Technology

Uber, which had already pulled its autonomous cars off the road following a fatal crash in Tempe, Arizona, is officially calling it quits in the state of Arizona, The Wall Street Journal first reported, citing an internal memo from Uber Advanced Technologies Group lead Eric Meyhofer.

As part of the wind-down, Uber has let go 300 of its test drivers. This comes after the state of Arizona in Marchofficially barred Uber from testing its autonomous vehicles on public roads.

&We&re committed to self-driving technology, and we look forward to returning to public roads in the near future,& an Uber spokesperson said in a statement. &In the meantime, we remain focused on our top-to-bottom safety review, having brought on former NTSB Chair Christopher Hart to advise us on our overall safety culture.&

Uber is hoping to have its self-driving cars performing tests on public roads again within the next few months, Uber CEO Dara Khosrowshahi said at an Uber conference earlier this month. Once the National Transportation Safety Board completes its investigation of the Tempe crash, Uber plans to continue testing in San Francisco, Toronto and Pittsburgh. But if Uber wants to continue its tests in California, it will need to apply for a new permit, as well as &address any follow-up analysis or investigations from the recent crash in Arizona,& DMV Deputy Director/Chief Counsel Brian Soublet wrote in a letter to Uber in March. Uber may also need to set up a meeting with the DMV.

- Details

- Category: Technology

Read more: Uber is done testing self-driving cars in Arizona

Write comment (100 Comments)A slew of well-funded new entrants backed by massive amounts of capital are chasing Tesla lead in an effort to power the next generation of the electric vehicle industry.

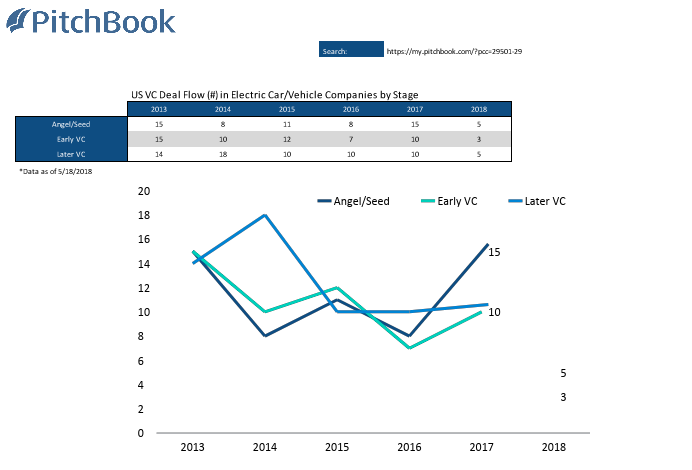

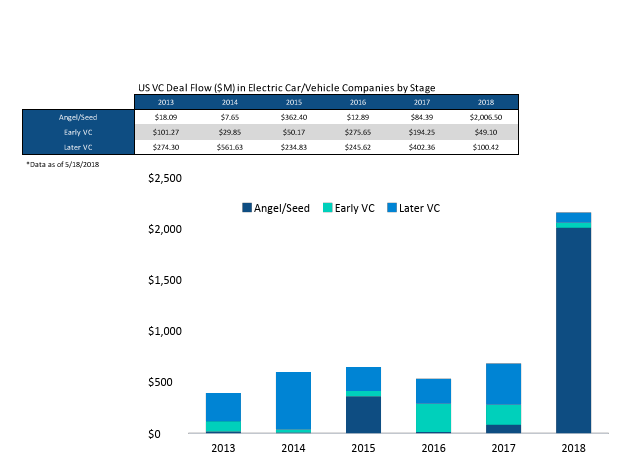

Electric vehicle startups have raised more than $2 billion in the U.S. over the first months of 2018 alone, a huge increase over the $650 million raised in 2017, according to data from PitchBook. And the investment trends point to more competition for Tesla from established car companies and upstart manufacturers alike in the next few years.

All of this activity is thanks to the size of the industry thatin play. The market for electric passenger vehicles is expected to reach $356.5 billion by 2023 led by $205.9 billion in sales coming from the Asia-Pacific region, according to predictions from the market intelligence firm, Absolute Reports.

