Technology

The Daily Crunch is TechCrunchroundup of our biggest and most important stories. If you&d like to get this delivered to your inbox every day at around 9am Pacific, you can subscribe here.

1. Adobe Photoshop arrives on the iPad

Adobe has released Photoshop for the iPad, making good on an announcement that it made last October.

The tablet version of the popular photo-editing software is free to download, and includes a 30-day free trial. After that it$9.99 per month via in-app purchase, or you can get access as part of an Adobe Creative Cloud subscription.

2. Cortana wants to be your personal executive assistant and read your emails to you, too

At its Ignite conference, Microsoft announced a number of new features that help Cortana to become even more useful in your day-to-day work, all of which fit into the companyoverall vision of AI as a tool that is helpful and augments human intelligence.

3. Apple commits $2.5 billion to address Californiahousing crisis and homelessness issues

The investment includes a $1 billion commitment to an affordable housing investment fund, $1 billion toward a first-time homebuyer mortgage assistance fund and $300 million in Apple-owned land that will be made available for affordable housing.

4. A startup just launched red wine to the International Space Station to age for 12 months

The wine isn&t being sent just to help the ISS astronauts relax. Instead, itpart of an experiment that will study how the aging process for wine is affected by a microgravity, space-based environment.

5. Lemonade gets a nastygram from Deutsche Telekom over its use of magenta, says it will fight

Deutsche TelekomGerman lawyers have sent a letter to AI insurance startup Lemonade, demanding it cease using magenta — a color that appears across Lemonadelogo and marketing material — globally.

6. Where tech companies should look to expand

ZillowCheryl Young says the company has analyzed data to determine the best markets that provide fertile environments for startups or tech companies looking to put down stakes for their next office.

7. This weekTechCrunch podcasts

On the latest episode of Equity, Alex and Kate discuss Sam Altmaninvestment in Quill, a company that could eventually challenge Slack. And on Original Content, we review the Netflix series &Living with Yourself,& in which Paul Rudd plays two different versions of the same man.

- Details

- Category: Technology

Read more: Daily Crunch: Adobe launches Photoshop for iPad

Write comment (97 Comments)Ben Horowitz, co-founder of venture firm Andreessen Horowitz, has a new book out titled &What You Do Is Who You Are,& which takes a look at how to create culture at a company.

We sat down with Horowitz last month to discuss some of the lessons he aims to impart and why he felt compelled to write about culture now — including whether it has to do with the growing tech backlash against once-small companies that have taken over the world, and whose cultures are magnified exponentially as a result.

We published parts of our chat here, where we talked about Uber and WeWork specifically. The rest, which dives more into practical advice for founders, follows. Our conversation has been edited lightly for length and clarity.

Extra Crunch: One of the problems we&re dealing with right now, thatdriving this big tech backlash in ways, has a lot to do with just how empowered founders are. And that seemingly goes back to them having more say than other shareholders via dual-class shares. How much power should these founders have?

Ben Horowitz: I think itpretty important for tech companies to have some sort of long-term view of the business. Now, fast forward and Eric Ries has this new idea of a Long Term Stock Exchange, which basically says, okay, founders won&t have to have dual-class shares, but the shareholders and the founders will be in it together. So the shareholders have to vest their shares to get voting rights and if you hold the stock for years, and you can get some power, but you don&t get it right off the bat.

I think that thatprobably the optimal model. But I would say that, at least in my view, dual-class is still better than activist investors going after tech companies, because you can&t get to the next product. It&ll just make the company very short-term.

Also, and maybe I&m talking like an old CEO, but I think one of the things that gets lost in the kind of conversation between founders and shareholders is employees. Itvery bad for employees when activist investors get control of the company and drive it toward short-term returns because often, everybody ultimately loses their job in those scenarios.

What about phasing out those dual-class shares over time, though, maybe over five, or seven, or 10 years, which is a decent amount of time for founders to transition their startups to publicly-traded companies?

