Technology

Ford provided its first peek of a Mustang-inspired electric crossover nearly 14 months months. Now, itready to show the world what &Mustang-inspired& means.

The automaker said Thursday it will debut the electric SUV on November 17 ahead of the LA Auto Show.

Not much is known about the electric SUV that is coming to market in 2020, despite dropping the occasional teaser image or hint. A new webpage launched recently, which provides few details, namely that Ford is targeting an EPA-estimated range of at least 300 miles. The look, specs and price will have to wait until at least the November 17 debut date.

What we do know is that Fordfuture (and certainly its CEO&s) is tied to the success of this shift to electrification. The Mustang-inspired SUV might not be the cornerstone to this strategy (an electric F150 probably deserves that designation), but it will be a critical piece.

Ford has historically backed hybrid technology. Back in 2016, Ford Chairman Bill Ford said at a Fortune event that he viewed plug-in hybrids as a transitionaltechnology.

A lot has changed. Hybrids are still part of the mix. But in the past 18 months, Ford has put more emphasis on the development and production of all-electric vehicles.

In 2018, the company said it will invest $11 billion to add 16 all-electric vehicles within its global portfolio of 40 electrified vehicles through 2022.

Ford unveiled in September at the Frankfurt Motor Show a range of hybrid vehicles as part of its plan to reach sales of 1 million electrified vehicles in Europe by the end of 2022.

It also invested in electric vehicle startup Rivian and locked in a deal with Volkswagen that covers a number of areas,including autonomy (via an investment by VW in Argo AI) and collaboration on development of electric vehicles. Ford will use VolkswagenMEB platform to develop &at least one& fully electric car for the European market thatdesigned to be produced and sold at scale.

- Details

- Category: Technology

Read more: Ford’s electric Mustang-inspired SUV will finally get its debut

Write comment (91 Comments)SpaceX will look to launch its Starlink service for consumers sometime next year, SpaceX President and COO Gwynne Shotwell confirmed at a media roundtable meeting at the companyoffices in Washington during the International Astronautical Congress this week (via SpaceNews). Shotwell, who also appeared on stage at the event to share some updates around SpaceXrecent progress across the company, told reporters present that in order to make the date, it&ll need to launch between six and eight different grouped payloads of Starlink satellites, a number that includes the batch that went up in May of this year.

All told, SpaceX has shared previously that it&ll need 24 launches in order to make the constellation global, and it also shared at that time that it intends to start with service in the Northern United States and parts of Canada beginning next year. Though 24 launches will provide full global coverage, Shotwell told media that it&ll still be doing additional launches after that in order to expand and improve coverage.

SpaceX President and COO Gwynne Shotwell

In fact, SpaceX recently filed paperwork to launch as many as 30,000 satellites in addition to the 12,000 it has already gotten permission to put up, for a total constellation size of up to 42,000. A SpaceX spokesperson previously described this as &taking steps to responsibility scale Starlinktotal network capacity and data density to meet the growth in users& anticipated needs& in a statement provided to TechCrunch.

Owning and operating a global broadband satellite constellation could be a considerable revenue driver for SpaceX, and an important product pillar upon which the company can rely for recurring profit as it pursues its more ambitious programs, including eventual Mars launch services. Setting up the satellite constellation, especially at the scale intended, will definitely be a cost-intensive process on its own, but SpaceX is looking to its product developments like its Starship, which will be able to take much more cargo to orbit in terms of payload capacity, to reduce its own, and customer launch costs over time.

Shotwell also told reporters at the gathering that the company is already testing Starlink connectivity for U.S. Air Force Research Laboratory use, and while she didn&t reveal consumer pricing, did note that many in the U.S. pay $80 for service that is sub-par already, per SpaceNews.

