on under the miles of ice (water or other) we&ll need something that can survive and move around down there.

The Buoyant Rover for Under-Ice Exploration, or BRUIE, is a robotic exploration platform under development at the Jet Propulsion Laboratory in Pasadena. It looks a bit like an industrial-strength hoverboard (remember those?), and as you might guess from its name, it cruises around the ice upside-down by making itself sufficiently buoyant to give its wheels traction.

&We&ve found that life often lives at interfaces, both the sea bottom and the ice-water interface at the top. Most submersibles have a challenging time investigating this area, as ocean currents might cause them to crash, or they would waste too much power maintaining position,& explained BRUIElead engineer, Andy Klesh, in a JPL blog post.

Unlike ordinary submersibles, though, this one would be able to stay in one place and even temporarily shut down while maintaining its position, waking only to take measurements. That could immensely extend its operational duration.

While the San Fernando Valley is a great analog for many dusty, sun-scorched extraterrestrial environments, it doesn&t really have anything like an ice-encrusted ocean to test in. So the team went to Antarctica.

The project has been in development since 2012, and has been tested in Alaska (pictured up top) and the Arctic. But the Antarctic is the ideal place to test extended deployment — ultimately for up to months at a time. Try that where the sea ice retreats to within a few miles of the pole.

Testing of the roverpotential scientific instruments is also in order, since in a situation where we&re looking for signs of life, accuracy and precision are paramount.

JPLtechs will be supported by the Australian Antarctic Program, which maintains Casey station, from which the mission will be based.

- Details

- Category: Technology

Read more: Antarctic tests will prepare this rover for a possible trip to an icy ocean moon

Write comment (98 Comments)Google has joined Twitter in revising its political ad rules ahead of what promises to be a brutal election season. But while the latter chose to ban political advertising altogether, Google is mainly limiting the ability to target political demographics, and promises to take action against &demonstrably false claims.&

In a blog post Wednesday afternoon, the search giant explained the new rules in a way that is clearly intended to be understood by a broad audience, not the ad-buying elite.

&Given recent concerns and debates about political advertising, and the importance of shared trust in the democratic process, we want to improve voters& confidence in the political ads they may see on our ad platforms,& wrote Scott Spencer, VP of product management at Google Ads.

The primary change, he explained, will be the limitation of targeting terms that can be used for political advertising buys that appear in search, on display ads and on YouTube.

Google knows an immense amount about every one of its users, and as such can display ads to people who like certain products, are concerned with certain issues and so on. But starting in December, if the ad is political in nature, it will only be able to be targeted to age, general and postal code. (Notably, Twitter considers using ZIP codes µtargeting& and will not allow it for political content.)

Thatnice, but it should be noted that such microtargeting may not be necessary for political issues, since advertisers can target search terms like &South San Jose city council candidates& and they&re off to the races. They just can&t send ads to people because they&re a Democrat, a Republican, support marriage equality, handgun restrictions, etc… but they can buy ads for the search terms &gay marriage,& &assault rifle ban& and other items. Thatkind of fundamental to search-based ad buys.

At least it seems to be a step in the right direction — deep targeting for serious issues like that is not only unproven and controversial, but also fundamentally creepy. Better to do without it.

Google also said that italready &against our policies for any advertiser to make a false claim—whether ita claim about the price of a chair or a claim that you can vote by text message, that election day is postponed, or that a candidate has died.&

As further examples of what it would not allow, it cited &misleading claims about the census process, and ads or destinations making demonstrably false claims that could significantly undermine participation or trust in an electoral or democratic process.& That puts rather a fine point on it.

And as a warning to temper your expectations, Google noted that &no one can sensibly adjudicate every political claim, counterclaim, and insinuation,& so it plans to take &very limited& action, only for &clear violations.&

Funnily enough, of all the institutions on Earth, Google seems the one best suited to adjudicating content in that way. But &sensibly& is the key word here, and it is sensible for Google to avoid making promises it can&t keep.

Lastly, Google will be expanding its election-related ad transparency reports to include &state-level candidates and officeholders, ballot measures, and ads that mention federal or state political parties.& These will be publicly searchable like those for national candidates, as shown above.

That the major platforms are moving at all on this question of money in politics is good, but it is hard to say how these restrictions — such as they are — will affect how things play out. Itunlikely this is the last we&ll hear from Google, Twitter or others on the topic.

- Details

- Category: Technology

Read more: Google limits political ad targeting and all ‘demonstrably false claims’

Write comment (97 Comments)If you wander into the Bandit coffee shop in Midtown New York, you won&t be able to just walk up to the counter and order something. Instead, you&ll need to download a mobile app.

I experienced it for myself yesterday afternoon, when I — along with several other customers — pulled out my phone, downloaded the Bandit app, then used the app to create a profile, order and pay. A couple of minutes later, a barista called me up to the counter and handed me a pretty good cup of coffee.