I think that that would make sense if the people who got power were long-term investors. I just think that if you have short-term investors, making decisions about [a] technology company, the easier way to expand profits is to stop doing R-D because itnot going to show up in the next two years. But long-term, that&ll spell doom. And I think thatkind of the way these proxy battles have gone. Itbeen like, ‘Okay, stop spending, stop investing.&

I don&t think the kind of cultural issues that companies have run into have much to do with voting power. I think it just has more to do some combination of lack of skill and how fast the companies are growing.

Going back to the book, why weave in the cultural figures that you have — Toussaint Louverture, Genghis Khan and Shaka Senghor [a contemporary who served time for murder and today is a criminal justice reform advocate]. There are so many people you could have included, and you focused on these three individuals.

Ita weird origin story, but Prince years ago put out an album called 3121, and he opened this club in Vegas called the 3121, and he would perform there, like, every weekend. And the show would start at 10 and he would show up at midnight or 1 a.m., but during that time in between, he would show these old films with these really interesting dancers in these elaborate clothes. And you&d just be watching these old guys, and then Prince would start to splice in [his own movies, including] &Under the Cherry Moon& and &Purple Rain,& and you&d go, ‘well those are the dance moves from those guys [in the older films] and thata quote from those guys,& and you realize: that was what he was trying to express. And I thought, you know, I finally really understand him. And I thought, you know, [these three] have really influenced my views on culture [for a variety of reasons] and it would be a good way to tell this story.

Itfascinating how it comes together. Were you ever a teacher?

When I was in graduate school, I was a computer science kind of TA, so I taught the freshmen computer science, programming languages, and whatnot.

My grandfather was a teacher — he was fired actually during the McCarthy era for being a communist teacher; he was teaching junior high.

He was a communist. So at least McCarthy got that part right. But it makes me very nervous, people wanting to remove people from their positions these days because of their points of view. My grandfather supported Stalin, and, like, Stalin was really bad. But I don&t think he should have been fired for being a teacher. I just don&t think itvery good for society. Everybodygot to be able to have a bad point of view. When you go, ‘You have a bad point of view and thatillegal, to think that, and now we&re going to take away your job from you, make you not a legitimate person . . .&

We just saw that in the sports world, which was pretty crazy. Speaking of which, in the book you talk about the need to create shocking rules as part of establishing a company culture. As part of that section, you reference former New York Giants coach Tom Coughlan, who started meetings five minutes early and fined players $1,000 for every minute they were late. Doesn&t Andreessen Horowitz do something like that, penalize people for being late?

- Details

- Category: Technology

Read more: Ben Horowitz on shocking rules and dramatic object lessons

Write comment (95 Comments)Danielle Bernstein is just 27 years old, but shebeen running her own business for 10 years. First it was street-style photography, then came the launch of her popular fashion blog WeWoreWhat. Next she took to Instagram, a new social media platform that quickly became the most effective tool in a bloggertoolkit. With new followers — today her account, @weworewhat, has 2.2 million — came opportunities to monetize her influence. She created and launched an overall brand and a swim collection, then came the book deal (&This is Not a Fashion Story: Taking Chances, Breaking Rules, and Being a Boss in the Big City& is expected out May 2020). Naturally, the next step in Bernsteinevolution from blogger to businesswoman was a technology startup.

Her newest venture, Moe Assist, claims to be the first project management and payments tool for influencers. Last month, the product launched with $1.2 million in funding from Rebecca Minkoff and other unnamed investors. Creators and influencers like Bernstein are forging a path from content creator to full-fledged business, with multiple revenue streams via podcasts, licensing deals, branded merchandise and even software products.

&A company like Moe will help legitimize the industry,& Bernstein tells TechCrunch. &I feel this responsibility to my industry to put the best business practices I&ve learned along the way into a platform so I can help other influencers.&

We are in phase three of the influencer economy. Bain Capital Ventures' Jamison Hill

Tech entrepreneurs, quick to pounce on any emerging economy, have also begun building services for creators and influencers from marketplaces that connect individuals with brands, financial solutions that help capitalize burgeoning influencer-led businesses, tailored monetization platforms and even a &LinkedIn for Influencers& intended to foster connections between influencers and brands.

