Technology

Enterprise software tool startups are so often birthed to either un-bundle or re-bundle what came before them. In an age where &consumerization of the enterprise& is a trendy phrase for investors, it was natural a startup would come along to bundle its take on some of the trendiest startup tools.

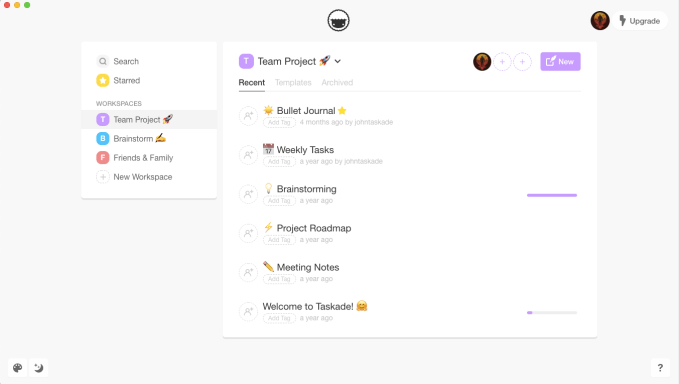

Taskade appears to be the love child of Notion, Slack and Asana. Ita tool for startup teams to collaborate around projects that can be re-organized based on how the individual user best works through tasks. The startup graduated from YC in the most recent batch and has now lockeddown $5 million in seed funding from Grishin Robotics and Y Combinator, Taskade CEO John Xie tells TechCrunch.

Ita platform that tries to meet an awful lot of needs at once. You can take notes, designate tasks, chat with co-workers, set goals and visualize everything you&ve already completed.

The startup certainly seems to take a page or two from Notion, where you can re-visualize databases in tables or Kanban boards with ease. Taskade has built this framework into a more collaborative tool, while trying to place limits on itself so that users aren&t left with an endless amount of customizations, something that can be both a blessing (to the technically minded) and a curse (to those who don&t find exploring a piece of software deeply enjoyable).

Taskade platform is organized around tasks arranged inside projects. Rather than being organized around pages, which can contain multiple data sets and perspectives, Taskadeprojects are limited strictly to one database each. Itcertainly a limitation, but one that probably cuts down on confusion and the temptation to stuff pages with as much as you can think of.

&Notion is a beautiful product, I think at some point it just gets extremely hard to manage all the hierarchy with the cross-linking and whatnot,& Xie told TechCrunch. &For us, we just wanted to make it much simpler and more workspace-driven so you are able to collaborate with multiple teams.&

The collaboration is another distinguishing factor of the platform. The team has built a commenting stream that lives inside each project so that a project can have its own ongoing dialog without forcing users into another Slack channel. You also can fire up video chats inside the project pages and chat through the data without opening another app or sending another invite.

The startups that Taskade is taking on feel ubiquitous. Slack went public this summer and is sitting on a $11.4 billion market cap. Asana has raised north of $210 million from investors. Notion, the youngin& of the group, recently nabbed new funding at an $800 million valuation.

The team at Taskade is still quite small; there are just six employees at the company right now, organized remotely, but the focus is on using this funding to build out the product over time rather than pumping cash into sales and marketing, Xie tells me. The company has largely been building up early customers through word-of-mouth and has taken a particular foothold among creative agency customers.

The product has free and paid tiers, priced at $10 per month per user. Taskade is still flirting with how they want the relationship between their free and paid tiers to look. Xie tells me they&re hoping to transition to a usage-based free model rather than one that leaves certain features pay-walled.

The platform is available on Windows, Mac, Android, iOS and the web.

- Details

- Category: Technology

In a wide ranging interview with The Wall Street Journalglobal technology editor Jason Dean yesterday, Slack CEO and co-founder Stewart Butterfield had some strong words regarding Microsoft, saying the software giant saw his company as an existential threat.