- Details

- Category: Technology

Read more: SpaceX intends to offer Starlink satellite broadband service starting in 2020

Write comment (95 Comments)SaaS has been the motherlode of enterprise software investing for two decades now. Venture investors, entrepreneurs, and Wall Street have all learned to pile on, leading to a shared consensus that cloud investing is &a sure thing.& Nothing is more destructive to investors over the long term than a sure thing, so I began to wonder, &what could cause the wonderful economics of cloud investing to unravel?&

My conclusion is that while the cloud is obviously here to stay, the next five years in cloud investing will neither be the same nor as easy as the last 10. My reason for writing this post is not to be a party pooper, but to provide a context for startups to navigate this potentially harsher environment. This post identifies three different startup strategies, all of which can work even in the more competitive cloud economy that I envisage. More on that below.

Big picture, the summary points are as follows:

First, cloud company valuations are at all-time highs which cannot be justified by improved company operating performance but can explained by 20 years of consistent 30% growth in the cloud software market. This has given investors the comfort to &pay up.&

Second, within the next two to three years, there will be a &growth crunch& as many cloud markets saturate. At that point the Gold Rush will become the Hunger Games, as cloud companies large and small compete against each other for survival.

Third, there will be three winning strategies for a startup when this happens: fight, or compete head on in an existing cloud market; focus, or find those parts of the cloud market where there is still low competition and good growth; fly, which is to build a company based on more than just the move to the cloud.

Fourth, &beyond the cloud& means &assume the cloud& and build on top of that stack using newer technologies and a design approach where instead of the user working for the software, the software works for (or instead of) the user. At Scale, we think of this as building the Intelligent Connected World (ICW).

Letwalk through the details.

How did we get here?