&We are in phase three of the influencer economy,& Bain Capital Ventures senior principal Jamison Hill, who led the firminvestment in the influencer shoutout marketplace Cameo, tells TechCrunch. &The first phase was the rise of the media platforms: YouTube, Instagram, etcetera, that allowed creatives to build audiences. The second phase was the emergence of influencer marketing, or connecting those influencers to brands to leverage their audiences … Now that influencer marketing has become an established part of the marketing playbook, we are in phase three: tools to help influencers further monetize their influence, like Cameo, and then manage their lives.&

While some businesses, like Cameo, have successfully raised venture financing, VCs have yet to fully tackle the influencer and creator economy. Founders and investors circling the space suspect a wave of Silicon Valley interest is coming, however, and that it will alter the category entirely.

&2020 will be a watershed year for investment in businesses around the creator economy,& Neil Robertson tells TechCrunch. Robertson is the founder of Influence, a networking tool for influencers thatexpected to announce its Series A financing in the coming weeks. &Influencers and creators are small businesses and if you think about all the things that small businesses need these days to succeed, they will be repurposed for the influencer marketing space.&

CEO of Patreon Jack Conte attends VidCon 2019 at Anaheim Convention Center on July 12, 2019 in Anaheim, California (Photo by Jerod Harris/Getty Images)

‘People say we&re crazy&

As venture capitalists wake up to the business opportunity, they&re seeding startups that help influencers go from hobbyists to professionals.

We know creators are legit businesses. Karat, a startup building a bank for creators

Karat, a startup expected to enter Y CombinatorWinter 2020 batch, is building a &bank for creators,& with its debut product focused on lending to individuals through a revenue-share agreement. The company was co-founded by Eric Lei, a former product manager at Instagram who focused on the creator and influencer side of the business.

The startup has already secured a seed investment from Maveron and CRV, TechCrunch has learned, and will receive another $150,000 in exchange for 7% equity upon entering YC next year. The company plans to give creators and influencers more independence from existing platforms by allowing them access to funding from a team well-versed in their unique capital needs.

Banks won&t underwrite an individual based on qualifications like their Instagram following, of course, and given that influencers don&t typically have a consistent income or a W2 statement to showcase their earnings, they may not be able to receive a bank loan to invest in their own brand. Imagine receiving a loan based on the size of your TikTok or YouTube following? Karat and other new startups focused on monetization could accelerate an influencerpath to entrepreneurship.

&People say we&re crazy, but we know creators are legit businesses,& Karat writes on its website — the company didn&t respond to a request to chat about what they&re working on. &And just like any other business, you need capital to grow faster, services to make you more money, tools to manage it all.&

Karatapproach to treating individual digital content creators as future &unicorns& is not isolated. Podfund, for example, writes checks sized between $25,000 to $50,000 to emerging podcasters. The company asks for 7% to 15% of revenue for three to five years depending on current traction, revenue and projected growth. Patreon, one of the first businesses to develop a tech solution for artists and creators seeking consistent income, recently announced Super Patron, a $50,000-per-year grant for creators, according to The Verge.

Influence, the &LinkedIn for influencers,& doesn&t directly invest in influencers or creators; rather, gives them a central meeting point to land gigs, learn about production, gain insights into brand deals and communicate with or befriend other influencers. Indeed, 175,000 people are using the platform, 30,000 of which are businesses, which pay between $229 and $600 in annual fees to reach influencers on the platform. Influencers, for their part, pay $48 per year for access to the companypremium features.

&Think of the old days when a young woman got off the bus at Hollywood - Vine and said ‘where do I go to be a star?,&& Robertson, the chief executive officer of Influence, said. &Thathappening in the influencer marketing space, but thereno answer to that question. People in the industry need a place to go and figure it out, to talk about it and learn about it.&

YouTuber Caspar Lee, the co-founder of a startup called Influencer, attends the UK Gala Screening of &Wonder Park& in London, England (Photo by David M. Benett/Dave Benett/WireImage)

Rethinking value

While angel investors like Rebecca Minkoff might be savvy to the business proposition of influencers, many investors have remained skeptical. InfluenceRobertson tells us venture capitalists were initially uncertain of his latest startup despite his track record, which includes the sale of multiple software businesses, including the affiliate marketing company VigLink.