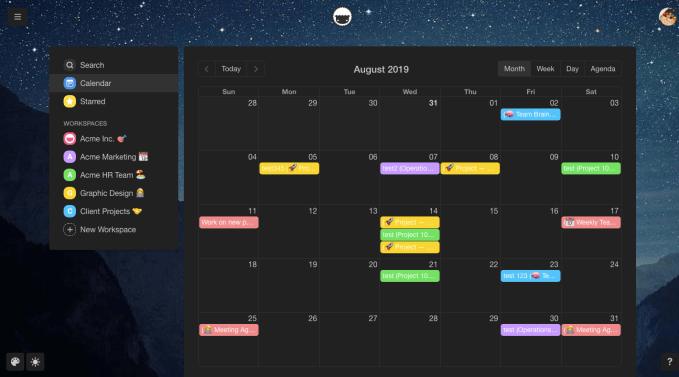

The interview took place at the WSJ Tech Live event. When Butterfield was asked about a chart Microsoft released in July during the Slack quiet period, which showed Microsoft Teams had 13 million daily active users compared to 12 million for Slack, Butterfield appeared taken aback by the chart.

Chart: Microsoft

&The bigger point is thatkind of crazy for Microsoft to do, especially during the quiet period. I had someone say it was unprecedented since the [Steve] Ballmer era. I think itmore like unprecedented since the Gates& 98-99 era. I think they feel like we&re an existential threat,& he told Dean.

Itworth noting, that as Dean pointed out, you could flip that existential threat statement. Microsoft is a much bigger business with a trillion-dollar market cap versus Slack$400 million. It also has the benefit of linking Microsoft Teams to Office 365 subscriptions, but Butterfield says the smaller company with the better idea has often won in the past.

For starters, Butterfield noted that of his biggest customers, more than two-thirds are actually using Slack and Office 365 in combination. &When we look at our top 50 biggest customers, 70% of them are not only Office 365 users, but they&re Office 365 users who use the integrations with Slack,& he said.

He went on to say that smaller companies have taken on giants before and won. As examples, he held up Microsoft itself, which in the 1980s was a young upstart taking on established players like IBM. In the late 1990s, Google prevailed as the primary search engine in spite of the fact that Microsoft controlled most of the operating system and browser market at the time. Google then tried to go after Facebook with its social tools, all of which have failed over the years. &And so the lesson we take from that is, often the small startup with real traction with customers has an advantage versus the large incumbent with multiple lines of business,& he said.

When asked by Dean if Microsoft, which ran afoul with the Justice Department in the late 1990s, should be the subject of more regulatory scrutiny for its bundling practices, Butterfield admitted he wasn&t a legal expert, but joked that it was &surprisingly unsportsmanlike conduct.& He added more seriously, &We see things like offering to pay companies to use Teams and that definitely leans on a lot of existing market power. Having said that, we have been asked many times, and maybe itsomething we should have looked at, but we haven&t taken any action.&

- Details

- Category: Technology

Read more: Stewart Butterfield says Microsoft sees Slack as existential threat

Write comment (99 Comments)

Pricing is the most important, least-discussed element of the software industry. In the past, founders could get away with giving pricing short shrift under the mantra, &the best product will ultimately win.& No more.

In the age of AI-enabled software, pricing and product are linked; pricing fundamentally impacts usage, which directly informs product quality.

Therefore, pricing models that limit usage, like the predominant per-seat per month structure, limit quality. And thus limit companies.

For the first time in 20 years, there is a compelling argument to make for changing the way that SaaS is priced. For those selling AI-enabled software, ittime to examine new pricing models. And since AI is currently the best-funded technology in the software industry — by far — pricing could soon be changing at a number of vendors.

Why per-seat pricing needs to die in the age of AI

Per-seat pricing makes AI-based products worse. Traditionally, the functionality of software hasn&t changed with usage. Features are there whether users take advantage of them or not — your CRM doesn&t sprout new bells and whistles when more employees log in; itstatic software. And since itpriced per-user, a customer incurs more costs with every user for whom itlicensed.

AI, on the other hand, is dynamic. It learns from every data point itfed, and users are its main source of information; usage of the product makes the product itself better. Why, then, should AI software vendors charge per user, when doing so inherently disincentivizes usage? Instead, they should design pricing models that maximize product usage, and therefore, product value.

Per-seat pricing hinders AI-based products from capturing value they create

AI-enabled software promises to make people and businesses far more efficient, transforming every aspect of the enterprise through personalization. Software tailored to the specific needs of the user has been able to command a significant premium relative to generic competitors; for example, Salesforce offers a horizontal CRM that must serve users from Fortune 100s to SMBs across every industry. Veeva, which provides a CRM optimized for the life sciences vertical, commands a subscription price many multiples higher, in large part because it has been tailored to the pharma userend needs.

