Technology

Wikimedia Foundation, the nonprofit group that operates Wikipedia and a number of other projects, has urged the Indian government to rethink the proposed changes to the nationintermediary liability rules that would affect swathes of companies and the way more than half a billion people access information online.

The organization has also urged the Indian government to make public the latest proposed changes to the intermediary rules so that all stakeholders have a chance to participate in a &robust and informed debate about how the internet should be governed in India.&

India proposed changes to intermediary rules(PDF) in late December last year and it is expected to approve it in the coming months. Under the proposal, theIndian Ministry of Electronics and IT requires &intermediary& apps — which as per its definition, includes any service with more than 5 million users — to set up a local office and have a senior executive in the nation who can be held responsible for any legal issues.

Amanda Keton, general counsel of Wikimedia Foundation, said on Thursday that Indiaproposed changes to the intermediary rules may have serious impact on Wikipediabusiness — as it operates an open editing model that relies on users to contribute new articles and make changes to existing articles on Wikipedia — as well as those of other organizations.

The rules may also create a &significant financial burden& for nonprofit technology organizations and impede free expression rights for internet users in India, she said. Wikimedia Foundation conveyed its concerns to Ravi Shankar Prasad, the Minister of Electronics and IT in India. The company also published the letter on its blog for the world to see.

Indialatest changes to intermediary rules, which have been drafted to make the internet a safer experience for local residents, also require intermediaries to deploy automated tools &for proactively identifying and removing or disabling public access to unlawful information or content.&

The proposed changes have raised concerns for many. In a joint letter(PDF) earlier this year, Mozilla, MicrosoftGitHub and Wikimedia had cautioned the Indian government that requiring intermediaries to proactively purge their platforms of unlawful content &would upend the careful balance set out in the existing law which places liability on the bad actors who engage in illegal activities, and only holds companies accountable when they know of such acts.&

The groups also cautioned that drafted measures &would significantly expand surveillance requirements on internet services.& Several trade bodies in India, that represent a number of major firms including Google and Facebook, have also suggested major changes to the proposal.

In the open letter published today, WikimediaKeton reiterated several of those concerns, adding that &neither participants in the consultation nor the public have seen a new draft of these rules since [last year].& She also requested the government to redefine, how it has in another recently proposed set of rules, the way it classifies an entity as an intermediary as the current version seems to have far-reaching scope.

India is the fifth largest market for Wikipedia — more than 771 million users from the country visited the online encyclopaedia last month.Wikimedia has run several programs in India to invite people to expand the online encyclopaedia in Indic languages.

Keton urged the government to rethink the requirement to bring &traceability& on online communication, as doing so would interfere withthe ability of Wikipedia contributors to freely participate in the project. (On the point of traceability, WhatsApp has said complying to such requirement would compromise encryption for every user.)

- Details

- Category: Technology

December has been a strong month for Brazilian startups, bringing a big IPO and a new unicorn for local companies. Tech-driven investment firm XP Investimentos went public on the U.S. Stock Exchange in mid-December, raising $1.81 billion in the fourth-largest IPO of 2019. XPstock price jumped 30% on its first day of trading, from $27 per share to $34.50.

XP was founded in 2001 to provide brokerage training classes to Brazilians to help them invest in the international stock market. Today, it is a full-service brokerage firm, providing fund management and distribution to more than 1.5 million customers in Brazil.

Notably, XP has outlined a strategy for beating Brazilian banks, among the most profitable in the world, in its 354-page report to the SEC. Brazilbanking market is highly concentrated, with the top five players dominating 93% of market share. This concentration has led to significant inefficiencies that XP tries to disrupt by offering a variety of financial products through an accessible online platform.

The heavy bureaucracy of these banks will prevent them from innovating quickly enough to compete with newer institutions like XP, whose debt products are attractive to frustrated Brazilian customers. The inefficiency of the Brazilian financial system has opened opportunities for companies like XP, or neobank Nubank, to rapidly attract customers who are disgruntled with the traditional system.