&We had to explain that there was a very different way to create value in the marketing economy,& Robertson said. &We needed VCs to rethink how value could be created in the influencer marketing space.&

Everyone wants to become an influencer. Influencer CEO Ben Jeffries

The first businesses to crop up in the space were traditional two-sided marketplaces: influencers on one side, companies and brands on the other. Naturally, these were also the first business to get funded. Ben Jeffries launched his startup, Influencer, in London in 2014 after his close friend matched with Caspar Lee, a YouTuber with 7.3 million followers, on Tinder. Once Jeffries and Lee were introduced, the pair begin brainstorming what became Influencer, a marketing platform that helps brands and influencers build more meaningful relationships. The business has attracted about $4.5 million in funding to date, including a recent $3.6 million Series A led by Puma Private Equity, a U.K.-focused fund.

&Theremoney coming into the industry and with this influx of money is more companies entering the market,& Influencer co-founder and CEO Jeffries tells TechCrunch. &Attached to that, brands are becoming much more savvy in how to run influencer campaigns.&

The company has used its new cash to open an office in New York City and expand its American clientele. Another company, Tribe, has similarly raised VC to grow its American footprint. The Australian startup, which connects brands to µ-influencers,& or every-day people with more than 3,000 followers on Instagram, Twitter or Facebook, raised a $7.5 million Series A in March. But even these straightforward marketplaces had trouble explaining their market to investors.

&What we used to always say to investors was ‘I guarantee if you ask your kids about influencers, that will spark a conversation and help you understand the industry and how crazy itgoing to become,& & Jeffries said. &When I was younger, everyone wanted to become a famous sports star. Now, everyone wants to become an influencer.&

Los Angeles-based funds, in closer proximity to the entertainment industry, have been quicker to invest in the creator economy. In fact, new funds have launched there with expertise in the category. Next 10 Ventures, an LA-based $50 million venture capital fund founded by Benjamin Grubbs, YouTubeformer global director of top creator partnerships and Paul Condolora, the former co-head of the Harry Potter franchise at Warner Bros., invests exclusively in the space. The firm even launched an accelerator for YouTube personalities in late 2018. The program, called The EduCator Incubator, planned to seed 25 to 40 &emerging video creators& with $25,000 to $75,000 in seed funding. Similar to Karat and PodFund, Next 10 signs a revenue-share agreement with participants of the accelerator, with a possibility for an equity investment in the future.

Rx3 Ventures, a new venture fund led by long-time Green Bay Packers quarterback Aaron Rodgers, is helping influencers in sports and entertainment get stakes in the companies for which they are hired to be spokespeople. The SoCal outfit has tapped influencers to become limited partners in their fund, giving them the opportunity to develop equitable relationships with the brands requesting their promotion.

&If I am going to support something, why don&t I take an equity position and benefit from the upside?,& Rx3 Ventures vice president Ryan McGuigan tells TechCrunch. &Itall about getting a stake in these brands as opposed to signing some sort of endorsement.&

Lil Miquela, a virtual influencer created by the venture-backed startup Brud, poses for a selfie

When anyone can be an influencer

This year, companies are expected to spend a total of $8 billion on influencer marketing campaigns, a figure that should swell to $15 billion by 2022, per data collected by Mediakix, an influencer marketing agency.

We all have that friend that somehow has 10,000 followers. Rx3 Ventures' Ryan McGuigan

Factors including the onset of shoppable video and live shopping — a category still in its infancy led by startups like Tiltsta — will give more autonomy to influencers, who have proven an ability to transform browsers to buyers time and time again. CGI influencers like Lil Miquela, a digital avatar with 1.7 million followers created by the venture-backed startup Brud, or the lifelike personalized avatars that Genies, SuperPlastic and Toonstar have cooked up, should drum up more dollars. Plus, efforts to democratize the path to influencer, including courses on how to become an influencer and marketing channels that allow for people with only a few thousand followers to earn money, should expand the market size and fuel growth.