AI-enabled software will be even more tailored to the individual context of each end-user, and thus, should command an even higher price. Relying on per-seat pricing gives buyers an easy point of comparison ($/seat is universalizable) and immediately puts the AI vendor on the defensive. Moving away from per-seat pricing allows the AI vendor to avoid apples-to-apples comparisons and sell their product on its own unique merits. There will be some buyer education required to move to a new model, but the winners in the AI era will use these discussions to better understand and serve their customers.

Per-seat pricing will ultimately cause AI vendors to cannibalize themselves

Probably the most important upsell lever software vendors have traditionally used is tying themselves to the growth of their customers. As their customers grow, the logic goes, so should the vendors& contract (presumably because the vendor had some part in driving this growth).

Tethering yourself to per-seat pricing will make contract expansion much harder.

However, effective AI-based software makes workers significantly more efficient. As such, seat counts should not need to grow linearly with company growth, as they have in the era of static software. Tethering yourself to per-seat pricing will make contract expansion much harder. Indeed, it could result in a world where the very success of the AI software will entail contract contraction.

How to price software in the age of AI

Here are some key ideas to keep top of mind when thinking about pricing AI software:

- Start by using ROI analysis to figure out how much to charge

This is the same place to start as in static software land. (Check out my primer on this approach here.) Work with customers to quantify the value your software delivers across all dimensions. A good rule of thumb is that you should capture 10-30% of the value you create. In dynamic software land, that value may actually increase over time as the product is used more and the dataset improves. Itbest to calculate ROI after the product gets to initial scale deployment within a company (not at the beginning). Italso worth recalculating after a year or two of use and potentially adjusting pricing. Tracking traditionally consumer usage metrics like DAU/MAU becomes absolutely critical in enterprise AI, as usage is arguably the core driver of ROI.

While ROI is a good way to determine how much to charge, do not use ROI as the mechanism for how to charge. Tying your pricing model directly to ROI created can cause lots of confusion and anxiety when it comes time to settle up at year-end. This can create issues with establishing causality and sets up an unnecessarily antagonistic dynamic with the customer. Instead, use ROI as a level-setting tool and other mechanisms to determine how to arrive at specific pricing.

- Details

- Category: Technology

Read more: Why per-seat pricing needs to die in the age of AI

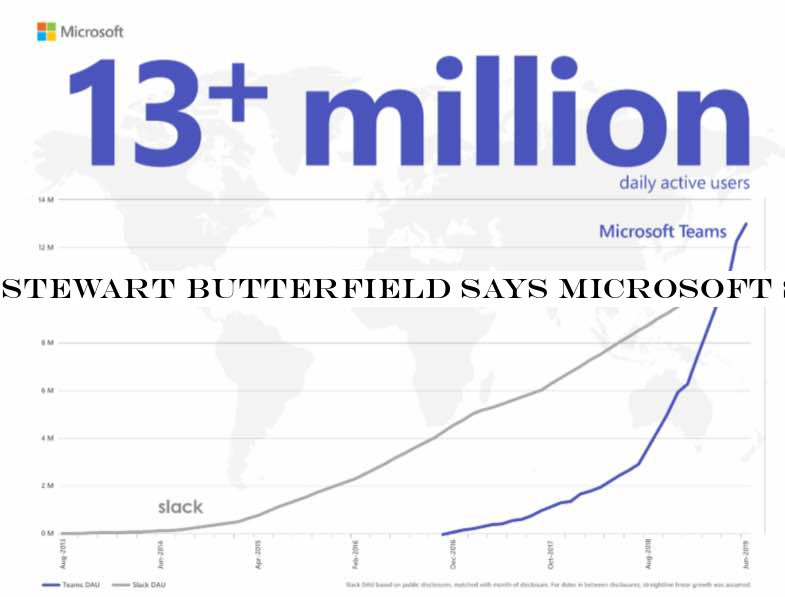

Write comment (95 Comments)At this weekInternational Astronautical Congress, where the space industry, international space agencies and researchers from around the world convene to discuss the state of space technology and business, I asked NASA Administrator Jim Bridenstine about what role he sees for startups in contributing to his agencyambitious Artemis program. Artemis (named after Apollo twin sister, one of the gods of Greek mythology) is NASAmission to return human beings to the surface of the Moon — this time to stay — and to use that as a staging ground for further exploration to Mars and beyond.

