Technology

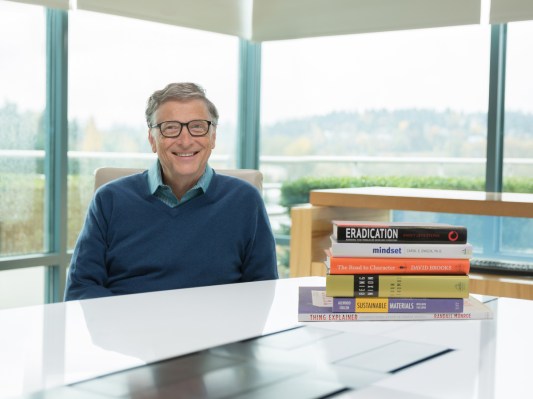

Since roughly 2012, billionaire Bill Gates has been participating in Redditannual Secret Santa gift exchange, which matches Reddit users with internet strangers who give them presents.

He seems to relish the role. For example, in 2017, he was matched with a cat lover, sending off a giant load of feline-themed gifts, including a large stuffed cartoon cat and $750 in donations to her favorite animal charities. Last year, his gift recipient was a self-described miniature horse owner who loves yarn, natural fibers, and card-making. Gates sent him a bounty of yarn, decorating tape, pencils, postcards, sketchbooks, a custom-made blanket for his horse, and a signed copy of a &An Absolutely Remarkable Thing& by Hank Green, the manfavorite author.

This year, the lucky Redditor who found herself on the receiving end of 81 pounds of gifts from Gates was a 33-year-old, Detroit-area marketer who told MarketWatch yesterday, &I always thought it would be super cool to be matched with him some day, but I never really would have expected this to happen to me.&

The woman — whose Reddit profile features a picture of her hugging the &Star Wars& character Chewbacca and that refers to Harry Potter and other books and video games — was also reportedly sent a Harry Potter Santa hat; Lego building sets that include a giant Hogwarts castle; a handmade quilt depicting scenes from Nintendo&Legend of Zelda& game series; and &Twin Peaks& memorabilia, including an L.L. Bean jacket worn by one of the crew members.

Gates, a renowned book lover who regularly shares his book recommendations, also sent her a bound manuscript of F. Scott Fitzgerald&The Great Gatsby,& lines from which the woman had incorporated into her wedding earlier this year.

Making the gift even more special, it came with scans of Fitzgeraldhandwritten notes as he was working on the now classic novel.

Gates has been a pioneer on the charitable front for many years. According to the Chronicle of Philanthropy, Gates and wife Melinda Gates donated an estimated $4.78 billion dollars in 2018, bringing the total they&ve given through their foundation and other family foundations to $45.5 billion.

Gates also famously created The Giving Pledge with billionaire Warren Buffett. The pledge invites billionaires to commit to giving away most of their fortunes to charity.

Even while only one Redditor benefits from Gatemunificence each holiday season, plenty of others of the platformusers benefit from being part of its Secret Santa community.

Among some of the presents sent: Google gifted one user a Pixel 4 phone. Another received a 3D printer from their &fantastic& Secret Santa. Yet another Redditor received a handmade Captain America shield — along with a smaller handmade shield for his dog.

- Details

- Category: Technology

Two and a half years after being blocked by the Turkish government, Wikipedia appears to have received a reprieve. The countryconstitutional court this week ruled that the April 2017 ban violated freedom of expression laws.

The Wikimedia Foundation has been arguing the ban since May of that year, winning in a 10-6 court decision that is expected to reinstate the user-edited online encyclopedia in Turkey.

In 2017, Turkey became the second country to completely ban access to the site, due to entries claiming ties to Isis and other terrorist groups. Turkey called the move an &administrative measure,& using a law designed to curb online security threats.

Wikipedia founder Jimmy Wales tweeted a photo of himself in front of the Turkish flag, along with the words &Welcome back, Turkey!& However, no time frame has been given for when the site will be reinstated in the country.