Gaming startup Wildlife becomes a unicorn

Brazil has seen a new unicorn emerge almost every month this year, and December was no exception. Gaming startup Wildlife raised a $60 million Series A round led by U.S.-investor Benchmark Capital at a $1.3 billion valuation to become the countryeleventh unicorn. This round was big even for Silicon Valley standards, and it is uncommon for startups even in markets like the U.S. or Europe to hit a $1 billion-plus valuation in such an early round.

Wildlife has created more than 60 games since 2011, including Zooba and Tennis Clash, which have both reached global acclaim. Founded by brothers Victor and Arthur Lazarte, Wildlife operates on a freemium model that only charges users for in-app purchases. They plan to use the funding to double their employee base and grow to $2 billion in 2020, continuing the 80% yearly growth they have seen since 2011.

Mexicolender Konfio receives $100 million from SoftBank

Konfio provides small business loans in Mexico through an online platform to help SMEs gain liquidity and grow their operations. These small businesses are often overlooked by banks in Mexico and Latin America, which do not know how to price risk for businesses that process less than $10 million per year.

Konfio recently raised $100 million from SoftBankInnovation Fund, the third investment that SoftBank has made into Mexico since launching the fund. The capital will go toward financing working capital loans, as well as creating new products for Konfiocustomers. Today, Konfioloans average around $12,000, while banks still struggle to loan less than $40,000. The tech-driven platform allows Konfio to disburse loans within 24 hours without requiring collateral.

Small business lending is a tremendous opportunity in Latin America, where banks are among the most profitable and the least competitive in the world. BrazilCreditas and ColombiaOmniBnk are among the other startups providing innovative products that calculate risk more effectively than banks in Latin Americacomplex lending environment.

The Albo team has raised $26.4 million to scale its leading neobank.

Albo, Mexicoleading neobank, raises $19 million

In an extension of a Series A round, Mexicoalbo raised a further $19 million from Valar Ventures to bring their newest round to $26.4 million in total. Albo previously raised $7.4 million from Mountain Nazca, Omidyar Network and Greyhound Capital in January 2019. Albomission is to provide banking services to unbanked and underbanked clients in Mexico. More than half of albocustomers claim that albo was their first-ever bank account.

Founded by Angel Sahagun in 2016, albo quickly became Mexicolargest neobank, serving more than 200,000 customers and sending out thousands of new cards every day. The investment from Valar Ventures, founded by Peter Thiel (also an investor in N26 and TransferWise), is a vote of confidence for this Mexican fintech. Albo has also previously received investment from Arkfund, Magma Partners and Mexican angels.

Albo plans to use the capital to develop new products, including savings and credit services, in the coming year. Mexico will likely be a battleground for Latin American neobanks in 2020, as Klar, Nubank and potentially ArgentinaUala will begin to grow in the regionsecond-largest market. While there is room for several competitive neobanks to thrive in Mexico, this industry will be one to watch in 2020.

News and Notes: Mercado Credito, Mimic, Rebel and Rappi

Goldman Sachs loaned $125 million to MercadoLibre to continue developing their credit product, MercadoCredito. MercadoLibre will use the capital to triple its $100 million debt facility for small business loans in Mexico. To date, MercadoCredito has loaned more than $610 million to 270,000 businesses around the region in Mexico, Brazil and Argentina.

Brazilian cloud-kitchen startup Mimic raised $9 millionin a seed round led by Monashees to develop a more efficient food delivery model in Brazil. Mimic will exclusively manage the logistics of &dark kitchens,& which exist only for delivery and have no sit-down facilities, saving time and money for clients. Mimic will use the investment to grow its team.

An early-stage online lending startup in Brazil, Rebel, recently raised $10 millionfrom Monashees and Fintech Collective to provide unsecured loans to middle-class Brazilians at affordable rates. Rebel has lowered rates to around 2.9% per month, compared to 40-400% at Brazillargest banks. The startup uses a proprietary algorithm to calculate risk for clients and provide loans rapidly through its online platform.

ColombiaRappi recently announced an expansion into Ecuador, where it has rapidly reached 100,000 users between Quito and Guayaquil, the countrytwo largest cities. Rappi is now active in nine countries and more than 50 cities in Latin America.

