Technology

The holidays might be a time of slowed activity for most companies in the tech sector, but for SpaceX, it was a time to ramp production efforts on the latest Starship prototype — &Starship SN1& as itcalled, according to SpaceX CEO Elon Musk . This flight design prototype of Starship is under construction at SpaceXBoca Chica, Texas development facility, and Musk was in attendance over the weekend overseeing its build and assembly.

Musk shared video of the SpaceX team working on producing the curved dome that will sit atop the completed Starship SN1 (likely stands for &serial number 1,& a move to a more iterative naming system and away from the &Mark& nomenclature used for the original prototype), a part he called &the most difficult& in terms of the main components of the new spacecraft. He added that each new SN version of the rocket SpaceX builds will have minor improvements &at least& through the first 20 or so versions, so itclear they expect to iterate and test these quickly.

As for when it might actually fly, Musk said that he hopes this Starship will take off sometime around &2 to 3 months& from now, which is still within range of the projections for a first Starship high-altitude test flight given by the CEO earlier this year at the unveiling of the Starship Mk1 prototype. That prototype was originally positioned as the one that would fly for the high-altitude test, but it blew its top during testing in November and Musk said they&d be moving on to a new design rather than repair or rebuild the Mk1.

Musk also shared new details about the construction process for Starship, including that SpaceX will move its build process for future spacecraft to an enclosed building starting with Starship &SN2& in January — though mostly to block out the winds experienced in Boca Chica, as Musk says that welding for stainless steel (the primary material for the Starship fuselage) is much less sensitive to dust and debris than aluminum.

In another tweet, Musk detailed another change from SpaceXprevious operating model in developing Starship: The future spacecraftdevelopment is being focused at Boca Chica currently, he said, while SpaceXCape Canaveral teams are &focused on Falcon/Dragon.& Up until now, SpaceX has been operating two separate teams working in parallel on Starship prototypes at both sites. Musk didn&t detail what will become of Starship Mk2, the other earlier prototype that was currently in development at Cape Canaveral in Florida.

Musk also shared updates about his tunneling company, The Boring Co. (they hope to open their Vegas tunnel to drivers in 2020), Starlink (could be available to customers in the Caribbean either in 2020 or 2021) and chocolate chip muffins.

- Details

- Category: Technology

2019 brought more global attention to Africatech scene than perhaps any previous year.

A high-profile IPO, visits by both Jacks (Ma and Dorsey) and big Chinese startup investment energized that.

The last 12 months served as a grande finale to 10 years that saw triple-digit increases in startup formation and VC on the continent.

Herean overview of the 2019 market events that captured attention and capped off a decade of rapid growth in African tech.

IPOs

The story of the year is the April IPO on the NYSE of Pan-African e-commerce company Jumia. This was the first listing of a VC-backed tech company operating in Africa on a major global exchange — which brought its own unpredictability.

Founded in 2012, Jumia pioneered much of its infrastructure to sell goods to consumers online in Africa.

With Nigeria as its base market, the Rocket Internet-backed company created accompanying delivery and payments services and went on to expand online verticals into 14 African countries (though it recently exited a few). Jumia now sells everything from mobile phones to diapers, and offers online services such as food-delivery and classifieds.

With Nigeria as its base market, the Rocket Internet-backed company created accompanying delivery and payments services and went on to expand online verticals into 14 African countries (though it recently exited a few). Jumia now sells everything from mobile phones to diapers, and offers online services such as food-delivery and classifieds.

Seven years after its operational launch, Jumiastock debut kicked off with fanfare in 2019, only to be followed by volatility.

The online retailer gained investor confidence out of the gate, more than doubling its $14.95 opening share price post-IPO.

That lasted until May, when Jumiastock came under attack from short-seller Andrew Left, whose firm Citron Research issued a report accusing the company of fraud. The American activist investorcase was bolstered, in part, by a debate that played out across Africatech ecosystem on Jumialegitimacy as an African startup, given its (primarily) European senior management.