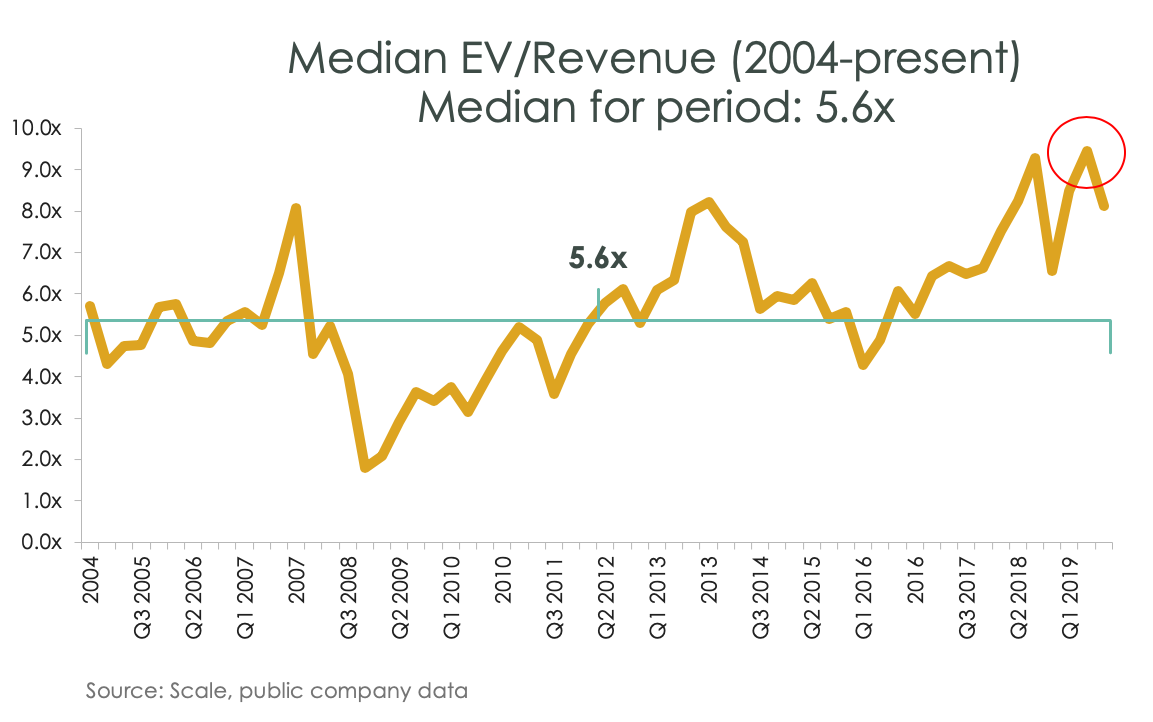

We got here because the cloud model works. It works as a computer architecture, and there is no clear replacement architecture on the horizon. It works for customers by aligning incentives with vendors to keep their software working. And it works & brilliantly & as a financial model. In a world of low growth and low interest rates, SaaS looks like a perpetual motion machine and the valuations show it. Today the median SaaS multiple is 8.5x run rate versus an all-time average of 5.6x. Higher growth companies trade at even loftier multiples of 20x and 30x.

Are cloud companies performing better than ever?