Bridenstine, fielding the question during a press Q+A about Artemis, said the program is incredibly welcoming of contributions from startups large and small, and that it sees a number of different areas where contributions from younger space companies can have a big impact.

&When we talk about entrepreneurs, there are big entrepreneurs and there are small entrepreneurs, but know this: What we&re building in the [Lunar] Gateway is open architecture, and we want to go with commercial partners,& Bridenstine said. &So there are in fact, a number of companies here [at IAC], big companies that have said they want to go to the Moon, they want to go sustainably, they want to be part of Artemis, and the Gateway is available to them.&

Artistconcept of NASALunar Gateway with the Orion capsule approaching to dock

The Lunar Gateway is a station NASA intends to put in orbit around the Moon to act as a staging ground for its vehicles, a key step to ensure the process of landing things on the Moon once they reach lunar orbit is more easily accomplished. Bridenstine pointed out that in the Broad Agency Agreement (BAA) that NASA originally put out for the Artemis program, it went further still and said that it welcomed proposals from private space companies that involve going directly to the Moon, bypassing the Gateway entirely.

Actually getting to the Moon has been taken on by some of the deeper-pocketed and more well-established entrepreneurs among the so-called &New Space& companies, including SpaceX . But Artemis participation goes well beyond the high-priced task of building vehicles capable of getting from Earth to lunar orbit, according to Bridenstine.

&We&re going to need cargo on the surface of the Moon,& he said, noting that the Space Launch System (SLS) and Orion crew capsule Artemis will use to take humans to the Moon in 2024 will lean on advance payloads to better ensure mission success. &[W]hen we talk about aggregating a lander at the gateway — when we talk about, maybe even putting hardware on the surface the Moon, including science hardware, like the Viper neutron spectrometer, an IR spectrometer helping us understand the regolith and the water ice, whatthere on the surface of the Moon, where it is and in what quantities […] we&re going to need those science instruments delivered to the surface of the Moon.&