The entire affair was further complicated by Jumiasecond-quarter earnings call when the company disclosed a fraud perpetrated by some of its employees and sales agents. JumiaCEO Sacha Poignonnec emphasized the matter was closed, financially marginal and not the same as Andrew Leftshort-sell claims.

Whatever the balance, Jumia2019 ups and downs cast a cloud over its stock with investors. Since the companythird-quarter earnings-call, JumiaNYSE share-price has lingered at around $6 — less than half of its original $14.95 opening, and roughly 80% lower than its high.

Even with Jumiapost-IPO rocky road, the continentleading e-commerce company still has a heap of capital and is on pace to generate more than $100 million in revenues in 2019 (albeit with big losses).

The company plans to reduce costs by generating more revenue from higher-margin internet services, such as payments and classifieds.

Therea fairly simple equation for Jumia to rebuild shareholder confidence in 2020: avoid scandals and increase revenues over losses. And now that the company is publicly traded — with financial reporting requirements — there&ll be four earnings calls a year to evaluate Jumiaprogress.

Jumia may not be the continentstandout IPO for much longer. Events in 2019 point to Interswitch becoming the second African digital company to list on a global exchange in 2020. The Nigerian fintech firm confirmed to TechCrunch in November it had reached a billion-dollar unicorn valuation, after a (reported) $200 million investment by Visa.

Founded in 2002 by Mitchell Elegbe, Interswitch created much of the initial infrastructure to digitize Nigeria(then) predominantly cash-based economy. Interswitch has been teasing a public listing since 2016, but delayed it for various reasons. With the companybillion-dollar valuation in 2019, that pause is likely to end.

&An [Interswitch] IPO is still very much in the cards; likely sometime in the first half of 2020,& a source with knowledge of the situation told TechCrunch.

China-Africa goes digital

2019 was the year when Chinese actors pivoted to African tech. China is known for its strategic relationship with Africa, based (largely) on trade and infrastructure. Over the last 10 years, the country has been less engaged in the continentdigital scene.

That was until a torrent of investment and partnerships this past year.

That was until a torrent of investment and partnerships this past year.

July saw Chinese-ownedOperaraise $50 million in venture spending to support its growing West African digital commercial network, which includes browser, payments and ride-hail services.

In August, San Francisco and Lagos-basedfintechstartupFlutterwavepartnered with Chinese e-commerce company Alibaba&sAlipayto offer digital payments between Africa and China.

In September, ChinaTranssion — the largest smartphone seller in Africa — listed in an IPO on Shanghainew STAR Market. The company raised ≈ $394 million, some of which it is directing toward venture funding and operational expansion in Africa.

The last quarter of 2019 brought a November surprise from China in African tech. More than 15 Chinese investors placed over $240 million in three rounds. Transsion-backed consumer payments startup PalmPay raised a $40 million seed, stating its goal to become &Africalargest financial services platform.&

Chinese investors also backed Opera-owned OPay$120 million raise and East-African trucking logistics company Lori Systems& (reported) $30 million Series B.

In the new year, TechCrunch will continue to cover the business arc of this surge in Chinese tech investment in Africa. There&ll surely be a number of fresh macro news points to develop, given the debate (and critique) of Chinaengagement with Africa.

Nigeria and fintech

On debate, the case could be made that 2019 was the year when Nigeria become Africaunofficial capital for fintech investment and digital finance startups.

Kenya has held this title hereto, with the local success and global acclaim of its M-Pesa mobile-money product. But more founders and VCs are opting for Nigeria as the epicenter for digital finance growth on the continent.

A rough tally of 2019 TechCrunch coverage — including previously mentioned rounds — pegs fintech-related investment in the West African country at around $400 million over the last 12 months. Thatequivalent to roughly one-third of all startup VC raised for the entire continent in 2018, according to Partech stats.

From OPay to PalmPay to Visa — startups, big finance companies and investors are making Nigeria home-base for their digital finance operations and Africa expansion strategies.