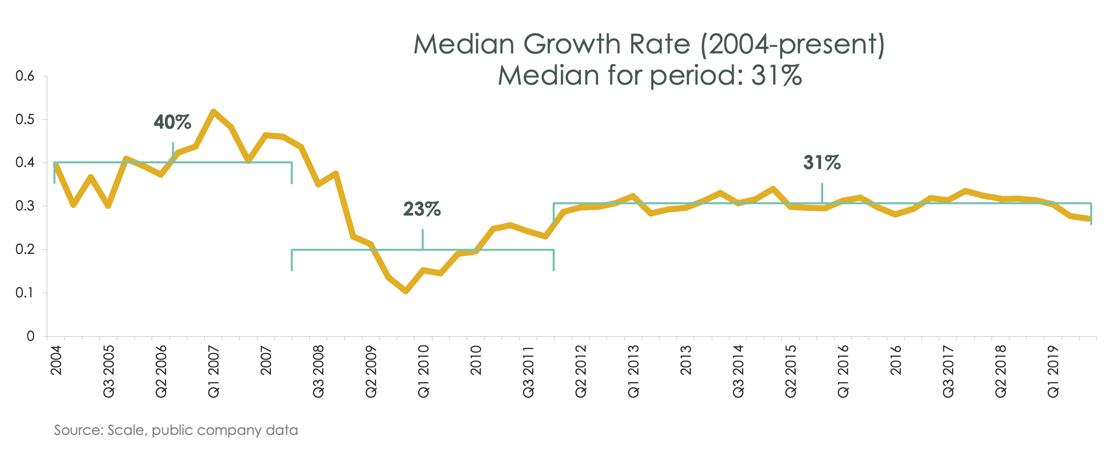

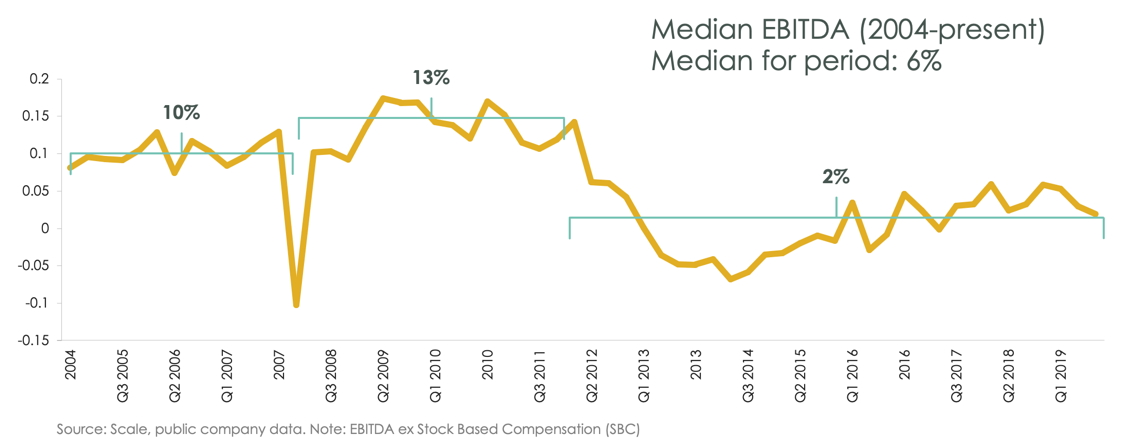

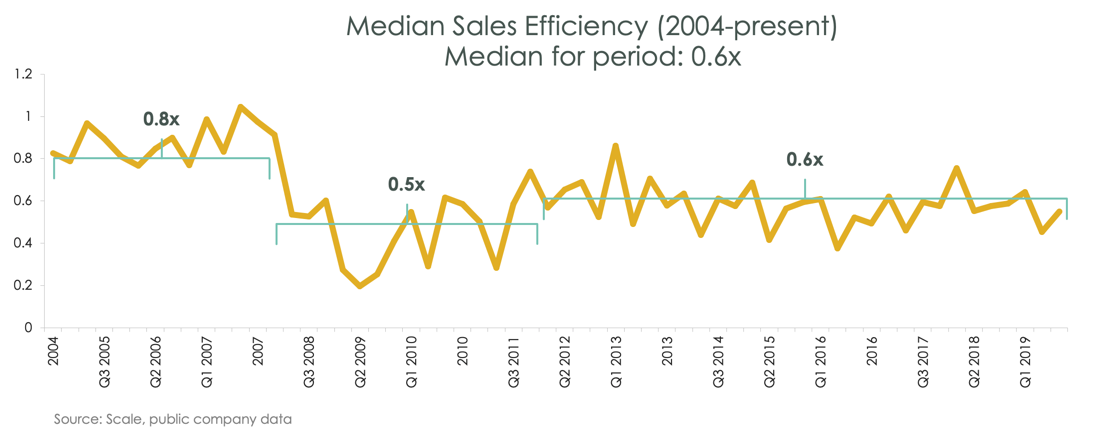

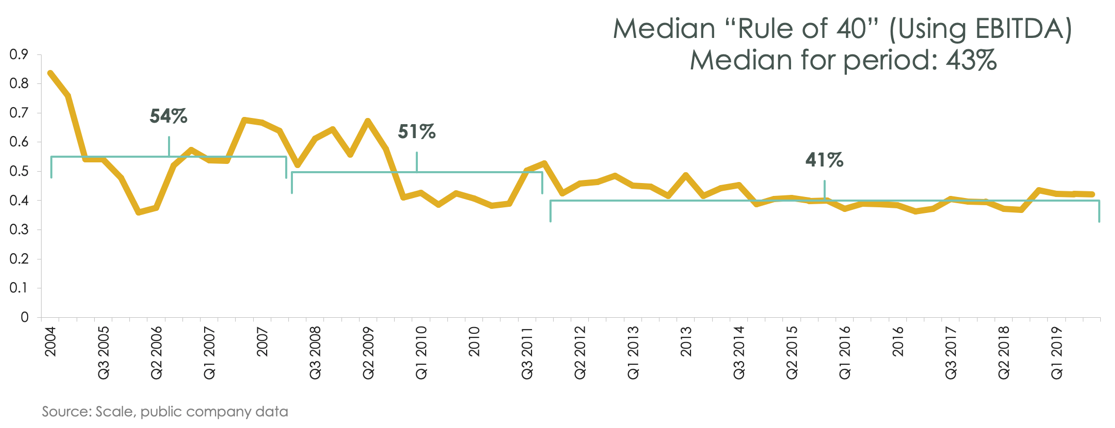

The short answer is no. The four charts below show growth rate, profitability, Sales Efficiency and the Rule of 40 (a combination of growth and profitability) for the entire public SaaS universe from 2004 to today. Each chart also shows separately the median for three sub-periods within this time period: pre-crash (2004 to 2008), the crash period (2009 to 2011), and post-crash (2011 to today).

The story is the same in every case. Pre-crash operating performance was stellar in what was then a new uncrowded market. The crash was brutal on growth and forced companies to get profitable fast. But since 2011, growth rates, EBITDA, Sales Efficiency and Rule of 40 measures have all been roughly flat and provide no justification for almost a doubling of valuations in the last two years.