&We all have that friend that somehow has 10,000 followers,& McGuigan of Rx3 Ventures said. &Giving them the tools to monetize that reach is going to be important and also a valuable angle to approach influencer marketing for brands.&

&Now, more and more, we are seeing that anyone can turn into a µ-influencer,& he adds. &Anyone with a decent following or free time can post about products — why can&t they be an influencer as well?&

With the expected influx of venture cash, entrepreneurship from creators themselves and startups looking to capitalize on the phenomenon, the creator and influencer economy is poised for a boom.

- Details

- Category: Technology

Read more: Venture capitalists ‘like and subscribe’ to influencers

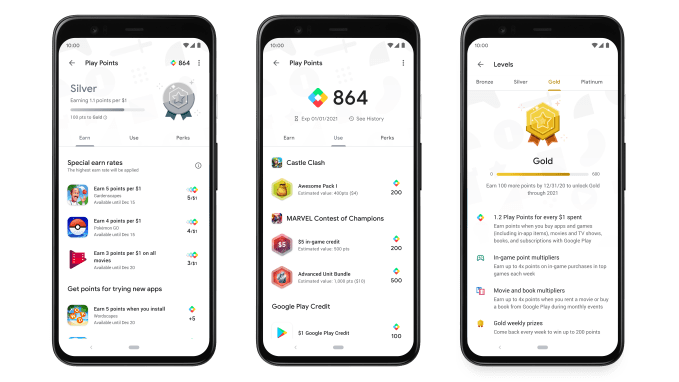

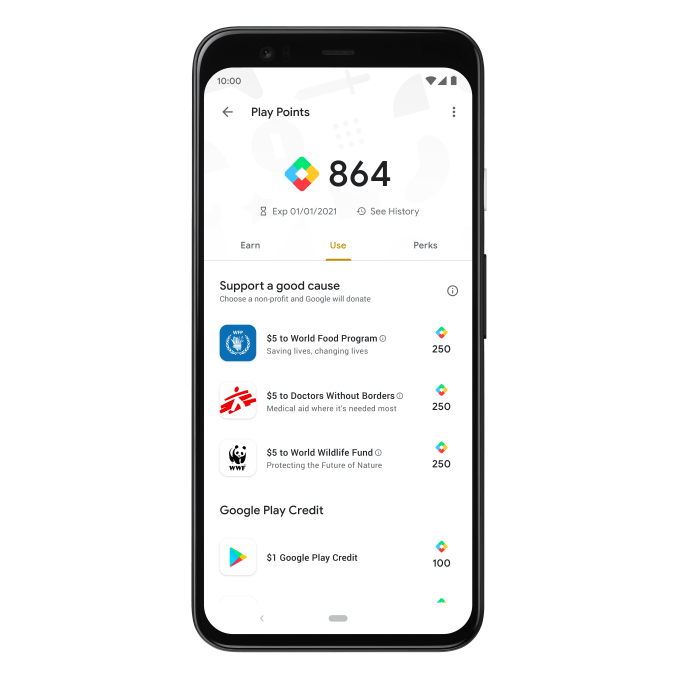

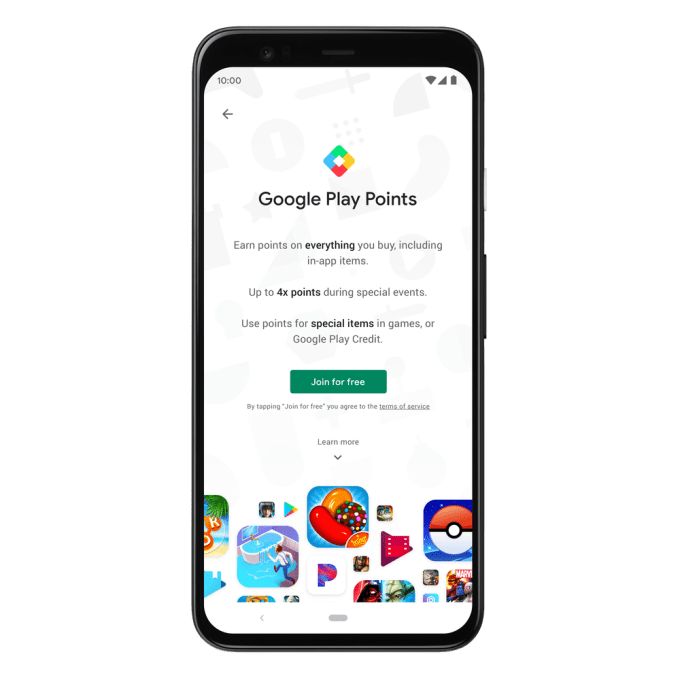

Write comment (91 Comments)Google Play is launching a new rewards program, Googe Play Points, that will allow you to earn points for everything you do on the Google Play marketplace, from downloading new apps to subscribing to services to buying movies, books and more. Users can redeem the points earned in the program for things like in-app purchases of characters, gems and other items in apps like Candy Crush or Pokémon GO, for example. Play Points also can be turned into Google Play Credit, then put toward renting a movie or buying an audiobook, Google says.

These rewards points will encourage people to launch their apps more often and more broadly participate in the Google Play ecosystem.

The program launched in Japan and South Korea, in September 2018 and April 2019, respectively. This is the first time itarriving in the U.S.

Italso been slightly tweaked in terms of point value and levels for its U.S. launch.

The new U.S. program has four levels — Bronze through Platinum. You move up as you earn more points. At the higher levels, you&ll also earn weekly prizes.

The point value begins at $1 USD for the Bronze level and goes up to $1 for 1.4 points at Platinum.

Special events may be hosted where you&ll have the opportunity to earn more points than usual. For example, for this kickoff week, everyone will earn 3x the usual Play Points on everything they buy.

In addition, users can donate their points to support a charitable cause, like Doctors Without Borders USA, Save the Children or the World Food Program USA. These nonprofits will rotate over time.