Given those numbers, itno wonder that investments into electric vehicle companies and the enabling technologies for them keep climbing — and most of the cash commitments are being made in newly formed companies. PitchBook data indicates that early-stage deals are on the rise, with 15 investments into startup electric vehicle companies in 2017. (Itimportant to note that PitchBook data, and the work of other market intelligence firms, is somewhat fuzzy and imprecise.)

In 2018, first investments accounted for the bulk of the $2 billion raised.

Many of these electric vehicle challengers emerged from the wreckage of other companies that had sought the pole position in the race for auto-industry dominance. Several new companies have emerged from the collapse of Faraday Future and Fisker Automotive, even as both companies found themselves reborn with new leases on life thanks to redoubled capital commitments from global billionaires, Chinese companies awash in money and traditional venture firms angling for a shot at Teslamarket dominance.

Teslaterrible, horrible, no good, very bad year (to date)

While the size of the electric vehicle market is one factor motivating the competition, another is the series of miscues from Tesla, the independent electric vehicle market leader, which has competitors wondering if the wheels are coming off Elon Muskbig bet.

By any measure, Tesla has had a very bad year. Consumer Reports just issued a report saying it could not recommend the companylatest offering, the Model 3. And production for that new car, the companyfirst effort to manufacture a low-cost electric vehicle, has caused innumerable problems for Musk and his staff.

Cost overruns have outlets likeBloomberg speculating that Tesla wouldn&t have enough cash to make it through the calendar year.

The company spends exorbitant amounts of money compared to its established automaker competitors. The companystaff has ballooned from fewer than 1,000 employees in 2010 to nearly 40,000 now, according to Bloomberg, and competitors like GM and Ford bring in 2.5 times as much revenue for each employee compared with Tesla.

Production problems are also compounded by an aggressive schedule for new vehicles, which has the Tesla hype machine calling for a new Roadster, a crossover car and an electric semi truck all supposedly coming to market in the next few years.

Stalled production and cost overruns aren&t Teslaonly concerns. The NTSB is investigating the companyliability in another deadly crash involving its autonomous systems and top executives have been bolting for the exits in what Musk categorized as a &flattening& of his companymanagement structure.

No wonder executives at new startups just now entering the market may be thinking that Musk and Tesla may no longer be in the drivers& seat.

Karma Revero (PRNewsFoto/Karma Automotive)

U.S. startups take their marks

Itagainst this backdrop that competitors like Evelozcity and Independent Electric Vehicles, two startups born from the wreckage of Faraday Future (the once-relevant Tesla competitor) have come to market to potentially challenge Teslasupremacy. While Independent Electric Vehicles has stayed under the radar — with not much known about the company other than Jalopnikreport of Chinese backers and an executive team headed in part by Steve Osario, Faradayformer head of design operations and advanced model development — Evelozcity has made a splash.

From its base in Los Angeles, Evelozcity boasts a $1 billion commitment from undisclosed international backers and a seasoned executive team (culled primarily from Faraday Future) that includes the former chief financial officer of BMW, Stefan Krause; Richard Kim, who was instrumental in the development of BMWi3 and i8; and Karl Thomas-Neumann, who joined the company from GMEuropean division.

Two other companies in the Los Angeles area, the Irvine, Calif.-based Karma Automotive and a newly reborn Fisker Inc. also have cars they&re putting into the market — along with a rebooted Faraday Future, which reportedly received a billion-dollar investment from a white knight before it was forced into insolvency.

What most of these would-be Tesla competitors have in common is a determination not to eschew the principles of auto manufacturing in favor of a completely new approach.

&There will be a lot of room to grow for many,& said one executive at a new early-stage electric vehicle company. &If I look at the combustion engine industry… when it started you had thousands of companies competing for a much smaller market.&

Global competition and Chinapotential to race ahead

If new entrants in the U.S. aren&t worrying enough for Tesla, then the deluge of electric vehicle startups coming from China should. An article inThe South China Morning Postlisted 10 startups coming from the worldnew economic powerhouse with a combination of capital and manufacturing muscle that could spell real trouble for other independent electric vehicle and autonomous driving-focused automakers.

&Tesla paved the way, now we&re taking this a step further,& Padmasree Warrior, the head of the U.S. arm of Shanghai-based electric vehicle startup, NIO, told The Wall Street Journal. &We have a mission to transform mobility.&

That Chinese investors should push so aggressively into the market isn&t surprising (remember that the Asia-Pacific region will account for $205.9 billion in sales), and global numbers show that investors are already anticipating that rising wave of demand.