So why are these companies trading so richly?

Itall about the growth

Sometimes the answer is in plain sight. The big picture in all the above numbers is that public companies in this sector have been growing at 30% plus for 15 years now, since the Salesforce IPO in 2004. Growth has not gone up but, far more importantly, it has not gone down.

- Details

- Category: Technology

Read more: The SaaS gold rush will become the ‘Hunger Games’

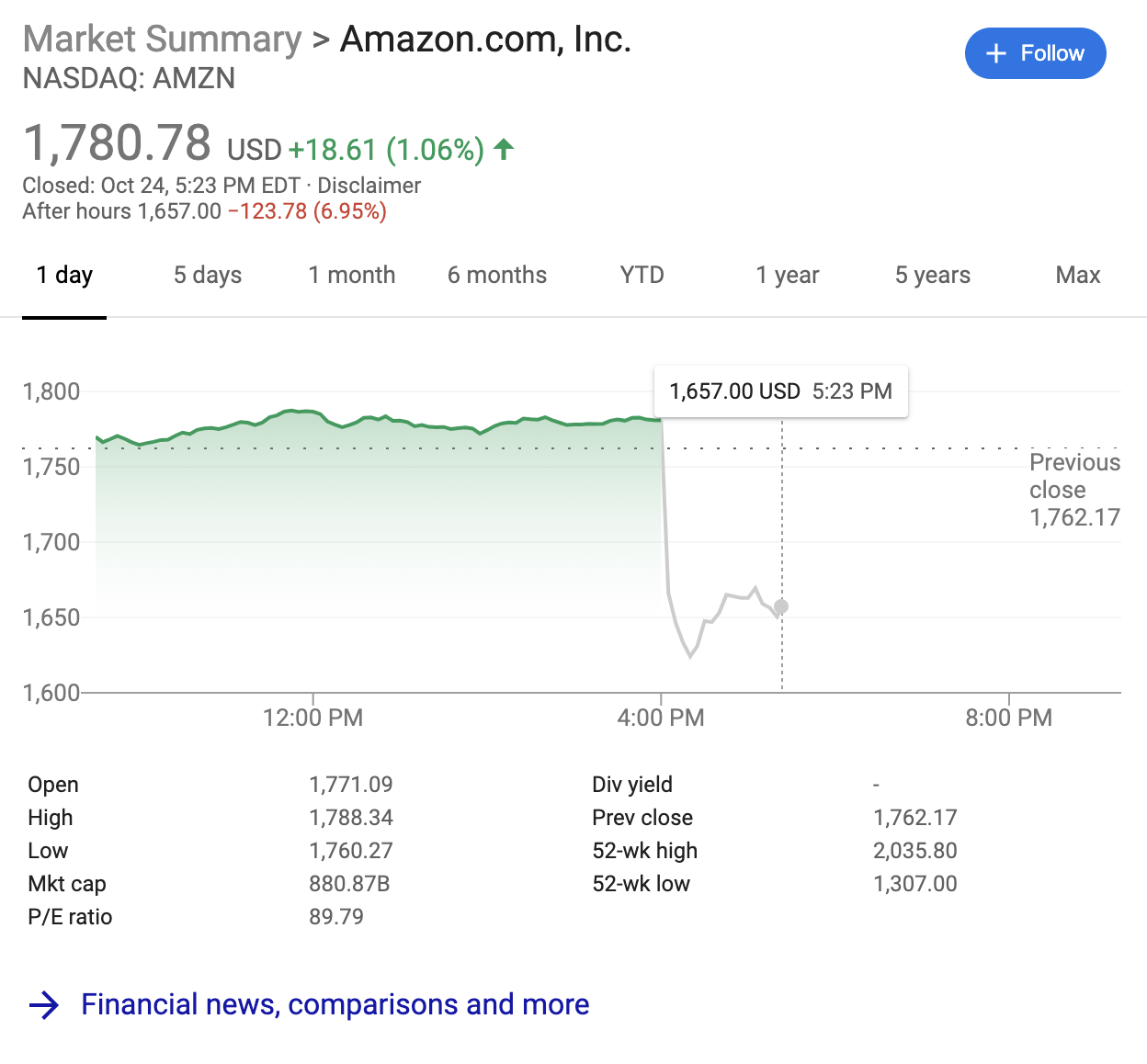

Write comment (93 Comments)Amazon shares fell by nearly 7%, or $118.38, in after-hours trading on Thursday after the company reported its first earnings miss in two years.

Financial analysts had predicted that the launch of one-day shipping would eat into Amazonearnings, but even with the forewarning investors pummeled the stock after the market closed. It didn&t help that the company predicted revenues for the fourth quarter — including the all-important holiday season — also look soft.

The good news for Amazon amidst all the bad news was that revenue was actually up at the company. For the quarter Amazon raked in $70 billion, beating analysts& expectations of $68.8 billion.

However, the company reported a profit of $2.1 billion, or $4.23 a share versus the $4.62 that analysts had projected. And even though sales were up this year, earnings per share were down from $5.75 in the year-ago period. As MarketWatch noted, itthe first time earnings at the company have shrunk since 2017.

Another potential warning sign for investors was the revenue from the companyweb services business, which came in at $9 billion. Analysts had predicted roughly $9.2 billion from the business line. If competition starts eating into the services business (which still grew at a healthy 35% over the year-ago period), that could spell problems for the companystock — which has used AWS revenues to buoy spending elsewhere.

The company has been spending heavily all year to offer new services. The expansion of its free one-day delivery program has cost Amazon more than $800 million in the second quarter.

Amazon founder and chief executive Jeff Bezos defended the move to one-day shipping in a statement.