In other words, while Starbucks has been experimenting with mobile ordering and payment, Bandit is betting entirely on what co-founder and CEO Max Crowley called a &mobile-only& store.

Obviously, this model can lead to some initial awkwardness, particularly if random passersby don&t understand it. But there are friendly Bandit staff members on-hand to help, and Crowley (who was previously the general manager of Uber for Business) said that this model offers an opportunity to create &a whole new type of experience.&

He pointed to the rapid growth of ChinaLuckin Coffee as an inspiration, and suggested that, ultimately, Bandit should offer customers the most convenient way to satisfy their coffee cravings: Wherever they are, they open the app and order the drink they want. Then they&ll be told when it will be ready, and where to pick it up.

Bandit can&t deliver that level of convenience for most customers quite yet, as it only has a single location. But Crowley said herethought other aspects of the coffee shop model.

For one thing, this first Bandit store is located in whatessentially a raw retail space. Crowley said his team has developed an 11&x11′ countertop where all the coffee is prepared — itassembled elsewhere and just needs to be plugged in, eliminating the need for an extensive buildout.

&We can launch [a new location] in a few hours, and we can do it at about a tenth the cost of a traditional store,& he said.

So the plan is to launch four or five more New York stores in the coming months, and to expand beyond New York by the end of the first quarter of 2020.

Crowley added that by keeping costs down, Bandit can also keep its coffee affordable: &I don&t think an iced latte needs to be $6 or $7. Our goal is to be less expensive than Starbucks.& (My coffee yesterday, for example, cost me $2.) Italso experimenting with other pricing models, starting with a $20 subscription that gets you an unlimited number of $1 drinks for a month.

And if this phone and pop up-focused mentality sounds a little transactional — maybe even a little soulless — I will note that the actual coffee shop didn&t feel that way at all. While the space was a bit bare, it was eye-catching, with several large games like cornhole set up for customers. Most importantly, people weren&t just rushing in to pick up their coffee — they were actually hanging out.

&When we did some rudimentary scouting of coffee shop locations, we saw that about 80% of customers are grabbing their coffee and leaving,& Crowley said. &That is definitely core to us, making it super easy to grab it and leave, fulfilling drink orders in less than a minute. All of that said, in the future, we&re going to have this portfolio of different kinds of spaces, different kinds of experiences.&

- Details

- Category: Technology

Read more: Bandit opens a ‘mobile-only’ coffee shop in New York

Write comment (91 Comments)

SpaceX Starship Mk1 prototype encountered an explosive failure during early testing in Texas on Wednesday & you can see exactly what happened in the video below, but basically it blew its lid during cryogenic testing & a standard test that you use to see if the vehicle can hold up to extreme cold temperatures, like those it would encounter in actual use. The good news is that this is exactly why SpaceX (and anyone building rockets) does this kind of early-stage testing on the ground, in controlled, relatively safe conditions. The bad news is that this might delay the companyoptimistic timelines.

As for next steps, the plan appears to be to take what Starship Mk1 has taught SpaceX so far and proceed with the next iteration of the prototype spacecraft & Starship Mk3. ‘Wait, didn&t we skip a Mk?& you might ask & no, because SpaceX is already building Mk2 in parallel with this now-destroyed Mk1 at its other facility in Florida.

SpaceX CEO Elon Musk was quick to answer a question on Twitter from YouTuber Everyday Astronaut regarding the next steps for Starship testing, saying it&ll move on to Mk3 design, and that Mk1value was primarily &as a manufacturing pathfinder,& noting that &flight design is quite different.&

This is still a different version of events and Starship development from whatbeen discussed previously: Starship Mk1 and Mk2 were originally characterized as high-altitude test flight vehicles, to follow the success of the ‘Starhopper& snub-nosed subscale demonstrator, which was used to test a single Raptor engine for a couple of low-altitude hops at SpaceXTexas site.

Timelines are always fluid in the space business, however, and in particular in the launch industry. SpaceX also sets incredibly optimistic timelines for most of its ambitious goals, by the open admission of both Musk and SpaceX President and COO Gwynne Shotwell. Still, the company has said it&ll look to achieve orbital flight with a Starship prototype vehicle as early as next year, so we&ll have to wait and see whether this inopportune test result affects that schedule.

SpaceX provided the following statement regarding todaytest:

The purpose of todaytest was to pressurize systems to the max, so the outcome was not completely unexpected. There were no injuries, nor is this a serious setback.

As Elon tweeted, Mk1 served as a valuable manufacturing pathfinder but flight design is quite different. The decision had already been made to not fly this test article and the team is focused on the Mk3 builds, which are designed for orbit.

- Details

- Category: Technology

Read more: SpaceX’s Starship Mk1 fails during testing, next step will be to move to a newer design

Write comment (92 Comments)Page 307 of 5614

12

12