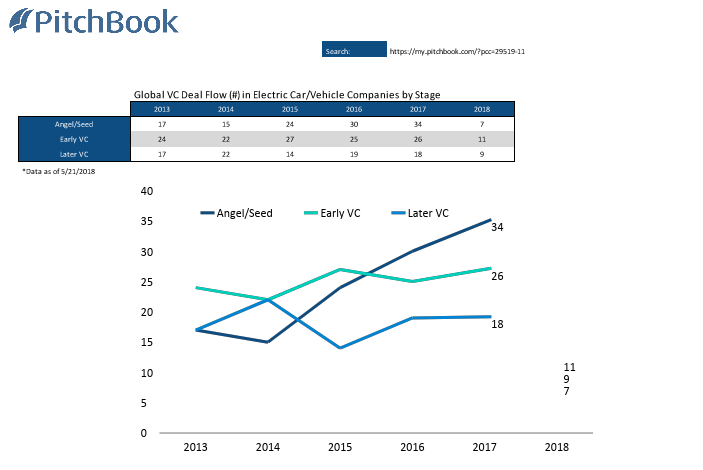

There are at least 34 new, early-stage startups that were launched in 2017 alone to tackle the electric vehicle ecosystem. Of the companies mentioned byThe SCMP, six are squarely focused on electrification.

They include Byton, a company backed by one of Chinabest (and most government-connected) funds, Legend Capital; along with the auto manufacturer Harmony Auto and League Automotive Technologies. Byton expects to begin production in 2019 and has a seasoned executive team from some of the worldbest manufacturers.

Niobackers aren&t too shabby either, given that they include Chinese tech giants, Baidu, Tencent Holdings and Xiaomi. Financial investors include the global venture capital powerhouse Sequoia Capital and domestic dynamo Hillhouse Capital. And the trinity of Tencent, Baidu and Sequoia are also backing another electric vehicle competitor in WM Motor, another Shanghai-based Tesla challenger that has automaker Zhejiang Geely Holding as another pillar in its foundation.

Arrayed against those three new entrants are four other companies like Xiaopeng Motors (backed by two tech titans — Alibaba and Foxconn — and four sterling investors in IDG Capital, Yunfeng Capital, CICC and Morning Ventures); Singulator Motor, which has backing from the Tongling government; and CHJ Automotive, a company backed by two players in the automotive industry, Zhejiang Leo Group and Changzhou Wunan New Energy Car.

Anyone who wonders what effect a flood of Chinese manufacturers can have on a market would do well to look at the role Chinese companies played in significantly driving down the cost of solar panels and wind turbines — and the ways those suppliers now control global renewable energy markets.

The Byton connected car is seen during its launch at CES 2018 in Las Vegas on January 7, 2018. MANDEL NGAN/AFP/Getty Images

Big Autobig bet

Even as these companies raise billions in commitments from investors to build the next generation of electric vehicles, the big automakers that first developed the technology (and then subsequently shelved it) are placing their own massive bets on electrification.

AsReutersreported at the beginning of the year, big auto is committing at least $90 billion to electrify at least some of their most popular vehicles over the coming years.

The big car companies are motivated in part by the competition they see coming from Tesla and startups, but more importantly from government regulations in China, Europe and potentially the U.S.

&There are three contenders for this huge market opportunity,& said one executive at an upstart electric vehicle company, speaking on background. &The first is the OEMs. But they had to learn from Tesla how to do it.&

Originally, these companies were skeptical about market adoption, but now, with China leading the charge toward electrification through regulation they have no choice. &The government will push it,& this executive said. &But the government will then have to deal with the principle of increased margins and higher costs for consumers.&

For this executive, in these still-early days of mass electrification the two companies that are most committed are GM and Volkswagen.

Beyond big auto, this executive also said that big tech — namely Alphabet, the parent company of Google and the autonomous driving company, Waymo, and Apple — represent the biggest competitive threat.

The leader of the pack

Despite all of the competitors shifting into overdrive, MuskTesla still remains the company to beat — even with its many missteps. The fact remains that Musk is the first person to build a new, independent automaker in the last century. Thatno small feat, but it accomplished in a vastly different competitive environment. Iteasy to win a race when there are only two or three other cars to beat. It remains to be seen how well Tesla can do when it faces a full field.