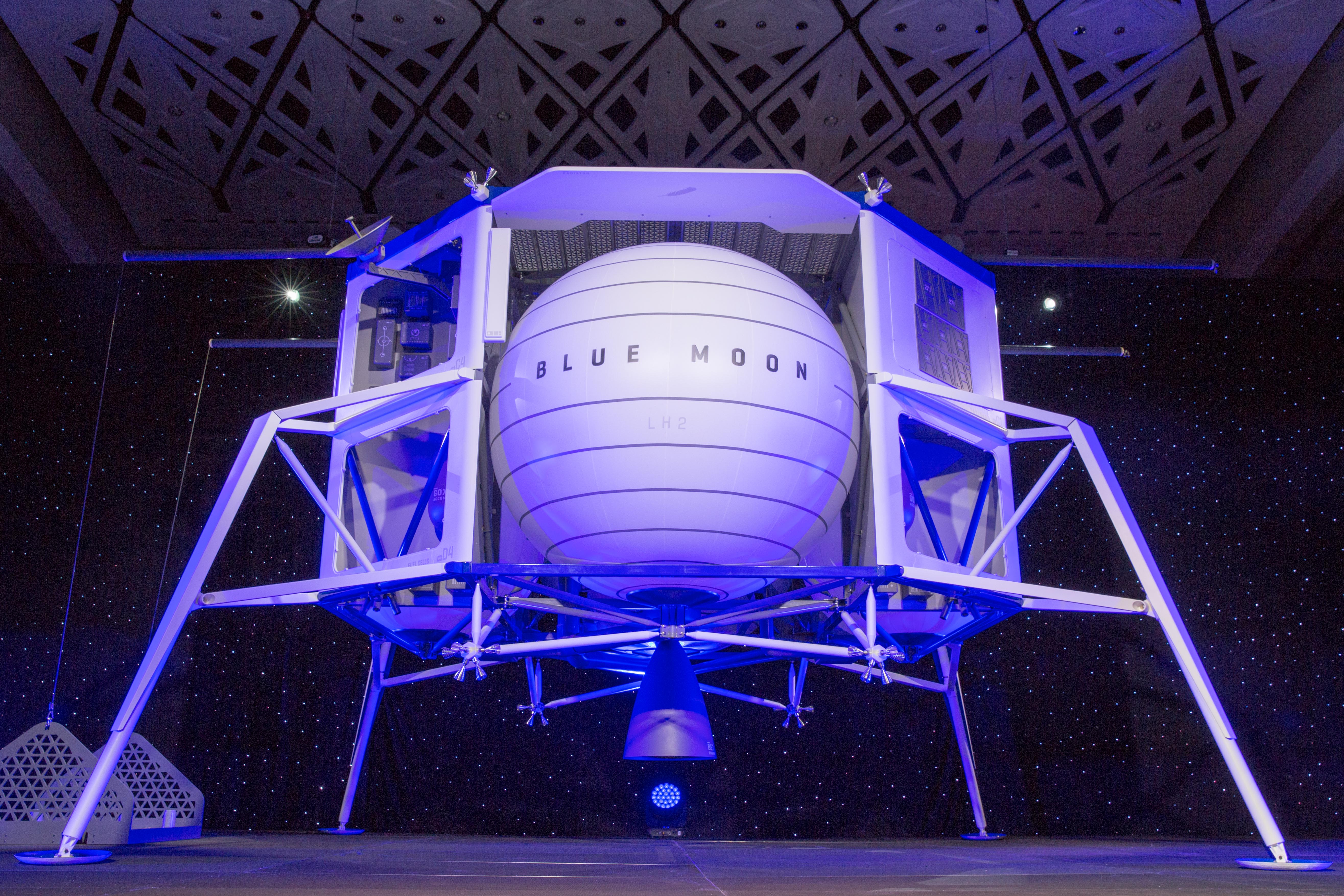

Blue OriginBlue Moon lander

Indeed, there are companies poised to deliver cargo via lunar landers in advance of, or in time with, NASA2024 target for a human landing, including AstroboticPeregrine Moon lander, which is looking to launch in 2021, and Blue OriginBlue Moon lander. Both these landers, and the payloads they carry, could include startup-designed equipment and systems to pave the way for sustainable human occupation of our large natural satellite. In fact, Bridenstine suggested some potential payloads that could be even more wild than advance data-gathering hardware.

&Maybe even — again it depends on budgets, and I&m not promising anything between now and 2024 — but maybe even an inflatable habitat on the surface of the Moon so that when our astronauts get there they have a place to go, and they can stay for longer periods of time,& he said. &Is that in the realm of possibility? Absolutely.&

Bridenstine continued that the agency is already working with many smaller, entrepreneurial businesses, and intends to continue exploring partnerships with more. Therea clear and growing need for lunar cargo from NASA, in increasing volumes, the Administrator pointed out.

&On top of SLS and Orion we need additional capability, there are opportunities there for all kinds of commercial companies entrepreneurs,& he said. &We also have small business investment and research that NASA is involved in, and we&re on-ramping small businesses all the time. In fact, right now we have the Commercial Lunar Payload Services [CLPS] program underway. We have nine companies that have signed up […] two of them now have task orders to deliver to the Moon in 2021 […] We&re on-ramping, not only those nine companies, but we want to on-ramp additional companies, and maybe even bigger companies for larger landing opportunities because, like I said, we&re going to have a lot more needs in the future for cargo on the surface of the Moon.&

- Details

- Category: Technology

As the market continues to turn against the wave of highly valued venture-backed startups operating with little end in sight to their huge losses — Uber and WeWork being two prime examples — another startup is taking a proactive step to get ahead of the story, by cutting costs and restructuring before public opinion forces the issue on them.

Fair.com, a startup building a flexible car ownership business that is valued at $1.2 billion — backed by some $500 million in equity from SoftBank and others, plus billions more dollars in debt funding — said today that it will be laying off 40% of its staff. On top of this, it is removing its CFO, Tyler Painter, the brother of the CEO and co-founder (and car business veteran) Scott Painter. Hebeing replaced in the interim by Kirk Shryoc.

Itnot clear how many people 40% translates to in terms of headcount, nor which areas of the business will be affected. Fair CEO Painter is not disclosing the full number of employees the company has across the U.S., or which parts of the business are going to be restructured. (As a marker though, there are some 539 employees listed on LinkedIn, which would work out at about 215 people.)

He did note that the business is not planning on shuttering any specific operations: leasing services for those driving for on-demand services, and its consumer-focused service, will both remain operational, even as certain geographies and certain segments of the markets that Fair is serving are proving to be unprofitable.

This is one area where the CFO change will play.