Beyond Candy Crush and Pokémon Go, there are dozens of other apps also participating in Play Points at launch, with more to come. Google is funding the points, so thereno impact on developer revenue. That is, developers won&t have to choose to participate and accept points as opposed to earning revenue from purchases.

A program like this gives Google more control over its marketplace, as it can turn the dials to boost engagement by offering rewards to its users. Participating apps benefit because it can drive customers to their app, where they&ll eventually spend more money over time.

Google is already familiar with how to incentivize users through gamification techniques — it rewards Local Guides for contributing to Google Maps,for example, with nothing more than badges and a handful of small perks.

The same goes for Play Points — these rewards are relatively small in scale, but could create a much larger incentive, by comparison, to download, play and purchase from Google Play. Therealso a longer-term goal of keeping users in the Android ecosystem by rewarding their loyalty with points that work like cash, in a sense.

Google Play Points will be available over the next week. The program is free to join and thereno ongoing fee. To access Play Points, just go to the menu in the Play Store app and tap on &Play Points.&

Worldwide, Google Play has more than 2 billion users in 190 countries, but those with a rewards program like this — Japan, South Korea and now the U.S. — are Google Playmost lucrative markets. In fact, they&re No. 1 (U.S.), No. 2 (Japan) and No. 3 (South Korea), in terms of 2018 consumer spend on Google Play, according to data from App Annie.That makes them the most important markets for Google to target with rewards, in terms of boosting usage and spending.

- Details

- Category: Technology

Read more: Google PlayUS Store adds a rewards program with points for purchases, downloads more

Write comment (92 Comments)Google News is going bilingual. The company announced this morning a new feature that will allow users to update their Google News settings to support two languages instead of one, in an effort to better serve the more than 60% of people worldwide who speak and read news across two or more languages.

The change means you won&t have to constantly toggle between two languages in order to keep up with news thatbeing covered elsewhere. This is particularly important for those who have moved to a different country, but want to keep up with their news from back home, as well as in places where itcommon for people to speak multiple languages.