- Details

- Category: Technology

Read more: Upstarts emerge to chase Tesla’s lead in electric vehicles

Write comment (98 Comments)Thirteen members of Congress have written to FCC Chairman Ajit Pai criticizing his &repeated evasive responses to our inquiries& and &outright refusal to respond to some of the members of this Committee.& Unsatisfied with the answers or evasions he has offered to date, they reiterate questions related to net neutrality and other issues that they&ve sent over the past months.

&While we appreciate your continued willingness to testify before our Committee, we are concerned that you have been unable to give complete responses to verbal questions, questions for the record, or oversight letters from our members,& reads the letter from the House Committee on Energy and Commerce Democrats.

&We take our oversight responsibilities very seriously, and we expect witnesses before the Committee and recipients of our letters to treat their responses the same way,& they wrote.

These Representatives, led by Frank Pallone Jr (D-NJ) and Mike Doyle (D-CO), have sent multiple letters of inquiry to Pai over run-up to and aftermath of the net neutrality vote.

In June, they questioned the nature of and response to the cyberattack on FCC systems during the net neutrality comment period. Pai responded saying that much of what they asked he could not answer because the threat was &ongoing& and revealing the measures they took would &undermine& them.

Before the passage of the rules, they warned that the FCCproposal &fundamentally and profoundly runs counter to the law,& and that they spoke with the authority of people who had helped craft that particular law. Pairesponse to this may be considered the rule itself, which he clearly believes is completely lawful and justifies itself in its lengthy preamble.

After the vote, they sent a letter asking about numerous problems relating to the comment system and why, for example, their own comments were not addressed. Pai responded to a number of letters taking issue with the FCCRestoring Internet Freedom order with a form letter of his own that assured his august pen pals that everything was fine.

The inadequate responses to these and many other letters (on such issues as media regulation and 911 issues) clearly got the Committee to the point where they felt they had to strike back. A sternly worded letter may not do any more now than it did over the last year, but a paper trail of displeasure and responses with a distinct &lack of candor,& as Rep. Pallone put it, could be useful down the road.

You can read the full letter here, to which is appended &a collection of letters that you have yet to answer completely, or at all.& Chairman Pai is requested to provide responses by June 4.

- Details

- Category: Technology

If you bought a battery replacement for an out-of-warranty iPhone last year, you may be eligible for a $50 credit from Apple. The company issued a new support page post this week, announcing the rebate policy, which applies to purchases made at authorized locations.

The move is part of on-goingrestitutionin the wake of an admission that the company was throttling processing speeds on older model phones, in order to save on battery life. Late last year, Apple apologized for not informing users about the issue, promising to be more transparent in the future.

Soon after, the company began offering $29 battery replacements — a $50 discount on out-of-warranty battery replacements. This credit covers those who purchased a battery out-of-warranty any point in 2017, leading up to that new offer.

The company has promised to send an email to all eligible users with instructions on how to get the credit transferred to their account between now and July 27. Those who don&t get a notification, but still believe themselves to be eligible, can contact Apple directly between now and the end of the year.

- Details

- Category: Technology

Read more: Apple offers a $50 credit for some out-of-warranty iPhone battery purchases

Write comment (97 Comments)Ahead of VivaTech, 50 tech CEOs came to Paris to have lunch with French President Emmanuel Macron. Then, they all worked together on &tech for good&. The event was all about leveraging tech around three topics — education, labor and diversity.

At the end of the day, French Prime Minister Édouard Philippe invited everyone for a speech in Matignon. It wasn&t a groundbreaking speech as Macron is also speaking at VivaTech tomorrow morning. &We&re trying to pivot France,& Philippe said.

With great power comes great responsibility Édouard Philippe

Maurice Lévy, the former CEO of Publicis, one of the two companies behind VivaTech with Les Échos, first introduced the event, as well as Eric Hazan from McKinsey. McKinsey worked on the data that was used to start those discussions. So letsee what they talked about.

&As McKinsey showed, thereno question that technology overall is a net creator of job and GDP. Ita positive force,& Uber CEO Dara Khosrowshahi said. &At the same time, AI and automation, while driving the economy and productivity, […] will lead to large groups being disadvantaged.&

He then listed a few important points to make sure that nobody is going to be left behind, such as coaching and mentorship programs.