&As Fair has grown, the skill sets needed to drive the business forward change. Kirk has a decade of experience running treasury and capital markets for large fleet companies, and is well known on the capital markets side,& the company said in a separate statement. &We&ve been working with him over the course of this year, and given our renewed focus on our acquisition and financing approach, now was the right time to ask him to step in to manage our upstream banking relationships and the fleet management.&

The full internal memo that Painter sent out to staff is included below.

Painter (the CEO) said in an interview earlier today that the reason for the move was to proactively come out to make changes to help the company become more profitable at a time when the &capital markets& are focused on profitability — perhaps more than the over-focus on growth that has fueled a lot of the biggest investments in recent years.

&Ithard building a sustainable company and these are the choices you have to make,& he said of the news.

Fair has been growing at a fast clip in the last couple of years, at a rate of 5x, Painter said. In 2018, ahead of its funding from SoftBank, the company picked up the unprofitable leasing business of Uber; and earlier this year it picked up Canvas, a car leasing business previously owned by Ford. In both cases, the terms of the deals were undisclosed.

At the time of the Canvas deal, Fair said it hadabout 45,000 subscribers currently in the U.S., with 3.2 million downloads across 30 markets, adding some 3,800 subscribers coming on from Canvas.

Itnotable that Fair is backed by the same investor that helped propel both WeWork and Uber to giant valuations ahead of the companies seeing their fortunes change: Uberin the public markets where itbeen pounded for its losses and WeWork before it ever got to its IPO (the company had to withdraw its filing and just this week saw SoftBank scoop up 80% of its business at a cut price in order to keep the whole thing from going under).

Cautionary tales for Fair, which is only profitable in certain parts of its business and is now turning its attention to fixing that.

Painter maintained that this was a proactive move, made not because SoftBank or another investor leaned on it to do so. Itnotable that the last time the company raised equity funding was close to one year ago, so this could help put it in a healthier position were it considering to raise again.

&Softbank is a big shareholder and supporting my focus, and that is the reality right now,& Painter said. &Leaning on us is not the term,& he added in response to my multiple questions of whether SoftBank pressured it to make these changes. &They are supporting us — there is a big difference,& he stressed.

&Thereno question that the world is changing and there is a lot of noise in system, but for us we are doing this proactively, on our terms. We recognise what we are seeing so we are being proactive to avoid this. We wouldn&t have the ability were it not for capital partners like SoftBank. Despite all this noise they remain a steadfast believer in Fair.&

Last weekbig story was about how Airbnb, which has reportedly been planning to go public next year, has seen a widening loss. Todaynews could be a sign that we will see more of these rationalizations to come.

Memo here:

As we discussed at our last Fair Family Lunch, todaycompanies must demonstrate a path to sustainable growth and profitability. Fair is no different. As one of the pioneers in automotive fintech, we now need to focus on being a profitable company. Our technology, our simple product design, and our focus on the customer are second to none. While we are proud of our growth, we are here for the long term. This means that we&ve decided to take proactive steps now to ensure we are a profitable public company later.

With the help and guidance of our leadership team, I&ve decided to focus the companyresources on strengthening Faircore technology and reducing costs associated with the capital-intensive supply side of our business. Going forward, Fair will be a smaller team, focused on doing fewer things well. As part of the process of achieving profitability, we&re reducing our headcount across the business.

While these are the decisions that every entrepreneur dreads making, these are important for us to be able to safeguard the future of the business we&ve all worked so hard to build.

I remain grateful for this teamhard work and optimistic for the future. We have created an entirely new category that consumers love. We&ve served tens of thousands of customers. We&ve powered Uber drivers& livelihoods. We&ve helped everyone get access to the car they want, when they want, for how long they want — all on their phone and without taking on debt. We all did this together. We should all be proud of these achievements and I am personally grateful to all those who have given their time and expertise to deliver the future we set out to build.

Now, we will set out to transform the supply side of our business over the coming months, focus on building a profitable model, and operating with the rigor of a publicly traded company.

I expect everyone to have questions about what this means for them and the health of Fair, and while I can&t promise to have all the answers, I commit to keeping you informed along the way. These types of changes are painful, as I know from my previous experiences building companies. Our leadership team is responsible for the long-term sustainability of Fair, and no matter how difficult these decisions are, we believe they are the right steps in ensuring we have a bright future as a company. We thank you for being on this journey with us.