&While todayruling from the Constitutional Court is a welcome development for free knowledge and the people of Turkey, there are other threats to our ability to continue to freely, openly, and collaboratively build the largest collection of knowledge in human history,& the foundation wrote in a post celebrating the ruling. &Despite this, today is a good day for those of us that believe in the power of knowledge and dialogue. We are encouraged by this outcome and will continue to work towards a world in which knowledge is freely accessible to all.&

- Details

- Category: Technology

Read more: Wikipedia ban ruled unconstitutional by Turkish court

Write comment (98 Comments)

2019 was a momentous year for gig workers. While the likes of Uber, Lyft, Instacart and DoorDash rely on these workers for their respective core services, the pay does not match how much they&re worth — which is a lot. Itthis issue that lies at the root of gig workers& demands.

&This past year has been a pivotal year not only for gig workers but for workers across the tech economy,& Gig Workers Rising co-organizer Lauren Casey told TechCrunch. &That unto itself is a win — to see mass mobilization of workers across apps, across sectors and across positions.&

Instacart workers kicked off the year with a class-action lawsuit over wages and tips, and spoke out against Instacartpractice of subsidizing wages with tips from customers. The suit alleged Instacart &intentionally and maliciously misappropriated gratuities in order to pay plaintiffwages even though Instacart maintained that 100 percent of customer tips went directly to shoppers. Based on this representation, Instacart knew customers would believe their tips were being given to shoppers in addition to wages, not to supplement wages entirely.&

Shortly after that lawsuit was filed, Instacart CEO Apoorva Mehta apologized and said the company would take steps to ensure tips were counted separately. Following Instacartcapitulation, DoorDash and Amazon eventually followed suit and stopped offsetting worker wages with tips.

While Instacart now pays workers their full wages plus 100% of tips, workers take issue with the fact that Instacartsuggested default tip decreased from 10% to just 5%.

In October, Instacart shoppers went on strike for 72 hours across the nation. Instacart responded by getting rid of a $3 quality bonus. This month, Instacart shoppers are engaging in six days of actions in protest of the company, including filing a complaint with the U.S. Department of Labor as well as filing a wage claim.

&We&re still just trying to get this one tiny thing: double the default tip percentage,& Instacart shopper and protest organizer Sarah (pseudonym) previously told TechCrunch. &We&ve tried endlessly to get them to raise the base guarantee pay. But we feel like, fine, at least give us the higher default tip.&

Meanwhile, DoorDash still has yet to offer back pay to workers who were subjected to the misappropriating of tips. In protest of Instacart, DoorDash and Postmates, labor group Working Washington delivered bags of peanuts their respective offices as a symbol of the pay workers receive.

&This was the year gig workers built a movement that seized control of the future of work from the tech lobbyists and venture capitalists,& Sage Wilson of Working Washington told TechCrunch.

- Details

- Category: Technology

Read more: The year of the gig worker uprising

Write comment (96 Comments)All manner of startups fail for all manner of reasons. But thereone constant: this is an incredibly difficult business. Launching a successful company isn&t just a matter of drive and finding the right people (though both, clearly, are important). Doing well in this business requires the stars to align perfectly on a billion different things.

A cursory look at this yearbatch of companies doesn&t find any story quite as spectacular as last yearbig Theranos flameout, which gave us a best-selling book, documentary, podcast series and upcoming Adam McKay/Jennifer Lawrence film. Some, like MoviePass, however, may have come close.

And for every Theranos, there are dozens of stories of hardworking founders with promising products that simply couldn&t make it to the finish line. Therealso room for debate about what is and isn&t a startup. For our purposes, we&re focusing here on independent startups, not digital initiatives from larger companies — though in at least one case, the startup was acquired by a larger company before shutting down.

So without further ado, here are some of the biggest and most fascinating startups that closed up shop in 2019.

Anki (2010 & 2019)

Total raised: $182 million

In 2013, a promising young hardware startup showcased a new generation of slot cars onstage at the World Wide Developer Conference keynote. It was quite an honor for a young company. Apple was clearly impressed with how Overdrive pushed the limits of what could be done on the iPhone.