The founder of early-stage payment startup ChipperCash, Ham Serunjogi, explained the imperative to operating there. &Nigeria is the largest economy and most populous country in Africa. Its fintech industry is one of the most advanced in Africa, up there with Kenyaand South Africa,& he told TechCrunch in May.

When all the 2019 VC numbers are counted, it will be worth matching up fintech stats for Nigeria to Kenya to see how the countries compared.

Acquisitions

Tech acquisitions continue to be somewhat rare in Africa, but there were several to note in 2019. Two of the continentpowerhouse tech incubators joined forces in September, when Nigerian innovation center and seed-fund CcHub acquired Nairobi-based iHub, for an undisclosed amount.

The acquisition brought together Africamost powerful tech hubs by membership networks, volume of programs, startups incubated and global visibility. It also elevated the standing of CcHubBosun Tijani across Africatech ecosystem, as the CEO of the new joint entity, which also has a VC arm.

CcHub/iHub CEO Bosun Tijani

In other acquisition activity, French television companyCanal+acquired theROK film studio from Nigerian VOD company IROKOtv for an undisclosed amount. The deal put ROK founder and producer Mary Njoku in charge of a new organization with larger scope and resources.

Many outside Africa aren&t aware that NigeriaNollywood is the Hollywood of the continent, and one of the largest film industries in the world (by production volume). Canal+ told TechCrunch it looks to bring Mary and the Nollywood production ethos to produce content in French-speaking African countries.

Other notable 2019 African tech takeovers included Kenyan internet company BRCKacquisition of ISP Surf, Nigerian digital-lending startup OneFiAmplify buy and Merck KGaapurchase of Kenya-based online healthtech company ConnectMed.

Moto ride-hail mania

In 2019, Africamotorcycle ride-hail market — worth an estimated $4 billion— saw a flurry of investment and expansion by startups looking to scale on-demand taxi services. Uber and Bolt got into the motorcycle taxi business in Africa in 2018.

Ampersand in Rwanda

A number of local and foreign startups have continued to grow in key countries, such as Nigeria, Uganda and Kenya.

A battle for funding and market share emerged in Nigeria in 2019, between key moto ride-hail startups MAX.ng, Gokada and Opera-owned ORide.

The on-demand motorcycle market in Africa has attracted foreign investment and moved toward EV development. In May,MAX.ng raised a $7 million Series A round with participation from Yamaha and is using a portion to pilot renewable energy powered e-motorcycles in Africa.

In August, the government of Rwanda announced a national policy to phase out gas-motorcycle taxis altogether in favor of e-motos, in partnership with early-stage EV startup Ampersand.

New funds

The past year saw several new funding initiatives for Africastartups. Senegalese VC investor Marieme Diop spearheaded Dakar Network Angels, a seed-fund for startups in French-speaking Africa — or24 of the continent54countries.

Africinvestteamed up withCathay Innovation to announce the Cathay Africinvest Innovation Fund, a $100+ million capital pool aimed at Series A to C-stage startup investments in fintech, logistics, AI, ag tech and education tech.

Accion Venture Lab launched a $24 million fintech fund open to African startups.

And Naspers offered more details on who can pitch to its 1.4 billion rand (≈$100 million) Naspers Foundry fund, which made its first investment in online cleaning services company SweepSouth.

Closed up shop

Like any tech ecosystem, not every startup in Africa killed it or even continued to tread water in 2019. Two e-commerce companies — DealDey in Nigeria and Afrimarketin Ivory Coast — closed up digital shop.

Southern AfricaEconet Media shut down its Kwese TV digital entertainment business in August.

And South Africa-based, Pan African-focused cryptocurrency payment startup Wala ceased operations in June. Founder Tricia Martinez named the continentpoor infrastructure as one of the culprits to shutting down. A possible signal to the startupdemise could have been its 2017 ICO, where Wala netted only 4% of its $30 million token offering.

Africastartups go global

2019 saw more startups expand to new markets abroad products and business models developed in Africa. In March, FlexClub — a South African venture that matches investors and drivers to cars for ride-hailing services — announced its expansion to Mexico in a partnership with Uber.