-Scott

- Details

- Category: Technology

Read more: Fair, the SoftBank-backed car subscription startup, lays off 40% of staff, sacks CFO

Write comment (99 Comments)Yesterday, in addressing nervous WeWork employees at an all-hands, the companynew chairman, SoftBank executive Marcelo Claure, told those gathered that their days of worrying are over, says Recode, which obtained a leaked recording of the meeting.

In comments that may stun industry observers who haven&t done the math — and upset at least some percentage of SoftBank investors — Claure is quoted as telling employees: &We have guaranteed the future of WeWork, but more importantly is we&re putting the future back into our hands. Thereno more days needed to go fundraising. Thereno more days needed to go prove to the investor community that we&re a viable company. The size of the commitment that SoftBank has made to this company in the past and now is $18.5 billion. To put the things in context, that is bigger than the GDP of my country where I came from. Thata country where there11 million people.&

Claure, a native of Bolivia who was named chairman as part of SoftBankrescue of the beleaguered co-working company, has been a SoftBank lieutenant for the last five years, and currently holds a variety of titles on its behalf, including COO of SoftBank Group Corp, CEO of SoftBank Group International and CEO of SoftBank Latin America.

He has said he first met SoftBank founder Masayoshi Son after building up his own business, Brightstar — a cellphone reseller — then selling 57% of it to SoftBank in 2013 in a deal that valued the company at $2.2 billion. SoftBank later acquired more of the company before deciding to explore a sale of the low-margin business last year for $1 billion.

By then, Claure was running Sprint, a SoftBank-backed property that installed Claure as CEO in 2014, where he presided over a massive share slide that began before he joined the company and ended only last year when T-Mobile and Sprint agreed to merge. (The deal has been green-lit by the FCC and the Department of Justice, but itstill facing a lawsuit from several state attorneys general who are trying to block the deal, saying it could hamper competition and drive prices higher. Claure stepped away from running the company and into the role of Sprintexecutive chairman in May of last year to become COO of SoftBank. Sprintshares have meanwhile held mostly steady for the past year.)

In talking with WeWork employees, Claure painted a rosy picture of his own career. (&Masa told me, ‘You&re a great entrepreneur. You built a company from scratch, very successful.& He says, ‘You&re a good operator. You fixed Sprint.& &)

To assuage fears, he also underscored repeatedly the gamble that SoftBank is taking on WeWork, telling employees, &We&ve had many, many endless nights with Masa in terms of what was the next thing to do with WeWork. I would say that 99% of advice that we got is to cut your losses and run away, but Masa absolutely is a believer in WeWork and the mission and disruption.

&You say why, right? The easy thing was just run away. There were no need. We didn&t have to come in and make an investment of this size. We&re basically betting SoftBank. We&re betting our reputation and we&re betting everything we have that this is going to be a success story. We want people to look at this move as not a failure, but we want this move as a genius move. We had many, many nights of debate. Everything that we look at the business, the more we dig, the more we love the business, the more community managers we interact with, the more we love the business.&

As for how WeWork saves the business, thatnot clear yet, said Claure.

&My goal in the next 30 days is to work with this management team, to work with Artie, Sebastian, and all the incredibly talented members of the team to basically set up a plan,& he said. &This plan is going to be very clear. We&re all going to know what each one of us is supposed to do. I&m going to make sure that itnot an empty plan. I&m going to make sure therenumbers. I&m going to make sure that we can measure. I&m going to make sure that we can hold people accountable.&

One possible hitch that Claure understandably didn&t raise yesterday — one in addition to the countless obvious challenges WeWork faces in trying to generate forward momentum, including convincing corporate customers not to look elsewhere for office space — is the Committee on Foreign Investment in the U.S., or CFIUS.

As Bloomberg reported last night, SoftBank will seek national security approval from CFIUS for its takeover, and the committee has stymied the Japanese conglomerate before.

It put conditions on SoftBankmajority ownership of Sprint; it restricted its control of the investment firm Fortress Investment Group, for which it paid $3.3 billion in late 2017; it also held up SoftBank when it wanted to fill two board seats after it sunk billions into Uber. Indeed, SoftBank was never able to fill those spots, noted Bloomberg. Once the rideshare company went public, it voided some of its obligations to SoftBank.

- Details

- Category: Technology

Page 540 of 5614

5

5