Three years later, Anki released Cozmo. The plucky little robot was the result of large investment, including the hiring of ex-Pixar and Dreamworks animators brought on board to craft a high range of emotions in the roboteyes. In late 2018, the company launched the similar but adult-focused Vector robot. By April 2019, Anki had shut its doors, in spite of selling 1.5 million robots and &hundreds of thousands& of Cozmo models.

Chariot (2014 & 2019)

Total raised: $3 million, acquired by Ford in 2017

Chariot was a shuttle startup hoping to reinvent mass transit with a fleet of vans for commuters. The routes, supposedly, were determined based on a &crowdsourced& vote.

After acquiring the service two years ago, Ford shut it down at the beginning of 2019. The company didn&t offer many details, except to say that &in todaymobility landscape, the wants and needs of customers and cities are changing rapidly.&

Daqri (2010 & 2019)

Total raised: $132 million

Daqri, another high-flying, heavily funded AR headset business, shut its doors around September and completed an asset sale. The company is one of many in the sector that failed to succeed in its efforts to court enterprise customers, as well as in its efforts to compete with Magic Leap, Microsoft and others.

Daqri was, at one point, speaking with a large private equity firm about financing ahead of a potential IPO, but as the technical realities facing other AR companies came to light, the firm backed out and the deal crumbled, according to earlier TechCrunch reporting. Sadly, Daqri wasn&t the only AR business to crumble this year.

HomeShare

Total raised: $4.7 million

HomeShare tried to deal with the challenge of rapidly rising housing costs by matching roommates who shared apartments split into µ-rooms.& The company said that as of March, it had about 1,000 active residents.

As part of the shutdown, HomeShare said residents would not be getting back the deposits for their partitions — but they would be able to keep the divider or sell it.

Jibo (2012 & 2018/19)

Total raised: $72.7 million

Between Anki and Jibo, you could say it was a tough year for consumer social robots. But then, therenever been a great year for the category. Not yet, at least. Like the sad death of the original Aibo before it, Jiboend was punctuated by the incredibly depressing nature of watching an adorable robot friend draw its final breath. Jibo did just that in April, telling consumers, &I want to say I&ve really enjoyed our time together. Thank you very, very much for having me around.&

Jibo technically died in late-2018, but we&re making an exception due to the dramatic nature of its demise. The end came in spite of a successful crowdfunding campaign and a healthy amount of venture capital raised. In spite of it all, the startup was forced to lay off most of its staff and then, ultimately, send Jibo upstate to live on the robo-farm.