&Customers love the transition of Prime from two days to one day — they&ve already ordered billions of items with free one-day delivery this year. Ita big investment, and itthe right long-term decision for customers,& Bezos said. &And although itcounterintuitive, the fastest delivery speeds generate the least carbon emissions because these products ship from fulfillment centers very close to the customer — it simply becomes impractical to use air or long ground routes.&

Looking ahead to the holiday season Amazon predicted net sales of between $80 billion and $86.5 billion, with operating income between $1.2 billion and $2.9 billion, versus $3.8 billion from a year-ago period. Analysts were expecting to see revenue numbers more in the $87 billion range.

- Details

- Category: Technology

Lotame, a company offering data management tools for publishers and marketers, today unveiled a new product called Cartographer— described by CMO Adam Solomon as &our new people-based ID solution.&

In other words, itLotame offering to help businesses connect their visitor and customer data across platforms and devices.

We&ve written about plenty of other cross-device targeting technologies — and in fact, Lotame acquired one of them, AdMobius, in 2014. But Solomon said the landscape has become more challenging given privacy regulations and especially updated browsers that place new limits on the types of cookies that can be used to track users.

&Therebeen an explosion of first-party cookies,& Solomon said, referring to cookies that are stored on the domain you&re actually visiting (as opposed to third-party cookies, which are increasingly blocked).

He argued that these &short-lived& cookies then create problems for publishers: &If you&re in Safari visiting the same site every day, a new ID could be generated& each day.So Cartographer deals with this by using data science and machine learning to attempt to &cluster& different IDs together that likely belong to the same user.

&Every day when we see an ID, we&ll capture it,& Solomon said. &We&re graphing those cookies together, these dozens or hundreds of cookies that we believe, based on our technology, that these cookies belong to the same individual.&

He also said that connecting IDs in this way is crucial to the whole &Russian nesting doll& of how a publisher or advertiser understands identity on the internet: &Cookies ladder up to devices, devices ladder up to people, people ladder up to households.& So by connecting cookies to people, Lotame can also offer better household-level data.