2019: A Year in Review

Given the arrival of the SoftBank Innovation Fund, Latin American startup investment in 2019 will likely more than double the $2 billioninvested in 2018. Here are a few of the highlights we saw this year:

- Record-breaking rounds and Brazilian unicorns: In 2019, Rappi raised $1 billionfrom SoftBank, beating iFoodprevious record-breaking $500 million from Naspers in 2018. Brazil got at least six new unicorns — Nubank, QuintoAndar, Gympass, Wildlife, Loggiand EBANX — most of whom raised funding from international investors.

- Asian investment in Latin American fintechs: Nubank received $400 million-plus in 2019 from investors that included TCV, Tencent, Sequoia, Dragoneer and Ribbit Capital. ArgentinaUala received $150 million from SoftBank and Tencent in November 2019. SoftBank has been investing in Brazilian and Mexican fintechs including Creditas, Konfio and Clip, throughout the year.

- U.S. investors take an interest in LatAm: Many U.S. investors made their first Latin American investments in 2019, including Valar Ventures (albo), Bezos Expeditions (NotCo), SixThirty Cyber (Kriptos) and Homebrew (Habi). This year has also seen large funds like a16z, Sequoia, Accel and others making earlier-stage investments in Latin America, rather than Series B and beyond. This change demonstrates that U.S. funds are becoming more familiar and involved with the Latin American ecosystem, helping early-stage companies grow rather than focusing on international scale-ups as they have in the past.

- The Cornershop acquisition: Chilean-Mexican delivery startup, Cornershop, was acquired by Walmart in late 2018 for $225 million, but the deal was blocked by the Mexican government. Four months after the block, Cornershop announced that Uber would take a 51% share of the company for $450 million, representing a 4x growth in valuation since the previous acquisition deal. The Mexican and Chilean governments still have to approve the Uber deal, so all eyes will be on Cornershop through the start of 2020.

- The start of the battle for Latin Americasuper-app: In China, two companies dominate the mobile market, handling payments, communications, ridesharing, delivery and more within a single app. Events in 2019, such as Rappi$1 billion round and the merger between MexicoGrin and BrazilYellow, suggest that Latin America may be heading in the same direction toward a few apps that integrate dozens of features. ColombiaRappi and BrazilMovile are strong competitors for the role, but the rise of a regional super-app still remains far in the future for Latin America.

Latin Americastartup and investment ecosystem has likely more than doubled this year as compared to 2019. As international investors like SoftBank, Andreessen Horowitz, Sequoia, Accel, Tencent and others are taking more bets on the region, more startups than ever have scaled and reached unicorn status. These startups will continue to scale in 2020, taking on a regional presence to provide services to Latin America650 million population.

- Details

- Category: Technology

Itgotten to the point now where a handful of angel investors can put a space company on the map. But the same changes that have made the industry accessible have made it increasingly complex to track its trends. By default, all space startups are exciting, but companies vary widely in risk, capital intensity and maturity. Herewhat you need to know about the four main areas of the new space economy.

Launch: playground of billionaires and forward thinkers

Perhaps simply the most exciting industry to be a part of today, orbital launch service has gone from a government-funded niche dominated by a handful of primes to a vibrant, growing community serving insatiable demand.

Therea good reason why it was dominated for so long by the likes of ULA, whose Delta rockets took up a huge majority of missions for decades. The barrier to entry for launch is huge.

As such there are three ways to enter the sector: brute force, stealth, and novelty.

Brute force is how SpaceX and Blue Origin have managed to accomplish what they have. With billions in investment from people who don&t actually care whether money is made in the short term (or with Bezos, even in the long term), they can perform the research and engineering necessary to make a full-scale launch platform. Few of these can ever really exist, and participation is limited when they do. Fortunately we all reap the benefits when billionaires compete for space superiority.

Stealth, perhaps better described as smart positioning, is where you&ll find Rocket Lab. This New Zealand-based company didn&t appear out of nowhere — look at its timeline and you&ll see scaled-down tests being conducted more than a decade ago. But what founder Peter Beck and his crew did was anticipate the market and work doggedly towards a specific solution.