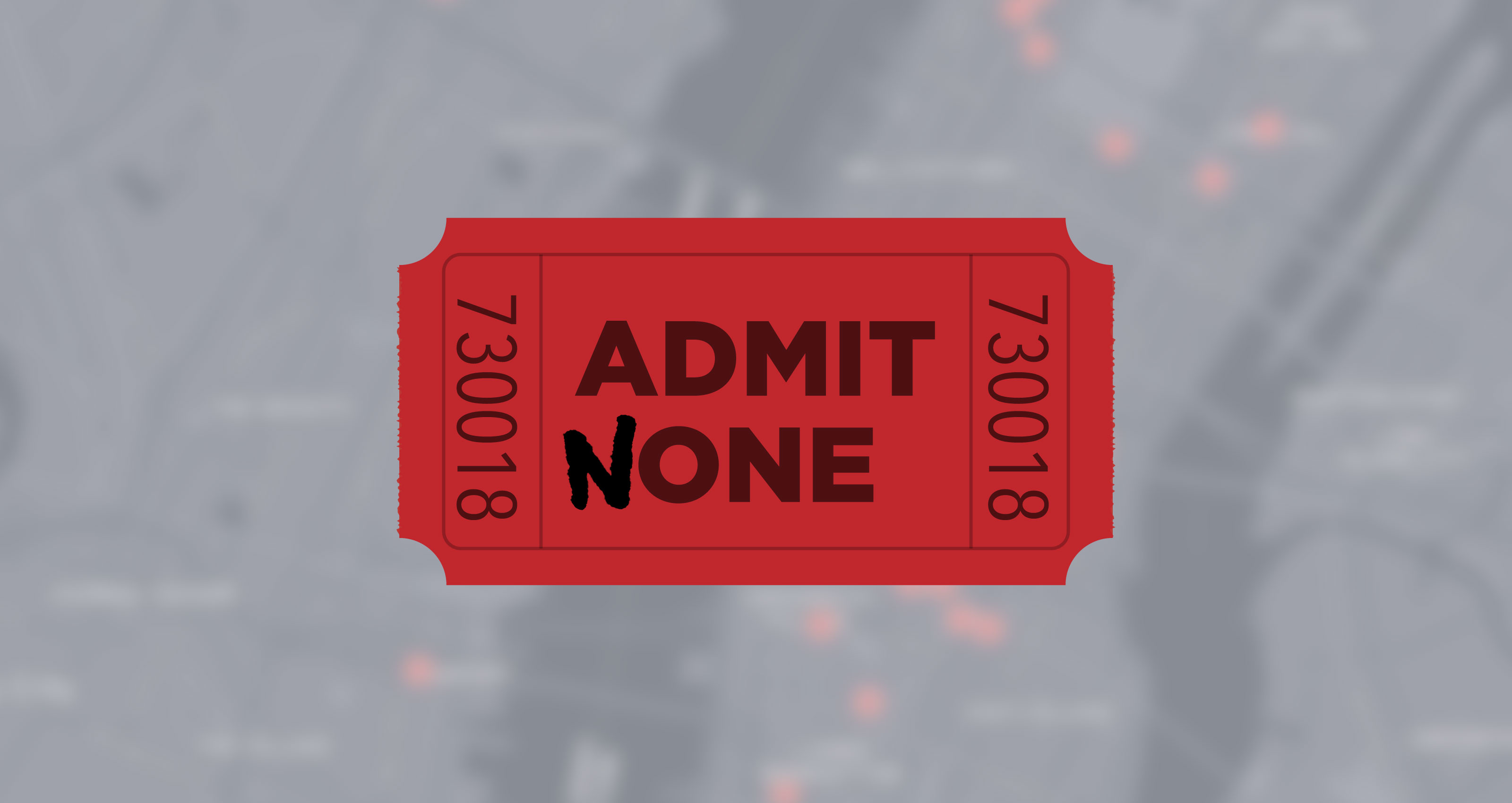

MoviePass (2011 & 2019)

Total raised: $68.7 million, acquired by Helios and Matheson in 2017

Image: Bryce Durbin / TechCrunch

Holy hell. Where to even start with this one? When we were putting this list together, one TechCruncher remarked that he swore MoviePass shut down years ago. Thatbecause (not unlike some current political events), the ticket subscription servicemagnificent train wreck of a demise appeared to unfold over the course of several years, in excruciating slow motion. We wrote a lot about it. A lot, a lot.

In fact, there seemed to be a new disaster every week, as the company hemorrhaged money, limited its service, experience outages, borrowed even more money, was forced to enter a kind of zombie state and had a massive data breech. Oh, and then there was the John Gotti movie it financed that was arguably even worse. By the end of it all, MoviePass& ultimate demise almost felt like an act of mercy.