And far from being an attempt to circumvent privacy restrictions, Solomon argued that Cartographer actually makes it easier for publishers to stay compliant with EuropeGDPR and CaliforniaCCPA rules, because they can do a better job of storing a customerprivacy preferences.

Grant Whitmore, chief digital officer at Lotame customer Tribune Publications, made a similar point: &One of the things that I think all publishers are wrestling with right now is really the disconnect that is occurring in the adtech landscape and the legislative landscape and really managing the persistence of that consent.&

Whitmore continued, &One of the unintended consequences of that legislation and some of what is happening in the browser space is that we could be forced into a position where we are having to ask you every single time you visit a site whether itokay to sell your data, whether itokay to track.&

And he said thatone of the big reasons Tribune is deploying Cartographer across all its properties, including its nine core newspaper sites. Though he acknowledged that itmore broadly useful too.

&From the standpoint of our core business, getting a more complete picture of who a user is across these device types … That is of ongoing importance to us,& Whitmore said. &As we fight in this very competitive landscape, our ability to bring our understanding of who a user is, what their interests are … and providing good solutions — whether on the advertising front or whether thathandling digital subscription offers — is just table stakes at this point.&

Solomon, meanwhile, said that Cartographerbenefits go beyond &just figuring which IDs cluster together to represent an individual,& because italso ensuring that thereproper ID synchronization with other data and ad-buying platforms.

&We make sure theremaximum connectivity, maximum dial tone, with all the ecosystem participants,& he said.

- Details

- Category: Technology

Read more: Lotame unveils Cartographer, its new approach to tracking user identity

Write comment (92 Comments)Apple Arcade introduced the idea of all-you-can-eat subscription-based mobile gaming to the mainstream. Google Play Pass soon followed as a way to subscribe to a sizable collection of both apps and games on Android devices. Today, a startup called GameClub is launching in the U.S. to offer an alternative. For $4.99 per month, mobile consumers will be able to access a library that includes some of the best games to have ever hit the App Store.

To be clear, GameClub is not a cloud gaming platform, like Google Stadia. Ita way to subscribe to actual App Store games, similar to Arcade. In GameClubcase, however, the focus is not on new releases but on quality games that already have proven track records and high ratings.

In fact, many GameClub games have made Appleown editorially selected &Game of the Year& lists in years past. And like the games offered on Apple Arcade, they don&t have ads or any in-app purchases.

At launch, GameClublibrary includes more than 100 titles, with around half that available for play today. More titles will roll out on a weekly basis in the months ahead. Combined, the games have over 100 million collective downloads, the company says.

On GameClub, you&ll find games like: Super Crate Box, Hook Champ, Mage Gauntlet, Space Miner, Forget-Me-Not, MiniSquadron, Plunderland, Pocket RPG, Sword of Fargoal, Incoboto, Tales of the Adventure Company, Hook Worlds, Orc: Vengeance, Mr. Particle-Man, Legendary Wars, Deathbat, The Path to Luma, Grimm, Zombie Match, Faif, iBlast Moki 2, Kano, Baby Lava Bounce, Run Roo Run, Gears and many others.

Ita selection that extends across gaming categories, like Action, Arcade, Puzzle, Adventure, Platformer, Retro, Role Playing, Simulation, Strategy and more.

To use the service, you first download the main GameClub app, which becomes the hub for your GameClub activities. You then sign up for the $4.99 per month subscription, which includes a 30-day free trial. Within the main app, you can browse the available titles as well as read editorial content like in-depth overviews and histories, get tips and learn about gaming strategies.

The startup was founded last year by game industry vets Dan Sherman and Oliver Pedersen.

Sherman, GameClub CEO, has worked in the gaming industry for around 17 years, including time spent at EA and his own startup, Tilting Point. His experience has involved, predominantly, signing content partnerships with game creators. Pedersen, meanwhile, built backend systems and platforms for games, including at Yahoo Games.

Though GameClub is seemingly arriving after Apple Arcadedebut, it actually began before that. The startup was founded in 2018, ahead of any Apple Arcade rumors. It went live on iOS outside the U.S. before Arcade launched.