Rocket Lab is focused on small payloads, delivered with short turnaround time. This avoids the trouble of competing against billionaires and decades-old space dynasties because, really, this market didn&t exist until very recently.

&Responsive space, or launch on demand, is going to be increasingly important,& Beck said. &All satellites are vulnerable, be it from natural, accidental, or deliberate actions. As we see the growth and aging of small sat constellations, the need for replenishment will increase, leading to demand for single spacecraft to unique orbits. The ability to deploy new satellites to precise orbits in a matter of hours, not months or years, is critical to government and commercial satellite operators alike.&

Rocket Labtenth launch, nicknamed &Running Out of Fingers.&

Investing in Rocket Lab early on would have seemed unexciting as for year after year they made measured progress but took on no cargo and made no money. Patience is the primary virtue here. But investors with foresight are looking back now on the companymany successful launches and bright future and marveling that they ever doubted it.

The third category of launch is novelty: entirely new launch techniques like SpinLaunch or Leo Aerospace. The term may not inspire confidence, and thatdeliberate. Companies taking this approach are high-risk, high-reward propositions that often need serious funding before they can even prove the basic physical possibility of their launch technique. Thatnot an investment everyone is comfortable making.

On the other hand, these are companies that, should they prove viable, may upend and collect a significant portion of the new and growing launch market. Here patience is not so much required as extra diligence and outside expertise to help separate the wheat from the chaff. Something like SpinLaunch may sound outlandish at first, but the Saturn V rocket still seems outlandish now, decades after it was built. Leaving the confines of established methods is how we move forward — but investors should be careful they don&t end up just blasting their cash into orbit.

- Details

- Category: Technology

Read more: The four corners of the new space economy

Write comment (93 Comments)Russia has begun testing a national internet system that would function as an alternative to the broader web, according to local news reports. Exactly what stage the country has reached is unclear, but certainly the goal of a resilient — and perhaps more easily controlled — internet is being pursued.

The internet, of course, is made up of a global web of infrastructure that must interface physically, virtually and, increasingly, politically with the countries to which it connects. Some countries, like China, have opted to very carefully regulate that interface, controlling which websites, apps and services can be accessed from the local side of that interface.

Russia has increasingly leaned toward that approach, with President Putin signing a law earlier this year there, Runet, which would build the necessary infrastructure to maintain, essentially, a separate internal internet should such a thing become necessary (or convenient).

Speaking earlier this week to the state-owned news outlet Tass, Putin explained that this was purely a defensive play.

Runet, he said, &is aimed only at preventing adverse consequences of global disconnection from the global network, which is largely controlled from abroad. This is the point, this is what sovereignty is — to have our resources that can be turned on so that we would not be cut from the Internet.&

More recent reports, in Tass and Pravda as relayed by the BBC, indicated that this effort has gone beyond the theoretical to the practical. Tests were done on the vulnerability of the so-called Internet of Things, which must have been disheartening if Russian IoT devices have security practices as poor as U.S. ones. Whether the local net could stand up against &external negative influences,& whatever those are, was also looked into.

Itno small task, what Russia is attempting here, and while the talk is ostensibly of sovereignty and robust infrastructure, the tensions between the U.S., Russia, China, North Korea and other countries with advanced cyberwarfare capabilities are unmistakably also part of it.

A Russian internet disconnected from the world would probably right now be almost non-functional. Russia, like everyone else, relies on resources located elsewhere in the world constantly, and duplication of many of those resources would be necessary to make it possible for the internet to work anything like normally, should the country decide to retreat into its shell for whatever reason.

A separate DNS system would be necessary, as would physical infrastructure connecting parts of the country directly to the rest, which at present must do so through international connections. And thatjust to create the basic possibility of a working Russian intranet.

Ithard to object to the idea of a robust &sovereign internet& should such a thing become necessary, but ithard not to think of it as preparation for conflict to come rather than simple investment in national infrastructure.

That said, what exactly Runet will grow to be and how it will be used are still a matter of speculation until we receive more specific reports of its capabilities and intended purposes.