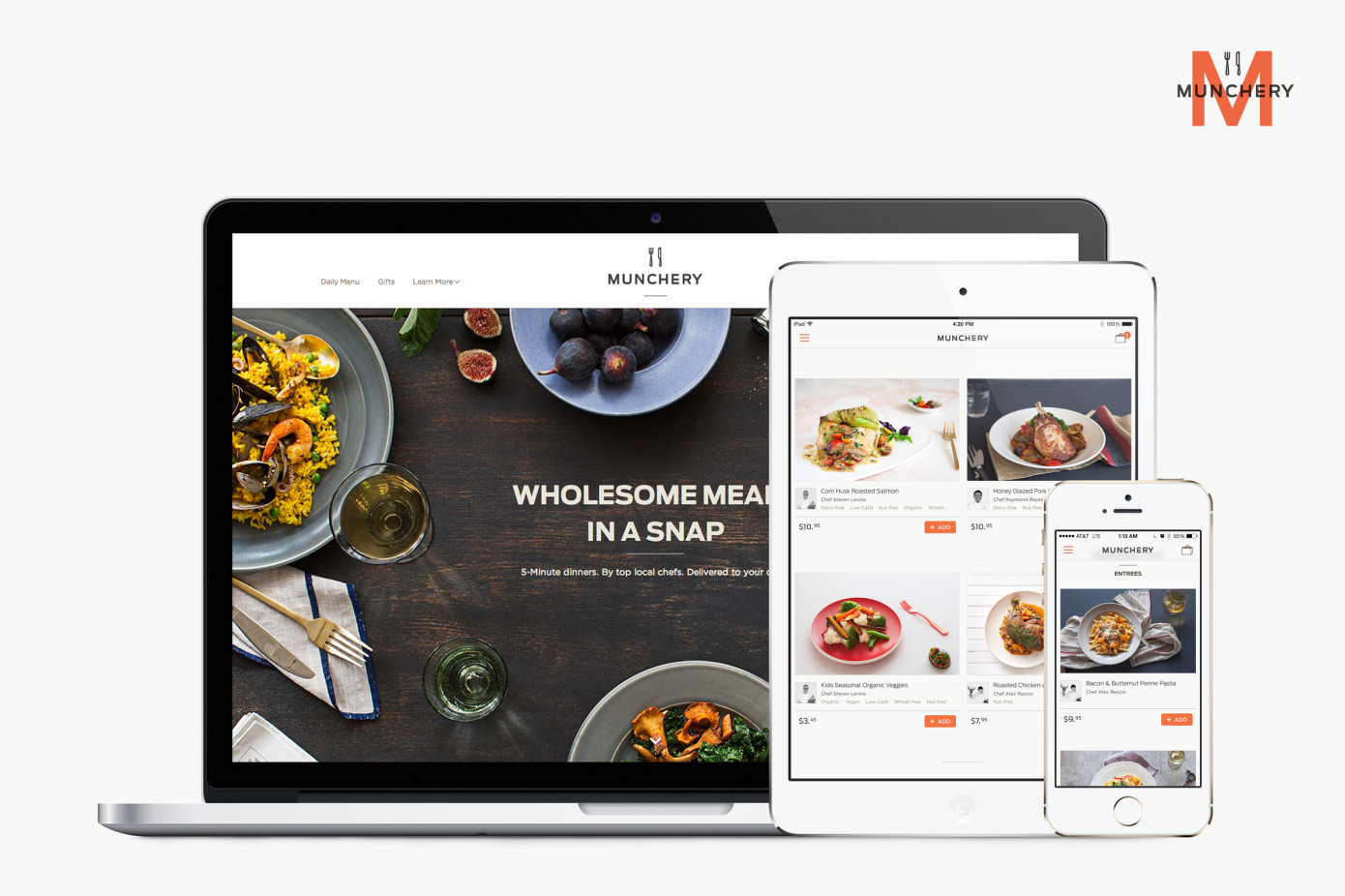

Munchery (2010 & 2019)

Total raised: $125 million

One of the first startup scandals of 2019 involved a once well-known meal delivery startup, Munchery . After the business emailed its customers notifying them of its imminent shutdown, its vendors came forward with a slew of accusations. Namely, the food delivery startup took advantage of them in its final hours, knowingly allowing them to continue making deliveries it couldn&t pay for.

The companysudden demise sparked a debate around accountability. While the CEO and its venture capital investors stayed largely silent, its vendors cried out for an explanation and even protested outside the offices of Sherpa Capital, one of Muncherybackers, in search of answers and payments.

Nomiku (2012 & 2019)

Total raised: $145,000

One of the most recent additions to this list, Bay Area-based food startup Nomiku called it quits earlier this month. The company helped pioneer the consumer sous vide category, only to see the market flooded by competing devices. In multiple successful Kickstarter campaigns totaling $1.3 million, backing from Samsung Ventures and an attempted pivot into meal plans, the startup just couldn&t survive.