In May, Extra Crunch profiled three African-founded fintech startups — Flutterwave, Migo and ChipperCash — developing their business models strategically in Africa toward plans to expand globally.

By December, Migo (formerly branded Mines) had announced its expansion to Brazil on a $20 million Series B raise.

2020 and beyond

As we look to what could come in the new year and decade for African tech, ittelling to look back. Ten years ago, there were a lot of &if& questions on whether the continentecosystem could produce certain events: billion-dollar startup valuations, IPOs on major exchanges, global expansion, investment from the worldtop VCs.

All those questionable events of the past have become reality in African tech, even if some of them are still in low abundance.

Thereno crystal ball for any innovation ecosystem — not the least Africa— but there are several things I&ll be on the lookout for in 2020 and beyond.

In the near term I&ll start with what Twitter/Square CEO Jack Dorsey may do around Bitcoin and cryptocurrency on his return to Africa (lookout for an upcoming TechCrunch feature on this).

I&ll also follow the next-phase of e-commerce in Africa, which could pit Jumia more competitively against DHLAfrica eShop, Opera and ChinaAlibaba (which hasn&t yet entered Africa in full).

On a longer-term basis, a development to follow is how the continentfirst wave of millionaire and billionaire tech-founders could disrupt 21st century dynamics in Africa around politics, power and philanthropy — hopefully for the better.

More notable 2019 Africa-related coverage @TechCrunch

- Nigeria#StopRobbingUs campaign could spur tech advocacy group, CEOs say

- Africa can list more gazelles at home than unicorn IPOs abroad

- KenyaTwiga Foods eyes West Africa after $30M raise led by Goldman

- Africa-focused Andela cuts 400 staff as it confirms $50M in revenue

- Facebooklatest account purge exposes Africamisinformation problem

- Ethiopiabid to become an African startup hub hinges on connectivity

- Lessons from M-Pesa for Africanew VC-rich fintech startups

- Details

- Category: Technology

Read more: 2019 Africa Roundup: Jumia IPOs, China goes digital, Nigeria becomes fintech capital

Write comment (100 Comments)

Nvidia in 2019 may have gotten some pretty stiff competition from its top rival. However, that doesn’t mean that the graphics card (GPU) manufacturer has been taken down from its lofty perch. Yes, it’s suffered a few revenue hits that started in 2018 as well as a couple of setbacks – particularly due to release delays and uncovered security

- Details

- Category: Technology

Read more: Nvidia in 2019: a GeForce to be reckoned with

Write comment (93 Comments)

The Samsung Galaxy S20 series may be coming nine years sooner than expected, as a new leak suggests what we've heard before: Samsung is set to leapfrog the Galaxy S11 and a bunch of numbers in its flagship phone naming scheme.

The unverified rumor gets even more interesting, as there may not be a Samsung Galaxy S20e in 2020. Instead, the South

- Details

- Category: Technology

Read more: Forget Galaxy S11 & the Galaxy S20 Ultra may be Samsung's new flagship phone

Write comment (100 Comments)