Google cites the ability to read both English and Hindi news at the same time as a key example.

The update won&t impact your other personalization preferences, Google notes — it will just pull in more stories that match the topics and interests you care about.

The changes follow a larger revamp of the Google News product and destination website thatbeen underway for over a year. At Googledeveloper conference in 2018, the company announced its plans to leverage AI technology to help select which stories were shown first and how the news selection would be customized to each user, while not trapping them in so-called &filter bubbles& where they don&t have access to fact checks or the other sideopinion.

The changes follow a larger revamp of the Google News product and destination website thatbeen underway for over a year. At Googledeveloper conference in 2018, the company announced its plans to leverage AI technology to help select which stories were shown first and how the news selection would be customized to each user, while not trapping them in so-called &filter bubbles& where they don&t have access to fact checks or the other sideopinion.

That AI-powered version of the Google News app rolled out last spring.

More recently, Google revamped the Google News tab on the desktop to organize articles in a card-style layout, which was meant to improve readability and better highlight the publisher sources.

Todaynew bilingual feature, however, is aimed at the Google News mobile app user base.

Google says the feature is available now across 141 countries and 41 languages on the Google News app for both iOS and Android. (On the desktop, you still have to pick just one language, we found.)

The company notes that being able to read news in other languages can also help people widen their perspective on issues.

&Therestill lots more to do to help connect people with quality and trustworthy news on the issues they care about, but we hope todayupdate will make it easier to connect with different cultures and perspectives from the comfort of your device,& Google says.

- Details

- Category: Technology

Read more: The Google News mobile app now supports bilingual users

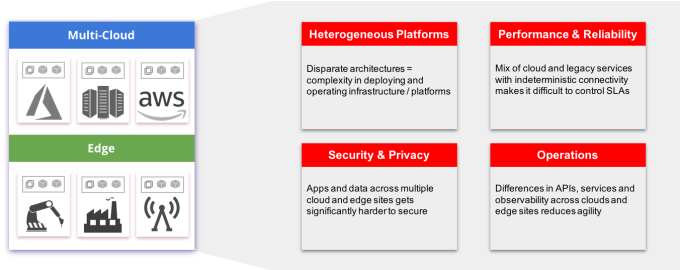

Write comment (95 Comments)Volterra is an early-stage startup that has been quietly working on a comprehensive solution to help companies manage applications in hybrid environments. The company emerged from stealth today with a $50 million investment and a set of products.

Investors include Khosla Ventures and Mayfield, along with strategic investors M12 (Microsoftventure arm), Itochu Technology Ventures and Samsung NEXT. The company, which was founded in 2017, already has 100 employees and more than 30 customers.

What attracted these investors and customers is a full-stack solution that includes both hardware and software to manage applications in the cloud or on-prem. Volterra founder and CEO Ankur Singla says when he was at his previous company, Contrail Systems, which was acquired by Juniper Networks in 2012 for $176 million, he saw first-hand how large companies were struggling with the transition to hybrid.

&The big problem we saw was in building and operating applications that scale is a really hard problem. They were adopting multiple hybrid cloud strategies, and none of them solved the problem of unifying the application and the infrastructure layer, so that the application developers and DevOps teams don&t have to worry about that,& Singla explained.

He says the Volterra solution includes three main products — VoltStack, VoltMesh and VoltConsole — to help solve this scaling and management problem. As Volterra describes the total solution, &Volterra has innovated a consistent, cloud-native environment that can be deployed across multiple public clouds and edge sites — a distributed cloud platform. Within this SaaS-based offering, Volterra integrates a broad range of services that have normally been siloed across many point products and network or cloud providers.& This includes not only the single management plane, but security, management and operations components.

Diagram: Volterra

The money has come over a couple of rounds, helping to build the solution to this point, and it required a complex combination of hardware and software to do it. They are hoping organizations that have been looking for a cloud-native approach to large-scale applications, such as industrial automation, will adopt this approach.

- Details

- Category: Technology

Read more: Volterra announces $50M investment to manage apps in hybrid environment

Write comment (100 Comments)Page 448 of 5614

16

16