&The total climate for food tech is different than it used to be,& CEO Lisa Fetterman told TechCrunch. &There was a time when food tech and hardware were much more hot and viable. I think a company can survive a few hurdles, and a few challenges [ …] For me, it was the perfect storm of all these things.&

ODG (1999 & 2019)

Total raised: $58 million

A pioneer in the AR glasses space, news emerged of Osterhout Design Group(ODG) demise in the first few weeks of January. Only a couple of years ago, the company raised a $58 million financing — less than a year later, it had burned through its funding and couldn&t pay employees. By early 2018, ODG had lost half of its workforce as it sought loans to pay back employees. By early 2019, only a skeleton crew awaited a patent sale after acquisitions from several large tech companies, including Facebook and Magic Leap, fell through.

&I hope Magic Leap is a huge success. I want everyone in AR to be a huge success,& Osterhout said in an interview with TechCrunch in 2017. &[Augmented reality] is going to be transformative.&

Omni (2014 & 2019)

Total raised: $35.3 million

The startup began as a physical storage company, then tried to pivot after selling off its physical storage operations to competitor Clutter in May — it tried, unsuccessfully, to build a white-label software platform that would allow brick-and-mortar merchants to operate their own businesses for renting and selling products.

As part of the shutdown, roughly 10 Omni engineers were hired by Coinbase.

Scaled Inference (2014 & 2019)

Total raised: $17.6 million

Founded by former Googlers Olcan Sercinoglu and Dmitry Lepikhin, Scaled Inference made headlines in 2014 with a plan to build machine learning and artificial intelligence technology similar to whatused internally by companies like Google, and making it available as a cloud service that can be used by anyone. The ambitions were grand and attracted investors like Felicis Ventures, Tencent and Khosla Ventures.

Unfortunately, the company was forced to call it quits recently. Former CEO Sercinoglu tells us the shutdown was a result of a lack of funding due to insufficient commercial traction. &We were working on various options until the last minute and retained the team as long as we could, but it did not work out. On the plus side, we were able to be transparent with the team throughout the process,& he said.

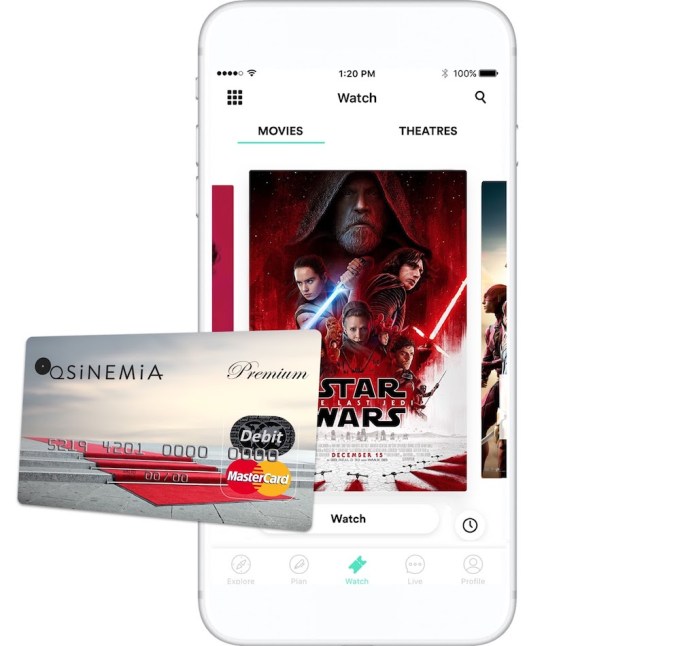

Sinemia (2015 & 2019)

Total raised: $1.9 million

It was a rough year for MoviePass -style movie ticket subscription services in general. Sinemia seemed at first to be a more sustainable competitor, but it was plagued by subscriber complaints and even lawsuits aroundapp issues, hidden charges and policies for shuttering accounts.

In April, the company announced that it was ending U.S. operations. To be clear, it did not say that it was shutting down entirely (much of its staff was based in Turkey), but the companywebsite has since gone offline. If Sinemia survives in some form, it has disappeared from view.

Unicorn Scooters (2018 & 2019)

Total raised: $150,000

Unicorn Scooters was one of the first fatalities of the electric scooter craze of 2018, though certainly not the last. As the story goes, the business spent way too much money on Facebook and Google ads; the startup quickly shut down with no money left over to issue refunds for more than 300 of its $699 scooters that had been ordered.