- Details

- Category: Technology

Read more: Russia starts testing its own internal internet

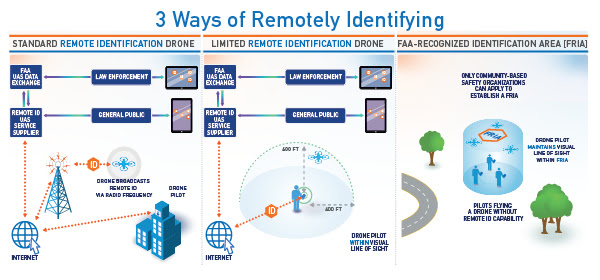

Write comment (91 Comments)The Federal Aviation Administration this week issued proposed rules for the remote identification of drones in the U.S. The &next exciting step in safe drone integration& (their words) aims to offer a kind of license plate analog to identify the some 1.5 million drones currently registered with the governmental body.

The document is currently available online through the Federal Register in a kind of draft form, as part of a 60-day comment period. The FAA is using the two months to solicit feedback from drone operators, enthusiasts and general aviation safety wonks.

&Drones are the fastest growing segment of transportation in our nation and it is vitally important that they are safely integrated into the national airspace,& Transportation Secretary Elaine Chao said in a statement.

The rules are clearly an attempt to not only address ongoing safety concerns in high-risk areas like airports and stadiums, but also to get out in front of ever-crowding skies. Between hobbyists and commercial interests like UPS and Amazon, itnot difficult to imagine even more issues, going forward.

Per the draft:

This is an important building block in the unmanned traffic management ecosystem. For example, the ability to identify and locate UAS operating in the airspace of the United States provides additional situational awareness to manned and unmanned aircraft. This will become even more important as the number of UAS operations in all classes of airspace increases. In addition, the ability to identify and locate UAS provides critical information to law enforcement and other officials charged with ensuring public safety.

DJI says it¤tly reviewing& the proposal, though the drone giant notes that it implemented its own AeroScope remote ID technology some two years ago, in order to address pilots flying too close to problem areas.

&DJI has long advocated for a Remote Identification system that would provide safety, security and accountability for authorities,& VP Brendan Schulman said in a release. &As we review the FAAproposal, we will be guided by the principle, recognized by the FAAown Aviation Rulemaking Committee in 2017, that Remote Identification will not be successful if the burdens and costs to drone operators are not minimized.&

- Details

- Category: Technology

Read more: The FAA proposes remote ID technology for drones

Write comment (96 Comments)If you haven&t noticed, Europestartup scene is in full bloom, with more than $30 billion deployed in startups across the continent over the last 12 months and more than 20 countries now home to a so-called unicorn company.

Investors around the globe are jumping into the pool, too. Consider that the Ontario Municipal Employees Retirement System (OMERS) is currently investing a €300 million fund in Europe. Abu Dhabistate investor, Mubadala, last year announced it was launching a $400 million fund to back European startups. And thatsaying nothing of the many Europe-based venture investors who are either raising new funds or recently closed them.

Atomico, for example, one of the continentbiggest early-stage firms, closed its most recent fund with $765 million in 2017 and is reportedly out fundraising again. Others of all different sizes have recently announced new vehicles, including Balderton Capital, which last month closed a new $400 million fund; United Ventures, a 6.5-year-old, Milan-based early-stage venture capital firm that last week closed its second fund with €120 million in capital commitments (nearly double the €70 million it raised for its debut fund); MiddleGame Ventures, a 1.5-year-old, Luxembourg-based fintech-focused investment firm that recently held a first close on a fund thattargeting €150 million altogether; Northzone, a 23-year-old, London-based venture capital firm that closed on $500 million in capital commitments for its ninth fund (its largest to date); Ada Ventures, a new London-based seed-stage venture firm that just closed its debut fund with $34 million; and Dawn Capital, a nearly 13-year-old, U.K.-based early-stage venture firm that in summer raised $125 million for an opportunities-type fund.