&This is not just the governmentjob but it is also the job of private companies,& Khosrowshahi added.

He wanted to remain hopeful and it felt a bit like a lobbying effort. &Iteasy to see the lost of jobs because of automation. But itmuch more difficult to dream about the possibilities of the future,& he said. In other words, don&t worry about the on-demand economy, don&t worry about self-driving cars.

IBM CEO Ginni Rometty was in charge of the discussions around education. &We also had a lot of engineers and pragmatic people there. And we ended up with five recommendations,& she said.

It sounds like these recommendations would be really favorable for IBM and other tech companies. So here are these recommendations:

- Focus and segment this problem. Focus on the quarter of the population the most at risk.

- Align the skills that businesses need with the education system (hard skills and soft skills).

- There should be an open partnership with governments to reposition vocational education, learn by doing, foster internships, apprenticeships, simulations and redirect tax to incentivize.

- Work with teachers to pilot, get hard evidence and then scale.

- Retraining employees is the responsibility of all employers.

Finally, SAP CEO Bill McDermott talked about diversity. &As we looked at the facts, there are 33 percent more revenue, more profit for companies that got the memo on companies more inclusive and more diverse,& he said.

Culture, gender and geography were the main themes. But they also talked about differently able people. SAP will make an announcement around autism in France.

&Dara, Ginni and Bill, thank you for your introduction, that was brilliant, in English and concise,& French Prime Minister Édouard Philippe said.

He then listed three ideas that sum up his thinking about the tech industry.

&I truly believe in freedom, in that fundamental ability that you need to be able to take good decisions and bad decisions,& he said. The second idea is the consequence of that first one.

&With great power comes great responsibility. I think a modern philosopher called Peter Parker said that for the first time. And I really think ittrue.&

&While you don&t have to regulate on everything, when something isn&t regulated, itpossible that it gets out of your control. And when it comes to the digital revolution and the data revolution, that freedom needs some boundaries. You know that Europe worked on some regulation — GDPR. What looked like regulation against innovation now appears as desirable and useful,& he said.

He then indirectly called out Facebook for its half-baked GDPR changes. &Some of you, and I believe itthe case of Microsoft, decided to enforce GDPR everywhere. And I encourage everyone to do the same.&

The fact that 50 CEOs came to Paris is interesting by itself. Ita sign that tech companies want to have an open discussion with governments. They want to make sure that regulation is favorable. On the other end, governments want to make sure that tech innovations aren&t going to divide society.

But itjust starting.

Some companies announced a few things in Paris. Uber expanded its accident insurance to contractors across Europe, when they&re working and also when they&re not on the road. IBM plans to hire 1,800 people in France. Deliveroo is going to invest $117 million (€100 million) over the next few years.

Letsee if Macron has more to say tomorrow.

Herethe full list of tech CEOs in Paris for the Tech for Good Summit:

- Kevin Sneader, CEO, Mckinsey

- Audrey Azoulay, Director, UNESCO

- Mark Zuckerberg, Founder and CEO, Facebook

- John Kerry, Senior Fellow, Carnegie Foundation

- Satya Nadella , CEO, Microsoft

- Pierre Louette, CEO, Les Echos

- Tony Elumelu, President, United Bank for Africa

- Maurice Lévy, Co-Founder, Viva Technology

- Charlotte Hogg, CEO, Europe Visa

- Jean-Paul Agon, CEO, L&Oréal

- Tristan Harris, Executive Director, Center for Human technology

- Alexandre Dayon, CEO, Salesforce

- Brian Krzanich, CEO, Intel

- Mitchell Baker, President, Mozilla Foundation

- Yves Meignié, CEO, Vinci Energies

- Gilles Pelisson, CEO, TF1

- Bill McDermott, CEO, SAP

- Young Sohn, CEO, Samsung

- Gillian Tans, CEO, Booking.com

- Niklas Zennstrom, Founder and CEO, Atomico

- Will Shu, CEO, Deliveroo

- Sunil Bharti Mittal, President, Bharti enterprises

- Joe Schoendorf, Partner, Accel

- Nick Bostrom, Director, Future of Humanity Institute

- Julie Ranty, Director, VivaTech

- Eric Leandri, CEO, Qwant

- Olivier Brandicourt, CEO, Sanofi

- Mo Ibrahim, President, Mo Ibrahim Foundation

- Yossi Vardi, Entrepreneur

- Philippe Wahl, CEO, Groupe La Poste

- Pierre Nanterme, CEO, Accenture

- Tom Enders, CEO, Airbus

- Tim Hwang, Director, Harvard-MIT Ethics - Governance of AI Initiative

- Octave Klaba, Founder and CEO, OVH

- Ginni Rometty, CEO, IBM

- Pierre Dubuc, CEO, OpenClassrooms

- Isabelle Kocher, CEO, Engie

- Sy Lau, CEO, Tencent

- Xavier Niel, Founder, Iliad/Free

- Jimmy Wales, Founder, Wikimedia Foundation

- Jean-Laurent Bonnafé, CEO, BNP Paribas

- Angela Ahrendts, Vice President Retail, Apple

- Frédéric Mazella, Co-Founder and President, BlaBlaCar

- Stewart Butterfield, CEO, Slack

- Alex Karp, CEO, Palantir

- Guillaume Pepy, CEO, SNCF

- Jacquelline Fuller, President, Google.org

- Stéphane Richard, CEO, Orange

- Clare Akamanzi, CEO, Rwanda Development Board

- Paul Hermelin, CEO, CapGemini

- Eric Hazan, Senior Partner, McKinsey

- Ludovic Le Moan, Co-Founder and CEO, Sigfox

- Dara Khosrowshahi, CEO, Uber

- Catherine Guillouard, CEO, RATP

- Tim Collins, CEO, Ripplewood

- Bernard Liautaud, Partner, Balderton

- Alain Roumilhac, CEO, Manpower Group France

- Hiroshi Mikitani, CEO, Rakuten

- John Collison, Co-Founder and CEO, Stripe

- Maxime Baffert, Director, VivaTech

- Thomas Buberl, CEO, Axa

- Details

- Category: Technology

Read more: 50 tech CEOs come to Paris to talk about tech for good

Write comment (99 Comments)Disrupt SF is set to be the biggest tech conference that TechCrunch has ever hosted. So it only makes sense that we plan an agenda fit for the occasion.

Thatwhy we&re absolutely thrilled to announce that Ring Jamie Siminoff will join us on stage for a fireside chat and Jason Mars from Clinc will be demo-ing first-of-its-kind technology on the Disrupt SF stage.

Jamie Siminoff & Ring

Earlier this year, Ring became Amazonsecond largest acquisition ever, selling to the behemoth for a reported $1 billion.

But the story begins long ago, with Jamie Siminoff building a WiFi-connected video doorbell in his garage in 2011. Back then it was called DoorBot. Now, itcalled Ring, and itan essential piece of the overall evolution of e-commerce.

As giants like Amazon move to make purchasing and receiving goods as simple as ever, safe and reliable entry into the home becomes critical to the mission. Ring, which has made neighborhood safety and home security its main priority since inception, is a capable partner in that mission.

Of course, one doesn&t often build a successful company and sell for $1 billion on their first go. Prior to Ring, Siminoff founded PhoneTag, the worldfirst voicemail-to-text company and Unsubscribe.com. Both of those companies were sold. Based on his founding portfolio alone, itclear that part of Siminoffsuccess can be attributed to understanding what consumers need and executing on a solution.

Dr. Jason Mars & Clinc

AI has the potential to change everything, but there is a fundamental disconnect between what AI is capable of and how we interface with it. Clinc has tried to close that gap with its conversational AI, emulating human intelligence to interpret unstructured, unconstrained speech.

Clinc is currently targeting the financial market, letting users converse with their bank account using natural language without any pre-defined templates or hierarchical voice menus.

But there are far more applications for this kind of conversational tech. As voice interfaces like Alexa and Google Assistant pick up steam, there is clearly an opportunity to bring this kind of technology to all facets of our lives.

At Disrupt SF, Clincfounder and CEO Dr. Jason Mars plans to do just that, debuting other ways that Clincconversational AI can be applied. Without ruining the surprise, let me just say that this is going to be a demo you won&t want to miss.

Tickets to Disrupt are available here.

- Details

- Category: Technology

Read more: Ring’s Jamie Siminoff and Clinc’s Jason Mars to join us at Disrupt SF

Write comment (98 Comments)Page 5291 of 5614

17

17