The not-so-aptly named Unicorn had completed the Y Combinator startup accelerator only a few months before it called it quits, likely making it one of the fastest YC grads to shutter post-graduation. &Unfortunately, the cost of the ads were just too expensive to build a sustainable business,& UnicornCEO Nick Evans wrote, according to The Verge. &And as the weather continued to get colder throughout the US and more scooters from other companies came on to the market, it became harder and harder to sell Unicorns, leading to a higher cost for ads and fewer customers.&

Vreal (2015 & 2019)

Total raised: $15 million

via @VrealOfficial twitter

Vreal was an ambitious game-streaming platform that aimed to let VR users explore the worlds in which live-streamers were playing. Those users could walk around streamers as avatars, or they could explore on their own as passive observers while listening to the live-streamer blast their way through zombies.

&Unfortunately, the VR market never developed as quickly as we all had hoped, and we were definitely ahead of our time,& the company said in a blog post. &As a result, Vreal is shutting down operations and our wonderful team members are moving on to other opportunities.&

- Details

- Category: Technology

Read more: Remembering the startups we lost in 2019

Write comment (97 Comments)Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

Today we&re peeking at whatgone on in the world of altcoins recently, the other cryptocurrencies aside from bitcoin.

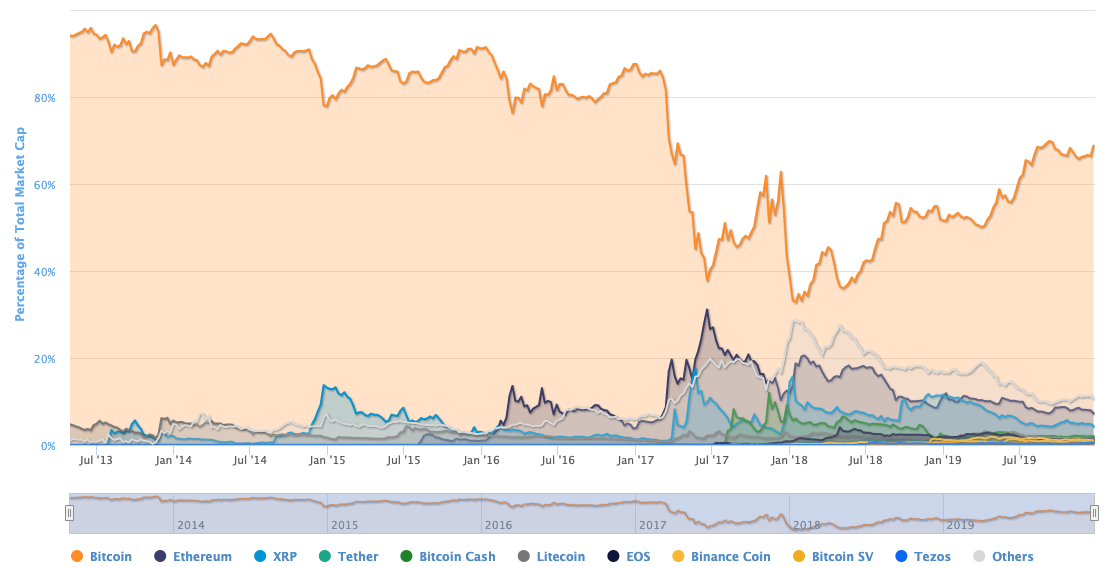

As 2016 came to a close, altcoins like ether and XRP saw their value soar. Toward the end of 2016 through early 2018, bitcoinrelative share of the aggregate value of all cryptocurrencies fell to about a third.

Since then therebeen a reversal. Bitcoin is not only back over the 50% market share mark, it has effectively doubled its portion of crypto worth over the last two years.

What happened? Why altcoins have struggled isn&t something we can answer with a single data point or chart. But we can highlight a few reasons that help explain what happened. We&ll start with a look at the data and then we&ll highlight three ideas concerning what changed that pushed altcoins down, and bitcoin back up.