To find out more about whathappening on the ground, we sat down at Disrupt Berlin earlier this month with two London-based investors — Carolina Brochado, who late last year left Atomico to join SoftBankVision Fund, and Andrei Brasoveanu of Accel — to discuss where the money is coming from, which European cities are becoming more interesting to both of them, and some of the challenges they face in covering so many different regions.

We also talked specifically with Brochado about whether SoftBank is changing up its tactics in light of some bets that aren&t panning out as intended — and whether she has any qualms about the outfitbiggest investor. Our conversation, edited lightly for length and clarity, follows.

TC: We&re all meeting for the first time, and I thought we could do everyone here a service who wants to understand both of you better by talking a little bit about who you are and what you focus on. Do you want to start Carolina? I know you studied in the U.S…

CB: Yes, so I&m originally from Brazil. I moved to the U.S. for university, spent over 10 years in the U.S., [and I] have worked in in large cap private equity, have worked at a pre launch, launch, [then failed] startup, and then have spent a lot of my time in Europe, which has been seven years now, at an earlier stage VC firm called Atomico . . . and for the last year, I&ve been at SoftBank Vision Fund, investing at the growth stage.

AB: I&ve been with Accel for six years. I&m originally from Romania and spent 10 years in the states like Carolina, studying and working in New York in high frequency trading. At Accel, I&ve been focused most of my time on enterprise software and financial services and I&ve been very excited to back European founders from London all the way to Bucharest. Accel is one of the few Valley-based venture firms with on-the-tground presence in Europe. We&ve been here for 20 years, and we really believe in having a local approach to investing.

TC: Carolina, you switched from Atomico to SoftBank this year. Why?

CB: Therea lot of push and pull with these sort of things. Europe is such an incredibly exciting place right now, and to be totally honest, back [when I moved here] in 2013, I didn&t totally see it, but over the years, you realize how many incredible entrepreneurs [are here], how many incredible teams, and the opportunity that lies ahead. And firms like Accel and Atomico were paving the path of the capital structure in Europe, which is actually very young; maybe the past 15 years, therebeen VC in Europe, and now you starting to see the fruits of that and the exits.

So for me, part of it was while there are great funds at the early stage, therestill a lot of underfunding at that later stage, so I was really excited about doing growth in Europe and putting significant amounts of capital behind founders who want to go for the really big outcomes.

TC: You now have an insiderview of these two very important firms. What are some of the biggest differences between Atomico and SoftBank, aside from the different stages at which they invest — how do maybe the processes differ?

CB: Thereobviously a difference in size — Atomico was 70 people and SoftBank is a 500-person organization. There is an interesting founder-led approach to both organizations. They are both very mission- driven by founders who want to change the world and by founders who want to be the best at what they do, which is really exciting.

One of the key differences at SoftBank is that itreally global firm [with] offices everywhere. We have offices in the U.S. We have offices in Asia. We have offices in Europe. For me, it has been a really interesting platform to see what other great founders are doing in other places of the world.

And then, just because of the sheer size of the organization, you have a group of 50-plus operating partners who may have really deep areas of domain expertise like talent but who are also helping our companies do business development, and who can look at our ecosystem — which today is over 85 portfolio companies — and make connections, and win business and actually win profitability for companies across and within that ecosystem.

TC: You&re both [in Berlin right now] from London. Andrei, do you run into each other in deals, or are your worlds vastly different?

AB: I would say we have quite different focus areas, we&re very much early-stage focused as our sweet spot [though] some of our companies, when they get to that mature stage, may benefit from working with SoftBank.

CB: We try tostay very close to the great companies at Accel, so they&ll nudge us [when itthe right time].

TC: Who are you seeing coming into deals who you might not have when you joined Accel in 2014?

AB: Itinteresting. Since I joined Accel, the quality of investors in Europe has increased dramatically. So we&ve seen quite a few former operators, for example, [meaning] very successful founders who are now starting the starting their own funds. We&ve seen more family offices enter the industry. We&ve seen more U.S. capital in the market. And in general, I think [all] has helped raise the bar in terms of the quality of capital available to founders across Europe. And many of these folks, especially the local players, have been good partners for us.

- Details

- Category: Technology

Page 41 of 5614

10

10