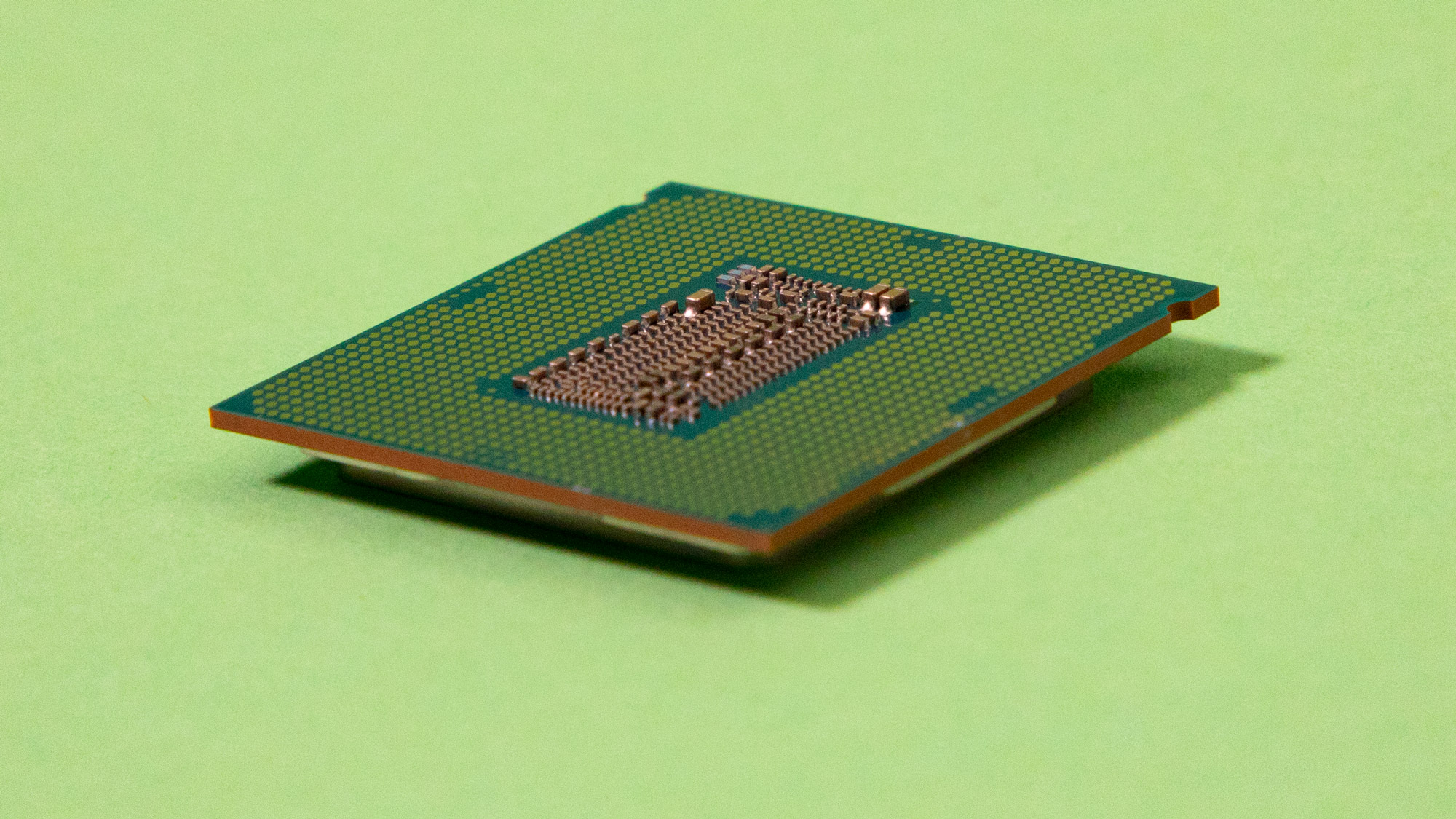

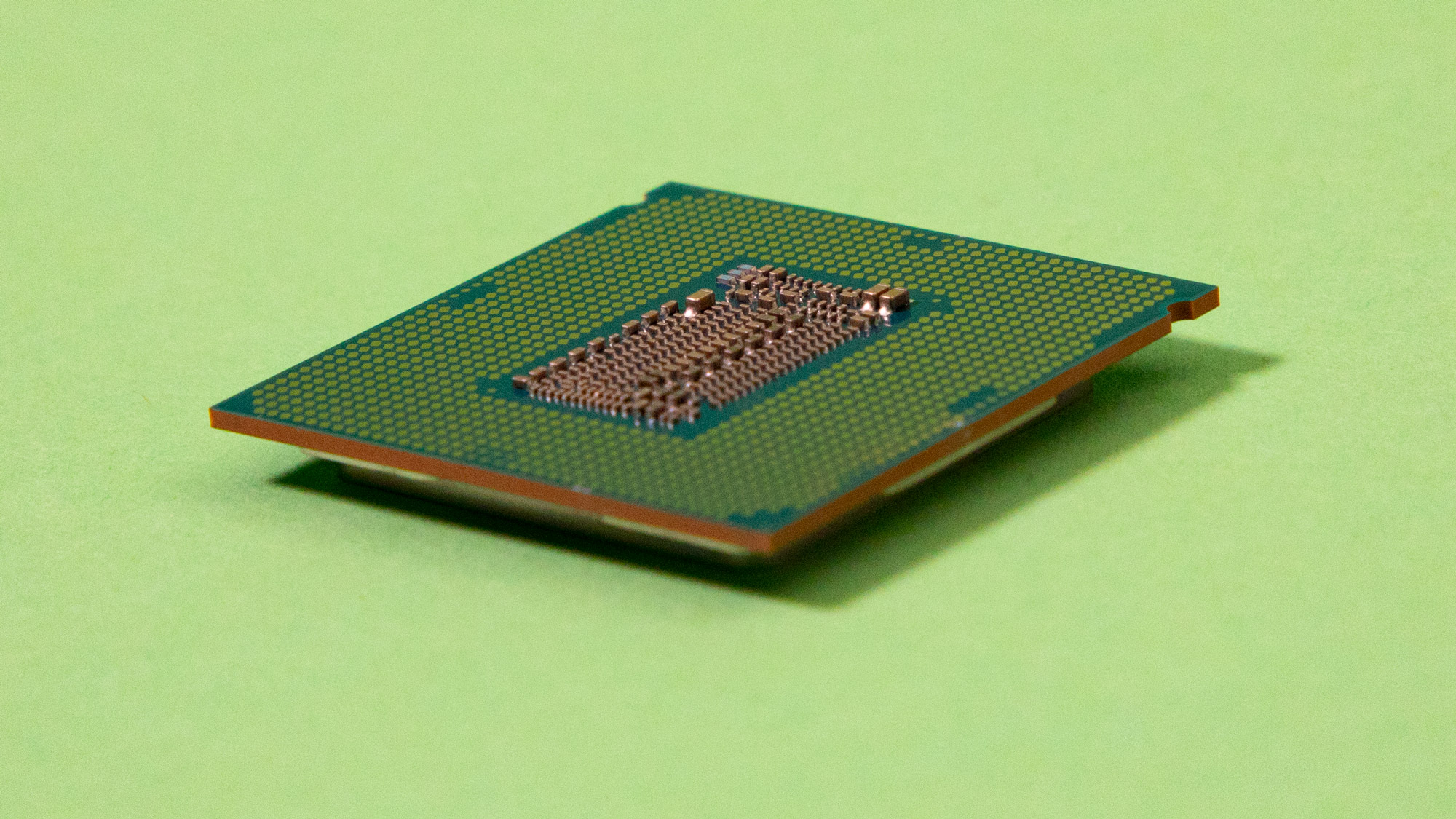

Just a little while ago we were able to catch a glimpse of the Intel Core i3-10300, a hyperthreaded entry-level chip from the upcoming Intel Comet Lake-S lineup. But, now, thanks to a new leak, we may have seen the entire range of 10th-generation desktop processors.

Some leaked slides from Intel appeared on Informatica Cero showing a broad lineup

- Details

- Category: Technology

Read more: Intel is coming for AMD if these leaked Comet Lake specs are any indication

Write comment (92 Comments)

Over the last decade we’ve seen things people wouldn’t believe. Samsungs on fire over our shoulder. We watched Windows Phones glitter in the dark near Bill Gates.

Many of those moments are already lost in time, like tears in the rain. But some other awful things endure, and it’s time they got in the sea.

When it comes to naming the tech trends we’d

- Details

- Category: Technology

Read more: Tech trends that need to die in 2020

Write comment (98 Comments)Page 22 of 5614

9

9