Over the past few weeks we&ve spent most of our time digging into IPOs, larger startups, stocksand revenue thresholds. Today we&re expanding our horizons a bit, looking at a market that sits somewhere to the side of our usual public-private divide. We&re having fun!

First words

Letstart with a few caveats to save tweets.

We all know that comparing the value of a cryptocurrency or token isn&t the only way to stack blockchains against one another. We also also know that comparing market caps isn&t a perfect way to examine the market. And, yes, therelots of development work that goes on behind the scenes that doesn&t show up in the data we are going to examine.

That said, we&re nearly 11 years into the bitcoin era. We care a bit more today than we did a half-decade ago about what is, versus what might be.

Comparative worth

From the fine folks over at CoinMarketCap, the following set of data maps the relative value of the major cryptos, with smaller coins aggregated into a shared line:

I know itthe day after a major holiday, so lethelp out. The big orange area is bitcoin. The 2017-2018 era is the period in which altcoins had their heyday. And since mid-2018 you can see bitcoin recapture most of its lost, relative prominence.

Bearing in mind that the value of bitcoin has traded as high as roughly $20,000 in late 2017, and is worth about $7,400 today, the chart doesnot merely show bitcoin recovering its former value. But it does show how over the last two years bitcoinshare of the value of traded cryptos has doubled. Here are the key data points:

- December 15, 2016, bitcoin share of total crypto market cap: ~86%

- December 15, 2017, bitcoin share of total crypto market cap: ~55%

- January 15, 2018, bitcoin share of total crypto market cap: ~33%

- December 15, 2018, bitcoin share of total crypto market cap: ~55%

- December 15, 2019, bitcoin share of total crypto market cap: ~66%

More simply, bitcoinshare of the value of all cryptos held steady above 80% for a very long time. Then in early 2017 that same share began to fall. It continued to slip into the early days of 2018. Since then it recovered first to its December 2017 levels. And this year the relative value of bitcoin rose again, bringing it to twice its lowest ratings.

Why did that happen? Here are three reasons that form a part of the why.

There and back again

For those of you with pie to eat, hereour arguments upfront. Bitcoin bounced back due to:

- The failure of distributed apps to take off in terms of usage, and spend;

- The general nonperformance of ICOs;

- A fraud-led flight to quality.

- Details

- Category: Technology

Read more: As 2019 closes, a look back at what happened to the altcoin boom

Write comment (100 Comments)

For those following Huaweisubstantial rise over the past several years, it&ll come as no surprise that the Chinese government played an important role in fostering the hardware maker. Even so, the actual numbers behind the ascent are still a bit jaw-dropping. Huawei reportedly had &access to as much as $75 billion in state support,& according to a piece published by The Wall Street Journal on Christmas Day.

That massive figure is culled from poring over various forms, including grants and tax breaks. Huawei, for its part, isn&t denying any government support, but said in response that what it received was &small and non-material,& in line with the usual variety of grants awarded to tech startups and companies.

Per WSJaccounting of public records, Huawei got around $46 billion in loans and other support, coupled with $25 billion in tax cuts used to accelerate tech advances. Therealso a billion or two here and there for things like land discounts and grants. At the very least, it seems China had a vested interest in the rise of a hardware company that could go head to head with the likes of Apple and Samsung. Certainly itnot unheard of that a government would foster some growth in the form of grants, but therea clear question of how much.

The phone makeralleged close ties to its government have been a major sticking point in its swift international expansion. Such notions have raised flags in the United States, where the company has been barred from providing mobile hardware for government bodies. Many leaders have also raised concerns over use of Huawei telecom equipment, as the company looks to be a linchpin in a global 5G rollout.

Due to such perception and central role in U.S./China trade tensions, itno surprise the company was quick to deny any such ties. Huawei has, of course, been hampered by a U.S. trade ban that has barred the use of U.S.-originated hardware and software. A domestic push and patriotic ad campaign, however, have helped its sales figures in China, even as it has struggled to expand in other parts of the world.

- Details

- Category: Technology

Read more: Huawei reportedly got by with a lot of help from the Chinese government

Write comment (98 Comments)Page 42 of 5614

9

9