The founders say they were inspired to address the issues caused by the free-to-play model that has infiltrated the gaming industry. In addition, they had witnessed a decline in consumers& willingness to purchase content upfront, which was impacting the industry.

&I was seeing all these amazing game developers leave mobile because the types of games they make are not the types of games that monetize through in-app purchases and ads,& Sherman tells TechCrunch. &The free-to-play model actually only works for a handful of genres,& he explains. &A lot of companies make a lot of money through a very small number of genres and game experiences — to the exclusion of a lot of other types of genres that GameClub is bringing back — action, adventures, arcade, tower defense — anything that can be completed.&

With free-to-play, games are built around perpetual retention loops. &And the freemium model comes out of the casino industry, not the premium game industry,& Sherman points out.

But because this is how games could make money, it led to homogeneity in the marketplace, he says.

GameClub aims to offer a subscription to the premium games that got left behind.

They are meant to be wholesome and fun, not overly addictive. They&re not designed to manipulate you into spending money. You simply pay your subscription fee every month to access the catalog, then play unencumbered.

Thanks to Apple Arcade and Google Play Pass, consumers are now comfortable with the idea of the subscription model for mobile games. And other services — like Spotify Netflix, and Xbox Game Pass, for example — have pushed the idea of subscription access to content across platforms and genres.

GameClub is different from Arcade, however, because itnot funding the development of content upfront — at least, not yet. Instead, itforging agreements with largely indie developers to release their existing IP as a GameClub exclusive.

This may include bringing an older game into the 64-bit era — something GameClub handles on their behalf.

&Many of [the GameClub titles] have been gone for many years,& says Sherman. &Itwith our team, our technology and our developers that they&ve been brought back. And they&ve been brought back in a way that is 100% using the original code and the exact same design…but making them look and feel new, with higher resolution, Retina Display assets and by optimizing for the latest screen sizes and configurations,& he adds.

The company doesn&t discuss the business model for GameClub, but itnot the same as Apple Arcadepay-upfront model.

What Sherman could say is that the more important the game is to the GameClub service, the more money the creator makes. Additionally, GameClub says ittransparent with developers about its subscription revenue, so thereno question about which games are earning or why.

The same can&t be said for Apple Arcade, which is a total black box to the point that consumers don&t know which Arcade games are most popular, developers can&t see how they&re doing compared with others and third-party measurement firms have no data.

Of course, there could be concerns that GameClub exists in a gray area, with regard to App Store policy. Those with longer memories may recall that Apple banned app-stores-within-a-store starting back in 2012. The company had kicked out apps that recommended other apps like AppHero, FreeAppADay, Daily App Dream, AppShopper and more. It also banned the more popular app recommendation service AppGratis the following year.

But Appleconcern was that these apps were leveraging their power to manipulate App Store charts and rankings, often charging for that service. GameClub, on the other hand, plays fairly. Its service also benefits Apple, by offering subscription access to quality games that couldn&t thrive as free-to-play titles.

Longer-term, GameClub wants to produce its own original content and offer its service across platforms, starting with Google Play, but eventually tackling PC and console gaming.

The startup is headquartered in New York City, with offices in Copenhagen. In addition to the founders, it includes Eli Hodapp, the former editor-in-chief of the popular game news and review site TouchArcade, and COO Britt Myers, the former chief product officer of subscription-based edtech apps platform Homer.

With the close of a seed round last week, GameClub is backed by $4.6 million in funding.

Investors from a round that closed last year include GC VR Gaming Tracker Fund, CRCM Ventures, Watertower Ventures, Ride Ventures, BreakawayGrowth Fund and others. New investors include GFR Fund, Gramercy Fund, CentreGold Capital, and AET Fund.

GameClub is available on the App Store.

- Details

- Category: Technology

Read more: GameClub offers mobile gaming’s greatest hits for $5 per month

Write comment (95 Comments)Page 539 of 5614

19

19